SBI Shinsei Bank's Third Quarter Financial Results

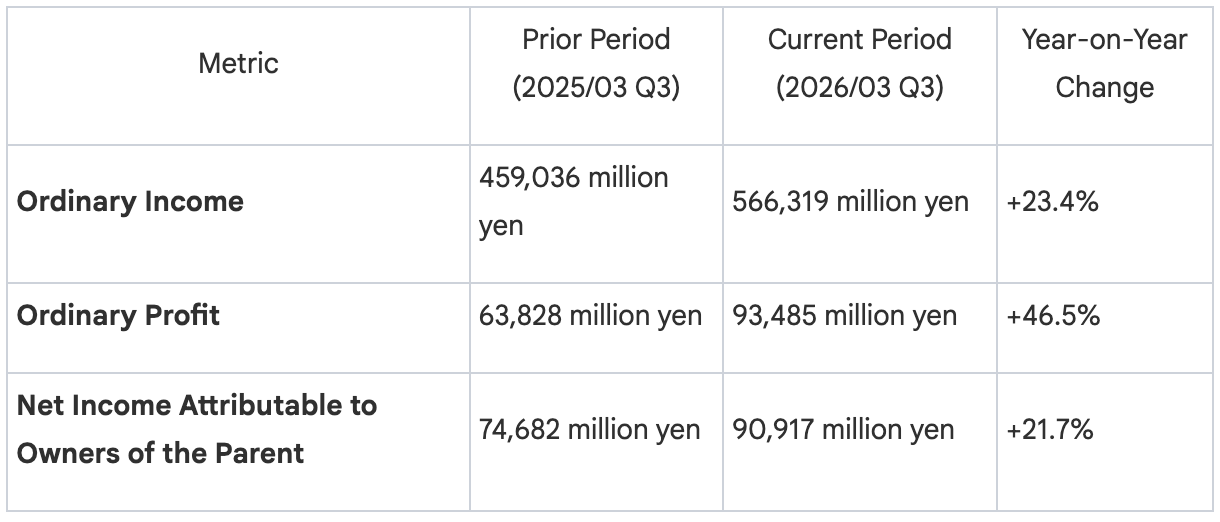

SBI Shinsei Bank has entered a decisive growth phase, characterized by robust double-digit increases across all primary profitability metrics for the nine-month period ending December 31, 2025. This performance must be contextualized within the broader shift in the Japanese financial sector as the Bank of Japan is normalizing the interest rate environment. While the bank’s prior period earnings were significantly inflated by extraordinary items, the current results represent high-quality organic growth. The 21.7% increase in net income on such a high base signals a successful transition to sustainable, operationally-driven earnings power.

The 46.5% surge in Ordinary Profit is the most telling indicator of the bank's improved operational efficiency. By stripping away the volatility of non-operating items, we see a bank that is effectively leveraging its new market positioning under SBI Holdings. This momentum is fundamentally driven by the expansion and diversification of the bank's core revenue streams.

1. Detailed Revenue and Expense Analysis

In a rising rate environment, a bank’s ability to manage its net interest margin (NIM) is the ultimate test of its strategic foresight. SBI Shinsei Bank’s current performance reflects a complex interplay between expanding asset yields and the inevitable rise in funding costs.

1.1 Revenue Synthesis

According to the Consolidated Statements of Income, Ordinary Income reached 566,319 million yen, underpinned by a significant increase in Funds Management Revenue (資金運用収益), which rose to 263,726 million yen from 217,127 million yen.

- Interest on Loans and Bills Discounted: Contributed 178,961 million yen.

- Interest and Dividends on Securities: Jumped to 61,716 million yen, up from 40,359 million yen, reflecting a more aggressive and higher-yielding securities portfolio.

- Fees and Commissions: Service transactions grew to 65,309 million yen, providing a vital non-interest buffer to the revenue base.

1.2 Expense Evaluation and Spread Analysis

However, the bank faces a tightening spread. Funds Procurement Costs (資金調達費用) escalated sharply from 98,062 million yen to 156,294 million yen. The most significant pressure point is Interest on Deposits, which more than doubled from 36,965 million yen to 73,999 million yen.

This can be viewed as a critical risk factor: while interest on loans grew by approximately 6.6%, the cost of deposit funding surged by 100%. This suggests a rapid repricing of the bank's liability base and an aggressive deposit-gathering strategy that is currently outpacing the yield expansion of its loan book. Managing this narrowing spread will be the primary challenge for management in the coming quarters.

While operational costs are rising, the bank's underlying capital health is being radically transformed through a high-speed restructuring.

2. Capital Structure Evolution: Repayment of Public Funds and Shareholder Returns

The defining narrative of SBI Shinsei Bank in FY2026 is the compressed, high-speed restructuring of its equity base. This sequence of maneuvers was designed with a single, clinical objective: to facilitate the privatized exit of the Japanese government and complete the repayment of public funds to the Deposit Insurance Corporation of Japan (DICJ) and the Resolution and Collection Corporation (RCC).

2.1 Strategic Chronology and Rationale

The bank executed a series of sophisticated equity changes to simplify its capital structure for full control by SBI Holdings:

- March 21, 2025: Conversion of 12 common shares into 12 preferred shares.

- July 27, 2025: A massive 1:14,000,000 stock split for both common and preferred shares.

- August 25, 2025: Final conversion of all preferred shares (Class A and B) back into common stock.

The rationale is clear: these steps eliminated the legacy complexities of multi-class shares held by government entities. By consolidating into a single class of common stock, SBI Holdings has "cleaned" the balance sheet, paving the way for a conventional commercial banking model unshackled from the oversight associated with public fund recipients.

2.2 Dividend in Kind: Portfolio Optimization

Furthering this lean strategy, the bank divested its holdings in Latitude Group Holdings Limited via a "Dividend in Kind."

- Property Type: Ordinary shares of Latitude Group Holdings Limited.

- Total Book Value: 41.9 billion yen (52.53 yen per share).

- Effective Date: September 30, 2025.

- Strategic Rationale: This divestment represents a tactical concentration on domestic core operations and capital optimization, freeing up the balance sheet for higher-velocity Japanese assets.

3. Balance Sheet Strength and Asset Quality

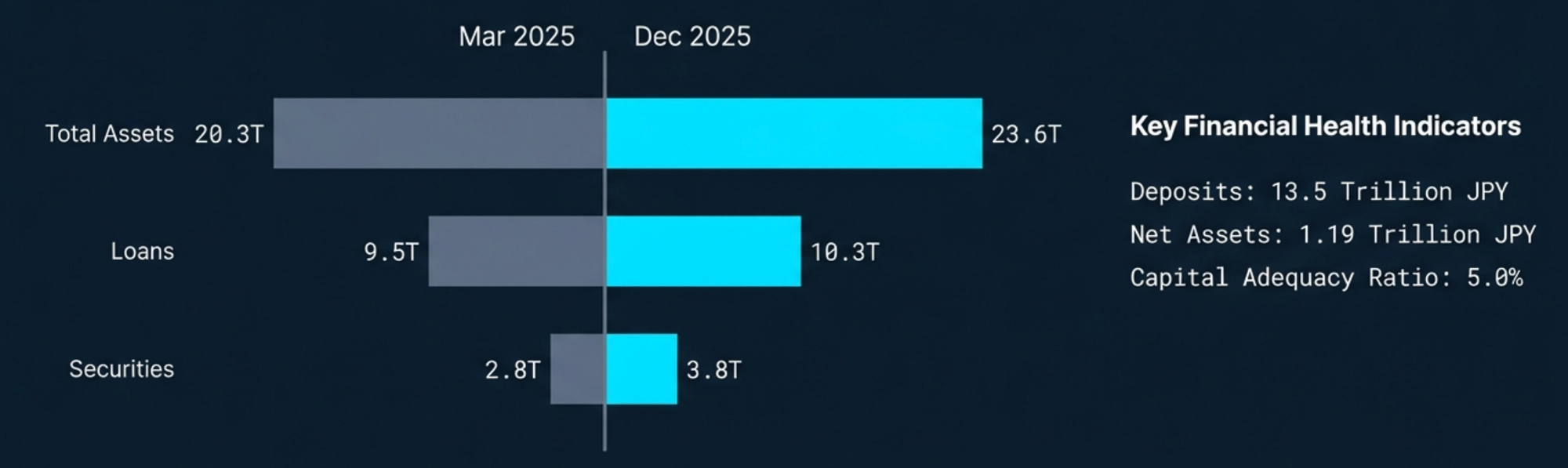

Despite the massive 41.9 billion yen reduction in Retained Earnings caused by the Latitude dividend, the bank's balance sheet become more robust while expanding.

3.1 Balance Sheet Expansion

- Total Assets: Grew from 20.3 trillion yen to 23.6 trillion yen.

- Loans and Bills Discounted: Increased to 10.3 trillion yen.

- Securities: Scaled significantly to 3.8 trillion yen.

- New Significant Item: The bank recorded 225.6 billion yen in "Guarantee deposits for securities lending transactions" (債券貸借取引支払保証金), an item that stood at zero in the prior fiscal year, indicating increased sophistication in its market activities.

3.2 Capital Adequacy Synthesis

The bank’s Equity Ratio improved to 5.0% as of December 31, 2025, a 30-basis-point increase from 4.7% in March. This is a remarkable feat of capital management. The bank managed to improve its ratio despite paying out the 41.9 billion yen dividend-in-kind. This suggests that the expansion to 1.19 trillion yen in Net Assets is higher-quality and more resilient than the raw numbers suggest, providing a significant buffer for future lending.

This balance sheet strength provides the necessary fuel for the bank’s high-performing business segments.

4. Segment Performance Highlights

The bank’s "Business Crude Profit" (Gross Profit) confirms that its transition toward specialized lending and market activities is yielding fruit, though the reliance on interest spreads remains high in the core.

4.1 Top-Performing Divisions (Gross Profit)

- Corporate Business: 25,604 million yen

- Structured Finance: 21,933 million yen

- Showa Leasing: 11,865 million yen

- Financial Markets: 4,483 million yen

4.2 Revenue Mix and Segment Reliability

A definitive analysis of the revenue mix reveals two distinct operational profiles:

- Corporate Business: Remains the most spread-reliant segment. 69.6% of its gross profit is derived from interest income (17,829 million yen), making it highly sensitive to the BoJ’s interest rate trajectory.

- Showa Leasing: Conversely, this is the most fee-reliant/non-interest heavy segment. It actually recorded a slight loss in interest income (△146 million yen) but generated 12,012 million yen in non-interest income. This 100%+ reliance on non-interest revenue, due to lease accounting structures, provides a vital hedge against spread compression in other divisions.

5. Full-Year Forecast and Strategic Outlook

As we approach the end of the fiscal year ending March 31, 2026, SBI Shinsei Bank is positioned to comfortably exceed market expectations.

5.1 Consolidated Earnings Forecast

- Projected Net Income: 100,000 million yen.

- Forecasted Year-End Dividend: 34.00 yen.

5.2 Feasibility and Analyst Verdict

With 90.9 billion yen in net income already secured in the first nine months, the 100-billion-yen target is highly conservative. The bank has reached 90.9% of its annual goal with 25% of the year remaining. Barring a catastrophic credit event or a sudden, violent reversal in the interest rate environment, there is significant potential for an upward revision to these targets in the final quarter.

6. Final Summary

SBI Shinsei Bank has successfully closed the door on its post-takeover restructuring phase. By executing a high-velocity capital restructuring and the systematic repayment of public funds, the bank has effectively concluded the legacy "public-debt era." Now fully integrated into the SBI ecosystem and unshackled from government oversight, the bank is emerging as a high-growth, high-efficiency commercial entity ready to dominate the new Japanese interest rate landscape.