SBI VC Trade and Aplus to Pilot USDC Retail Payments in Japan

SBI VC Trade and Aplus, both subsidiaries of the financial conglomerate SBI Group, will partner to launch a proof-of-concept (PoC) for in-store payments using the U.S. dollar-pegged stablecoin, USD Coin (USDC).

The pilot program, scheduled to commence in the spring of 2026, aims to establish a new commercial model for stablecoin settlement in the Japanese retail sector. The initiative is designed to capture the growing demand from international visitors (inbound tourism) while advancing the "International Financial City OSAKA" project championed by local governments.

Bridging Crypto and Traditional Retail

Historically, the use of stablecoins for retail payments in Japan has been hampered by technical hurdles and regulatory constraints. However, SBI VC Trade is uniquely positioned to bridge this gap as the country’s first registered "Electronic Payment Instrument Exchange Service Provider" (Registration No. 00001).

Under the proposed scheme, the two companies will leverage the digital wallet infrastructure developed during the Osaka-Kansai Expo 2025. The workflow addresses the volatility and technical complexity often associated with crypto payments:

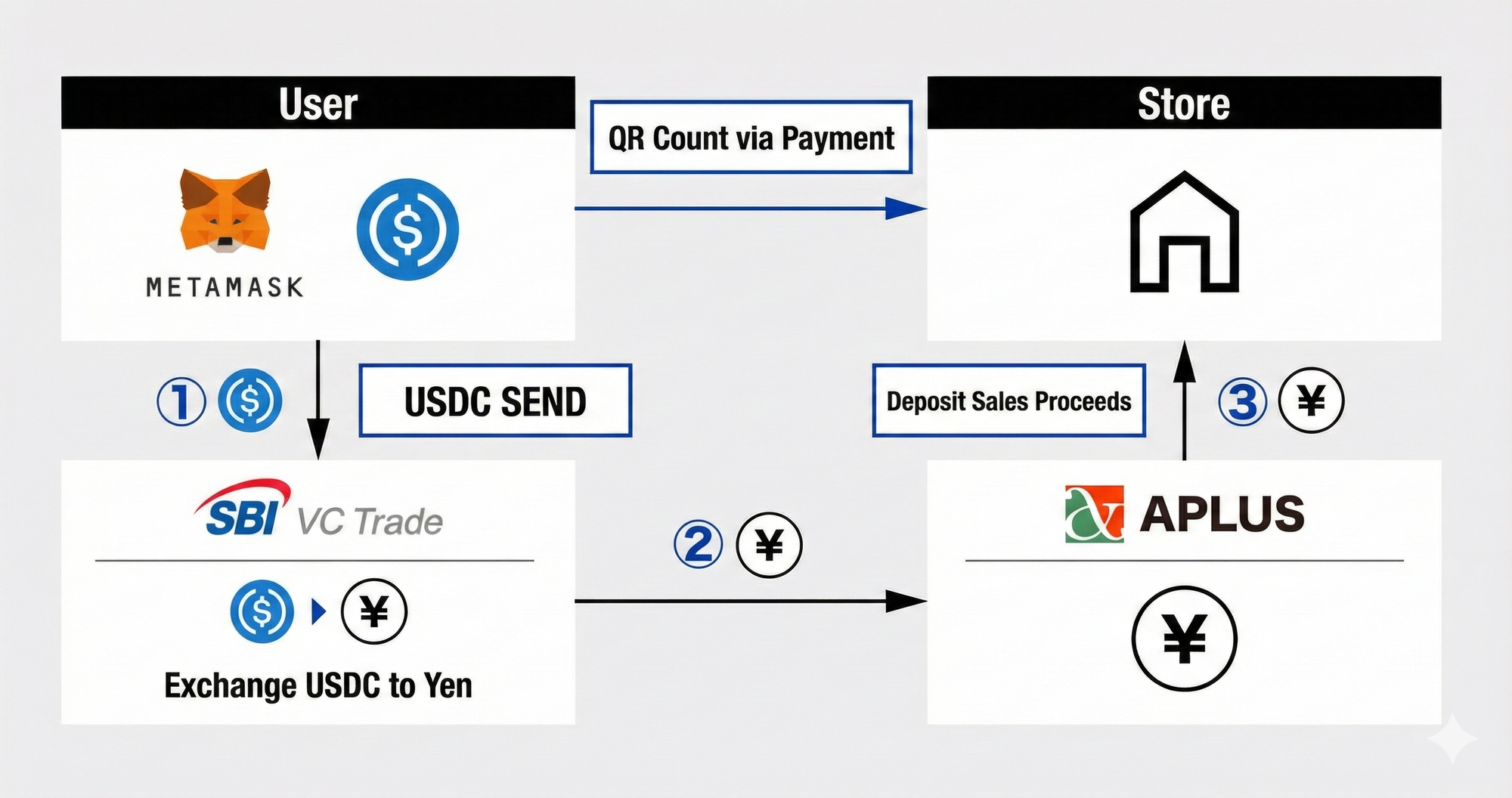

- Consumer Experience: Customers holding USDC in private wallets (such as MetaMask) will scan a QR code provided by the merchant to initiate payment.

- Conversion: SBI VC Trade will intercept the USDC transaction, converting the funds into Japanese Yen (JPY).

- Settlement: Aplus, leveraging its extensive merchant network, will receive the JPY funds from SBI VC Trade and settle the payment with the retailer in local currency.

This structure allows merchants to accept stablecoin payments without handling the digital assets directly or bearing foreign exchange risks, while offering international tourists a seamless payment option using their existing crypto holdings.

Strategic Implications

The collaboration utilizes the respective strengths of the SBI Group entities: SBI VC Trade’s regulatory compliance and liquidity in the crypto asset space, and Aplus’s robust payment network in the consumer finance sector.

"This experiment embodies SBI Group's philosophy of being a 'Financial Innovator,'" the companies stated. "We aim to accelerate the social implementation of stablecoin payments and create real commercial demand for USDC circulation within Japan."

Following the pilot, the companies intend to examine commercial viability, expand their merchant network, and integrate with a wider range of wallet providers.