Securitize Supports PPIH Group's Digital Bond Issuance

Securitize Japan, which provides a security token (ST)/digital securities issuance and lifecycle management platform, announces that the Securitize Platform has been adopted for the security token bonds (digital bonds) planned to be issued by Pan Pacific International Holdings (PPIH), which operates the comprehensive discount store "Don Quijote," mall-type shopping center "Apita," and general supermarket "Piago" within its group.

The move is notable as few large companies outside the financial and technology sectors have issued digital bonds. PPIH’s initiative targets its young customer base directly.

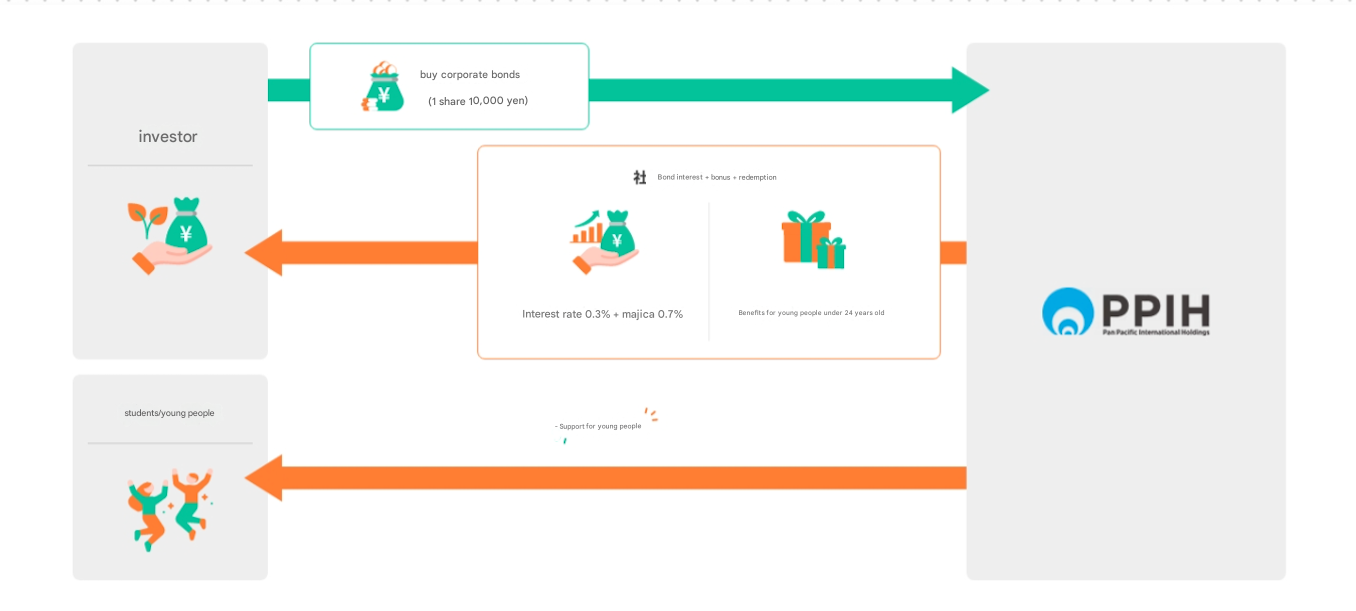

The one year bond offers a 1% return and includes a unique feature designed to attract PPIH’s core demographic. Investors aged 24 and under will earn majica rewards points through the company’s digital payment app, redeemable across the entire PPIH group. This youth focus aligns with the company’s plan to use proceeds for youth empowerment programs.

With a total value of approximately $700,000 and minimum investment of 100,000 yen ($69), the issuance is relatively small scale. PPIH is conducting a month long draw system rather than direct sales, suggesting they anticipate demand exceeding supply. The company is proceeding without traditional intermediaries, though SMBC Nikko Securities serves as advisor.

Securitize's Role

The Securitize Platform will be utilized in the sales and issuance of these digital bonds. The introduction of Securitize Platform enables comprehensive support for the entire series of operations from digital securities sales to redemption, facilitating smooth implementation of self-offering by business companies.

A distinctive feature of this usage method is the introduction of a process that automatically confirms that investors are UCS card members with majica numbers through system integration with UCS Net Serve to verify eligibility for sales targeting during investor registration.

Additionally, with investor consent, personal information is securely transferred from UCS Net Serve to PPIH's sales system, allowing investors to skip input work and achieve smooth registration.

Comment from Securitize Japan Country Head Eiji Kobayashi

"Through this cutting-edge model, companies can strengthen their distance and connection with customers, enhancing customer engagement through support and empathy. Furthermore, they can provide customers with venues for expressing and participating in their values as 'fans' and 'supporters,' expanding into new worlds of value creation. We are pleased to work together with PPIH on such innovative initiatives. We hope this effort will lead to expansion of digital securities users, investors, and market participants, contributing to the efficiency of Japan's financial and capital markets and ultimately strengthening the international competitiveness of Japanese companies."