Seven Bank Second Quarter Financial Results

Seven Bank's second quarter of fiscal year 2025 was a period of solid top-line revenue growth, which was contrasted with planned pressure on profitability driven by strategic investments in the business. The following points summarize the performance across Seven Bank's key business areas:

- Financial Results: Both consolidated and non-consolidated results saw an increase in ordinary income while ordinary profit declined, reflecting underlying revenue growth being offset by rising expenses related to ATM modernization and retail business expansion.

- Domestic ATM Business: Seven Bank observed steady growth in transaction volume, demonstrating the continued relevance of its core services, even as the pace of new ATM installations fell slightly short of its internal plan for the first half.

- Domestic Retail Business: The planned growth in Seven Bank's loan balance was successfully achieved, indicating strong market reception for its lending products, and while the total number of Seven Card members declined, recent application numbers have encouragingly exceeded the targets.

- Overseas Business: Seven Bank's international portfolio showed divergent performance, with the U.S. business delivering strong results that surpassed expectations while its subsidiaries in Asia underperformed against their respective plans, highlighting varied market conditions.

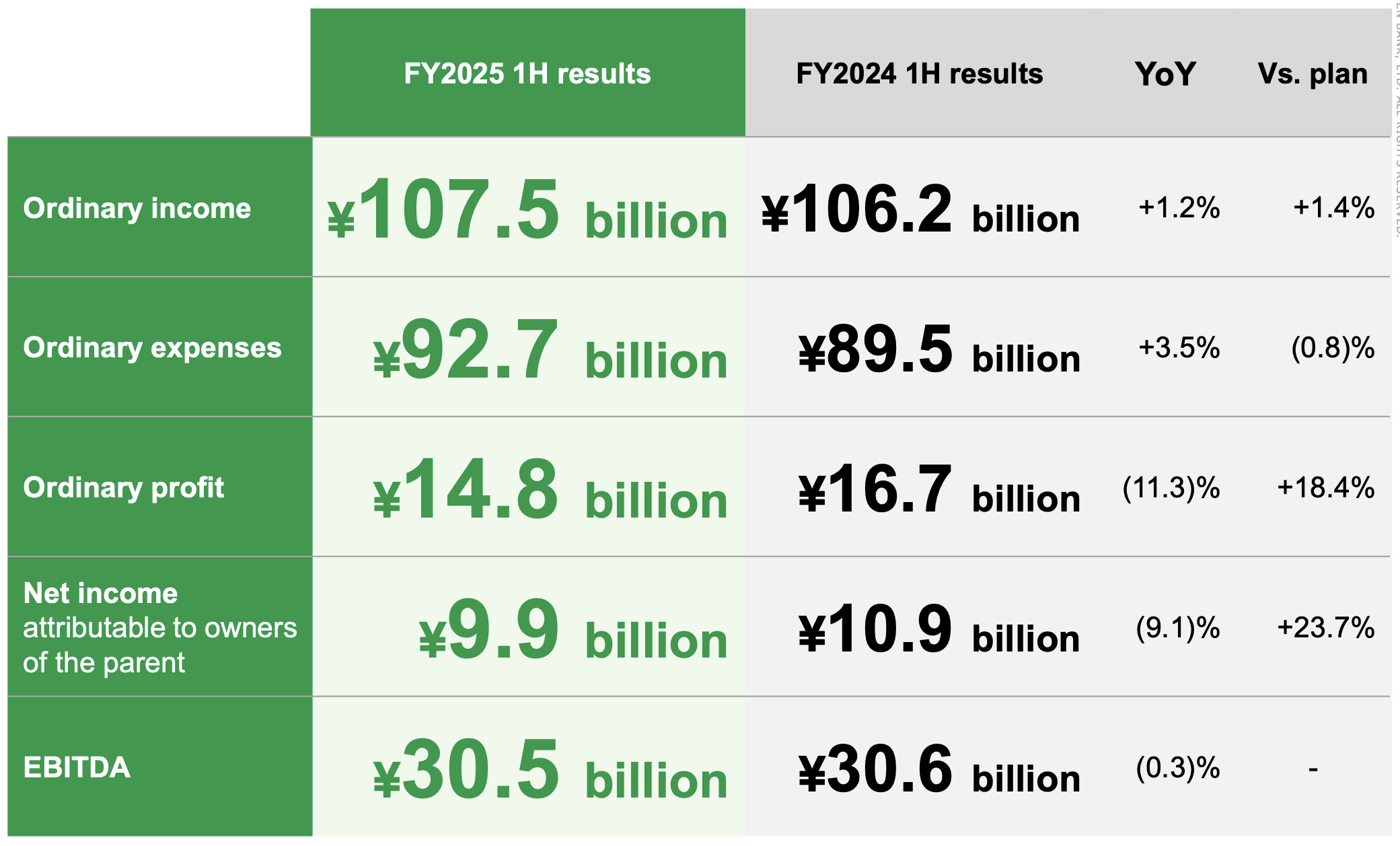

Consolidated Financial Performance

An analysis of Seven Bank's consolidated financial results is essential for understanding the overall health and performance of the entire group. These figures aggregate the performance of Seven Bank and its subsidiaries, offering a comprehensive view of its collective operations.

Analysis of Key Drivers

- Ordinary Income: The 1.2% year-over-year increase in ordinary income, reaching ¥107.5 billion, was primarily driven by the solid performance of the core non-consolidated entity, Seven Bank.

- Ordinary Profit: Ordinary profit declined 11.3% year-over-year to ¥14.8 billion, a result of higher planned expenses at the non-consolidated level. Despite this decline, ordinary profit significantly exceeded the internal plan by 18.4%. This outperformance was largely due to the stronger-than-expected results from Seven Bank's U.S. operations and a favorable impact from Seven Card Service.

This consolidated view sets the context for a more focused analysis of the core non-consolidated banking entity.

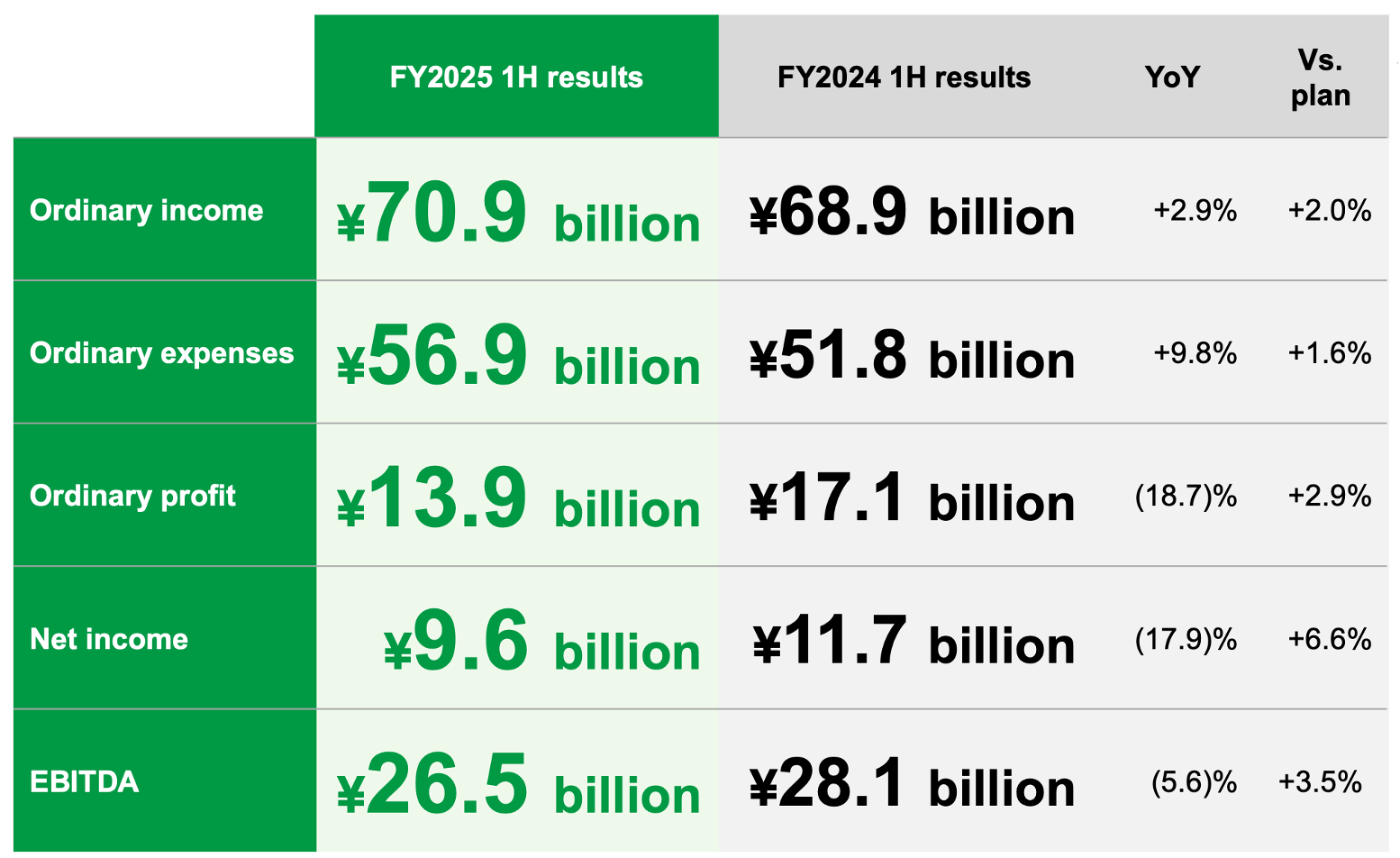

Non-Consolidated Financial Performance: Seven Bank

This section isolates the performance of the core Seven Bank entity. Examining the non-consolidated results provides a clear view of the primary domestic banking operations that form the foundation of Seven Bank's business.

Factors Influencing Performance

- Ordinary Income: The 2.9% year-over-year growth in ordinary income to ¥70.9 billion reflects the successful expansion of the domestic retail businesses. Specifically, growth in loan and post-payment services, complemented by steady ATM-related fee income, drove this positive result.

- Ordinary Profit: The significant 18.7% year-over-year decrease in ordinary profit to ¥13.9 billion was anticipated. The primary drivers were anticipated, strategic investments: higher depreciation from Seven Bank's essential ATM replacement program and increased funding and guarantee fees directly supporting the successful expansion of its high-growth retail loan portfolio.

Having reviewed the high-level financial statements, the next segment will now turn to a detailed operational review of the key business segments.

Performance Analysis by Business Segment

A granular analysis of Seven Bank's business segments is crucial for investors to understand the distinct operational drivers and strategic challenges within its portfolio. This section deconstructs Seven Bank's consolidated results into the three core segments: Domestic ATM, Domestic Retail, and Overseas.

Domestic ATM Business

Seven Bank's core Domestic ATM business continues to demonstrate its resilience and essential role in Japan's financial infrastructure.

- Total Transactions (FY25 1H): 560 million (+18 million transactions YoY)

- Daily Average Transactions per ATM (FY25 1H): 109.2 transactions (+1.5 transactions YoY)

- Total ATMs at End of Term (1H): 28,236 units (+534 units YoY)

- Seven-Eleven Stores: 23,025 units (+170 units YoY)

- Non-Seven-Eleven Stores: 5,211 units (+364 units YoY)

These metrics confirm consistent growth in ATM usage, reflecting strong underlying consumer demand. The expansion of Seven Bank's physical network, while slightly behind the internal schedule, shows particularly robust growth in placements outside of Seven-Eleven stores. This strong performance in non-traditional locations underscores the importance of Seven Bank's strategy to diversify its footprint, a key objective that will be dramatically accelerated by the new alliance with ITOCHU Corporation to place ATMs in FamilyMart stores.

Domestic Retail Business

Seven Bank's Domestic Retail segment is a key engine for future growth, and the first-half results show strong momentum in customer acquisition and the adoption of higher-margin products.

- Customer Accounts: 3,443,000 accounts (+268,000 accounts YoY)

- Balance of Deposits: ¥620.7 billion (+¥14.2 billion YoY)

- Personal Loan Services Balance: ¥70.3 billion (+¥19.0 billion YoY)

- Post Payment Service Transaction Value: ¥49.4 billion (+¥14.1 billion YoY)

The data indicates significant growth in Seven Bank's customer base and demonstrates the success of the strategy to expand its personal loan and post-payment service offerings.

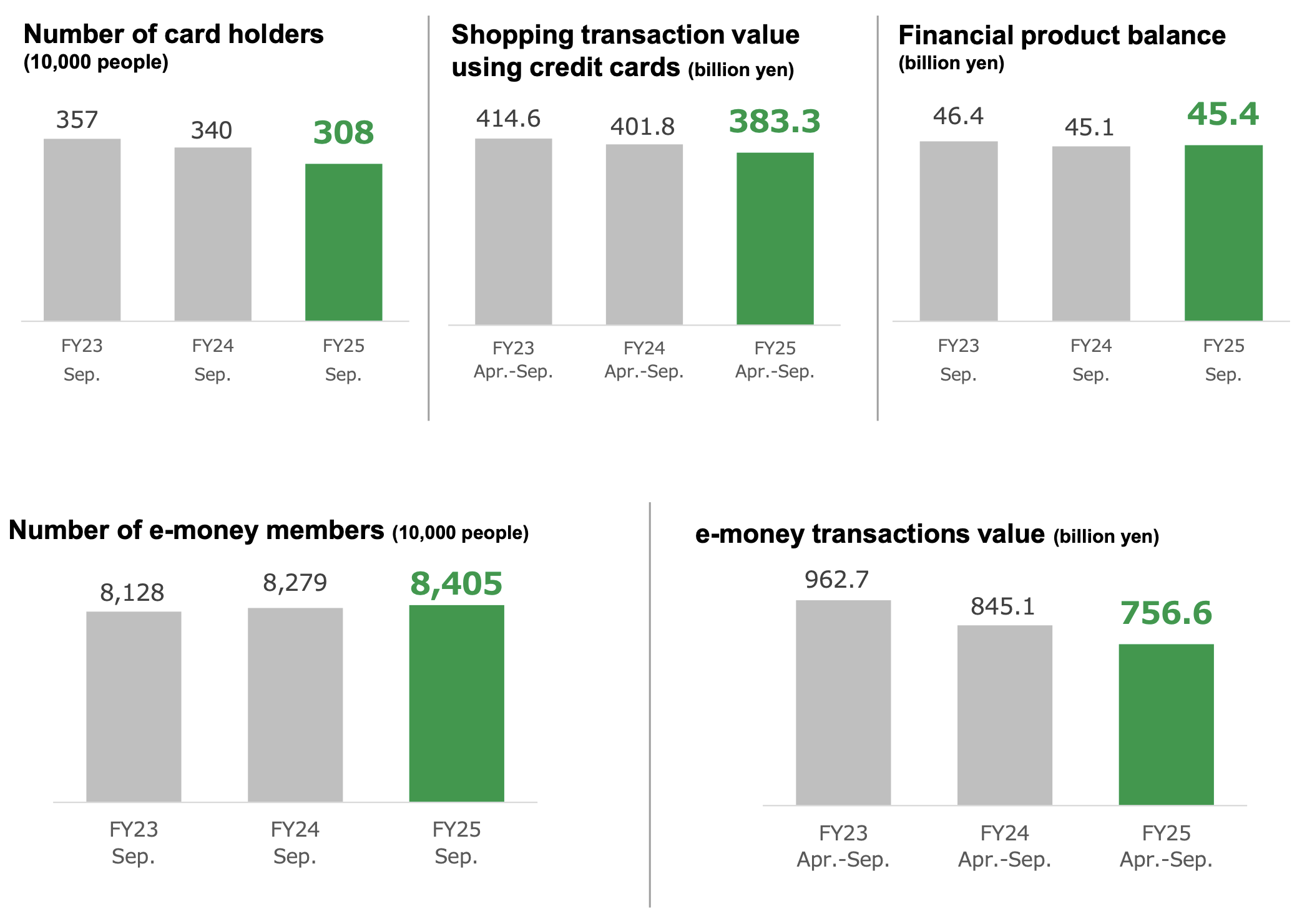

Seven Card Service

The Seven Card Service subsidiary is undergoing a strategic transition. While the financial product balance saw a nominal tick up to ¥45.4 billion, this follows a period of decline and, when viewed alongside the 9.4% YoY drop in the number of cardholders (from 3.40 million to 3.08 million), points to a business in transition. In contrast, the number of e-money members grew from 82.79 million to 84.05 million, and recent credit card application numbers have exceeded Seven Bank's plans, suggesting a consolidation of the user base toward more engaged members as Seven Bank prepares for future product launches.

Overseas Business

Performance in Seven Bank's overseas segment varies significantly by region, a critical context for understanding the international operations. Overall, total ATM transactions for the first half of FY2025 reached 261.8 million, an increase of 8.7 million year-over-year. However, this aggregate figure masks significant regional performance disparities, which the following subsections will explore.

A. United States (FCTI)

Seven Bank's U.S. operation delivered an exceptionally strong first half, with profit significantly exceeding the plan. This success was driven by two key factors: a reversal to growth in daily average transactions per ATM to 48.6 (+1.5 YoY) following new network connections, and an increase in the number of installed ATMs. At the end of the period, the network stood at 8,603 units, with preliminary data showing further growth to 9,085 units as of September 30, 2025. Buoyed by this progress, Seven Bank has revised its second-half installation plan upward, particularly for Speedway store locations.

B. Indonesia (ATMi)

The Indonesian business is currently underperforming relative to plan, prompting a strategic pivot. Seven Bank's new focus is on improving network efficiency by removing underperforming ATMs and driving up the average number of transactions per machine. Initiatives such as the addition of cardless transactions are central to this strategy. Key metrics for the period were 8,933 installed ATMs and a daily average of 46.1 transactions per ATM, down from 49.5 YoY.

C. Philippines (PAPI)

The primary challenge in the Philippines has been a decrease in average transactions per ATM, which fell to 178.1 from 187.9 YoY. This was a direct result of a major partner bank introducing fees to its customers for ATM usage. Seven Bank's strategy is to improve operations and mitigate this impact by expanding partnerships with new financial institutions. The network consisted of 3,731 installed ATMs at period end, with preliminary figures showing growth to 3,898 units as of September 30, 2025.

D. Malaysia (RFMY)

Seven Bank's newest market in Malaysia is progressing well. Seven Bank has nearly achieved its plan to install 100 ATMs this fiscal year, with 97 units installed as of September 30, 2025. The daily average transactions per ATM stands at a promising 208.0.

This segment analysis leads us to the company's outlook for the remainder of the fiscal year.

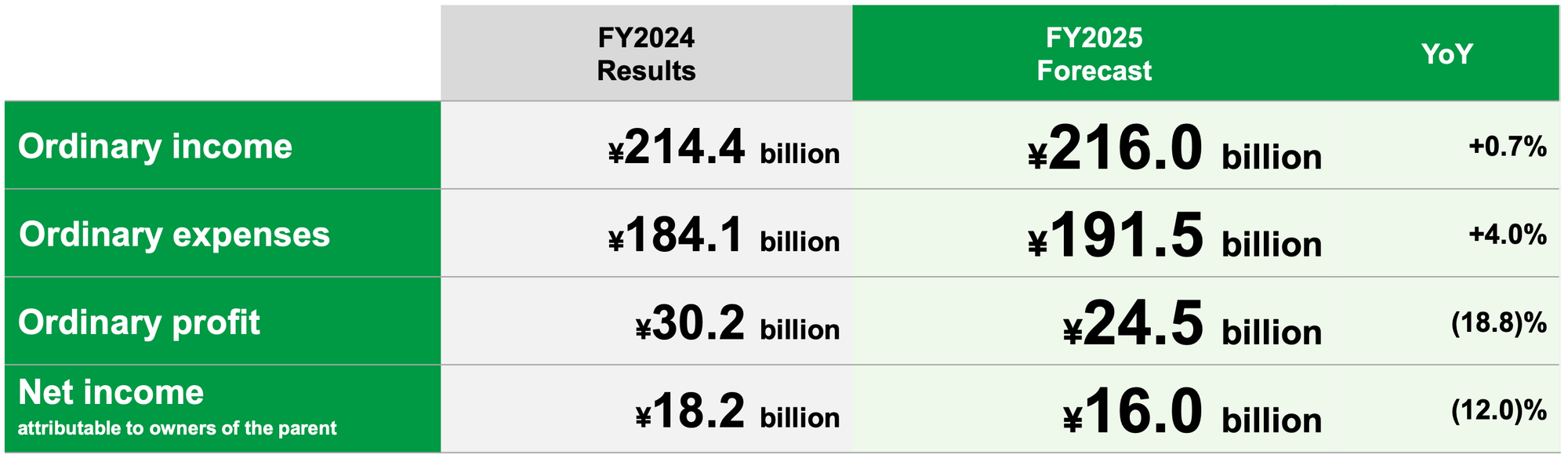

Full-Year Forecast and Shareholder Returns

Despite the mixed results and regional challenges experienced in the first half, Seven Bank is reaffirming its full-year consolidated financial forecast for fiscal year 2025. This decision reflects Seven Bank's confidence in the underlying strength of its core business and the strategic initiatives planned for the second half of the year.

Seven Bank's rationale for maintaining this forecast is based on the following key factors:

- The performance of the core non-consolidated business (Seven Bank) is generally in line with the plan, excluding temporary factors.

- Seven Bank's credit card member acquisition plan is intentionally weighted towards the second half of the year, and will utilize promotional expenses as planned to achieve these targets.

- The overseas business dynamic is expected to continue, with the steady performance of the U.S. operations providing a buffer against the sluggishness in the Asian markets.

In line with this forecast, Seven Bank has confirmed an interim dividend of ¥5.50 per share and maintain its year-end dividend forecast of ¥5.50 per share.

The next section will now detail the specific strategic initiatives designed to drive future growth and ensure Seven Bank achieves these forecasts.

Strategic Initiatives and Future Growth Strategy

This section outlines the forward-looking strategic pillars that underpin Seven Bank's plan for long-term value creation. The strategy is twofold: refining the existing strengths of Seven Bank's core businesses and simultaneously laying the groundwork for new opportunities and alliances.

Refining Strengths: Enhancing the ATM and Retail Core

- Domestic ATM Business ("+Connect"): Seven Bank's "+Connect" initiative is transitioning from its initial launch phase to one of establishment and expansion. Its goal is to solve operational issues and promote digital transformation (DX) for partner financial institutions by leveraging Seven Bank's ATM network. This initiative is a key growth driver, targeting a total addressable market with a potential scale of approximately ¥4 trillion per year.

- Overseas ATM Business: Seven Bank is strategically evolving its overseas operations from a simple ATM operator into a comprehensive "finance x retail service provider." Key initiatives supporting this vision include CRM trials and on-screen advertising in the U.S., and the implementation of cardless transactions in Indonesia.

- Domestic Retail Business: Seven Bank's approach to strengthening the retail segment is focused on two key areas: attracting stable deposits through competitive interest rate campaigns and unique reward programs, and steadily increasing the card loan balance, which is on track to meet its ¥80.0 billion full-year target.

Laying the Groundwork: New Ventures and Alliances

- Credit Card Business: Seven Bank's strategy for the credit card segment involves expanding the current member base through enhanced rewards and targeted marketing, with first-half applications already exceeding the plan. Concurrently, Seven Bank is preparing for the launch of a new, next-generation credit card in fiscal year 2026.

- Capital and Business Alliance with ITOCHU Corporation: This recently formed alliance is a cornerstone of Seven Bank's future strategy and has two critical components:

- Business Alliance: Seven Bank plans to begin installing Seven Bank ATMs in FamilyMart convenience stores starting in fiscal year 2026. Seven Bank will also continue discussions on broader collaborations in credit card, payment, and other financial services.

- Capital Alliance: Through a disposal of treasury stock, ITOCHU Corporation has been allocated 16.35% of Seven Bank's voting rights. ITOCHU plans to increase its holding to 20%, solidifying a long-term partnership.

This alliance fundamentally reshapes Seven Bank's growth trajectory, nearly doubling the potential convenience store footprint and creating an unparalleled physical network for financial service delivery at the heart of daily life in Japan. It is central to Seven Bank's vision of becoming a "financial service platformer" centered on this unparalleled network.

Conclusion: Vision for Sustainable Growth

In summary, the second quarter results tell a clear story of top-line revenue growth paired with pressure on profitability, driven by necessary and strategic investments in Seven Bank's future. Seven Bank is successfully expanding its retail business, modernizing its ATM network, and building powerful alliances that will define the next phase of growth.

Seven Bank reaffirms its long-term vision to become a "financial service platformer" that leverages its unique position at the intersection of finance and retail to meet a wide range of customer needs. The second half of the year will be a period of focused execution, where Seven Bank will aim to capitalize on the investments and strategic partnerships established in the first half. By achieving its full-year targets, Seven Bank aims to demonstrate the power of its evolving business model and solidify the foundation for sustainable, long-term growth.