SMBC Acquires 20% Stake in YES BANK

Sumitomo Mitsui Financial Group and Sumitomo Mitsui Banking Corporation have reached an agreement with State Bank of India (SBI), the state-owned bank of the Republic of India, and other financial institutions in India to acquire a 20.0% equity stake in YES BANK, a private commercial bank in India, subject to regulatory approvals, and signed definitive agreements. As a result of the investment, YES BANK is expected to become an equity-method affiliate of SMBC Group and SMBC.

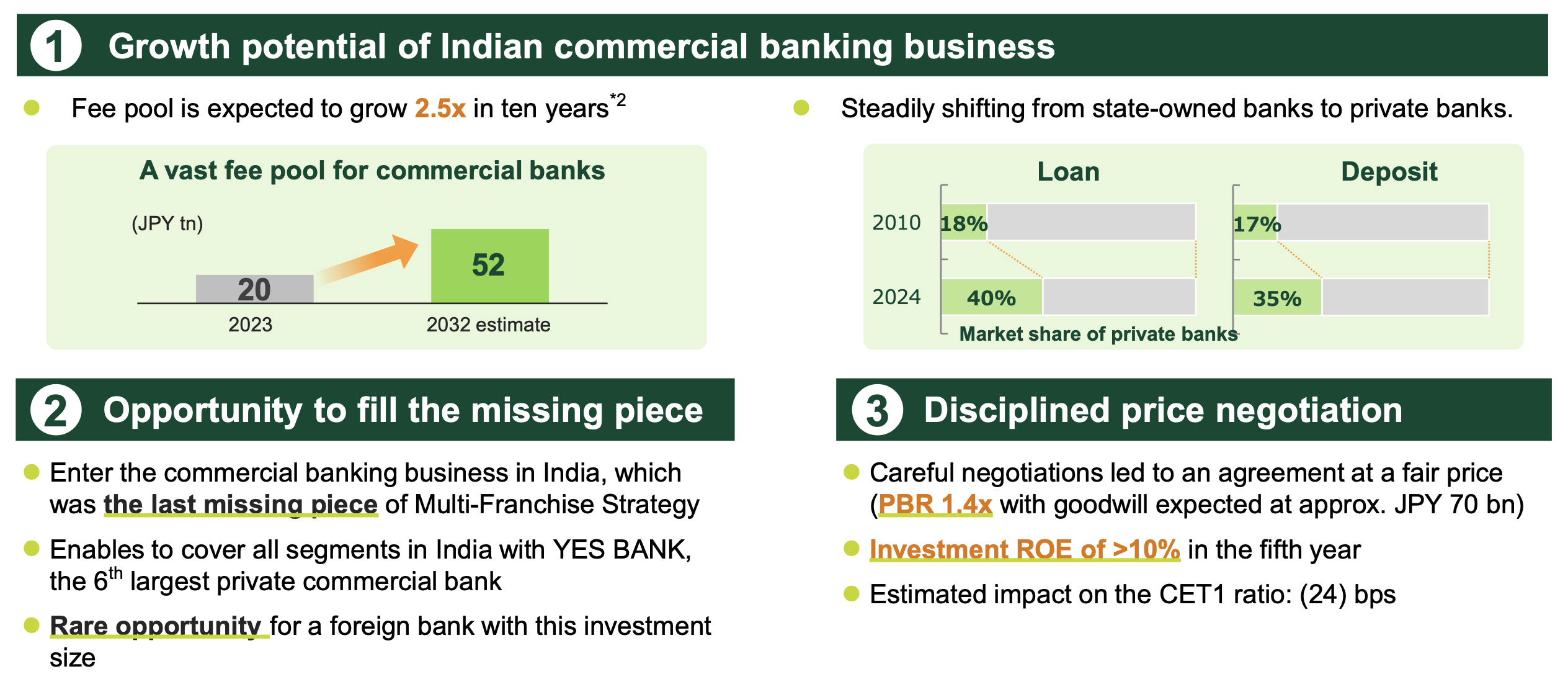

The purchase consideration is INR 134.8bn, approximately JPY 240bn, at a Price-Book-Ratio of 1.4 times.

Restrictions on ownership, stricter capital requirements, and state domination of the banking sector have made cross-border deals a rarity across Indian banks. A takeover of troubled Lakshmi Vilas Bank by Singapore-based DBS Group in 2020 was the last major deal in the sector.

As part of the deal, SMBC will acquire a 13.19% stake from State Bank of India, also its largest investor, and an aggregate of 6.81% from Axis Bank, Bandhan Bank, Federal Bank, HDFC Bank, ICICI Bank, IDFC First Bank Limited and Kotak Mahindra Bank.

SMBC Group's Business in India

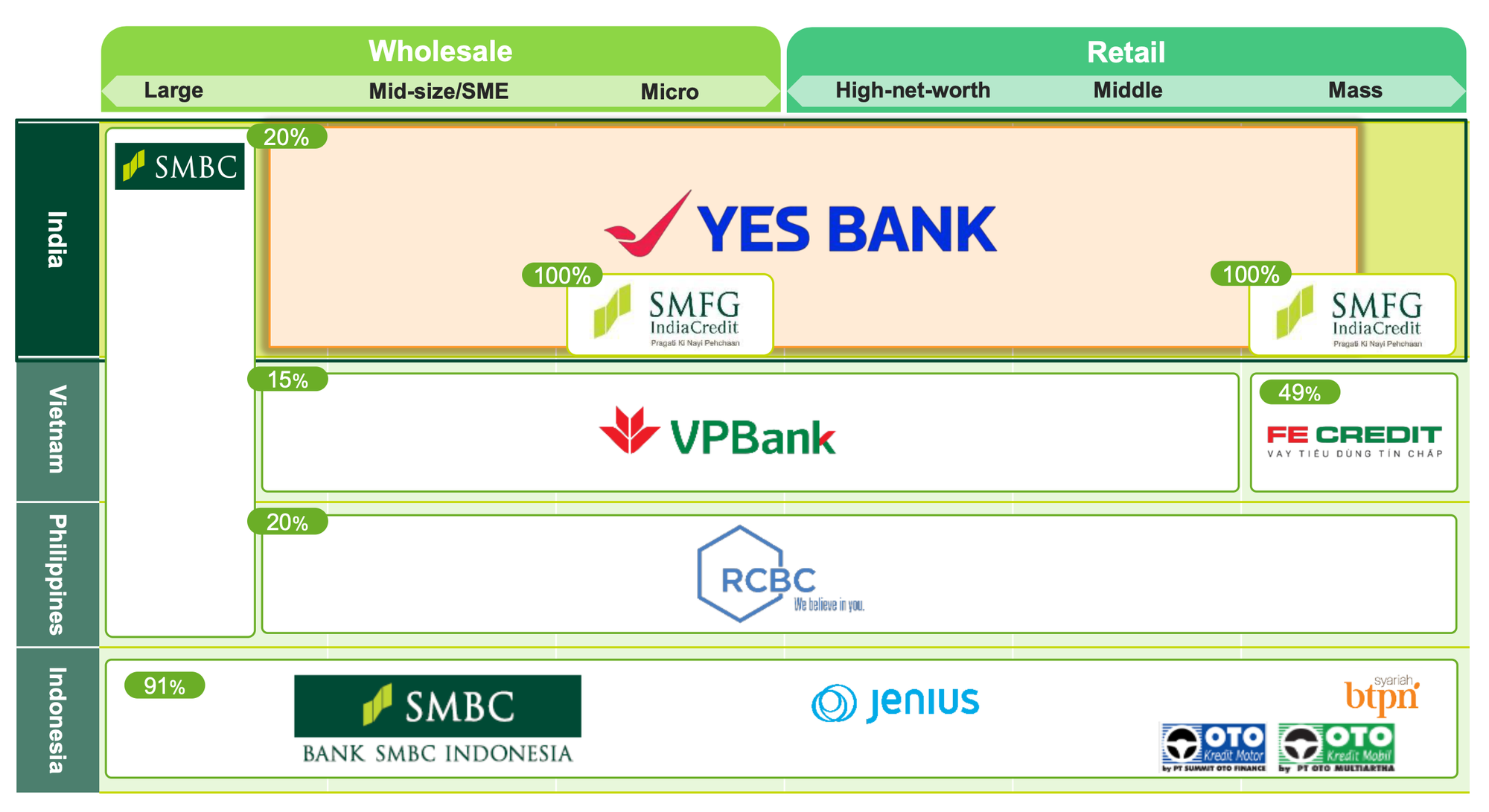

SMBC Group has been working on its Asia multi-franchise strategy to build a second and third SMBC Group by developing full banking and financial services operations, with the aim of capturing growth in Asia from a medium- to long-term perspective.

In India, which is a focus country for this strategy, since establishing the New Delhi Branch in 2013, SMBC has expanded its network with the Mumbai Branch, Chennai Branch and GIFT City Branch offices.

Additionally, through SMFG India Credit, which SMBC Group acquired in 2021, it has been providing financial services to a broad range of customer segments including retail customers and small and medium enterprises.

Furthermore, SMBC Group established an India Division in April this year to strengthen its focus and commitment to India and accelerate its growth strategy.

Strategic Rationale of the Investment

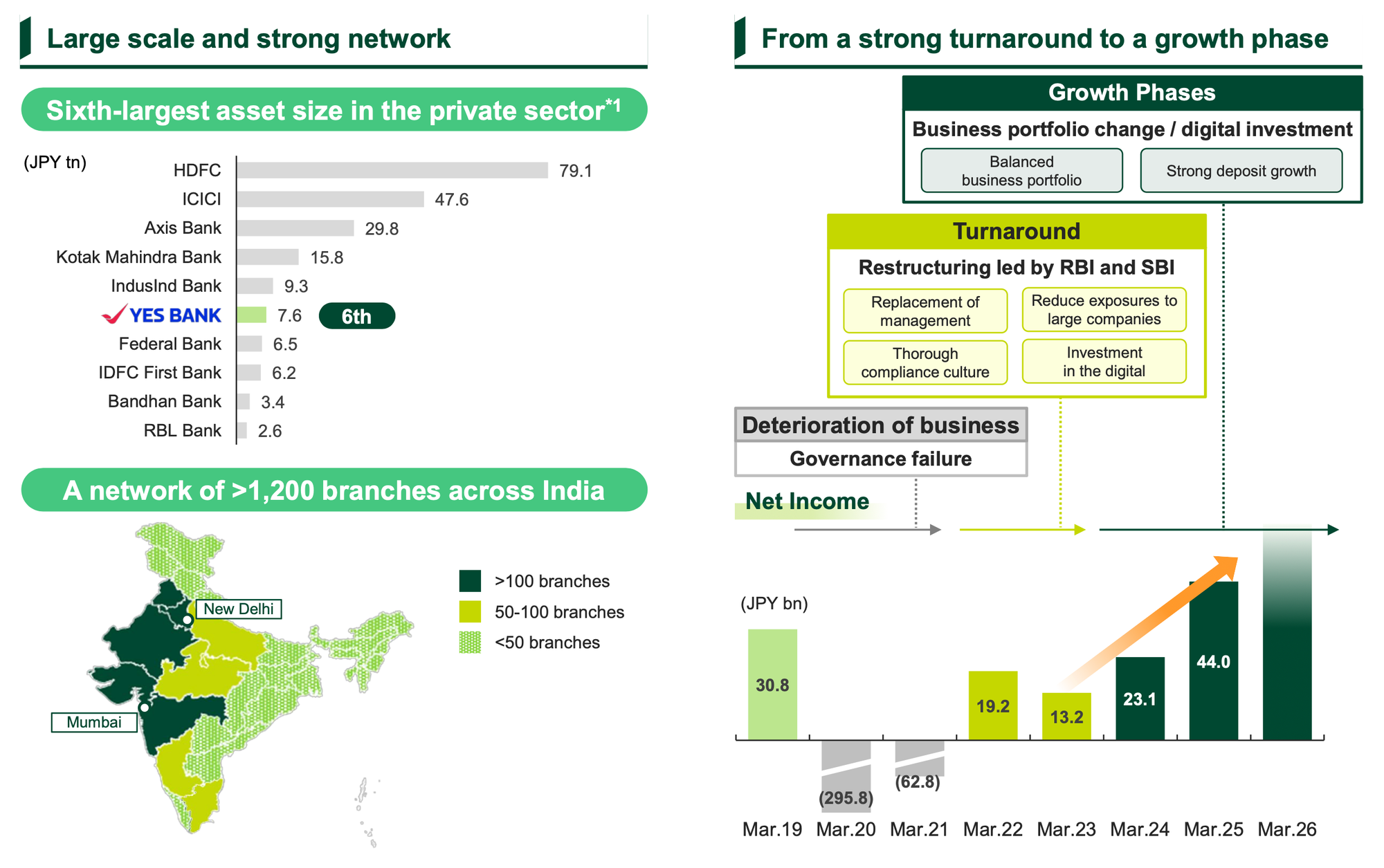

YES BANK is the sixth-largest private sector commercial bank in India, with a network of more than 1,200 branches across India. It provides a wide range of financial services from large corporates to the retail segment, with a strong franchise in in the digital and transaction banking areas and has achieved high growth in recent years.

With this investment, SMBC will gain an access to one of the largest private sector commercial banks in India which will allow it to further accelerate SMBC Group’s business in India, and contribute to the further development of the Indian financial industry as well as supporting the flow of trade and capital from Japan to India.