SMBC Group and Jefferies Launch Wholesale Japanese Equities Joint Venture

Sumitomo Mitsui Financial Group (SMBC Group), its wholly owned subsidiary Sumitomo Mitsui Banking Corporation (SMBC) and SMBC Nikko Securities, and Jefferies Financial Group have signed a memorandum of understanding to expand their global strategic alliance by establishing a joint venture in Japan to conduct their wholesale Japanese equities business. This joint venture will be the cornerstone of the wholesale Japanese equities business, encompassing equity capital markets (ECM) within investment banking, equity sales and trading, and equity research across global markets. With a view to further deepening the strategic partnership, SMBC plans to increase its economic investment in Jefferies to up to 20.0% on an as converted and fully diluted basis. SMBC will continue to own less than 5% of a voting interest in Jefferies. The increased economic investment in Jefferies is subject to receipt of required regulatory approvals.

SMBC Group and Jefferies initially entered into a Strategic Alliance in 2021 to collaborate on future corporate and investment banking business opportunities. In 2023, the Global Strategic Alliance was expanded to enhance collaboration across M&A, equity and debt capital markets, with a particular focus on investment grade clients in the U.S. SMBC Group and Jefferies subsequently expanded the Global Strategic Alliance to the EMEA region and APAC region, as well as expanded the scope of Joint Coverage initiatives to larger global sponsors, pre-IPO companies, and sub-investment grade corporate clients.

In addition to integrating the Japanese equities business, SMBC Group and Jefferies will further strengthen the scope of their Global Strategic Alliance by agreeing to expand joint coverage of large sponsor clients in EMEA. In parallel, with a view to deepening the partnership, SMBC has agreed to extend an additional $2.5 billion in credit facilities to Jefferies. This robust partnership initiative aims to enhance collaboration between the two firms, deliver expanded capabilities and services to meet the needs of their respective clients and enhance the exceptional services of the firms in a manner tailored to the needs of their respective clients.

Japanese Equities Joint Venture

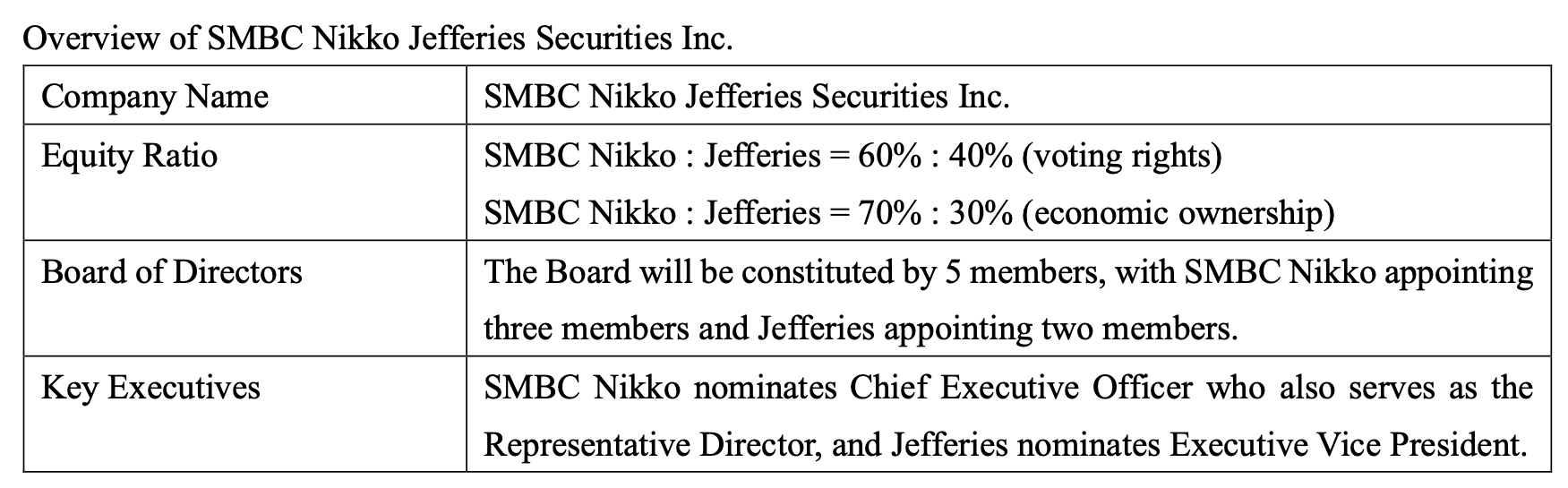

The respective wholesale Japanese equities businesses in Japan of SMBC Nikko and Jefferies will be consolidated into a newly established joint venture, which will serve as the core entity overseeing operations to ensure a unified global approach, while SMBC Nikko’s overseas wholesale Japanese equities business, including sales, will be transferred to and operated through Jefferies’ regional bases. The joint venture will be named SMBC Nikko Jefferies Securities and will be a consolidated subsidiary with a majority investment from SMBC Nikko. The integration will cover ECM operations, equity sales and trading, and equity research.

Through the integration of the wholesale Japanese equities business, SMBC Nikko will enhance its system infrastructure and research capabilities by leveraging Jefferies' strengths in its global network and deep sector expertise. This will enable SMBC Nikko to deliver higher value-added financial services to clients not only in Japan but also globally.

In addition, SMBC Group is considering the establishment of an intermediate holding company to ensure cohesive management of wholesale and retail businesses in Japan and globally, and SMBC Group’s equity interest in SMBC Nikko and the Japanese joint venture would be held by such intermediate holding company. SMBC Nikko Jefferies Securities is targeted to launch its operations in January 2027 and is expected to consolidate Japan operations related to both Japan domestic and overseas institutional investors, while sales and related activities for the Japanese equities business conducted by SMBC Nikko’s overseas group entities will be migrated to Jefferies’ regional bases, with the joint venture serving as the core platform to jointly operate the Japanese equities business. In connection with these arrangements, we aim to ensure that Japanese equities order flow from Jefferies’ global network is securely routed to SMBC Nikko Jefferies Securities, while providing meticulous services to Japanese institutional investors, to facilitate a seamless transition to the new secondary business framework. The establishment of SMBC Nikko Jefferies Securities is subject to receipt of applicable regulatory and other approvals or consents.

For ECM operations, SMBC Nikko Jefferies Securities will act as the underwriter starting in January 2027, while issuer relations will continue to be managed primarily by the coverage division within SMBC Nikko.

Additionally, following the launch of the wholesale Japanese equities joint venture, SMBC Group and Jefferies plan to discuss potential further collaboration—leveraging both firms’ strengths—across the majority of the Japan domestic wholesale securities operations, including coverage.

Expanding SMBC’s Equity Ownership in Jefferies

SMBC intends to increase its economic ownership of Jefferies to up to 20% (on an as-converted and fully-diluted basis) by purchasing shares in the open market and then exchanging those common shares for either non-voting common shares or non-voting preferred shares that will be mandatorily convertible into non-voting common shares. SMBC will continue to own less than 5% of a voting interest in Jefferies. The increased investment is subject to receipt of applicable regulatory and other approvals or consents.

Joint Sponsor Coverage in EMEA

SMBC Group and Jefferies will expand their joint coverage of larger sponsors in EMEA and to offer the investment and corporate banking capabilities of both Jefferies and SMBC Group to such large sponsor clients.

New and Enhanced Credit Facilities

SMBC has agreed to extend a total of $2.5 billion in new credit facilities to support Jefferies and to advance collaboration in key areas, including structured finance such as EMEA leveraged lending and U.S. pre-IPO lending.

As a key component of the new credit facilities, SMBC has agreed to provide revolving credit commitments for pre-IPO companies. This newly agreed, substantial $2.5 billion financing package aims to enhance SMBC's commitment to deepening the partnership, enhances capabilities across these focus areas, and enables SMBC to further deliver exceptional services to its clients.