SMBC Group First Quarter FY3/2026 Financial Results

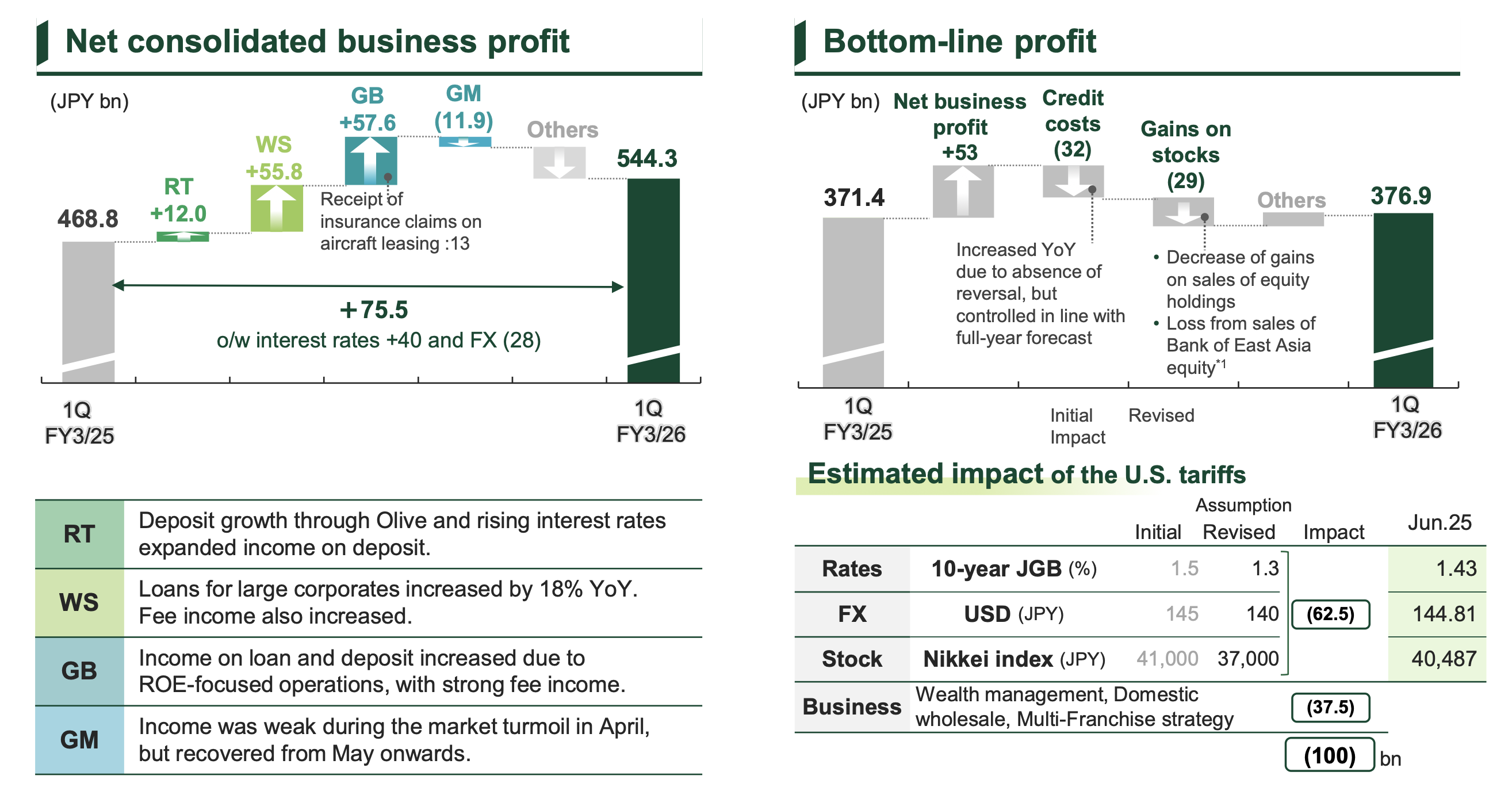

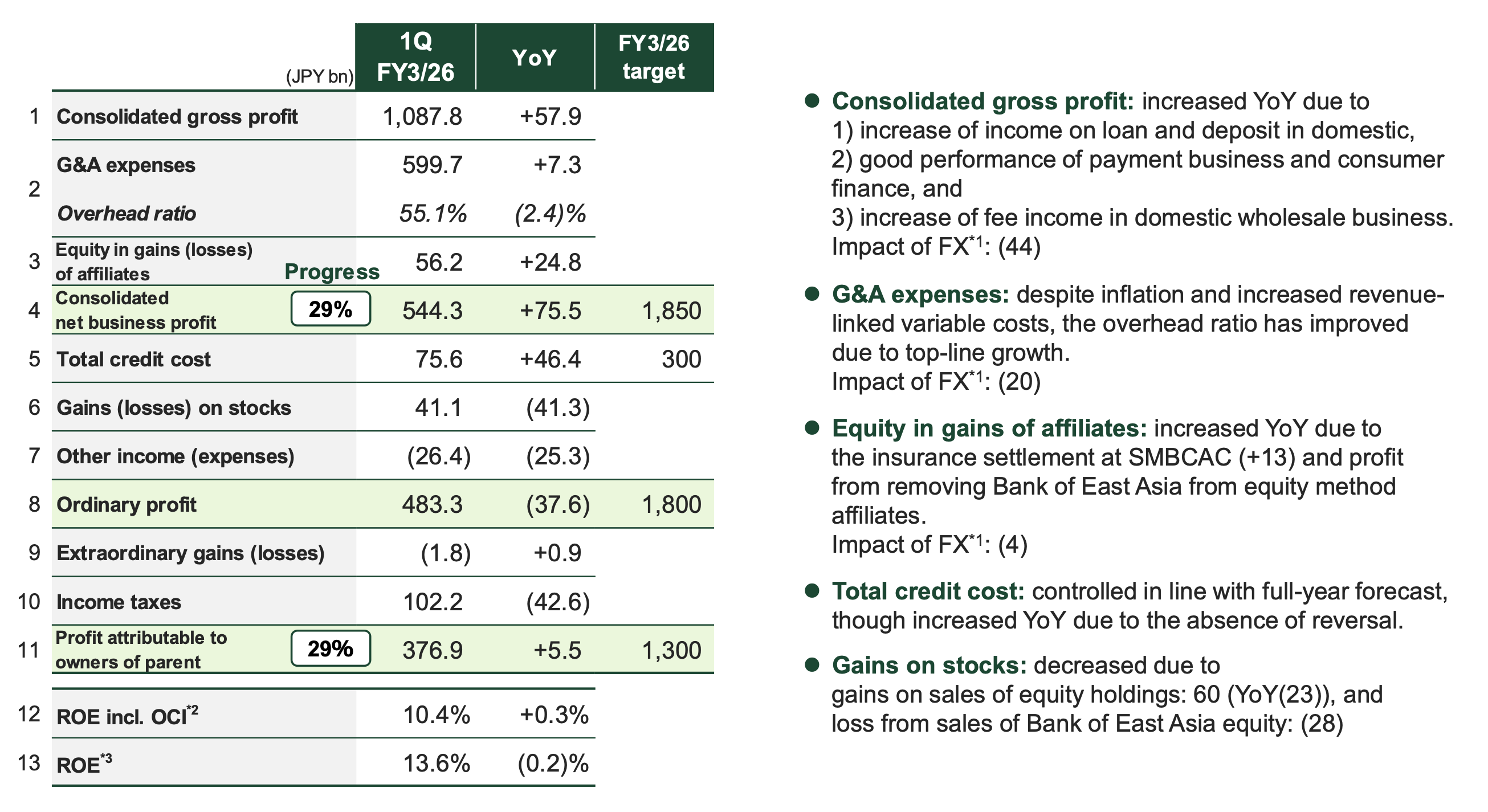

Sumitomo Mitsui Financial Group (SMFG) has commenced the fiscal year ending March 2026 with a robust first-quarter performance, characterized by strong underlying fundamentals in its core domestic operations. The group reported a Profit Attributable to Owners of Parent of ¥376.9 billion, a modest increase of 1.5% year-over-year (YoY), and a more substantial 16.1% YoY surge in Consolidated Net Business Profit to ¥544.3 billion.

Both of these key profitability metrics are tracking at a solid 29% of the full-year forecast, signaling a strong start and providing a significant buffer against potential future volatility. This performance surpassed analyst consensus on earnings per share (EPS), yet was met with a negative market reaction, indicating that investor focus has shifted from the strong current results to the significant forward-looking risks on the horizon.

The central theme emerging from SMFG's first-quarter results is a critical divergence. The domestic business is powerfully capitalizing on Japan's ongoing monetary policy normalization, which is fueling a high-quality expansion in core earnings, particularly through net interest income. This domestic strength, however, is being partially offset by margin pressures in overseas markets and the looming, albeit deferred, geopolitical risks stemming from newly implemented U.S. trade policies.

The group's proactive balance sheet management—notably the accelerated reduction of strategic equity holdings—and the remarkable success of its "Olive" digital banking platform stand out as key strategic differentiators. Nonetheless, the ability to sustain this performance and achieve full-year targets will be contingent on the group's capacity to navigate an increasingly challenging and uncertain global macroeconomic environment.

Key strategic developments underscore this dynamic:

- Domestic Outperformance: The normalization of Japanese interest rates has been a direct and powerful tailwind, fueling a significant expansion in domestic Net Interest Income (NII) and enhancing the profitability of the core lending franchise.

- Digital Acquisition Success: The "Olive" comprehensive financial services platform has proven to be a formidable strategic asset. Having surpassed 6 million accounts, it has become a highly effective and low-cost channel for deposit gathering, expanding the customer base, and deepening engagement, particularly with younger demographics.

- Proactive De-risking: Management has demonstrated strong execution on its multi-year plan to reduce its portfolio of strategic equity holdings, reporting that the program is "ahead of schedule." This initiative enhances capital efficiency, reduces exposure to stock market volatility, and strengthens the overall quality of the balance sheet.

- Tariff Risk Deferred, Not Dismissed: A significant source of market apprehension, the anticipated ¥100 billion negative impact from U.S. tariffs, had not yet materialized in the first quarter's profit and loss statement. However, with the trade deal now finalized, this impact is no longer a hypothetical risk but an impending headwind that will begin to affect performance in the coming quarters.

I. Consolidated Financial Performance: A Deep Dive into the First Quarter

Income Statement Analysis: Unpacking the Quality of Profit

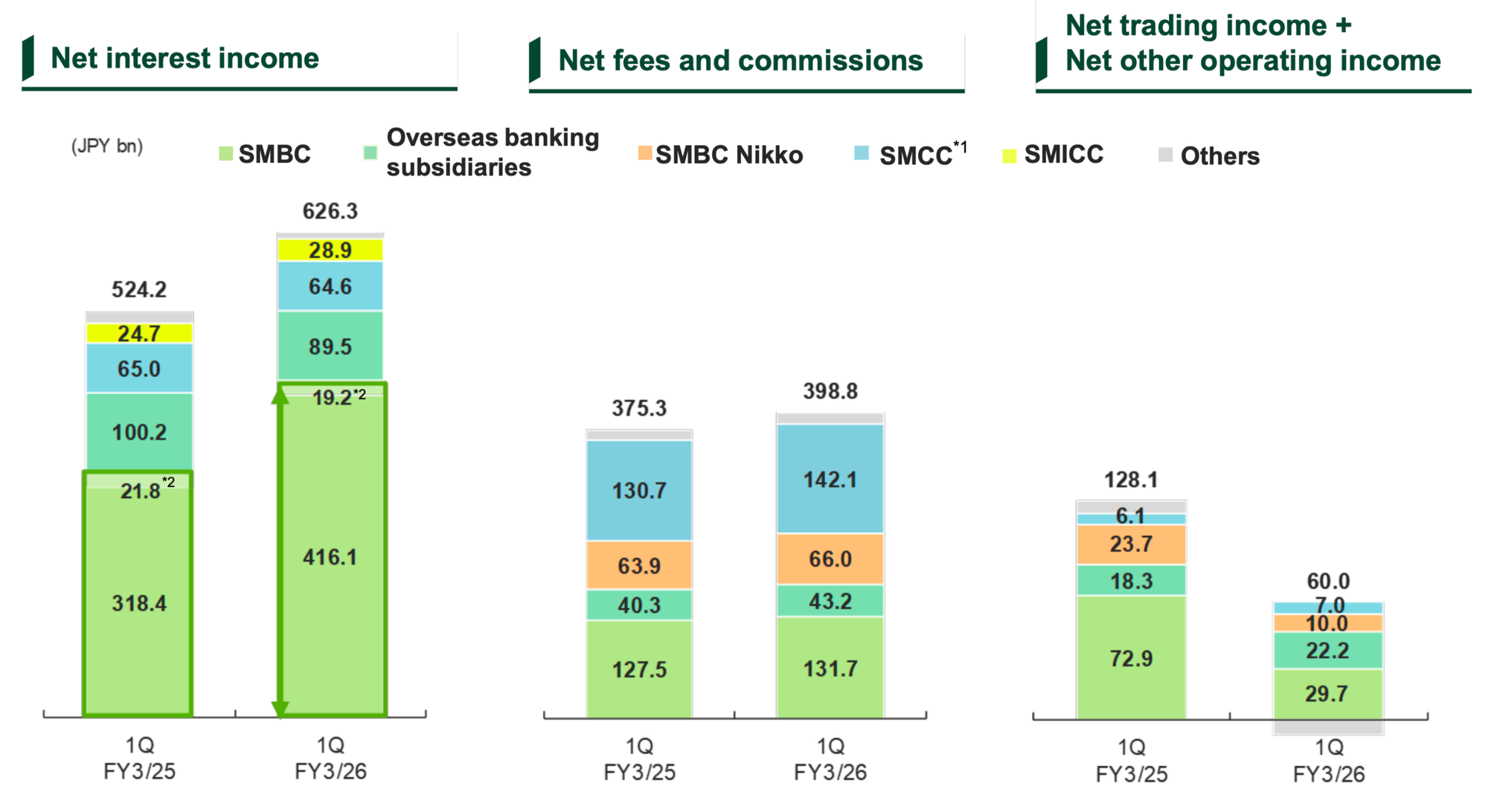

SMFG's consolidated income statement for the first quarter reveals a narrative of strengthening core profitability, even as headline figures show modest growth. Consolidated Gross Profit rose to ¥1,087.8 billion, an increase of ¥57.9 billion YoY. This top-line growth was underpinned by a confluence of positive factors, including a significant increase in domestic loan and deposit income, the robust performance of the payment and consumer finance businesses, and a healthy rise in fee income from the domestic wholesale segment.

The most telling indicator of underlying health, Consolidated Net Business Profit, surged by an impressive ¥75.5 billion YoY to reach ¥544.3 billion. This demonstrates the powerful momentum in the group's fundamental operations, driven primarily by exceptional performance in the Wholesale (+¥55.8 billion) and Global (+¥57.6 billion) business units.

In contrast, the bottom-line figure, Profit Attributable to Owners of Parent, registered only a slight increase of ¥5.5 billion YoY to ¥376.9 billion. The significant gap between the growth in core business profit and the final net profit figure is a critical element of the quarter's results. This divergence is primarily attributable to movements in non-core, below-the-line items.

Gains on Stocks, a significant contributor in the prior year, decreased substantially by ¥41.3 billion YoY to ¥41.1 billion. This decline was driven by two main factors: lower gains from the strategic sale of equity holdings and a notable ¥28 billion pre-tax loss recorded from the partial sale of the group's equity stake in the Bank of East Asia. This ¥41.3 billion drop largely offsets the ¥75.5 billion improvement in core business profit when viewed from the perspective of the final net income figure. This structural shift implies that the prior year's results were more heavily reliant on non-recurring asset sales. The current quarter's performance is, therefore, fundamentally healthier and of higher quality, as it is driven by sustainable growth in the core banking activities of lending and fee generation. For institutional investors, this signals a favorable transition towards a more predictable and sustainable earnings stream, a crucial qualitative factor not immediately apparent from the headline net income figure alone.

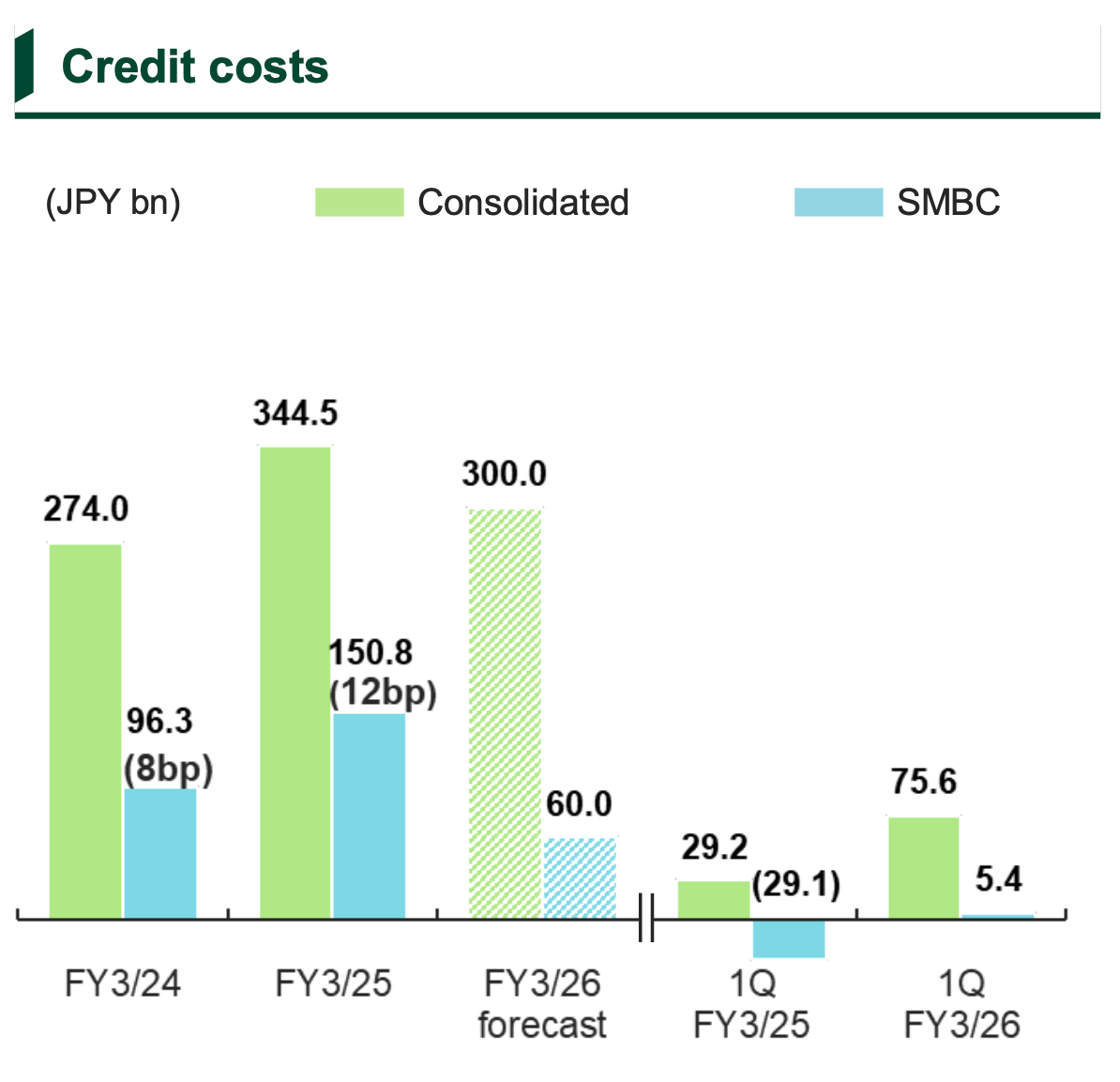

On the risk side, Total Credit Costs increased to ¥75.6 billion, a YoY rise of ¥46.4 billion. This increase was anticipated and is largely technical, stemming from the absence of a large provision reversal that benefited the prior-year period. Management has confirmed that credit costs remain well-controlled and are tracking in line with the full-year forecast of ¥300 billion, suggesting that underlying asset quality remains stable and benign.

From a profitability perspective, the group maintained strong returns. Return on Equity (ROE), based on shareholder's equity, stood at a robust 13.6%, though this was a marginal decrease of 0.2% from the prior year. ROE including Other Comprehensive Income (OCI) was 10.4%, showing a slight improvement of 0.3% YoY.

Balance Sheet and Asset Quality Analysis

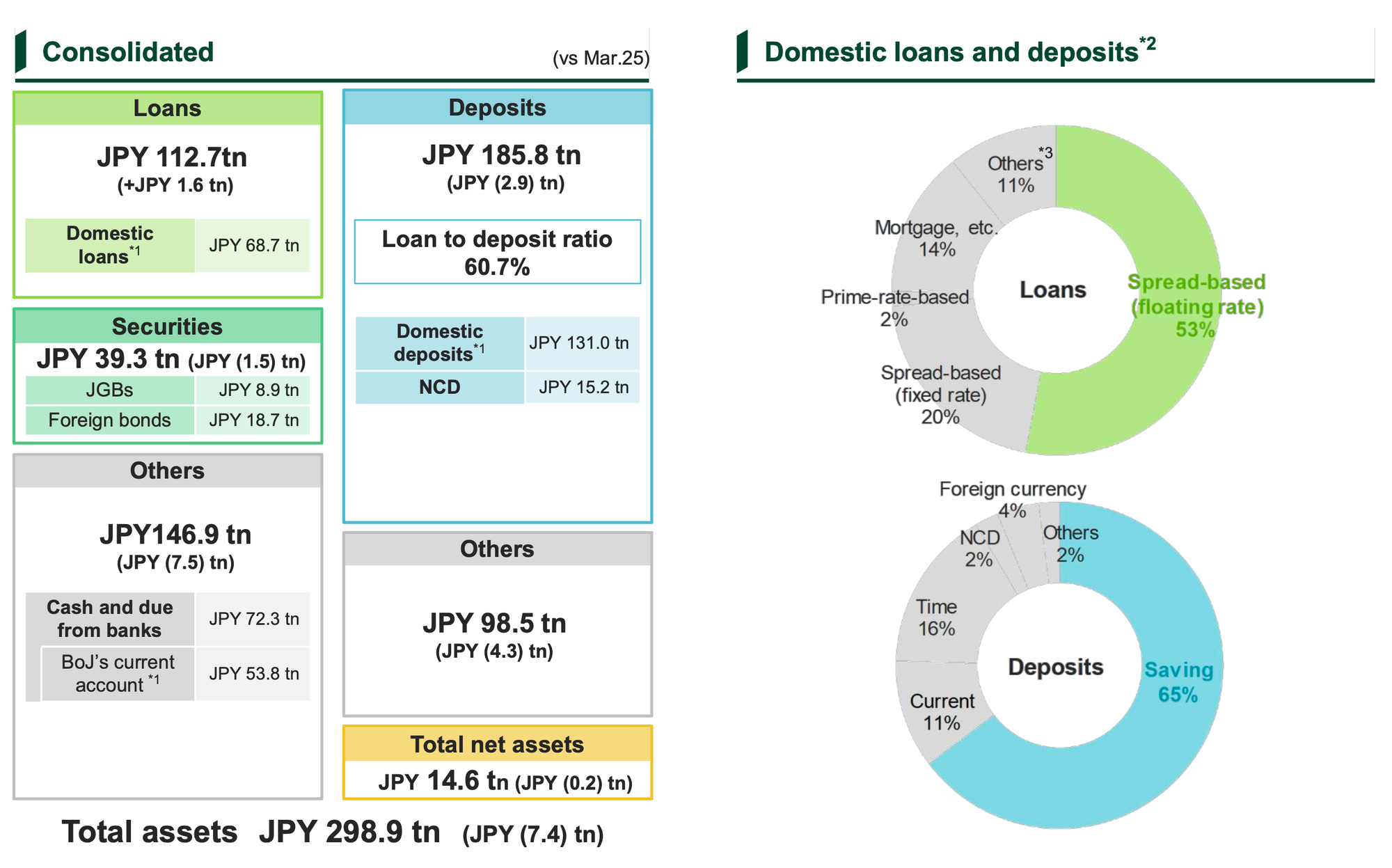

As of June 30, 2025, SMFG's balance sheet remained solid, with Total Assets at ¥298.9 trillion. This represented a decrease from the ¥306.3 trillion reported at the end of March 2025, a change primarily attributed to foreign exchange translation effects and other seasonal balance sheet movements.

The group's core lending activities showed continued momentum. The total Loan Portfolio expanded to ¥112.7 trillion, a notable increase of ¥1.6 trillion from the end of the previous fiscal year. This growth was led by the domestic loan book, which stood at ¥68.7 trillion, reflecting robust funding demand from corporate and retail clients. On the funding side, total Deposits were ¥185.8 trillion, resulting in a conservative consolidated Loan-to-Deposit Ratio of 60.7%. This indicates a strong and stable funding base with ample liquidity to support further asset growth.

Asset quality metrics remained exceptionally sound, a testament to disciplined underwriting standards even in a shifting economic landscape. The consolidated Non-Performing Loan (NPL) ratio was stable at 0.80%, with the total NPL balance amounting to ¥1,014.1 billion. The performance of the core banking entity, Sumitomo Mitsui Banking Corporation (SMBC), was even stronger, with a non-consolidated NPL ratio of just 0.52%. This stability in asset quality, even as interest rates begin to rise, is a crucial indicator of the portfolio's resilience and provides confidence in the outlook for credit costs.

II. Business Segment Analysis: Unpacking the Engines of Growth

A detailed analysis of SMFG's business units reveals that the strong consolidated performance was primarily driven by the domestic-facing Wholesale unit and the international Global Business unit, which more than compensated for headwinds faced by the market-sensitive segments.

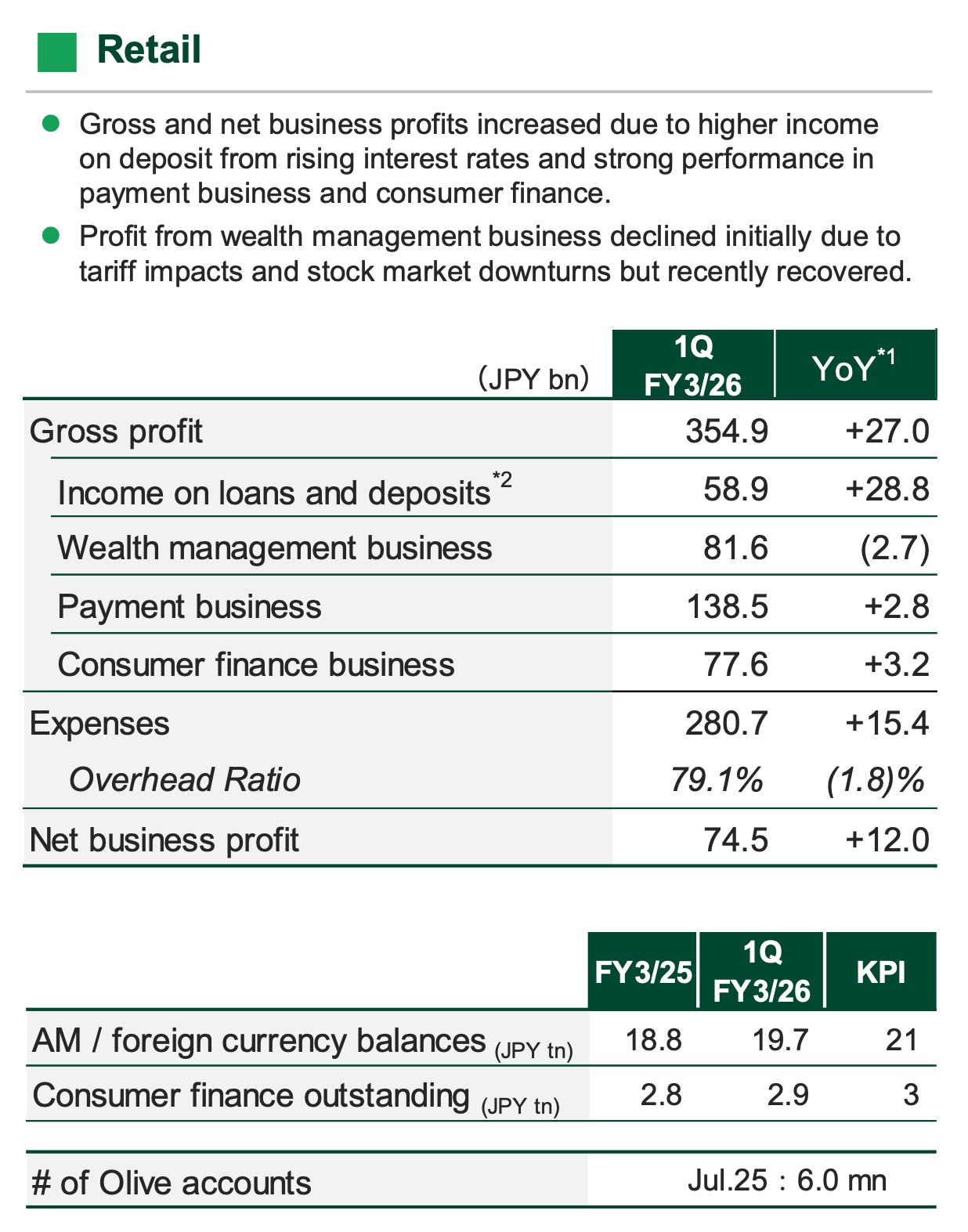

Retail Business Unit (RT)

The Retail Business Unit delivered a solid performance, with net business profit increasing by ¥12.0 billion YoY to reach ¥74.5 billion. This growth was multifaceted. A key contributor was the expansion of income on deposits, a direct consequence of the rising interest rate environment in Japan. Concurrently, the group's payment business, centered around Sumitomo Mitsui Card Company (SMCC), and its consumer finance operations both demonstrated strong, consistent performance.

A notable strategic success within this segment is the "Olive" digital financial platform, which was explicitly cited for its role in driving deposit growth and expanding income. As of July 2025, the platform had successfully acquired 6.0 million accounts, a testament to its appeal and effectiveness as a customer acquisition engine. In contrast, the wealth management business saw a slight YoY decline in profit. This was attributed to initial negative impacts from U.S. tariff announcements and associated stock market downturns in April, though management noted that performance had begun to recover towards the end of the quarter.

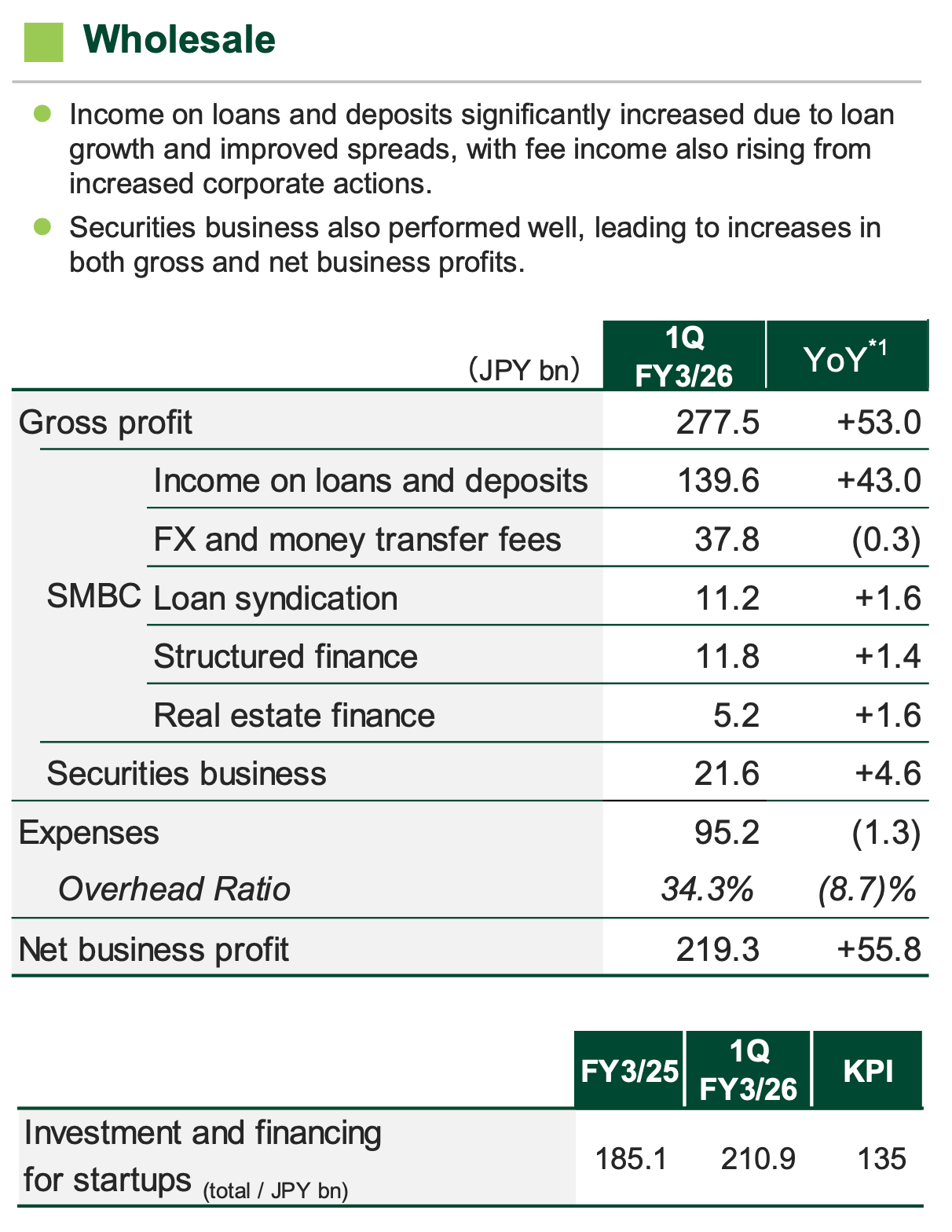

Wholesale Business Unit (WS)

The Wholesale Business Unit was the standout performer and the largest single contributor to the group's YoY profit growth. Net business profit surged by an impressive ¥55.8 billion to ¥219.3 billion. The primary engine of this growth was a significant increase in income from loans and deposits, which rose by ¥43.0 billion. This was driven by both robust loan growth, particularly to large corporates where balances increased by a remarkable 18% YoY, and an improvement in lending spreads. In addition to the strong lending performance, fee income also registered a healthy increase, reflecting a pickup in corporate client activity, including M&A advisory and capital markets transactions.

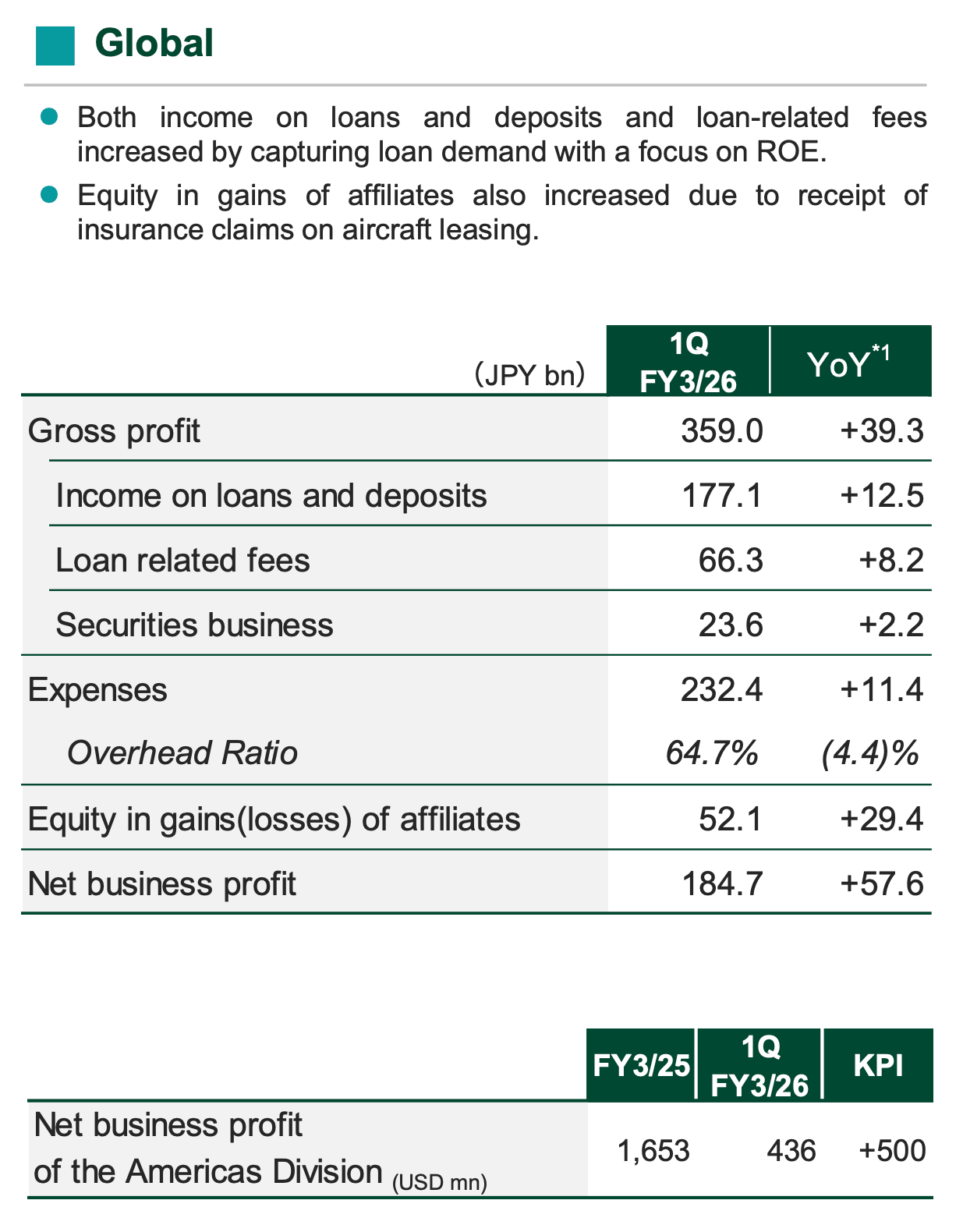

Global Business Unit (GB)

The Global Business Unit also delivered a powerful growth contribution, with net business profit rising by ¥57.6 billion YoY to ¥184.7 billion. This performance was underpinned by the group's success in capturing robust loan demand in overseas markets, with a clear strategic focus on improving ROE. The Americas region was a particular bright spot, with loan balances growing 11% YoY on a currency-neutral basis. A significant portion of the unit's profit growth came from a ¥29.4 billion increase in Equity in gains of affiliates. This was substantially boosted by a one-time gain of ¥13 billion from the receipt of insurance claims at the group's aircraft leasing subsidiary, SMBC Aviation Capital (SMBCAC).

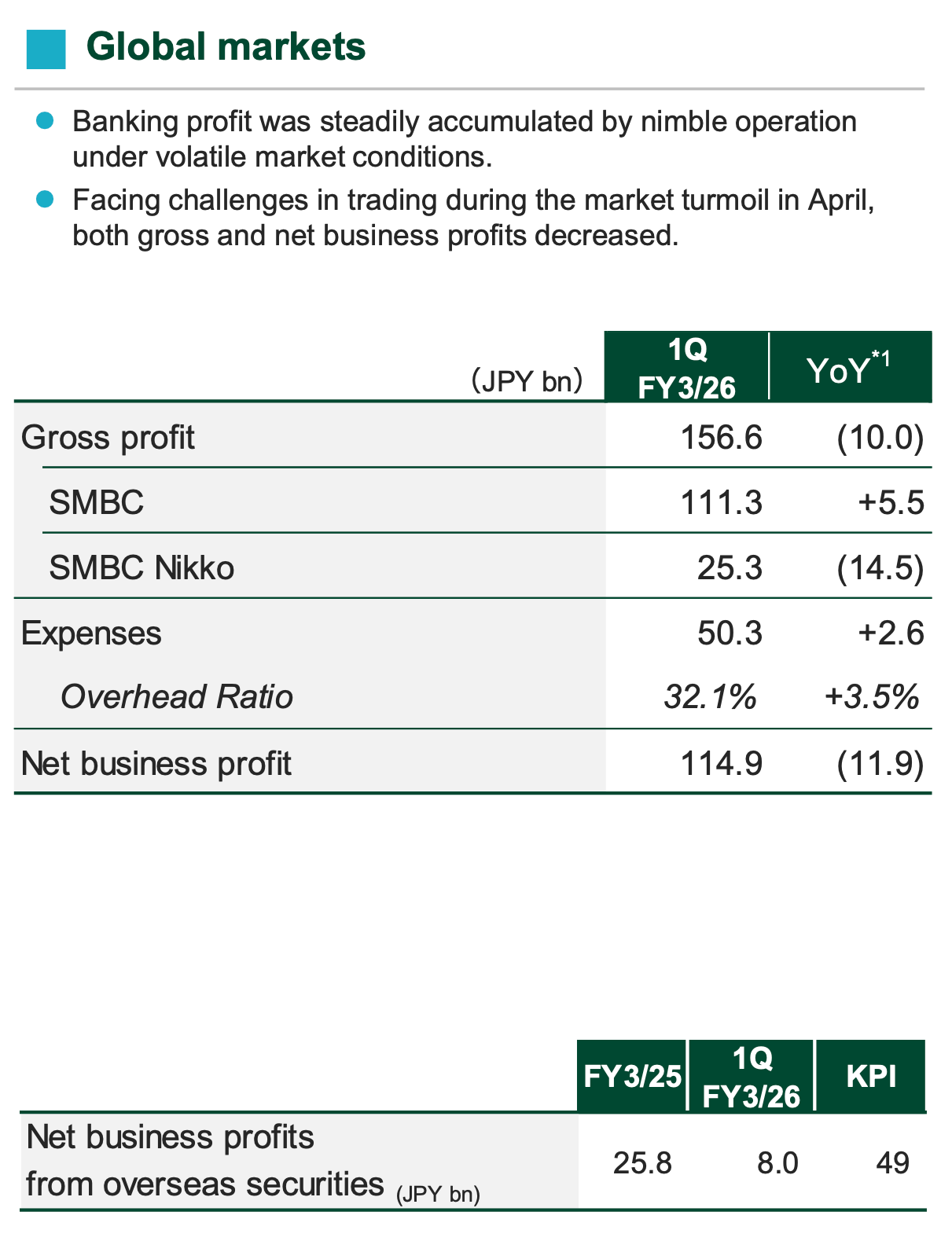

Global Markets Business Unit (GM)

The Global Markets Business Unit faced a more challenging quarter, with net business profit decreasing by ¥11.9 billion YoY to ¥114.9 billion. The unit's performance was directly impacted by the significant market volatility and turmoil experienced in April, which created difficult conditions for its trading operations. However, management noted that performance recovered steadily from May onwards, demonstrating the operational resilience and risk management capabilities of the team.

Key Subsidiaries Performance

An examination of the major group companies provides further granularity on the quarter's performance:

- SMBC (Bank): The core banking entity reported a net income of ¥253.6 billion, a slight decrease of ¥7.9 billion YoY. This modest decline was primarily the result of higher credit costs (due to the absence of prior-year reversals) and certain extraordinary losses. Importantly, these factors masked a very strong underlying performance, with core banking profit increasing by a substantial ¥54.4 billion YoY.

- SMBC Nikko Securities: The securities arm posted a largely flat net income of ¥19.6 billion. The results reflected a stark divergence within its own operations: a strong performance in the Global Investment Banking (GIB) division, which benefited from increased corporate activity, was almost entirely offset by a significant loss in the Global Markets (GM) division, which bore the brunt of the market turmoil in April.

- Sumitomo Mitsui Card (SMCC): The card and consumer finance business was a key source of strength, with net income growing robustly to ¥32.2 billion, a YoY increase of ¥16.7 billion. This reflects strong consumer spending and successful expansion in the payments and consumer lending segments.

III. The New Rate Environment: Capitalizing on Domestic Monetary Policy Shifts

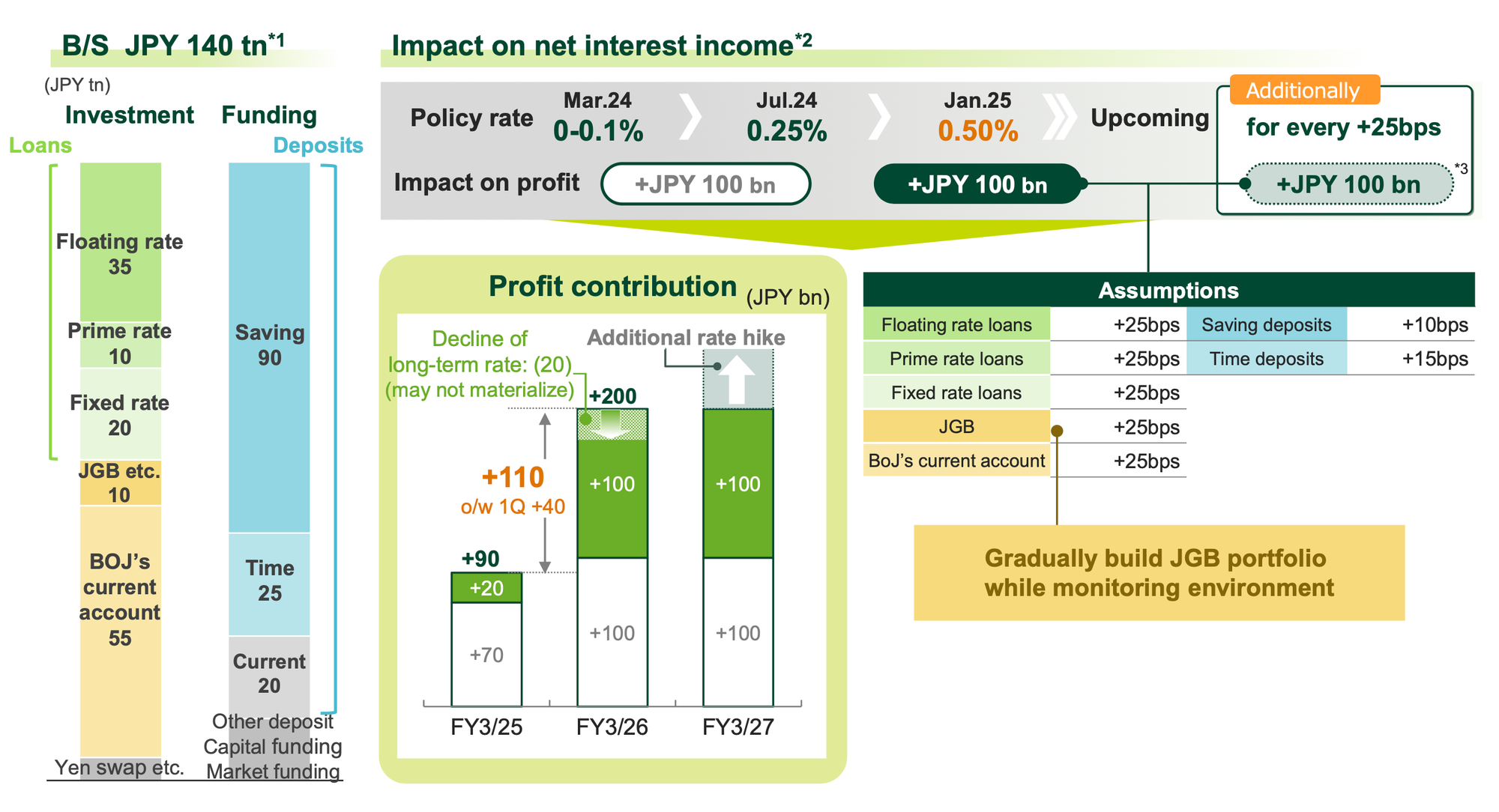

The most significant tailwind for SMFG's first-quarter performance was the changing interest rate environment in Japan. The Bank of Japan's (BOJ) gradual normalization of monetary policy has provided a direct and substantial benefit to the group's domestic earnings power. At its June 2025 meeting, the BOJ maintained its policy rate at 0.5% but reinforced its commitment to normalization by announcing a gradual, predictable reduction in its purchases of Japanese Government Bonds (JGBs). This policy stance creates a clear and favorable operating environment for domestic bank profitability, allowing for the repricing of assets at higher rates.

This benefit is starkly evident in SMFG's Net Interest Income (NII). At the core banking entity (SMBC), consolidated NII experienced a dramatic ¥97.7 billion YoY increase, reaching ¥416.1 billion, making it the single largest driver of the group's gross profit growth.

However, the story of NII performance is a clear dichotomy between the domestic and overseas businesses. The domestic franchise was the undisputed engine of growth. Domestic income from loans and deposits surged by ¥62.4 billion, a move almost entirely driven by margin expansion (+¥55.3 billion), supplemented by steady loan volume growth (+¥7.1 billion). This translated into a significant widening of the domestic loan-to-deposit spread, which expanded by 17 basis points YoY to 1.08%.

In stark contrast, overseas NII faced significant headwinds and contracted during the quarter. Overseas income from loans and deposits decreased, with margin compression leading to a ¥55.2 billion negative impact. The company explicitly attributed this to the appreciation of the yen against other major currencies and the effect of interest rate cuts in key overseas markets like Europe and the U.S.

This performance highlights a critical strategic dynamic for the group. The domestic business is currently a powerful and predictable engine, benefiting directly from the BOJ's policy trajectory. However, the group's global expansion—a central pillar of its long-term growth strategy—is confronting significant margin pressure due to divergent central bank policies worldwide. This creates a complex challenge for management. While the domestic tailwind provides a strong earnings foundation, it raises important questions about capital allocation and the group's ability to achieve its ROE targets in the Global Business unit if overseas margin compression persists. Investors will need to assess whether the strength of the domestic engine is sufficient to offset this global drag in the coming quarters.

SMFG's own internal modeling underscores the significance of this domestic rate sensitivity. The company's simulation projects that the full-year positive impact from rising Japanese interest rates could reach ¥200 billion in FY3/26, representing a YoY benefit of ¥110 billion. Of this amount, ¥40 billion has already been realized in the first quarter's results. The simulation further indicates that for every 25 basis point parallel shift upward in both short-term and long-term Japanese interest rates, the group's profit is expected to increase by approximately ¥100 billion, highlighting the substantial leverage to further BOJ policy normalization.1

IV. Strategic Balance Sheet and Portfolio Management

Beyond capitalizing on the favorable rate environment, SMFG has demonstrated a commitment to proactive balance sheet management and de-risking, undertaking two significant strategic initiatives to enhance resilience and improve capital efficiency in an uncertain market.

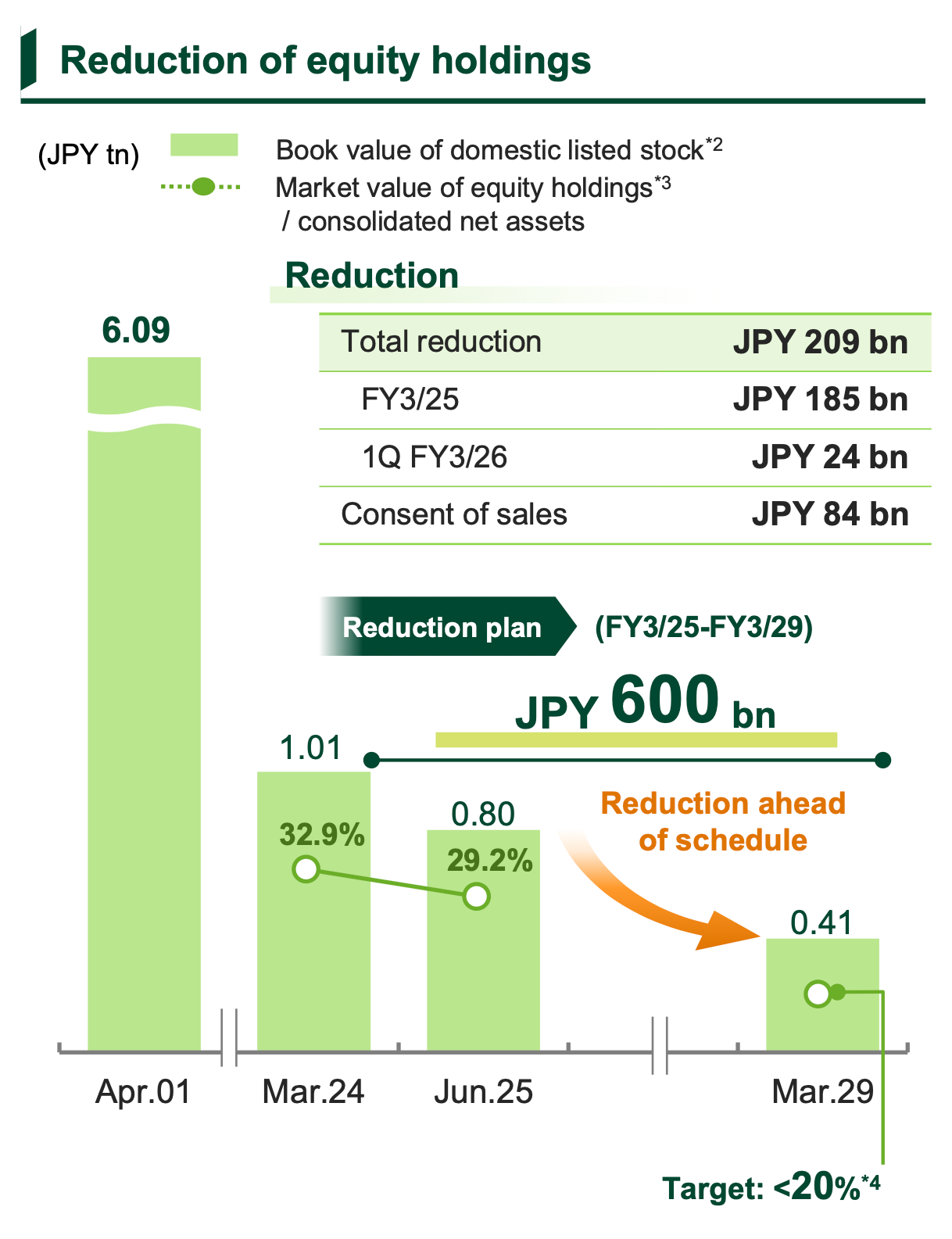

Accelerated Reduction of Equity Holdings

The group is actively executing a multi-year plan to reduce its holdings of domestic listed stocks, a legacy of Japan's era of corporate cross-shareholdings. The plan targets a total reduction of ¥600 billion between the fiscal years ending March 2025 and March 2029. As of the end of the first quarter of FY3/26, a total of ¥209 billion has already been divested, placing the program significantly "ahead of schedule". This has successfully reduced the market value of these equity holdings as a percentage of consolidated net assets to 29.2%. While still above the long-term target of under 20%, the rapid progress demonstrates strong management execution.

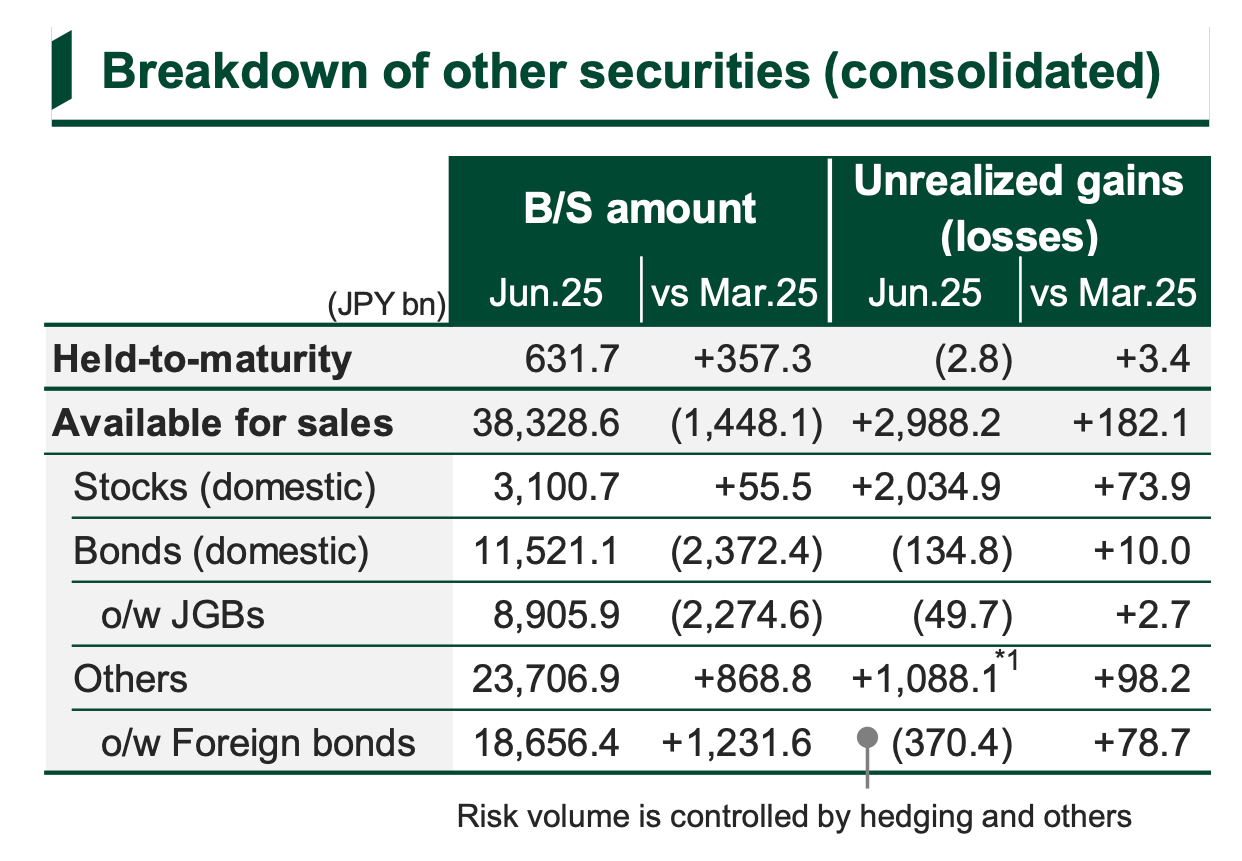

Securities Portfolio Rebalancing

In conjunction with the equity reduction, SMFG has strategically rebalanced its securities portfolio, particularly its holdings of yen-denominated bonds, in response to the recent rise in long-term interest rates. There is a clear and deliberate shift towards classifying a larger portion of its JGB portfolio as held-to-maturity (HTM). This accounting treatment allows the group to secure stable, predictable interest income while insulating its regulatory capital from the price volatility associated with rising yields. The balance sheet amount of HTM JGBs has more than doubled since March, and now stands at ¥631.7 billion, while available-for-sale JGBs have decreased by ¥2.274 trillion. Furthermore, to mitigate the impact of rising rates on the remaining available-for-sale portfolio, the group has actively managed down the duration of its yen-denominated bond holdings to a relatively short 1.8 years.

These actions are not merely administrative adjustments but represent a prudent and proactive de-risking of the balance sheet. The push to unwind cross-shareholdings aligns with long-standing corporate governance reforms in Japan and serves to improve capital efficiency by freeing up capital from non-core, volatile assets. The rebalancing of the bond portfolio is a direct response to the evolving macroeconomic environment, where rising JGB yields and a volatile Nikkei index present tangible risks. By selling stocks, SMFG reduces the sensitivity of its profit and loss statement to equity market fluctuations. By shifting JGBs to the HTM category, it reduces the impact of rising bond yields on its capital base, as unrealized losses on HTM securities do not flow through to Common Equity Tier 1 (CET1) capital. These are sophisticated risk management decisions that enhance the resilience of SMFG's earnings and capital base, thereby improving the overall quality of the balance sheet. This strategic fortification is a key positive for long-term investors, even if it necessitates realizing short-term losses on certain sales, such as the divestment of the Bank of East Asia stake.

V. Operating Environment: Macroeconomic and Geopolitical Context

SMFG's performance in the first quarter was set against a complex and increasingly challenging global backdrop, defined by modest domestic growth, shifting monetary policies, and significant geopolitical trade tensions.

Japanese Economic Outlook

The Japanese economy is navigating a period of transition and uncertainty. Consensus forecasts for real GDP growth in the fiscal year ending March 2026 are modest, generally falling within the range of +0.4% to +0.7%. A key concern among economists is the potential for the economy to experience two consecutive quarters of negative growth during 2025, driven primarily by the anticipated impact of U.S. tariffs. These tariffs are expected to act as a drag on both exports, a traditional engine of Japanese growth, and domestic capital investment, as corporations adopt a more cautious stance amid the uncertainty. Domestically, private consumption remains a point of weakness. While wage growth has picked up, it has generally not kept pace with inflation, leading to a decline in real wages and subdued consumer sentiment and spending.

U.S. Tariff Impact: The Deferred Headwind

The most significant geopolitical development during the period was the finalization of a U.S.-Japan trade deal in July 2025. This agreement established a new 15% tariff on a broad range of Japanese exports to the U.S., including automobiles. While this rate is a reduction from the 25% level that had been threatened, it still represents a substantial increase in costs for Japanese exporters compared to the pre-existing tariff regime.

SMFG's first-quarter results, which cover the period ending June 30, 2025, correctly note that the anticipated ¥100 billion negative impact from these tariffs had "not yet materialized". This statement, while factually accurate for the reporting period, belies the reality that the risk is now imminent. The trade deal was announced on July 22, after the close of the quarter, meaning its financial impact will begin to be felt in the second quarter and will likely accelerate through the second half of the fiscal year. Economic forecasts explicitly link these tariffs to an expected slowdown in Japanese exports and capital investment later in 2025.

This will directly affect SMFG's large corporate client base, particularly in the automotive and manufacturing sectors, which are major users of the bank's lending and advisory services. The primary risk for SMFG is therefore a future increase in credit costs should these clients face financial distress, coupled with a potential slowdown in loan demand as investment plans are curtailed. The negative market reaction to SMFG's otherwise strong earnings report likely reflects this forward-looking concern. Investors appear to be pricing in this deferred risk, viewing the strong first-quarter results as the "calm before the storm" and questioning the sustainability of this performance once the full impact of the tariffs flows through the economy.

Key Market Indicators

The market environment during the first quarter was volatile:

- Nikkei 225: The Japanese stock market experienced a dip in April amid initial tariff-related uncertainty but staged a strong recovery through May and June, with the Nikkei 225 index climbing back above the 40,000 level by the end of the quarter.

- USD/JPY Exchange Rate: The Japanese yen appreciated against the U.S. dollar during the quarter. The USD/JPY exchange rate moved from approximately 149.5 at the end of March to 144.8 by the end of June. This currency strength created a negative translation impact on the yen value of profits earned by SMFG's overseas subsidiaries.

- 10-Year JGB Yield: Reflecting the BOJ's monetary policy normalization, the yield on the 10-year Japanese Government Bond continued its upward trend, rising during the quarter to end at 1.43%.

VI. Competitive Landscape and Market Perspective

The market's reception of SMFG's results presented a notable paradox. The company's reported EPS of ¥97.46, or approximately $0.40 per American Depositary Receipt (ADR), significantly surpassed analyst consensus estimates, which were clustered around $0.31 per ADR. Typically, such a strong earnings beat would be met with a positive market response.

However, despite the outperformance on the bottom line, SMFG's stock price declined by 4.0% in the week following the earnings announcement. This disconnect between the reported results and the market's reaction suggests that investors are looking past the strong historical performance of the first quarter and are instead focused on the quality of the results and the risks that lie ahead.

Several factors likely contributed to this investor-management disconnect. First, as previously discussed, the market is likely pricing in the future risks associated with U.S. tariffs and a potential global slowdown, which are not yet reflected in the first quarter's profit and loss statement. Second, while EPS was strong, the group's top-line revenue of ¥1.36 trillion was viewed by some analysts as merely in-line with, or even a miss against, very high expectations, raising some concerns about underlying revenue momentum.

Finally, the reported weakness in market-sensitive segments, such as the Global Markets unit and the trading arm of SMBC Nikko Securities, may have been interpreted as a negative leading indicator for the broader financial market environment, outweighing the concurrent strength seen in traditional lending activities. This suggests a clear divergence in perspective: while management highlighted a strong start to the fiscal year based on current results, the market is weighing the macroeconomic and geopolitical risks more heavily, leading to a more cautious and forward-looking valuation.

VII. Outlook and Strategic Imperatives

Despite the market's cautious stance, SMFG has positioned itself well for the remainder of the fiscal year. The strong start provides a significant operational cushion. With both consolidated business profit and net profit tracking at 29% of their respective full-year targets of ¥1,850 billion and ¥1,300 billion, the group has a solid foundation from which to navigate the anticipated challenges.

Key Risks to Outlook

The primary risks to achieving these full-year targets are external and significant:

- Materialization of Tariff Impact: The most immediate and quantifiable risk is the 15% U.S. tariff. This will likely begin to dampen client activity, slow loan growth in export-oriented sectors, and potentially lead to an increase in credit costs in the second half of the fiscal year.

- Global Economic Slowdown: A broader-than-expected economic slowdown, particularly in the key markets of the U.S. and Europe, could exert further pressure on overseas NII, investment banking fees, and overall loan demand.

- Adverse Foreign Exchange Movements: A continued or accelerated appreciation of the Japanese yen would create additional headwinds for the translation of overseas profits into yen, potentially impacting the group's consolidated earnings.

Key Opportunities and Strategic Levers

Conversely, SMFG has several powerful strategic levers to pull to offset these risks and drive growth:

- Domestic Margin Expansion: The clearest opportunity lies in the domestic market. Continued monetary policy normalization by the Bank of Japan presents a direct path to further expansion of the domestic loan-to-deposit spread, which should continue to fuel NII growth.

- "Olive" Platform Monetization: The Olive platform, with its rapidly growing user base of over 6 million, is a key strategic asset. The focus is expected to shift from pure customer acquisition to deepening client relationships and driving monetization through the cross-selling of higher-margin products. The expansion of Japan's NISA (Nippon Individual Savings Account) scheme provides a timely catalyst to promote wealth management and investment products to this newly acquired, digitally-native customer base.

- U.S. & Asia "Multi-Franchise" Growth: Despite near-term margin pressure, SMFG remains committed to its long-term "Multi-Franchise Strategy" of building out its global business. The group continues to invest in high-growth areas, such as the U.S. fintech ecosystem through its SMBC Fin Atlas Beyond Fund, and is actively expanding its presence and market share in high-growth Asian markets through strategic partnerships and acquisitions.13

Concluding Assessment

Sumitomo Mitsui Financial Group has delivered a high-quality first quarter, powerfully demonstrating the earnings potential of its domestic franchise in a normalized interest rate environment. The group's strategic execution, particularly in its digital "Olive" initiative and its proactive balance sheet de-risking, is commendable and sets it apart from its peers. However, the investment thesis for the remainder of the fiscal year ending March 2026 hinges on a critical question: can this formidable domestic strength successfully absorb the significant and now-imminent headwinds from U.S. tariffs and a slowing global economy? The market's negative reaction and the current valuation appear to be pricing in these substantial risks. This creates a potential value opportunity for investors who believe that management can navigate the forthcoming challenges as effectively as they have capitalized on the opportunities in their home market. The strong start to the year provides a valuable buffer, but the path to achieving the full-year target of ¥1.3 trillion in net profit will require navigating a period of heightened uncertainty.