SMBC Group FY3/25 Financial Results

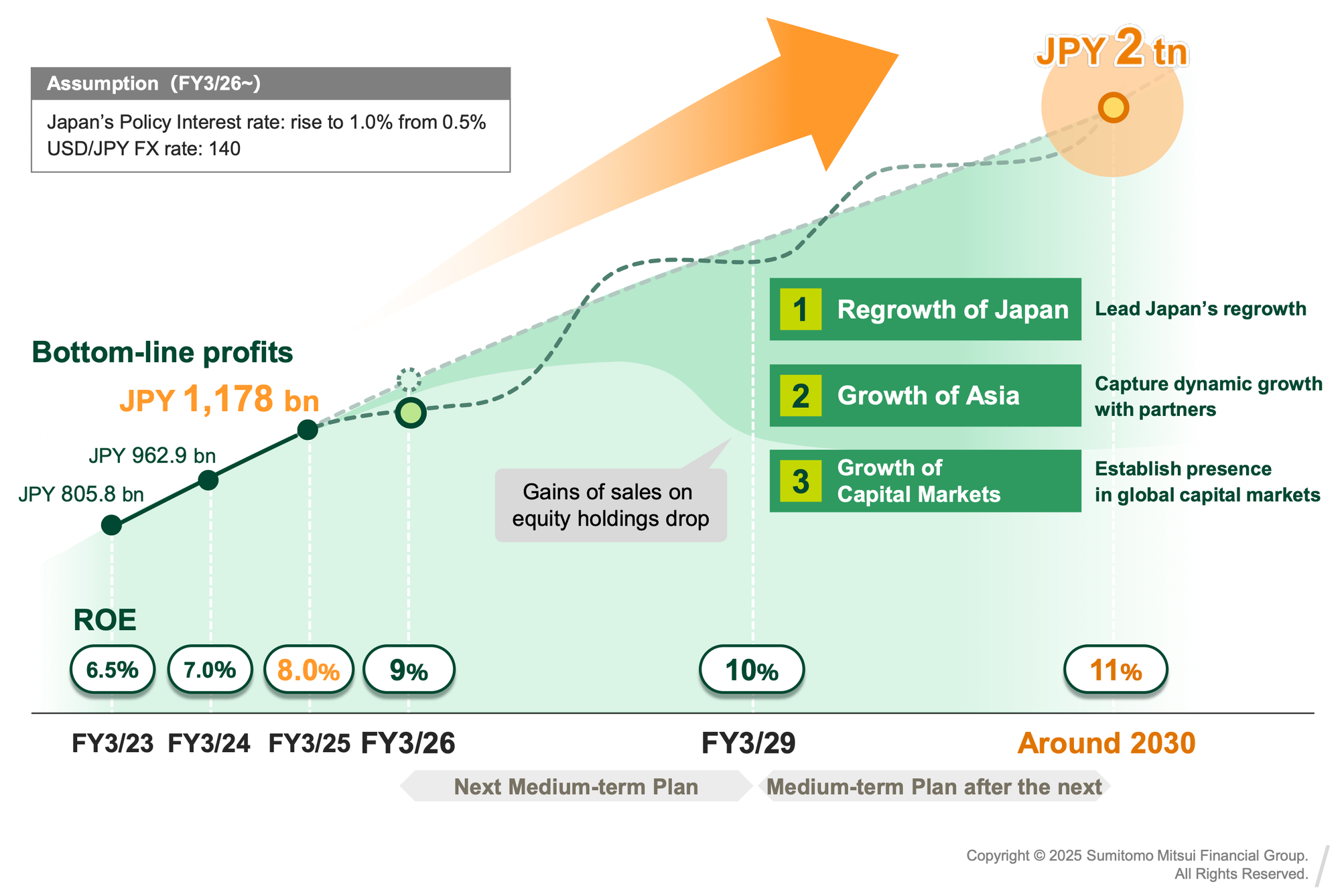

SMBC Group reported on its financial performance for the fiscal year ending March 2025 (FY3/2025). The organization highlighted record achievements, primarily fueled by the robust performance of its core domestic market business. These gains were strategically leveraged to fortify future initiatives and address potential vulnerabilities arising from evolving trade dynamics, particularly those connected to U.S. tariffs. A significant marker of the Group's effectiveness was its achievement of an 8% return on equity (ROE), surpassing the initially projected timeline.

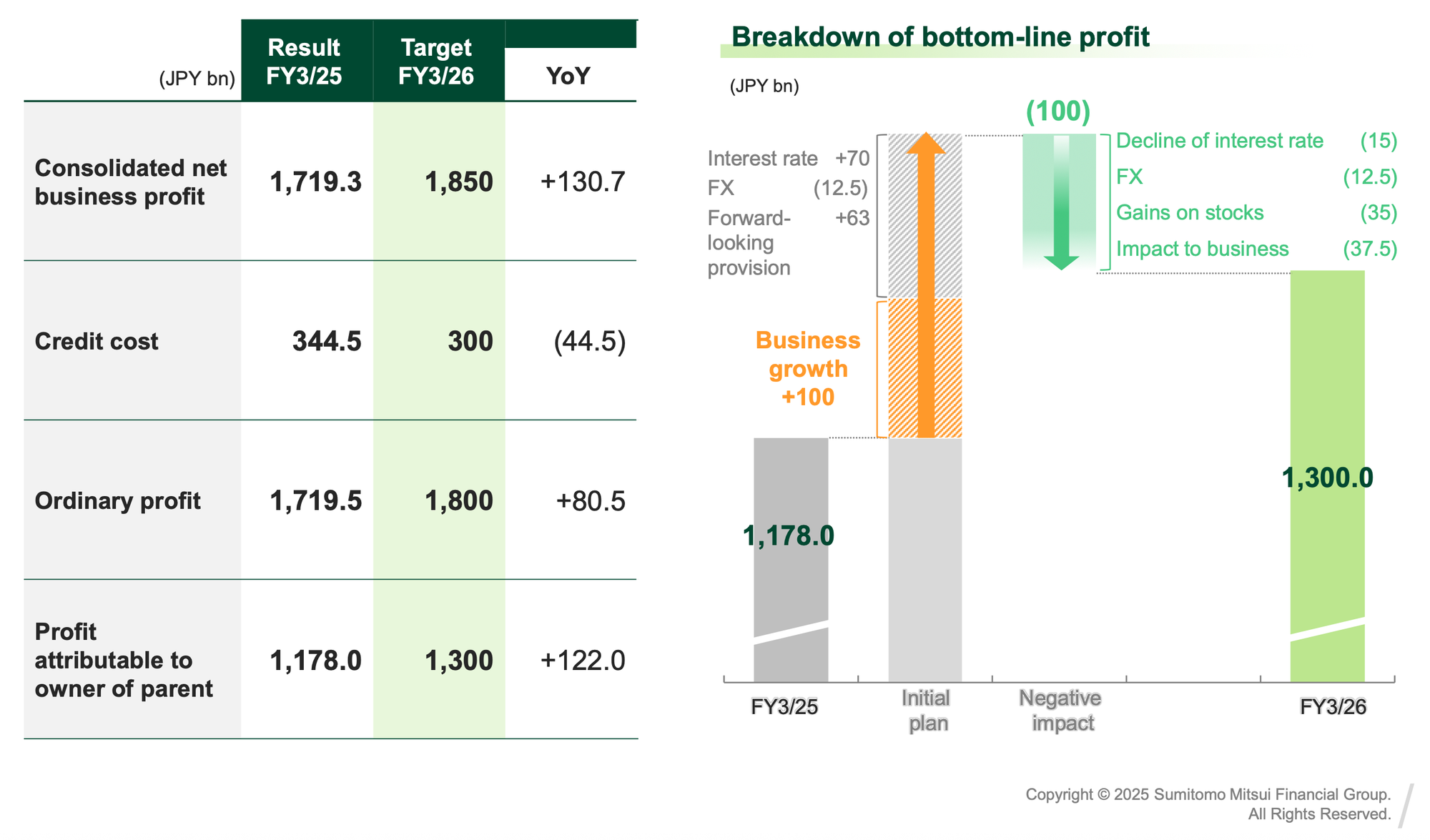

Looking ahead to the fiscal year ending March 2026 (FY3/2026), SMBC Group has developed strategic targets that take into account shifting global conditions and possible economic downturns. The Group has successfully completed key objectives under its Medium-Term Management Plan and intends to produce ¥1.3 trillion in bottom-line profit, an increase of 10% year over year, in FY3/26.

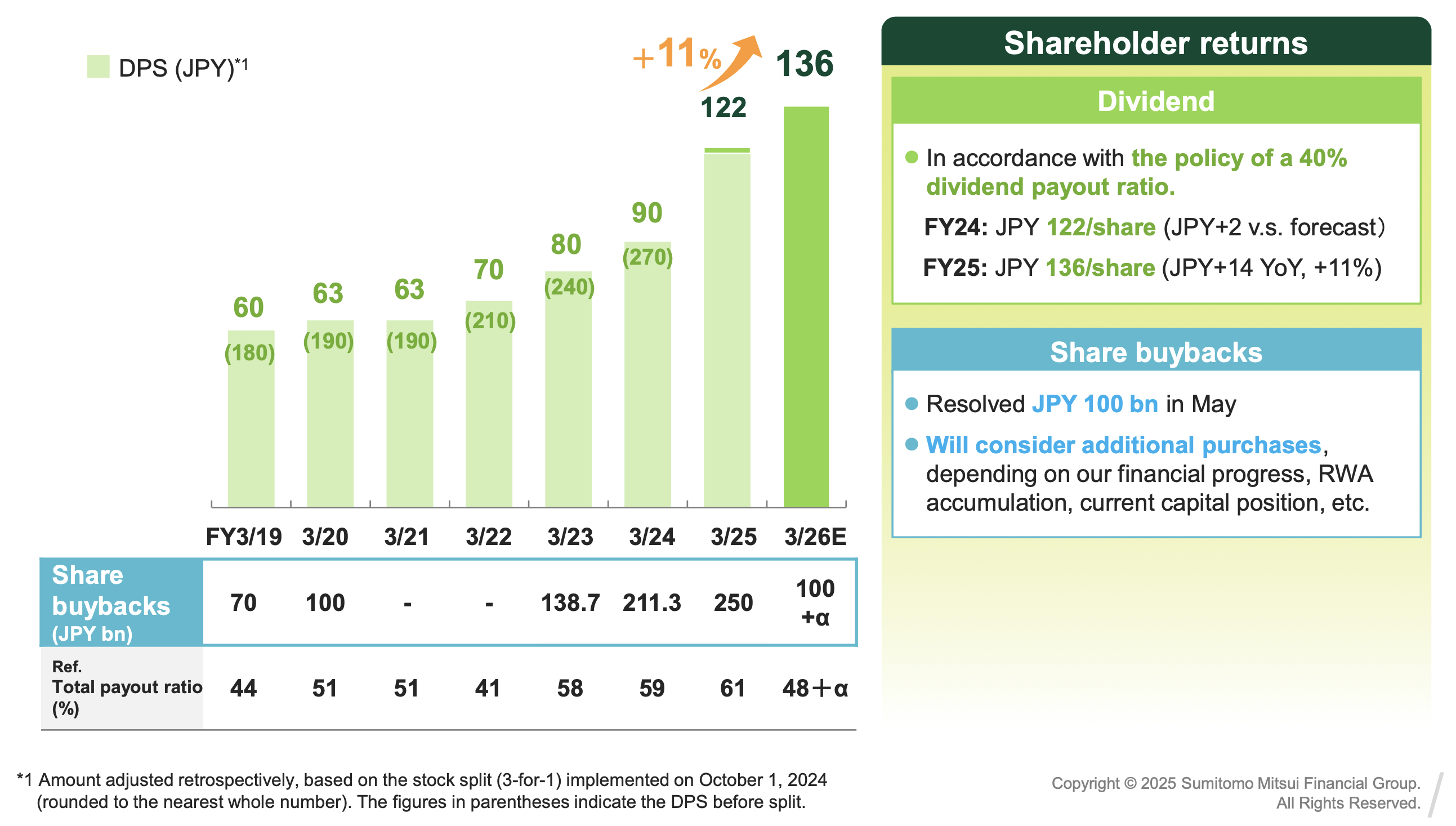

The financial summary emphasizes SMBC Group's dedication to its investors and stakeholders. For FY3/25, the company declared a dividend per share (DPS) of JPY 122, which is two yen higher than expected. The business also plans to raise its dividend by +JPY 14, setting the DPS for FY3/26 at JPY 136, which implies a dividend payout ratio of 40%. Furthermore, the company authorized a share buyback program with a budget of up to JPY 100 billion and stated that it will assess possibilities for additional purchases over the coming fiscal year.

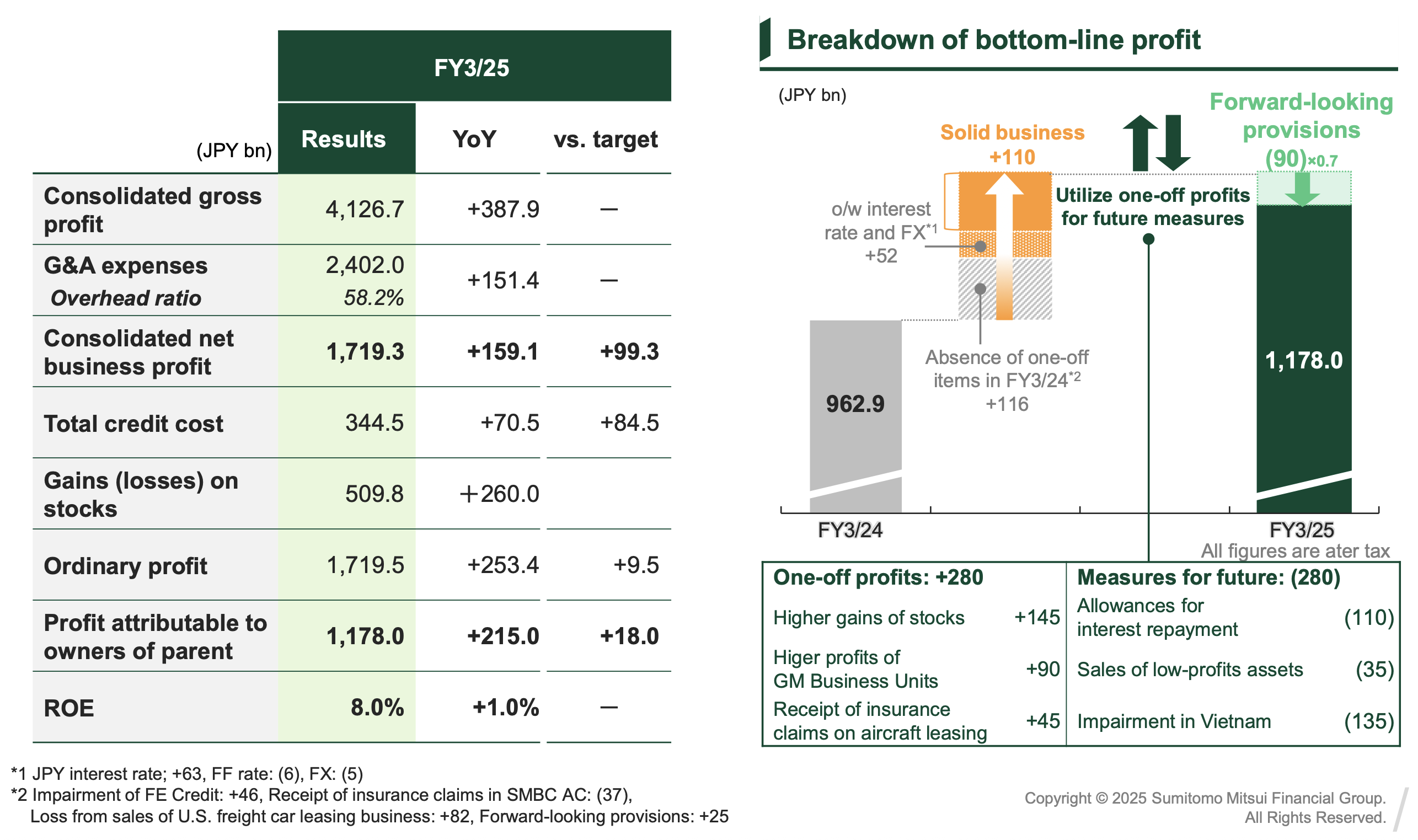

The review of FY3/25's results revealed considerable successes, with significant profits attributed to key business activities, even after allocating some of those earnings to strategic measures for the future. The strategic allocation towards forward-looking provisions, totaling JPY 90 billion, illustrates SMBC Group's proactive stance in preparing for potential risks associated with forthcoming economic recessions.

The Group's consolidated gross profit totaled ¥4,126.7 billion, propelled by a considerable YoY growth of +387.9 billion. This underlines the Group's robust revenue generation capabilities and efficient resource allocation. The G&A expenses totaled ¥2,402.0 billion (+151.4 billion YoY), which resulted in the overhead ratio being 58.2%. The solid profit growth was evident in the consolidated net business profit, which achieved ¥1,719.3 billion (+159.1 billion YoY), exceeding the set target by +¥99.3 billion.

Total credit costs were ¥344.5 billion, which is +70.5 billion YoY and +84.5 billion above the target. Gains on stocks contributed a substantial ¥509.8 billion (+260.0 billion YoY), reinforcing the Group’s investment acumen and adeptness in navigating market opportunities. This yielded an ordinary profit of ¥1,719.5 billion, demonstrating an increase of +253.4 billion YoY, also above the set target by +¥9.5 billion. With all these factors considered, the profit attributable to the owners of the parent company amounted to ¥1,178.0 billion, marking an increase of +215.0 billion YoY and exceeding the set target by +¥18.0 billion. The resulting ROE stood strong at 8.0%, which is +1.0% over the YoY.

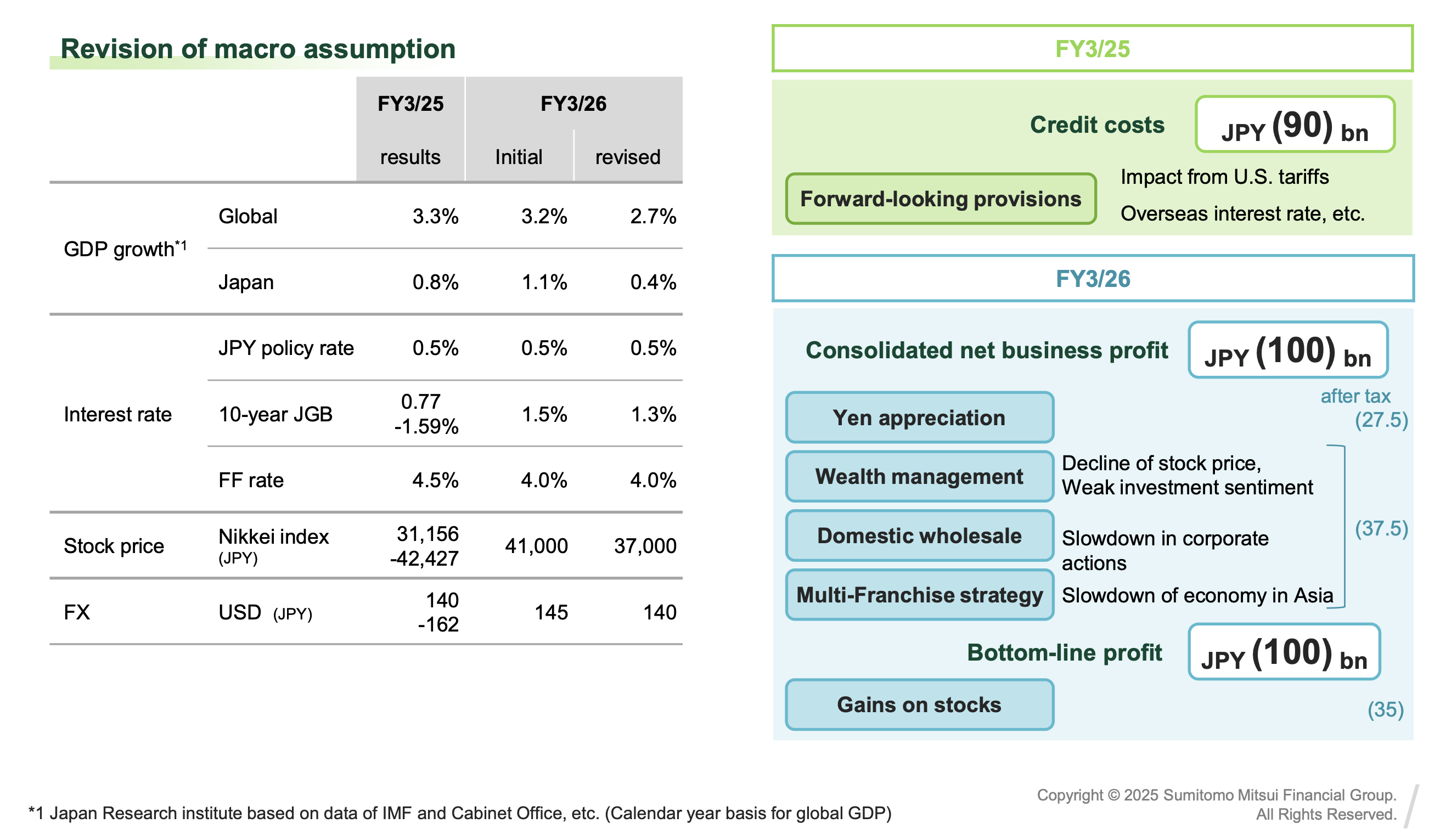

SMBC Group adjusted its FY3/26 targets in light of changing macroeconomic factors, with a focus on the U.S. tariffs. The company estimates that these changes will have a negative impact of JPY 100 billion on both consolidated net business profit and bottom-line profit.

Global GDP growth was reported to be 3.3% in FY3/25. For FY3/26, the initial estimate was 3.2%, and the revised figure stands at 2.7%. Japan’s GDP growth was 0.8% in FY3/25, and the new target is 0.4% following an initial estimate of 1.1%. The JPY policy rate stayed constant at 0.5%. The 10-year JGB interest rate was 0.77% - 1.59% in FY3/25, with estimates for FY3/26 set to 1.5% and 1.3% initially and after revision, respectively. Finally, the Nikkei index, which was 31,156 - 42,427 in FY3/25, is now expected to be around 37,000.

Factoring all of these changes, SMBC Group expects JPY (90) bn in credit costs and JPY (100) bn in consolidated net business profit due to Yen appreciation and a slowdown of corporate actions (37.5), in wealth management (-27.5) and in economy in Asia (37.5). The Group also projected JPY (100) bn in bottom-line profit from gains on stocks (35).

SMBC Group is aiming for a 10% profit increase in FY3/26 despite challenging conditions, while planning for environmental changes and recession risks. Interest rate (+70), FX (-12.5) and forward-looking provision (+63) will contribute to a business growth of +100; decline in interest rate (-15), FX (-12.5), gains on stocks (-35), and impact to business (-37.5) will detract from the bottom-line profit. The bottom line profit of JPY 1,300 billion is somewhat below the Bloomberg consensus estimate of JPY 1,370 billion.

SMBC Group has a policy of 40% dividend payout ratio and has a history of share buybacks. JPY 122/share (+JPY+2 v.s. forecast) and JPY 136/share (JPY+14 YoY, +11%) are the FY24 and FY25 dividends, respectively. Moreover, the Group made a decision to buyback JPY 100 bn, representing approximately 1.0% of the Group's total outstanding shares. The buyback program is slated to run from May 15 to July 31, and its implementation demonstrates SMBC Group's proactive approach to capital allocation and shareholder value enhancement.. The group stated that will take into account financial progress, RWA accumulation, and the current capital position when considering additional purchases.

Despite the recent announcement of an agreement to acquire a 20% stake in India's YES BANK, which is expected to impact the Group's CET1 ratio by -24 basis points, SMBC Group has maintained its focus on delivering solid shareholder returns.

Based on the company's data, Japan’s Policy Interest rate would increase to 1.0% from 0.5%, and the USD/JPY FX rate would be 140 in the medium term. This plan to meet these goals includes expanding across Japan, growing in Asia, and expanding capital markets, and is expected to yield JPY 2 trn in bottom-line profits by 2030.