SMBC Launches Japan’s First Credit Card-Based Foreign Currency Accumulation Service to Court Retail Investors

In a bid to accelerate the shift from savings to assets among Japanese households, Sumitomo Mitsui Financial Group (SMBC Group) has announced the immediate launch of a new service allowing individual customers to accumulate foreign currency deposits via credit card payments.

This initiative—a collaboration between Sumitomo Mitsui Banking Corporation and Sumitomo Mitsui Card Company—marks a first for Japan. Dubbed "Foreign Currency Credit Card Accumulation", the service aims to lower the barrier to entry for currency diversification while incentivizing users with SMBC’s loyalty program, V Points.

Capitalizing on the Shift to Foreign Assets

SMBC Group’s move comes against a backdrop of persistent yen depreciation and inflation, which have heightened consumer interest in asset protection and global diversification. While foreign currency-denominated investment trusts have gained traction, SMBC is positioning foreign currency deposits as a fundamental tool for meeting diverse liquidity and investment needs.

Service Mechanics: Zero Fees and Low Entry Barriers

The new service is designed for accessibility. Customers can set monthly accumulation amounts ranging from 500 yen to 100,000 yen. The system automatically converts these yen contributions into one of six target currencies: US Dollar, Euro, British Pound, Swiss Franc, Australian Dollar, or New Zealand Dollar.

Notably, SMBC has waived the foreign exchange fee for these transactions, a significant departure from traditional forex costs. Purchases are executed at the public market rate on the 26th of every month.

The "V Point" Incentive

The core differentiator of this product is its integration with the credit card ecosystem. Unlike traditional bank transfers, funding these deposits via credit card generates V Points.

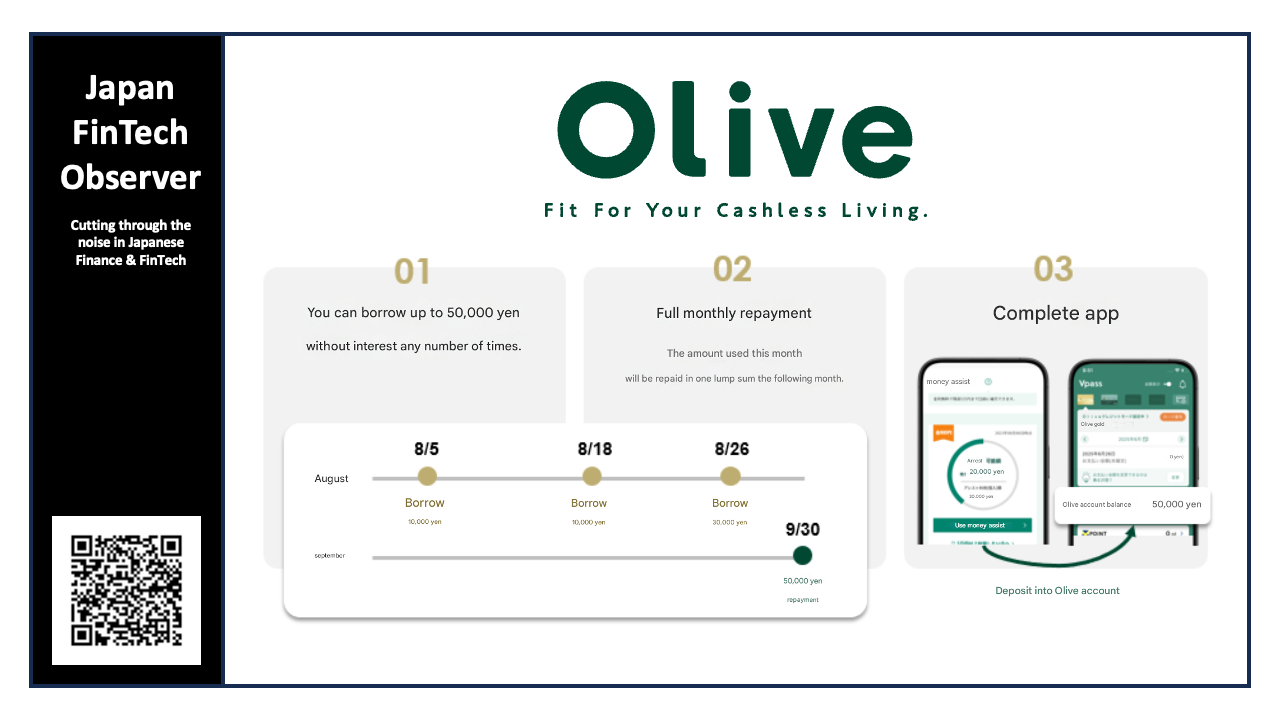

The rewards rate is tiered based on the card status, specifically for users of the "Olive Flexible Pay" ecosystem:

- Olive Platinum Preferred: 3.0% accumulation rate (up to 3,000 points/month).

- Olive Gold: 1.5% accumulation rate.

- Olive Standard: 1.0% accumulation rate.

This effectively provides a guaranteed immediate "return" in the form of points, acting as a buffer against potential short-term currency fluctuations.

Strategic Trade-offs: Points vs. Flexibility

SMBC provided a comparison between this new offering and their existing automated foreign currency accumulation service. The new credit card method trades flexibility for rewards.

While the legacy service allows for accumulation up to 5 million yen with flexible daily or weekly schedules and access to 18 currencies (in-branch), it offers no point rewards. The new credit card service is capped at 100,000 yen monthly with a fixed execution date, clearly targeting the mass affluent and retail segment looking for steady, automated dollar-cost averaging rather than high-volume forex trading.

Market Outlook

By combining the disciplined approach of automated savings with the rewards structure of credit card spending, SMBC is betting that "Foreign Currency Credit Card Accumulation" will become a standard vehicle for Japanese consumers looking to hedge against domestic currency risks.