SMBC’s $15M Bet on Aerem Signals Maturity in India’s Solar Fintech Market

Mumbai-based Aerem Solutions has secured $15 million in a Pre-Series B round led by the SMBC Asia Rising Fund. While the deal size may appear modest against the backdrop of global infrastructure finance, its strategic implications are profound, marking the intersection of Japanese institutional capital’s search for yield and India’s aggressive decarbonization targets.

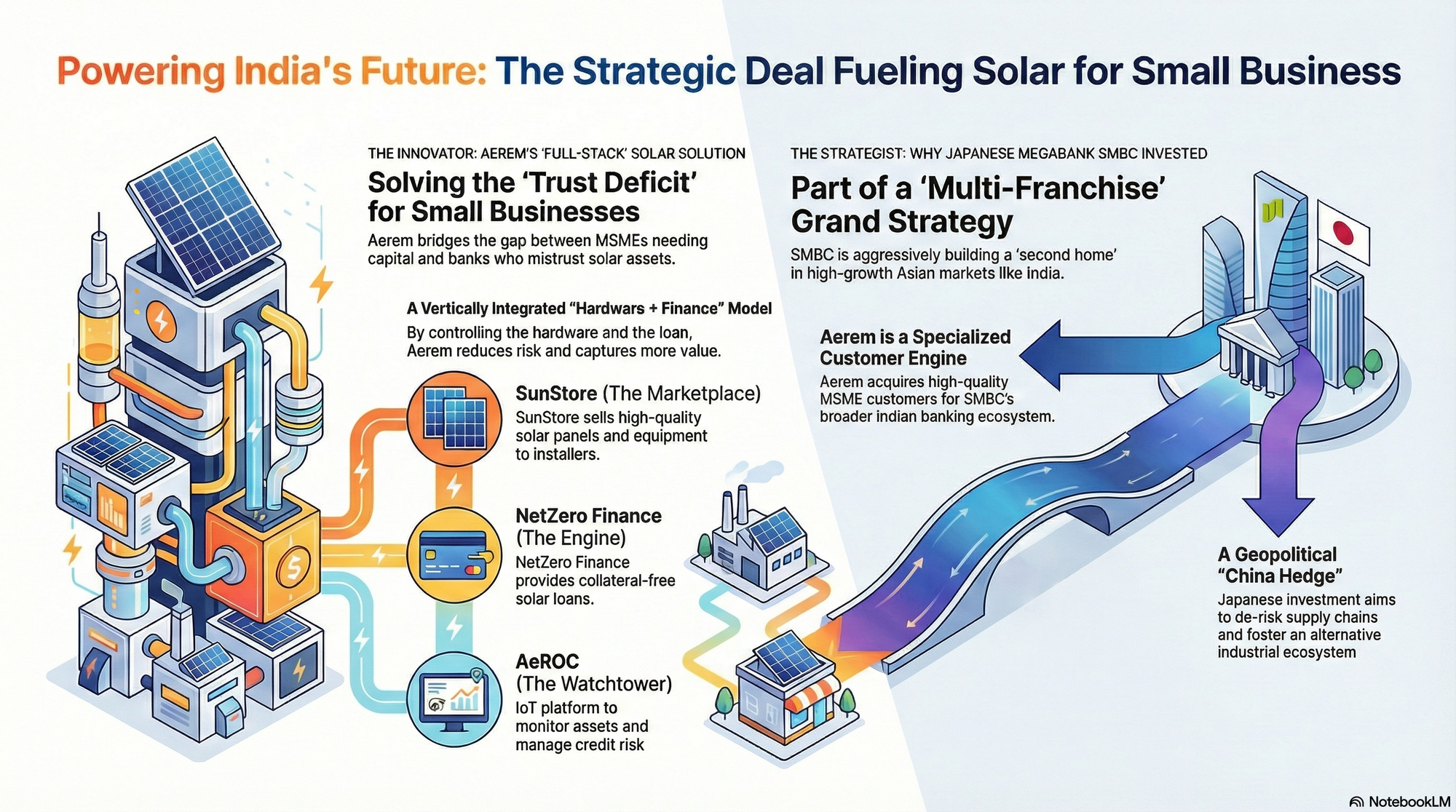

The "Multi-Franchise" Play

For Sumitomo Mitsui Banking Corporation (SMBC), this investment is a calculated component of their "Multi-Franchise Strategy." Facing demographic contraction and stagnant credit demand in Japan, SMBC is aggressively building a "second home" in India. By backing Aerem, SMBC secures a specialized origination engine for high-yield MSME assets, complementing its existing 20% stake in Yes Bank and full ownership of SMFG India Credit. This move effectively creates a vertically integrated financial ecosystem where Aerem acts as the "last-mile" acquisition channel for the Japanese giant's broader Asian ambitions.

The "Full-Stack" Moat

Aerem, led by former Lehman Brothers banker Anand Jain, has distinguished itself from pure-play lenders by constructing a "full-stack" ecosystem. The company operates on three pillars:

- NetZero Finance: An NBFC providing collateral-free loans to MSMEs based on cash-flow savings rather than asset backing.

- SunStore: A B2B marketplace for solar hardware, bolstered by the strategic 2024 acquisition of distributor Spinkraft Ventures.

- AeROC: An IoT-based remote operations center that monitors asset performance, effectively serving as a digital collateral manager.

This vertical integration—controlling the financing, the hardware supply, and the monitoring technology—has allowed Aerem to capture margins across the value chain, driving FY24 revenue to ₹176.73 crore, a massive leap from just ₹1.84 crore the previous year.

Macro Tailwinds and Geopolitics

The deal arrives as India’s distributed solar sector enters a "golden era," propelled by the PM Surya Ghar: Muft Bijli Yojana, which has already seen nearly 2.4 million installations by early 2026. Simultaneously, the "China Plus One" strategy is driving industrial growth among Indian MSMEs, exacerbating their need for reliable, low-cost power. Japanese investment here also serves a geopolitical function—a "China Hedge"—by fostering an independent industrial and energy ecosystem in India.

Competitive Landscape and Outlook

Aerem faces stiff competition from European-backed Ecofy and rural-focused Metafin. However, Aerem’s control over hardware distribution creates a defensive moat that purely financial competitors lack.

As the company utilizes this fresh capital to deepen its presence in Tier 2 and 3 cities, industry observers view this transaction as a precursor to a potential future consolidation. With access to SMBC’s balance sheet to lower its cost of funds, Aerem is positioning itself not just as a startup, but as the potential dedicated green lending arm for SMBC’s expanding Indian empire.