SMFG Second Quarter Financial Results

Fiscal year 3/2026 began in a highly uncertain global environment, creating significant headwinds for financial forecasts across the banking sector. Sumitomo Mitsui Financial Group (SMFG), like its peers, entered this period with caution. Market turmoil, triggered by a U.S. tariffs announcement in May 2025, prompted the firm to factor a substantial negative impact into its initial financial projections.

However, as the first half of the fiscal year progressed, markets began to calm. Progress in U.S.–Japan negotiations eased tariff-related concerns, and the anticipated negative impacts largely failed to materialize. Against this stabilizing backdrop, SMFG has demonstrated not only resilience but solid operational momentum and significant financial outperformance. This has prompted an upward revision of its full-year forecast and provides a compelling basis for a deeper competitive evaluation.

This outperformance merits a deeper evaluation of the firm's underlying financial health, its standing relative to global peers, and the strategic initiatives that will determine if this momentum is sustainable.

Financial Performance and Competitive Market Standing

A bank's financial performance is the bedrock of its competitive strength, market credibility, and capacity for strategic investment. For a Global Systemically Important Bank (G-SIB) like SMFG, consistently strong profitability, capital efficiency, and a robust balance sheet are essential for navigating complex global markets and earning the confidence of investors, clients, and regulators. The following sections detail SMFG's recent financial results and place them in the context of its global peer group.

H1 FY2026 Financial Highlights & Upgraded Forecast

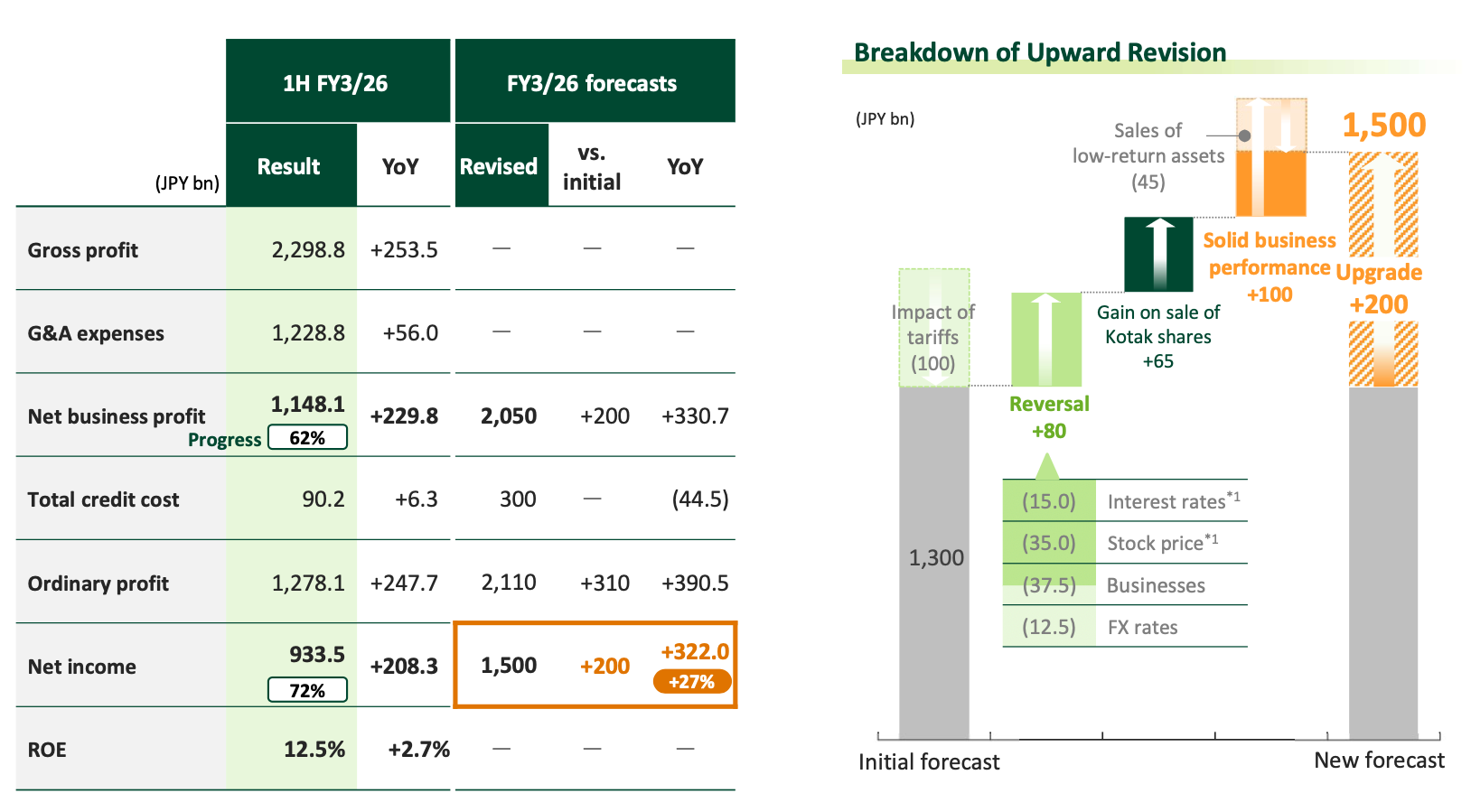

SMFG delivered a stellar financial performance in the first half of fiscal year 3/2026, with gross profit, net business profit, and net income all setting new first-half records. The results underscore a significant step-up in the firm's earnings power, with H1 net income of JPY 933.5 billion approaching the full-year result from just two years prior (FY3/24).

Key H1 FY2026 Performance Indicators:

- Net Income: JPY 933.5 billion (+ JPY 208.3 billion YoY)

- Net Business Profit: JPY 1,148.1 billion (+ JPY 229.8 billion YoY)

- Gross Profit: JPY 2,298.8 billion (+ JPY 253.5 billion YoY)

- Return on Equity (ROE): 12.5% (+2.7% YoY)

This powerful momentum, representing 72% progress toward the initial full-year target, led management to upgrade the full-year net income forecast by JPY 200 billion to JPY 1.5 trillion. If achieved, this would represent a 27% year-over-year increase. The upward revision is attributed to several key factors:

- Reversal of Tariff Impact Assumption: +JPY 80 billion

- Solid Business Performance: +JPY 100 billion

- Gain on Sale of Kotak Shares: +JPY 65 billion

- Impact from Sales of Low-Return Assets: (JPY 45 billion)

Benchmarking Against Global Systemically Important Banks

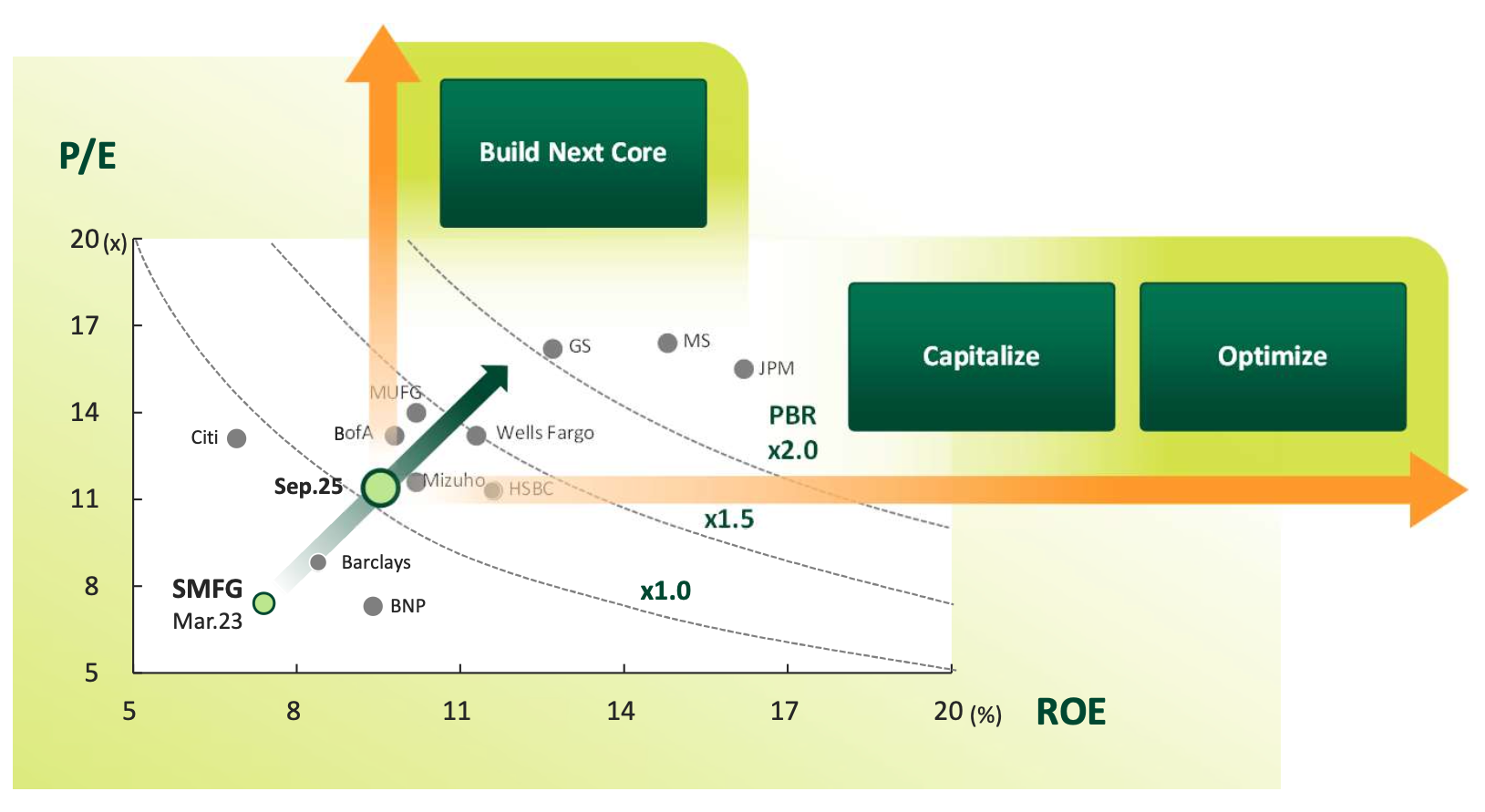

Despite its strong absolute performance, SMFG's market valuation reflects a persistent gap with its top-tier global competitors. A comparison of Return on Equity (ROE) versus Price-to-Book Ratio (PBR) positions SMFG—alongside its Japanese megabank peers Mizuho and MUFG—in a quadrant characterized by lower ROE and PBR. This contrasts sharply with U.S. peers like JPMorgan (JPM), Morgan Stanley (MS), and Goldman Sachs (GS), which command higher valuations on the back of superior capital efficiency. This valuation gap is the central problem that the "Optimize" and "Build Next Core" strategic pillars are designed to solve by improving capital efficiency and creating new, higher-return growth narratives.

From a creditworthiness perspective, SMFG maintains strong investment-grade ratings that are broadly in line with its Japanese peers but trail the highest-rated U.S. and European G-SIBs.

Entity | Moody's | S&P | Fitch |

SMFG (Holding Co.) | A1 | A- | A- |

SMBC (Operating Bank) | A1 | A | A |

JPMorgan Chase Bank | Aa2 | AA- | AA |

Bank of America | Aa2 | AA- | AA |

HSBC Bank | A1 | A+ | AA- |

MUFG Bank | A1 | A | A |

Mizuho Bank | A1 | A | A |

This high-level financial overview sets the stage for a more granular analysis of the individual business units that are driving the group's overall performance.

Analysis of Core Business Segments

A comprehensive competitive analysis requires dissecting the performance of individual business units. This approach helps identify the core engines of growth, areas of underperformance, and the specific strategic levers SMFG is using to enhance profitability and capital efficiency across its diverse operations.

Domestic Operations: The Engine of Growth (Retail & Wholesale)

SMFG's domestic businesses were the definitive source of its H1 outperformance, directly compensating for the strategic realignment occurring in the global segments. The Wholesale Business Unit acted as the primary engine, delivering a significant increase in net business profit fueled by strong corporate funding demand and market share gains. This outperformance is expected to contribute a JPY 120 billion upside versus the initial plan, directly linking the unit's success to the group's upgraded forecast. Its capital efficiency is a standout, with a Return on CET1 (RoCET1) of 16.5% (excluding gains from equity sales), providing a powerful offset to less profitable segments.

The Retail Business Unit also showed marked improvement, with its RoCET1 rising significantly to 12.9%. This growth was driven by the favorable impact of higher domestic interest rates on deposit margins and the continued success of the "Olive" digital platform in expanding the customer base and driving wealth management activity. Overall domestic loan balances increased, led by strong funding demand from large corporations, while the bank also successfully achieved both volume growth and wider spreads with mid-sized corporations and SMEs.

Global Operations: Pursuing Capital Efficiency (Global & Global Markets)

While domestic operations powered H1 growth, SMFG's global segments are undergoing a strategic realignment focused on improving capital efficiency. The Global Business Unit saw its net business profit increase, but its RoCET1 of 8.2% remains well below the group average, identifying it as a key strategic challenge. The core strategy to address this is the disciplined reduction of low-return assets, with the freed-up capital being reallocated to higher-return opportunities and the ongoing execution of the Multi-franchise Strategy in Asia.

In contrast, the Global Markets Business Unit continues to deliver robust returns, posting a strong RoCET1 of 21.6%. While its core banking profit remained steady, overall performance was dampened by a decline in trading profit, which was negatively impacted by market turmoil in April.

The performance of these business units provides the context for SMFG's forward-looking strategic plan, which is designed to build on domestic strengths while systematically addressing areas of underperformance.

Strategic Initiatives and Future Growth Vectors

Looking ahead to the next Medium-term Plan, SMFG has organized its strategic initiatives around three core pillars: "Capitalize" on existing strengths, "Build Next Core" sources of growth, and "Optimize" the business portfolio for higher returns. These pillars guide the firm's current actions and lay the groundwork for its future competitive positioning.

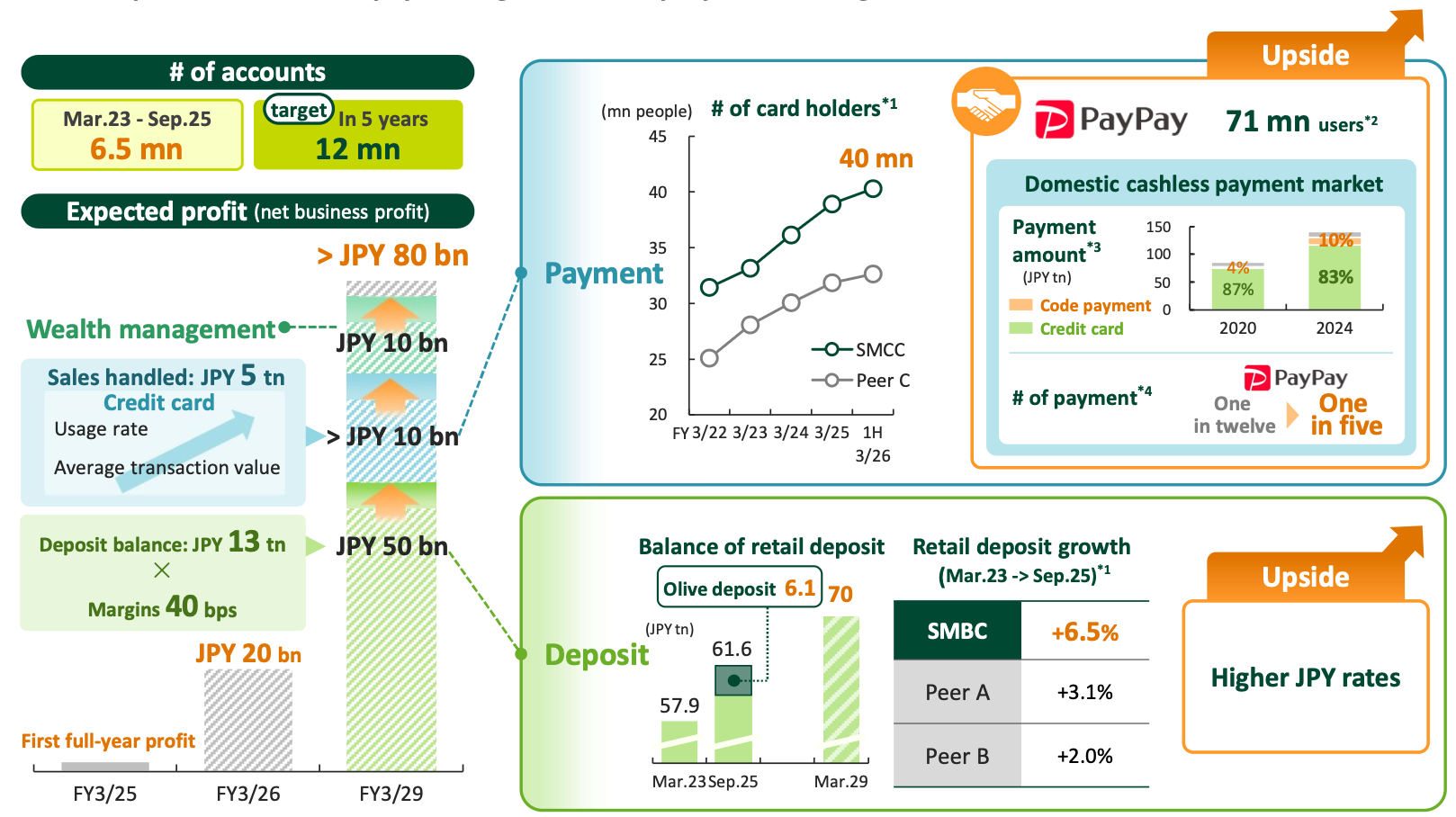

"Capitalize": Leveraging Domestic Strength

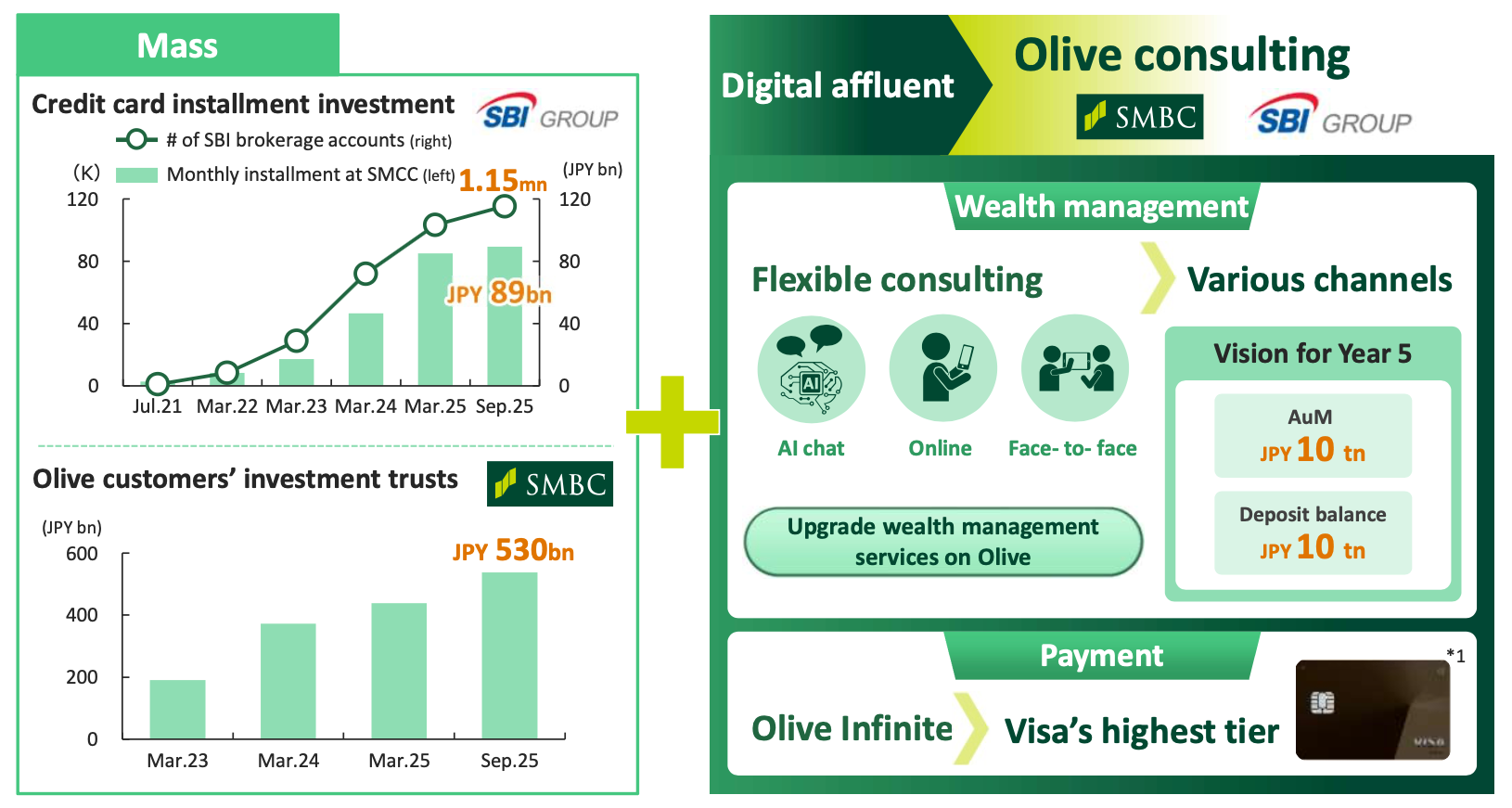

This pillar focuses on maximizing the potential of successful existing initiatives, with the "Olive" platform serving as a prime example. This integrated digital financial service has reached 6.5 million accounts, keeping a solid pace toward its five-year target of 12 million, and has enabled SMFG to outpace its peers in retail deposit growth. The platform is projected to generate over JPY 80 billion in net business profit by FY3/29. To further solidify this market position, SMFG's strategic partnership with PayPay aims to accelerate growth in Japan's cashless payments market and attract new Olive customers, creating additional upside potential.

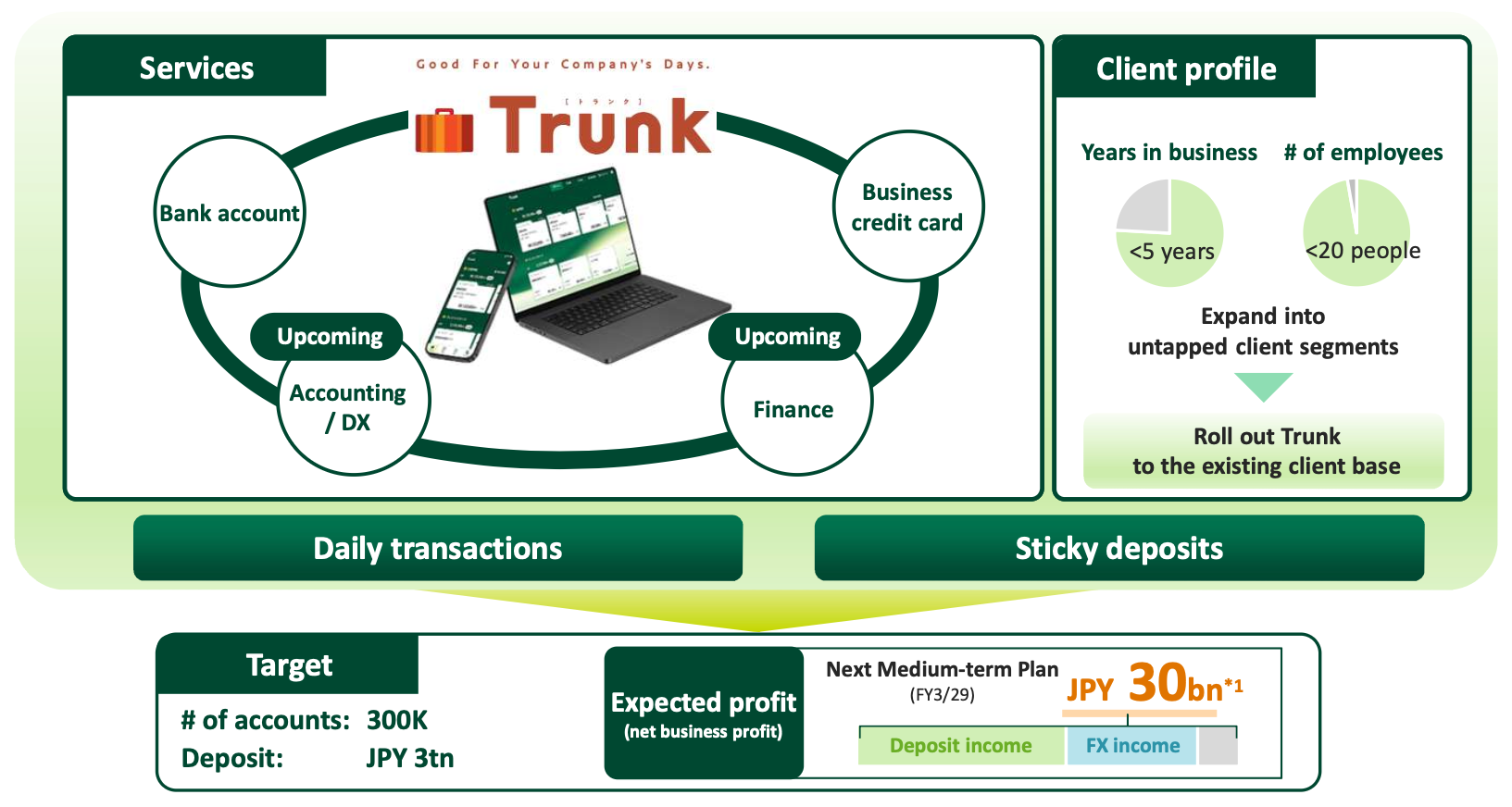

"Build Next Core": Developing New Digital Franchises

SMFG is actively investing in new digital ventures to create future engines of growth. With "Trunk," SMFG is making a crucial strategic play to penetrate the historically underserved SME segment, aiming to capture sticky, low-cost deposits that become increasingly valuable in a positive interest-rate environment. The firm is targeting 300,000 accounts, JPY 3 trillion in deposits, and JPY 30 billion in net business profit from Trunk by FY3/29.

In wealth management, the "Olive Consulting" joint venture with SBI Group will target the "digital-affluent customer" segment by combining online brokerage with human advisory services, aiming for JPY 10 trillion in both AuM and deposits in year five.

Finally, SMFG is pursuing a group-wide transformation to become an "AI-leading company," backed by a JPY 50 billion investment budget and the establishment of a world-class AI company in Singapore to develop AI agents that will drive significant operational efficiency.

"Optimize": Portfolio Reallocation for Higher Returns

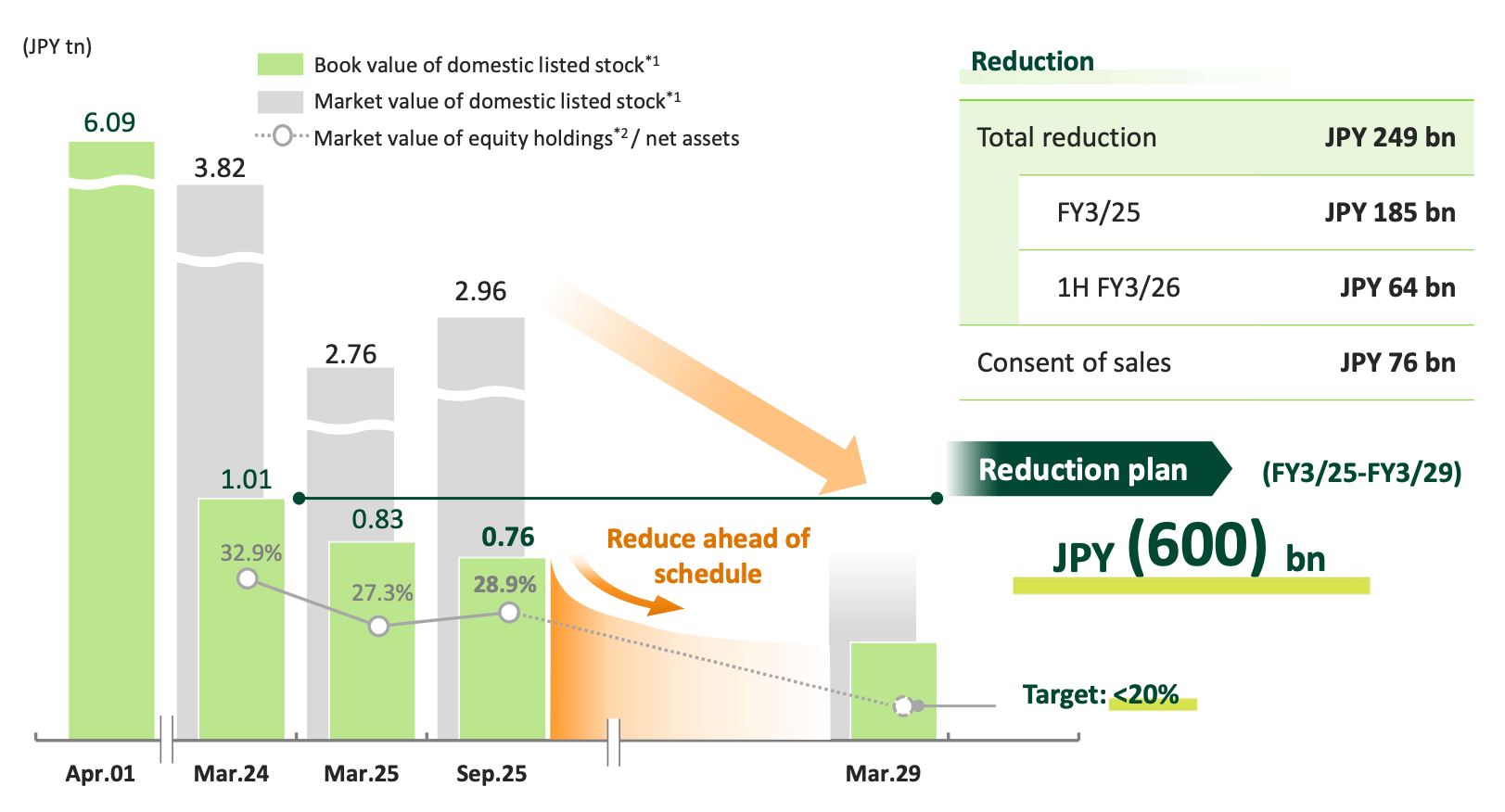

The "Optimize" pillar is focused on enhancing capital efficiency through a disciplined rebalancing of the group's business portfolio. The core strategy involves rigorously reducing low-return assets to free up capital for redeployment into key growth areas, such as high-demand domestic large corporates and higher-margin "Credit card / Consumer finance" businesses. On this front, SMFG is making steady progress on its five-year, JPY 600 billion reduction plan for strategic equity holdings, having already achieved a reduction of JPY 249 billion through the first half of FY3/26.

These strategic pillars are complemented by a focused approach to global partnerships, designed to accelerate growth and enhance capabilities.

Global Expansion and Strategic Alliances

SMFG has adopted a partnership-centric approach to global expansion, using targeted overseas investments and alliances to plug capability gaps, enter high-growth markets, and strengthen its competitive footing without overextending its balance sheet.

The Multi-Franchise Strategy in Asia

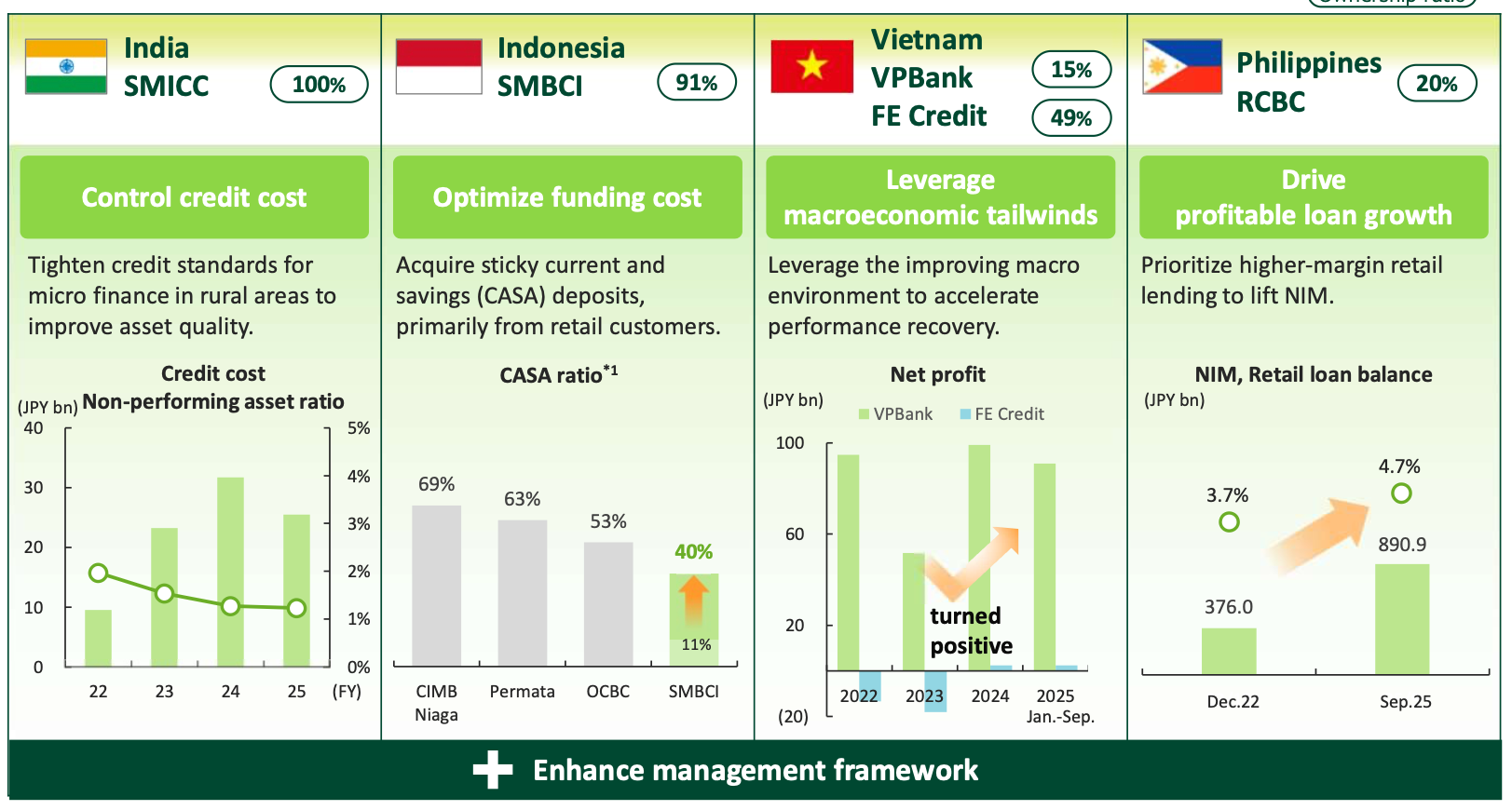

The centerpiece of SMFG's international strategy is its "Multi-franchise" model, which involves taking significant equity stakes in leading financial institutions in four high-growth Asian markets: India (YES BANK, 24.9%), Vietnam (VPBank, 15%), Philippines (RCBC, 20%), and Indonesia (SMBCI, 91%). The 24.9% stake in YES BANK notably represents the maximum ownership permitted by the Reserve Bank of India, reflecting SMFG's commitment to executing its strategy to the fullest extent allowed by local regulation. With the key investments now in place, the strategic focus has shifted to execution and monetization. However, management acknowledges that returns are currently "short of initial expectations," and each market presents unique challenges.

Key Alliances for Capability Enhancement

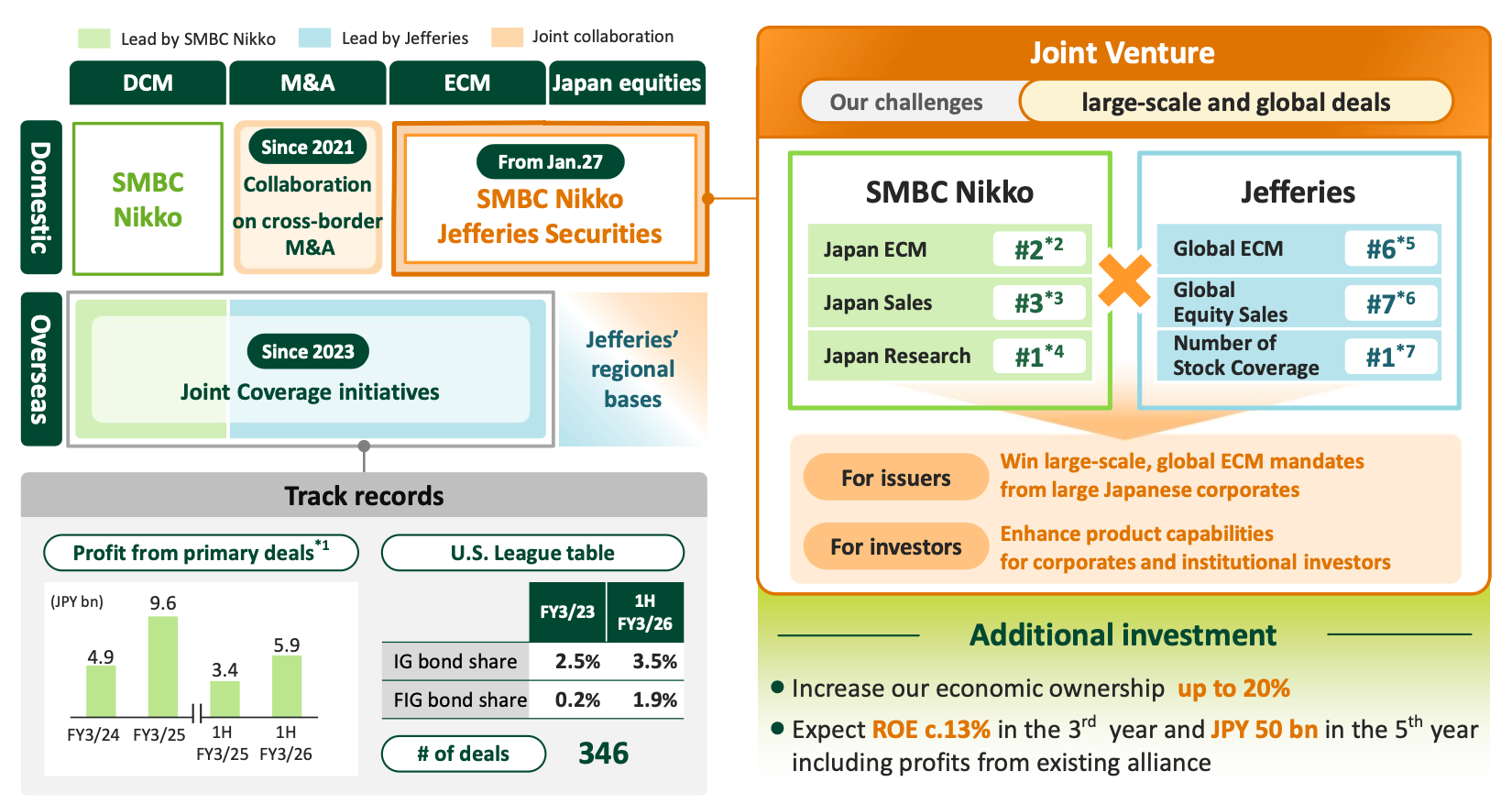

Beyond its Asian banking investments, SMFG leverages partnerships to accelerate growth in its core capabilities. To address a previously identified gap in its ability to win large-scale, global equity capital markets (ECM) mandates, SMFG is establishing a joint venture with Jefferies. This partnership combines SMBC Nikko's strong domestic presence with Jefferies' global platform, and SMFG expects the JV to achieve an ROE of c.13% in its third year and contribute JPY 50 billion in profit by its fifth year.

This is complemented by domestic alliances with SBI Group in wealth management ("Olive Consulting") and PayPay in cashless payments, which allow SMFG to leverage external expertise and dominant platforms to rapidly enhance its offerings in core Japanese markets.

These initiatives, taken together, provide a clear picture of SMFG's overall competitive strengths and the challenges it must navigate to achieve its long-term ambitions.

Summary: Competitive Standing and Strategic Outlook

This analysis provides a comprehensive view of SMFG's competitive position at a pivotal moment. Bolstered by record-breaking financial performance and a clear strategic roadmap, the group is capitalizing on a favorable domestic environment while laying the groundwork for its next phase of growth. This final section synthesizes the firm's core strengths, acknowledges its primary challenges, and offers a concluding assessment of its strategic outlook.

Core Competitive Strengths

- Dominant and Profitable Domestic Operations: SMFG's Wholesale and Retail business units are powerful growth engines, benefiting from a positive interest rate environment, strong corporate activity, and the success of digital platforms like Olive, which is driving market share gains in retail deposits.

- Strategic Agility through Partnerships: The firm has effectively used alliances with partners like Jefferies, SBI Group, and PayPay to rapidly enhance its capabilities in investment banking, wealth management, and payments, accelerating its time-to-market in critical growth areas.

- Clear Capital Efficiency Strategy: Through its "Optimize" pillar, SMFG is executing a disciplined strategy to enhance shareholder returns. This includes the systematic reduction of low-return assets and strategic equity holdings to free up capital for reinvestment in higher-return opportunities.

- Established Platform for Asian Growth: Despite current profitability challenges, the Multi-franchise Strategy provides SMFG with a unique and established footprint in four of Asia's most promising high-growth markets, offering a significant long-term growth vector that differentiates it from many global peers.

Key Strategic Challenges

- Underperformance in Global Capital Efficiency: The Global Business Unit's return on capital (RoCET1) significantly lags the group average. The success of SMFG's overall strategy hinges on its ability to execute the planned portfolio reallocation and improve the profitability of its international assets.

- Monetizing the Multi-Franchise Strategy: The firm's key challenge in Asia is to translate its significant investments into profitable growth engines that meet initial return expectations. This requires successfully navigating specific operational headwinds in India (credit costs), Indonesia (funding costs), and Vietnam (market recovery).

- Closing the Valuation Gap: SMFG, like other Japanese megabanks, trades at a significant valuation discount to its U.S. G-SIB peers. Overcoming this requires sustained execution on its capital efficiency goals and effectively communicating a compelling growth story to convince the market of its long-term potential.

Concluding Assessment

Sumitomo Mitsui Financial Group is in a strong competitive position, powered by a resurgent domestic business and a clear, multi-pronged strategy for future growth. The firm's disciplined focus on its "Capitalize, Build, Optimize" framework provides a coherent approach to leveraging current strengths while investing in future capabilities. SMFG's ability to close its valuation gap with global peers will be contingent on the disciplined execution of its portfolio optimization, the successful monetization of its digital platforms, and its capacity to turn the high-potential, but currently underperforming, Asian multi-franchise into a material contributor to group profitability.