SOMPO to Acquire Aspen Insurance Holdings for USD 3.5bn

SOMPO Holdings, through its subsidiary Sompo International Holdings (SIH), has entered into a definitive agreement to acquire 100% of the outstanding ordinary shares of Aspen Insurance Holdings. The Acquisition has been unanimously approved by the Board of Directors of SOMPO and of Aspen.

Background of the Acquisition

Under the Mid-Term Management Plan (FY2024 – FY2026) announced in May 2024, SOMPO is aiming to establish its purpose of “For a future of health, wellbeing and financial protection” and contribute to society by evolving into a group of companies that provide solutions through “increasing resilience” and “connecting with customers and delivering connected services”, and promoting initiatives to achieve the goals in each of its two business areas: SOMPO P&C (Domestic and Overseas insurance business) and SOMPO Wellbeing.

In the overseas P&C insurance sector, SOMPO has been steadily expanding its earnings by shifting all overseas insurance operations to SIH (formerly Endurance Specialty Holdings), which SOMPO acquired in 2017 for USD 6.3 billion (approx. JPY 680 billion), as a global platform and focusing on growth mainly in the U.S. and Europe.

In addition, SOMPO acquired Lexon, a U.S.-based surety insurance company, in 2018, W. Brown, a U.S.-based aviation managing general agent, and Diversified, a crop insurance company, in 2020, to complement SIH's existing businesses and enhance the balance of its business portfolio and revenue structure. Furthermore, in Brazil, SOMPO exited the health insurance business in 2021 and the consumer business in 2022.

These measures have enabled SIH to grow into one of the world's leading global insurance and reinsurance players, generating gross written premiums of USD 16.5 billion (approx. JPY 2.6 trillion) and Adjusted Profits of USD 1.4 billion (approx. JPY 214 billion) in 2024.

SOMPO aims to complete the sale of all strategic cross-shareholdings by 2030. Since last year, its capital has steadily grown from ongoing share sales and higher profits, allowing it to seek new investments for additional profit contribution and capital efficiency.

Aspen is a specialty insurance group that operates insurance and reinsurance businesses primarily in the U.S., U.K. (including the Lloyd's market), and Bermuda. Aspen’s Lloyd’s syndicate is recognized as one of the best-performing syndicates in the market. Additionally, it has a stable fee-based business managing third-party capital, a unique strength that would otherwise be difficult to build organically. SOMPO has determined that the Acquisition is optimal for achieving non-linear growth in its Group's overseas business and will qualitatively transform its revenue structure.

The Acquisition is expected to increase Adjusted EPS (earnings per share) and achieve the Adjusted Consolidated ROE target (13-15%) set in the current Mid-Term Management Plan.

Overview of the Acquisition

(1) Acquisition target: Aspen

(2) Acquirer: Endurance Specialty Insurance Ltd. (“ESIL”), a subsidiary of SIH

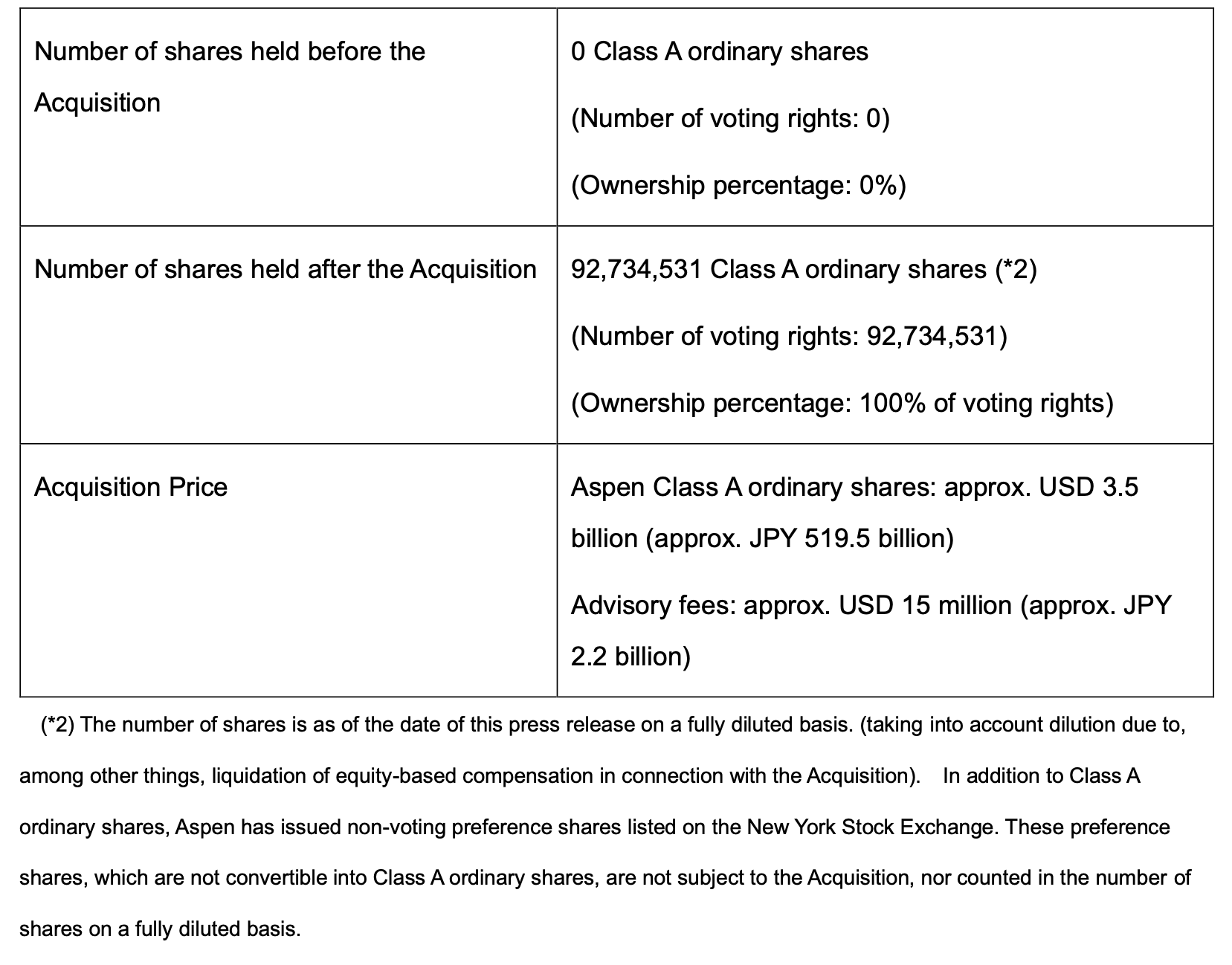

(3) Shares to be acquired, acquiring price, and shares owned before and after the transaction

(4) Acquisition terms: USD 37.5 per ordinary share (approx. JPY 5,602)

This constitutes an acquisition price to tangible book value ratio of 1.32x per ordinary share of USD 28.59 as of June 2025. The acquisition premium represents a 14.3% premium to the most recent share price as of the close of trading on August 25, 2025 and 20.7% premium to the volume-weighted average price of the closing prices for the past 30-day period ended August 25, 2025. After the holistic analysis and review of Aspen’s assets, business operations, and prospects, SOMPO considers the acquisition price fair and reasonable

(5) Funding for the Acquisition: The Acquisition will be financed exclusively through SOMPO's internal capital.

Features of Aspen

Founded in 2002, Aspen is a specialty insurance and reinsurance group with operations across the U.S., U.K., and Bermuda.

In 2019, Aspen was acquired by funds managed by affiliates of Apollo Global Management, a private equity fund, transitioning the company to private ownership. Under the leadership of Mark Cloutier, the current Chairman and CEO—a seasoned industry veteran who previously served as CEO of Brit, a prominent Lloyd's player—the company underwent a strategic transformation. This overhaul culminated in a successful re-listing on the New York Stock Exchange in May of this year.

Aspen demonstrates robust profitability and financial health, and SOMPO expects a significant contribution to the group:

- Profitability: Aspen maintains strong profitability, evidenced by an average combined ratio of 89.5% over the past three years (2022-2024). This performance is underpinned by a well-balanced portfolio of primary and reinsurance businesses and a consistently low expense ratio.

- Financial Health: Aspen exhibits robust financial strength, affirmed by high insurance financial strength ratings from leading private rating agencies (main insurance subsidiaries' ratings: S&P: A-, A.M. Best: A).

Strategic Rationale

Strengthen Global Scale

- Expands footprint in key international markets, accelerating SOMPO’s strategy to increase overseas contribution to gross premiums, Adjusted Consolidated Profit, and Adjusted Consolidated ROE.

- Solidifies SOMPO as a leading global insurance and reinsurance franchise with enhanced presence in the U.K., Bermuda, and the Lloyd’s market.

- Adds complementary business lines that balance SOMPO’s portfolio risk and earnings mix, while Aspen’s stable, fee-based income stream further reduces earnings volatility.

Access to High-Quality, Defensible Platforms

- Lloyd’s Platform: Aspen’s syndicates offer unique access to Lloyd’s distribution and licensing. It has a strong underwriting track record and capital discipline and is recognized as one of the best-performing Lloyd’s platforms.

- Aspen Capital Markets (ACM): Stable, fee-based income (USD 169 million in 2024) from third- party capital management with long-term client and capital provider relationships enhances Adjusted Consolidated ROE.

- Favorable Market Conditions: Attractive pricing and terms environment expected to continue in the near-to-medium term, supporting disciplined growth.

Enhances Capital Position and Earnings Accretion

- Synergy Creation: The integration of SIH and Aspen is expected to yield various synergies, including surplus capital generation, enhanced investment returns, and improved business efficiency.

- Shareholder Value Creation – Contributes to Adjusted EPS accretion, operating income growth, and achieving mid-term Adjusted Consolidated ROE targets of 13–15%, supported by Aspen’s stable underwriting profits and recurring fee income.