Sony Bank Makes a Major Move: Applying for a U.S. National Trust Bank Charter

In a significant signal that global financial giants are eager to establish regulated footing in the U.S. digital asset market, Sony Bank has formally applied to the Office of the Comptroller of the Currency (OCC) to establish a national trust bank.

Dated October 6, 2025, the application outlines plans for a limited-purpose institution named Connectia Trust, National Association, headquartered in New York, with a clear focus on cryptocurrency activities.

Here is a breakdown of the key details revealed in the regulatory filing and what they mean for the future of regulated crypto banking.

1. Introducing Connectia Trust, National Association

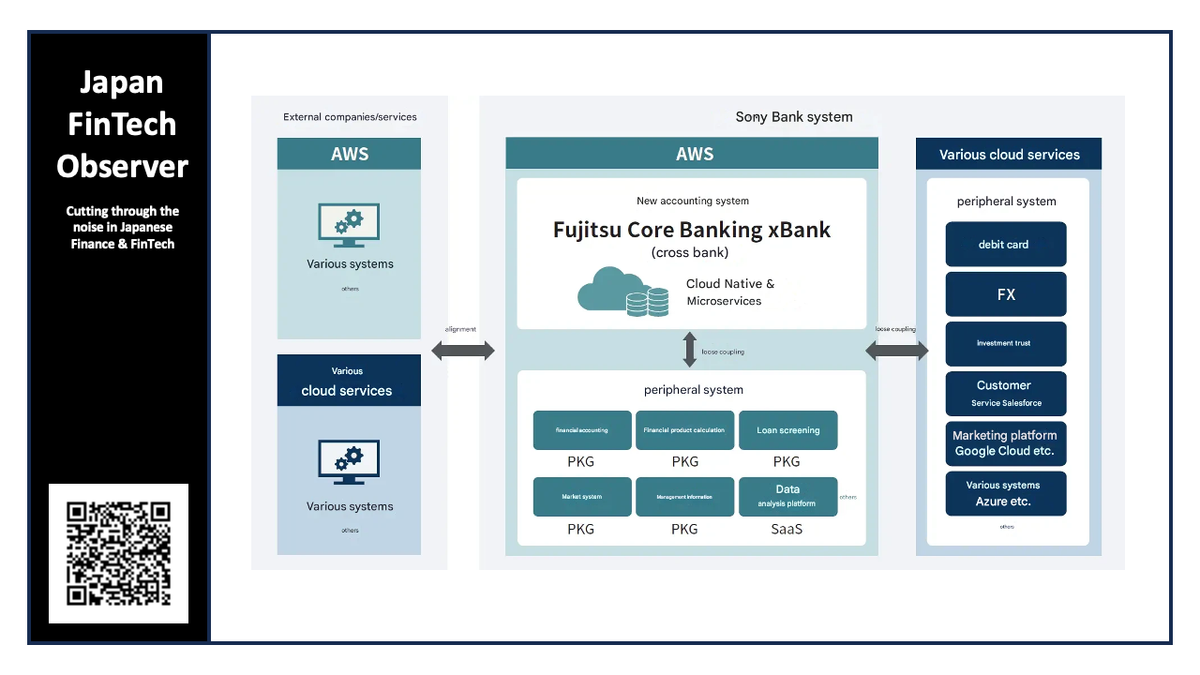

Sony Bank, a wholly-owned subsidiary of the publicly traded Japanese financial services holding company Sony Financial Group (SFG), is the sponsor behind this ambitious new venture.

The proposed institution, Connectia Trust, NA, is seeking a charter as a de novo national bank but will limit its operations strictly to those of a trust company.

Key Characteristics:

- Location: Main office will be located at 25 Madison Avenue, New York, NY.

- Scope: It will be a special purpose bank (a "trust bank") and will not take traditional deposits or seek FDIC deposit insurance.

- Business Model: Services will be offered digitally throughout the entire U.S., leveraging the trust charter to engage in activities incidental to the business of banking, including fiduciary services.

2. Digital Assets at the Core of the Business

The most compelling aspect of the application is the explicit intention to engage in "Cryptocurrency Activities". Sony Bank states that Connectia Trust will immediately pursue digital asset activities that the OCC has previously found permissible under existing national bank legal authorities.

Specifically, the initial phase of operations will include:

- Stablecoin Issuance: Issuing dollar-pegged stablecoins and maintaining the corresponding reserve assets.

- Digital Asset Custody: Providing non-fiduciary digital asset custody services.

- Asset Management: Offering asset management services as a fiduciary to certain affiliates.

This focus positions Connectia Trust directly in the vanguard of institutions attempting to bridge traditional finance with the Web3 economy under the rigorous oversight of a federal regulator.

3. A Team Built for Regulatory Compliance and Web3

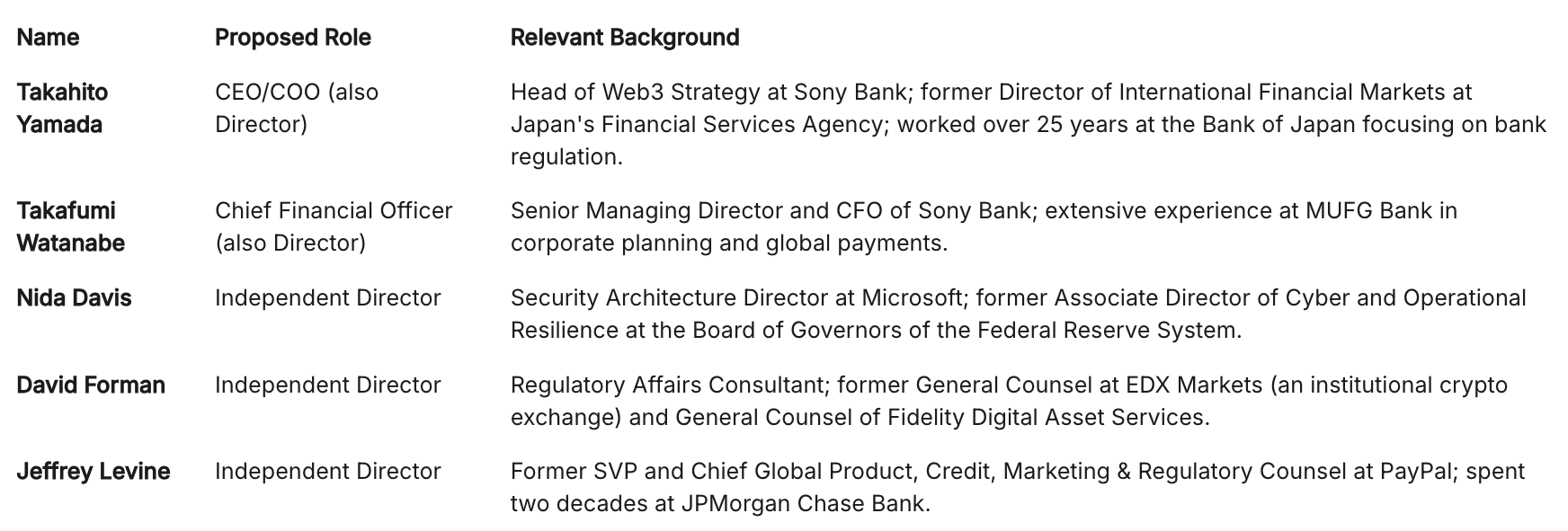

To navigate this complex regulatory environment, Sony Bank has assembled a five-member Board of Directors and a senior executive team that blends deep experience in global banking regulation, financial services, and cybersecurity.

Key Management Appointments Include:

The composition of the leadership, especially the independent directors with strong backgrounds in cybersecurity (Davis) and institutional crypto regulation (Forman), suggests that the application is built on a foundation of operational resilience and deep regulatory respect.

4. Navigating the OCC Process

The application, filed with the OCC, demonstrates the comprehensive preparation required for a national charter:

- Confidentiality: Sony Bank requested confidential treatment for a large volume of materials (Confidential Exhibits) relating to the business plan, ownership structure, and proposed cryptocurrency activities. The justification cites potential "substantial competitive harm" if the details of their new business model were made public.

- Waiver Requests: Due to the international nature of the sponsoring organization, Connectia Trust is requesting waivers of the citizenship requirements for two of its directors and waivers of the residency requirements for four of the five proposed directors, pursuant to 12 C.F.R. § 5.43.

- Policy Infrastructure: The application includes a list of extensive draft policies ready for regulatory review, including a Privacy Program Policy, Draft Compliance Management Systems Policy, Cybersecurity Policy, and a Draft Anti-Money Laundering and Sanctions Policy.

The application confirms that Connectia Trust will be requesting full fiduciary powers from the OCC, a mandatory step for its trust bank structure.

5. What Comes Next?

If approved, Connectia Trust, N.A., would become one of a select few national trust banks dedicated to digital asset and crypto-related services in the U.S.

The application serves as a powerful indicator of Sony Group's commitment to Web3 finance and highlights a continuing trend: major international financial players are choosing the federal trust charter path to establish a regulated presence for their digital asset ventures in the United States. The OCC review process will be crucial, setting a potential standard for how Japanese institutions integrate into the U.S. crypto regulatory framework.