Sony Financial Presents First Quarterly Results after Spin-Off

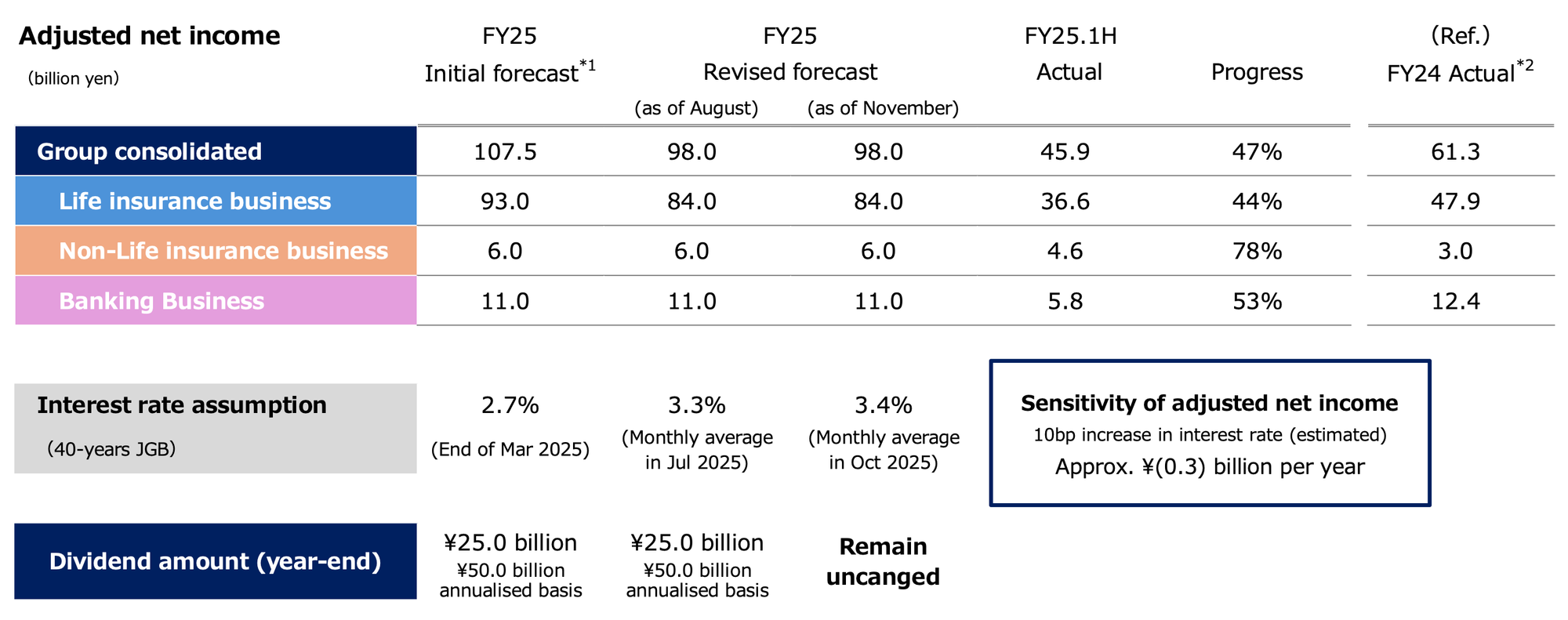

For the first half of fiscal year 2025 (FY25.1H), Sony Financial Group delivered a Group Consolidated Adjusted Net Income of ¥45.9 billion, based on IFRS Accounting Standards. This result represents a 4.8% decrease (¥2.3 billion) compared to the same period in the previous fiscal year. The decline is primarily attributable to decreased adjusted net income in the Sony Life insurance business. Despite this year-over-year decrease, the Group's overall progress is almost in line with the plan, with a 47% progress rate achieved against the revised full-year forecast.

Consolidated Financial Performance Analysis

This section provides a comprehensive view of the Group's overall financial health, detailing the primary factors that influenced the year-over-year performance and assessing the current trajectory against annual targets. The consolidated results reflect a complex operating environment, characterized by both positive operational momentum in certain areas and headwinds from a rising interest rate environment.

Metric | Value / Status |

FY25.1H Group Adjusted Net Income | ¥45.9 billion |

Year-over-Year (YoY) Change | -¥2.3 billion (-4.8%) |

Progress vs. FY25 Forecast | 47% |

The ¥2.3 billion year-over-year decrease in adjusted net income was driven by downturns in both the life insurance and banking businesses. This was partially offset by a strong positive contribution from the non-life insurance business, where adjusted net income increased due to a welcome decrease in insurance claims payments from fewer natural disasters. The decline in the life insurance segment was mainly due to an increase of loss components resulting from higher risk adjustments caused by rising interest rates and changes in estimated future cash flows of insurance policies.

This consolidated view sets the stage for a more detailed examination of the individual business segments that collectively shape the Group's performance.

Business Segment Performance Highlights

A segment-level review is essential to understand the distinct operational dynamics and market conditions affecting each core business unit—Life Insurance, Non-Life Insurance, and Banking—and their respective contributions to the Group's consolidated results.

Sony Life: Core Business Strength Overcomes Market Headwinds

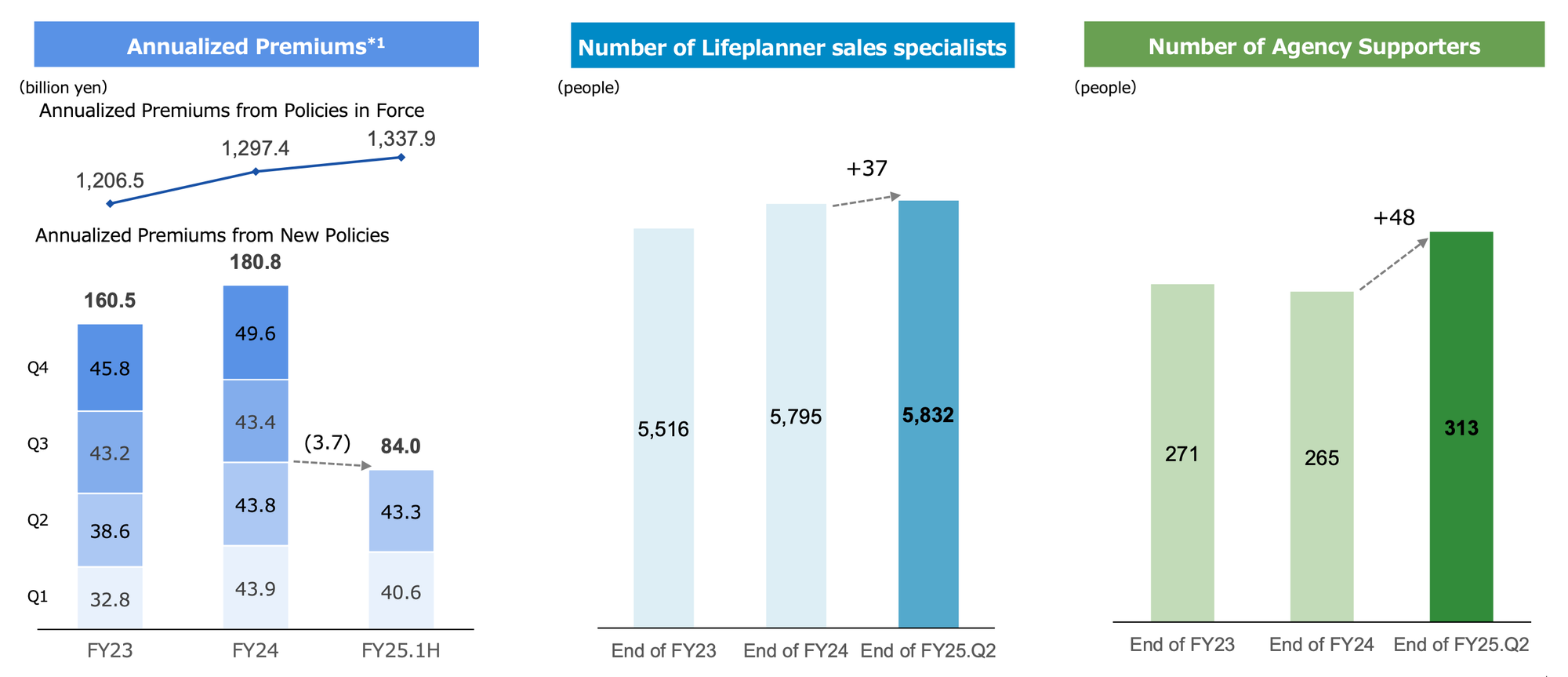

While Sony Life's adjusted net income decreased year-over-year, its key operational metrics demonstrate strong underlying business stability and continued growth in core areas. This resilience is a testament to the strength of its sales channels and product offerings.

- Strong Corporate Sales: New policy acquisitions in the corporate segment remain robust, supporting steady and consistent growth in the total value of policies in force.

- Growing Sales Force: The recruitment of Lifeplanner sales specialists and Agency Supporters is progressing well, leading to a significant expansion of Sony Life's sales channels. As of the end of Q2, the sales force grew to 5,832 Lifeplanners and 313 Agency Supporters.

- Stable Policy Value: The Contractual Service Margin (CSM) balance, a key indicator of future profitability, increased compared to the end of FY24. This demonstrates that the value generated from robust new business acquisition was strong enough to overcome the negative valuation impact from changes in economic assumptions (primarily rising interest rates), signaling exceptional underlying business momentum.

- Improving Retention: After an increase in FY23, lapse and surrender rates have begun to decline, signaling an improvement in policyholder retention.

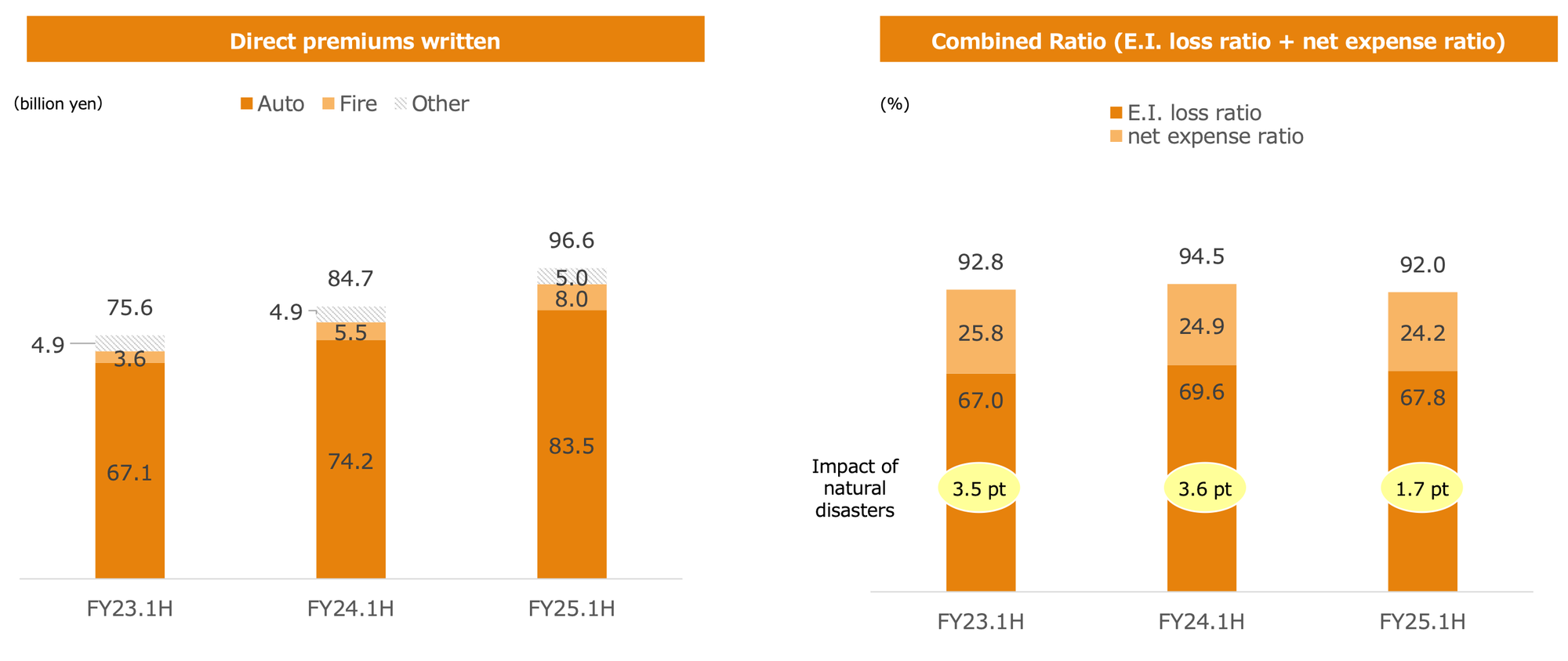

Sony Assurance: Profitability Soars as Catastrophe Losses Subside

The non-life insurance business delivered a notable increase in adjusted net income. This improved profitability was primarily driven by a significant decrease in insurance claims, as the prior year's results were impacted by natural disasters that added 3.6 percentage points to the loss ratio. This performance was reinforced by two key positive trends:

- A solid increase in direct premiums written, led by growth in auto insurance.

- An improvement in the combined ratio, which decreased to an efficient 92.0%.

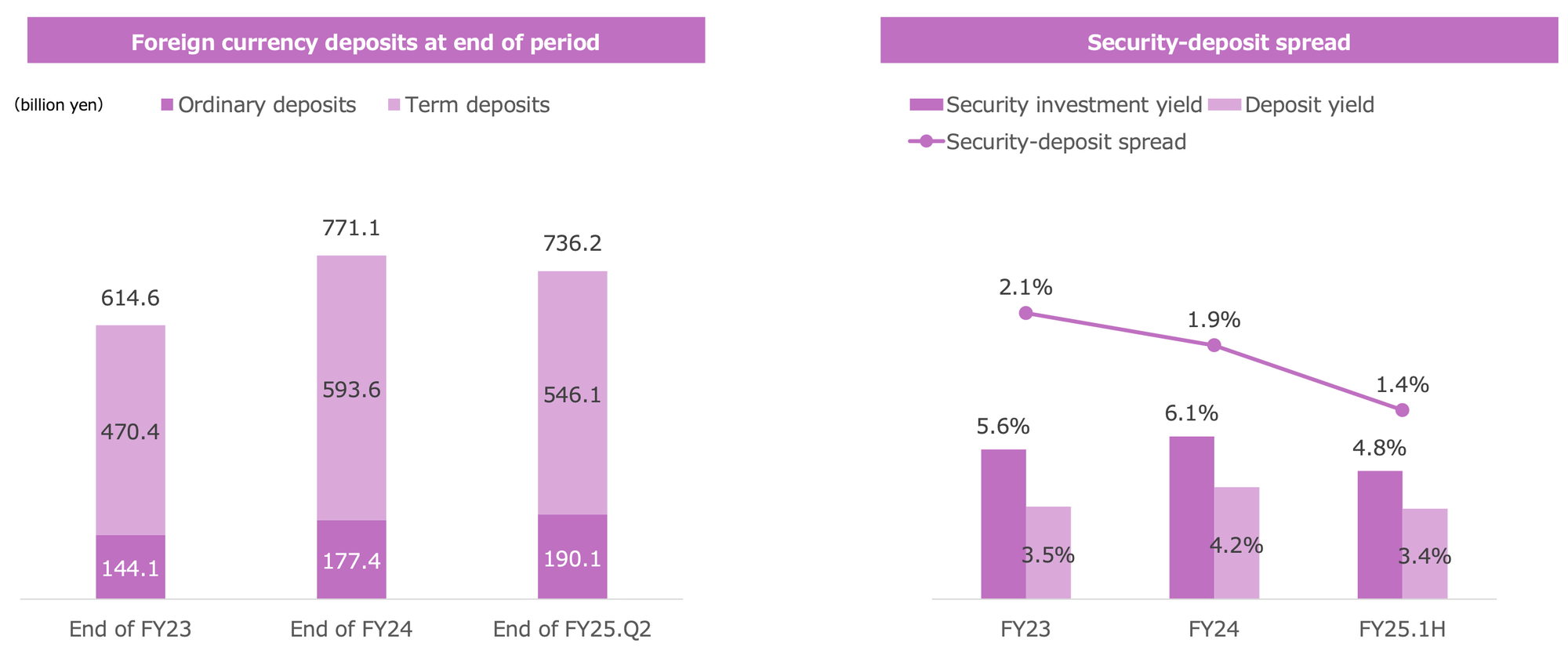

Sony Bank: Proactively Managing Margins in a New Rate Cycle

The banking business experienced a decrease in adjusted net income as it navigates a period of significant monetary policy shifts. Foreign currency deposit balances saw a slight decrease from the end of FY24 due to profit-taking sales by customers amid yen depreciation.

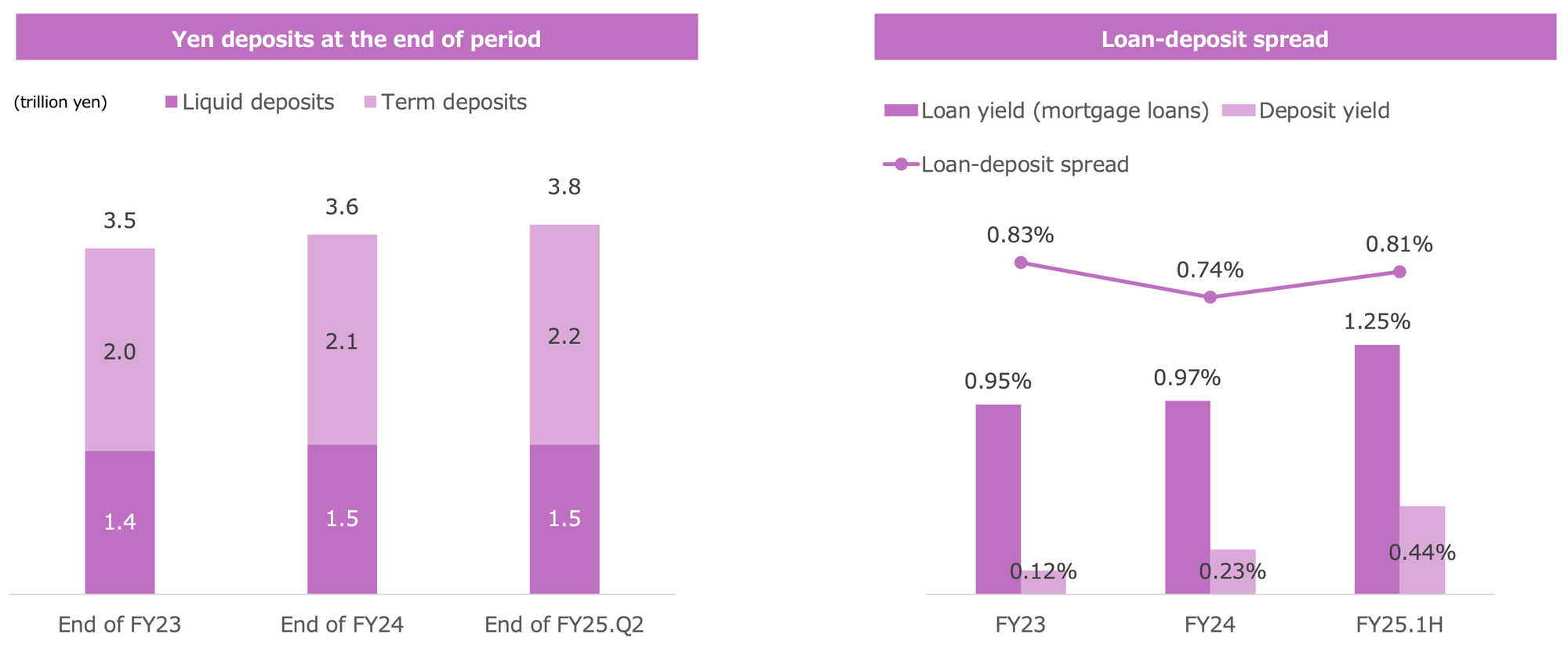

In contrast, yen deposit balances expanded steadily despite intensifying competition. To proactively manage profitability in this new rate environment, the bank is widening the loan-deposit spread by strategically increasing mortgage loan rates, ensuring continued margin security.

This review of the business segments provides the foundation for Sony's confident forward-looking guidance and underscores the stability of its financial position.

Financial Position and Full-Year FY25 Forecast

Forward-looking guidance and a strong balance sheet are cornerstones of investor confidence. This section assesses the Group's financial resilience and reaffirms management's outlook for the remainder of the fiscal year, signaling stability and a clear path forward.

The Group’s financial position remains robust. At the end of Q2 FY25, the group consolidated Economic Solvency Ratio (ESR) was 185%. This strong level of capitalization was maintained even after absorbing the impact of recent interest rate hikes, demonstrating sound risk management.

Reflecting confidence in the Group's operational stability and strategic direction, the full-year guidance for FY25 remains unchanged:

- Group Consolidated Adjusted Net Income: The forecast remains unchanged at ¥98.0 billion.

- Shareholder Returns: The year-end dividend forecast is unchanged at ¥25.0 billion, which represents ¥50.0 billion on an annualized basis.

In conclusion, while first-half performance reflects market challenges from rising interest rates, the Group's core operational strength, robust financial position, and confident full-year outlook remain firmly intact.