Sony Shares Plan for Spin-off of Financial Services Business

Sony Group is embarking on a significant strategic shift by partially spinning off its Financial Services business. The motivation behind this move is multifaceted, encompassing a desire for greater focus on core entertainment and technology areas, enhanced operational agility for both Sony and the financial services entity, and an improved capital allocation strategy. The decision follows a period where Sony Financial Group Inc. (SFGI), a wholly-owned subsidiary, achieved operational successes after initially becoming fully integrated within Sony. Despite this integration, Sony believes a spin-off is the next logical step to unlock further value and drive sustainable growth.

Sony emphasizes that the Financial Services business, while valuable, has somewhat constrained Sony's ability to efficiently allocate capital toward its highest-growth potential areas, primarily the entertainment sector (including gaming, music, and movies) and the image sensor business. These sectors are seen as holding the key to Sony's future innovation and market leadership. By separating the financial services arm, Sony aims to free up resources to invest more aggressively in these core areas.

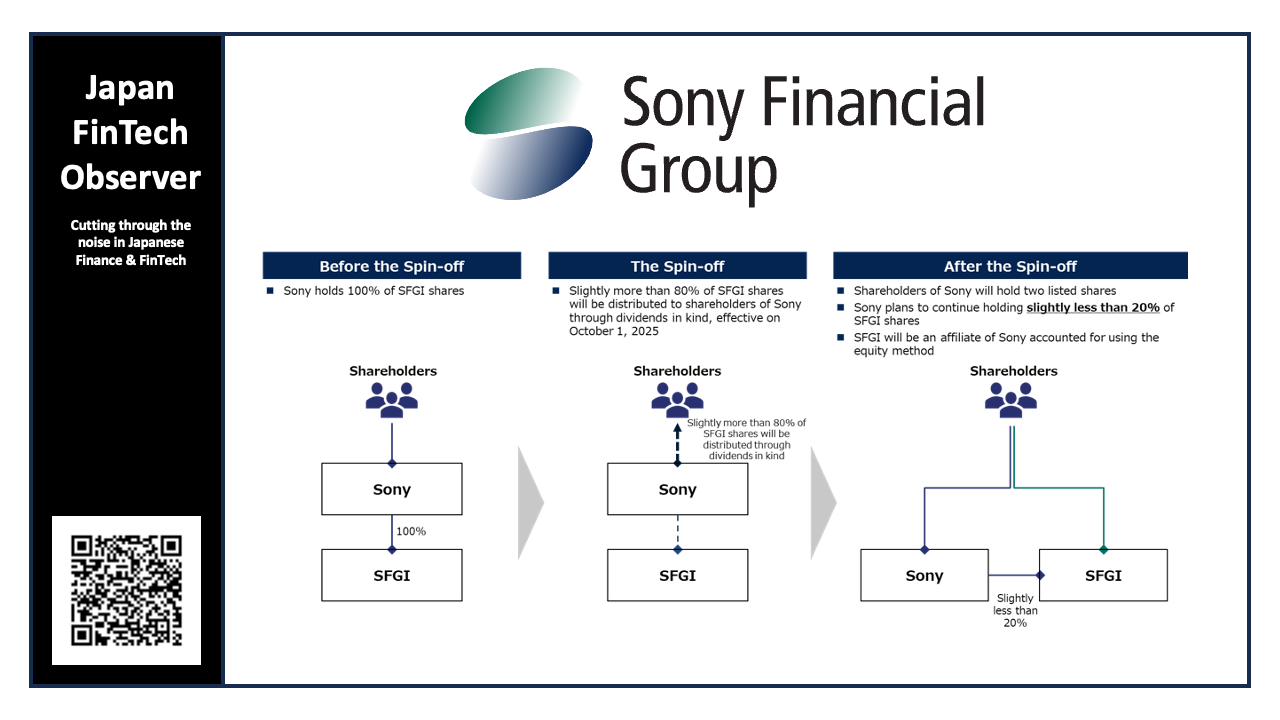

The spin-off is designed as a partial separation, meaning Sony will retain a significant minority stake (slightly less than 20%) in SFGI. This approach aims to balance the benefits of independence with continued collaboration and brand association. Sony intends to maintain a business relationship with SFGI, leveraging the Sony brand and providing technological support, implying continued synergy potential post-spin-off.

Transaction Structure and Timeline

The spin-off will be executed through a dividend-in-kind distribution of SFGI shares to existing Sony shareholders, as shown in the title graphic. Shareholders will receive SFGI shares in proportion to their Sony shareholdings, effectively creating a new class of shareholders directly invested in the financial services business. Slightly more than 80% of SFGI's shares will be distributed, with Sony retaining the remaining shares. This dividend distribution is planned for October 1, 2025.

To facilitate liquidity in the newly distributed SFGI shares, the company will seek a direct listing on the Prime Market of the Tokyo Stock Exchange (TSE). This direct listing allows existing shareholders to trade their SFGI shares without requiring a traditional initial public offering (IPO) with the issuance of new shares. SFGI has already submitted a preliminary application for listing, signifying a commitment to transparency and market access for investors. The final application is slated to occur before the spin-off execution. Nomura Securities, Goldman Sachs Japan, and JPMorgan Securities Japan have been appointed as financial advisors to Sony and SFGI, assisting with the execution of the spin-off.

The timeline outlines key milestones, including board approvals, regulatory clearances based on Japan's Act on Strengthening Industrial Competitiveness, investor communications, and the ex-dividend date for Sony shares. A corporate strategy meeting in May 2023 signaled the commencement of the spin-off assessment. Subsequent approvals were obtained throughout 2024, leading to the announcement of the detailed plan in May 2025. Financial services investor day has been scheduled to convey the growth strategy of the financial service business. Sony stresses that the execution of the spin-off and the listing of SFGI shares remain subject to TSE approval and other regulatory requirements.

Details of SFGI Share Distribution

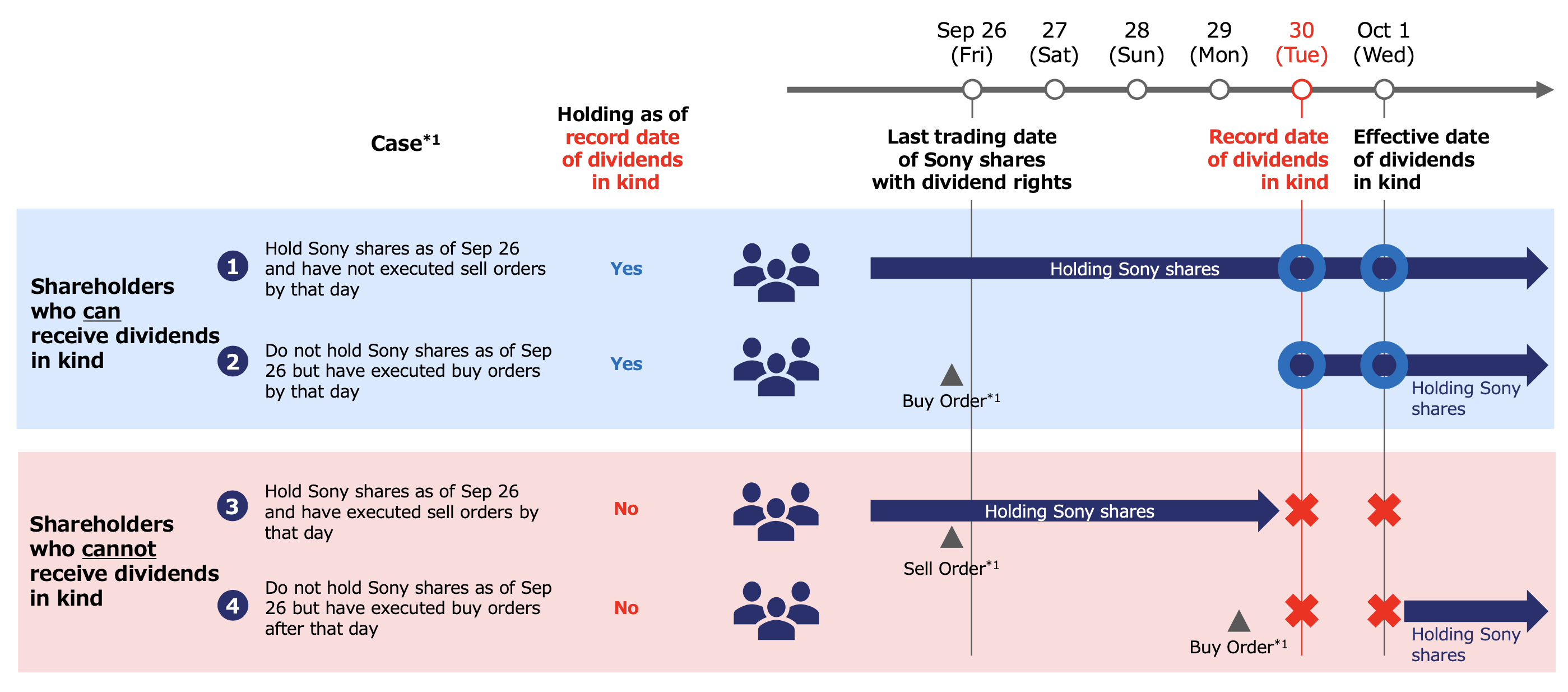

Sony details the process by which shareholders will receive SFGI shares. It provides scenarios illustrating the impact of buying or selling Sony shares around the ex-dividend date (September 30, 2025) and the last trading date with dividend rights (September 26, 2025). The key takeaway is that to receive the SFGI shares as a dividend-in-kind, investors must hold Sony shares as of the record date (September 30, 2025). The process involves meticulous tracking of buy and sell orders to determine eligibility.

Crucially, Sony explains how those holding Sony American Depositary Receipts (ADRs) will be treated. JPMorgan, the depositary for Sony ADRs, will establish a new SFGI ADR program and distribute SFGI ADRs to holders as of the distribution record date for Sony ADRs (September 29, 2025 Eastern Time). The SFGI ADRs will not be listed on major U.S. exchanges and will instead be traded on the over-the-counter (OTC) market.

Listing Mechanism and Price Discovery

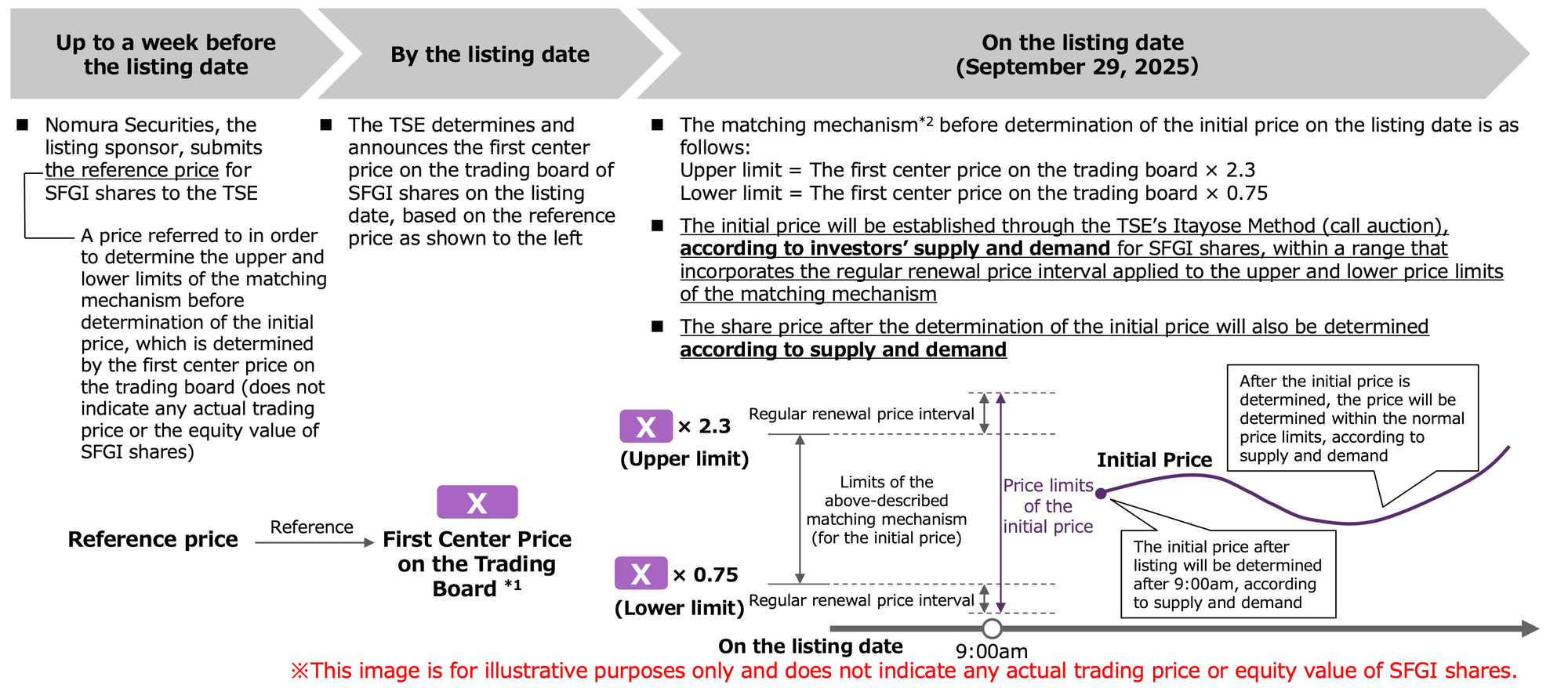

Given the direct listing approach, Sony clarifies the process of price discovery for SFGI shares. It states that the TSE will determine the first center price on the trading board, referencing a price submitted by Nomura Securities as the listing sponsor. This first center price serves as a basis for the matching mechanism, which defines upper and lower price limits for trading until an initial price is established.

The actual initial price will be determined through the TSE's Itayose Method (call auction), which considers investors' supply and demand for SFGI shares. The price will be within a range that incorporates regular renewal price intervals applied to the upper and lower price limits of the matching mechanism. This process ensures a fair and transparent price discovery mechanism for the newly listed shares.

Impact on Sony's Financial Statements

The spin-off will have several implications for Sony's consolidated financial statements. From Q1 FY2025, the financial services business will be classified as a discontinued operation under IFRS accounting standards. This means its financial results will be presented separately from Sony's continuing operations (primarily the entertainment and technology businesses). Sony will apply the equity method to account for its remaining stake in SFGI, recording its share of SFGI's profits or losses as operating income or loss within continuing operations.

A significant one-time loss is expected to be recorded in Sony's consolidated income statement at the time of the spin-off, reflecting the difference between the carrying amount and fair value of the SFGI shares distributed as dividends-in-kind. However, this loss will be classified within discontinued operations, thereby preventing any impacts in its operating income or earnings within the continuing operations. In addition, it will reclassify the financial services business' accumulated other comprehensive income (AOCI) to income and loss from the discontinued operations, but this will not affect total equity of Sony. The presentation stresses that the accounting treatment is a reclassification within equity and will not affect Sony's consolidated equity.

Tax Implications and Future Relationship

Sony expects that this transaction will be a tax efficient spin-off in Japan. Additionally, the taxation on the deemed dividend will not apply to the shareholders of Sony shares in connection with the dividends in kind of SFGI shares, and the taxation on the gains or losses will be deferred. The acquisition cost of Sony shares and SFGI shares applicable to the shareholders for tax purposes immediately after the Spin-off will be the amounts calculated using the proportion of distributed assets. As of today, the estimated proportion of distributed assets is expected to be approximately “0.20”. The proportion of distributed assets is currently expected to be determined in mid September 2025.

Despite the spin-off, the Financial Services business is expected to remain an important part of the larger Sony ecosystem. Sony intends to continue licensing its brand to SFGI and providing technological support. There will be continued access to Sony's technological resources and the brand. SFGI also intends to repurchase shares to improve capital efficiency after its listing. After the share repurchase, Sony will own just below 20% of SFGI.