Speeda's Japan Startup Finance 2025 Report

The Japanese startup ecosystem entered 2025 in a phase of consolidation and strategic re-evaluation. Top-level funding metrics serve as a critical barometer for the health of this ecosystem, reflecting aggregate investor confidence and the overall capacity for innovation. Understanding these macro trends is the first step in identifying the underlying currents shaping capital allocation, from early-stage ventures to mature, scale-up enterprises. The data from 2025 reveals a market characterized by stability at the surface, but with significant shifts occurring in how capital is being deployed.

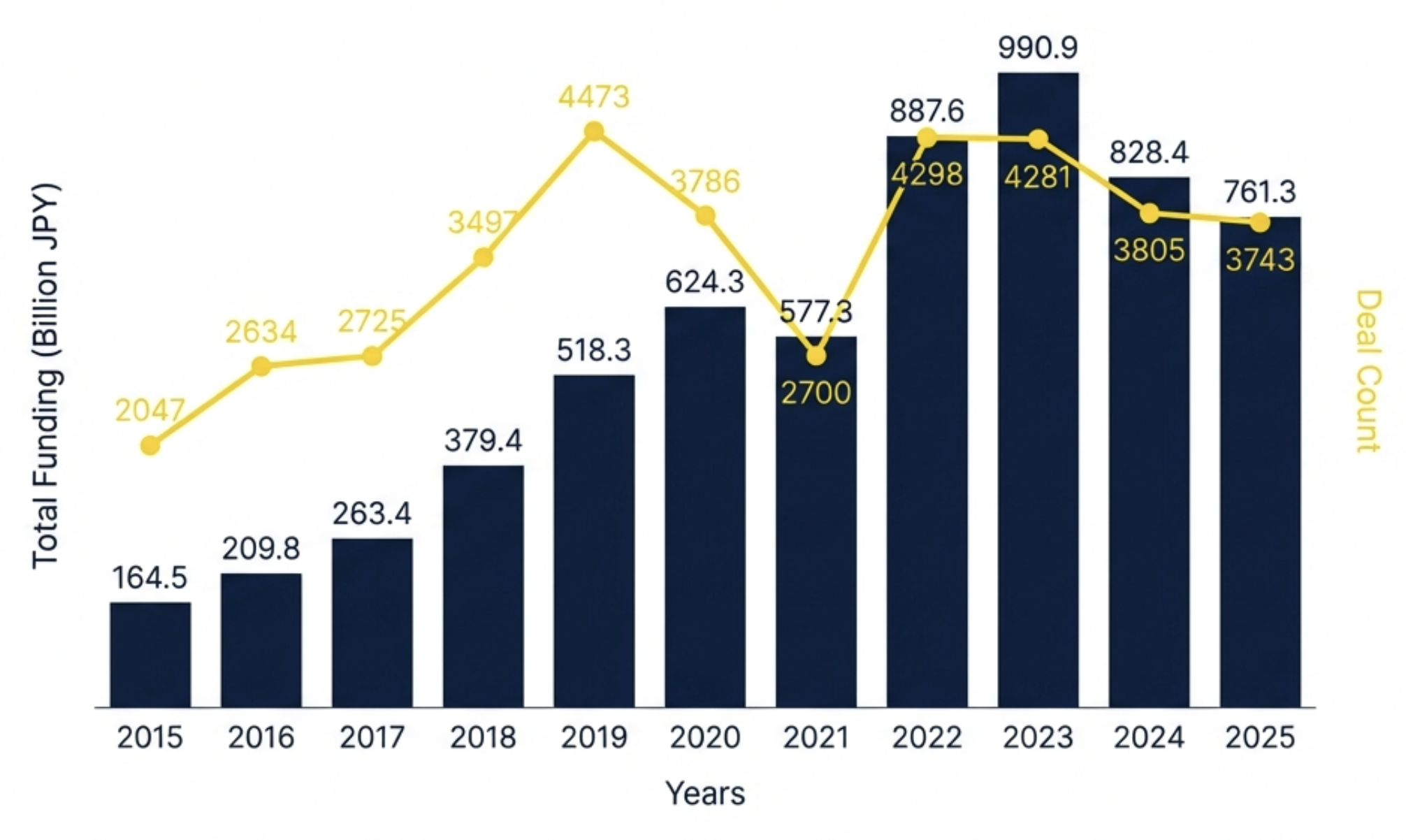

The headline statistics for the 2025 funding year paint a picture of a resilient but cautious market:

- Total Funding Amount: 761.3 billion yen (excluding debt).

- Total Deal Count: 3,743 (including those with undisclosed funding amounts).

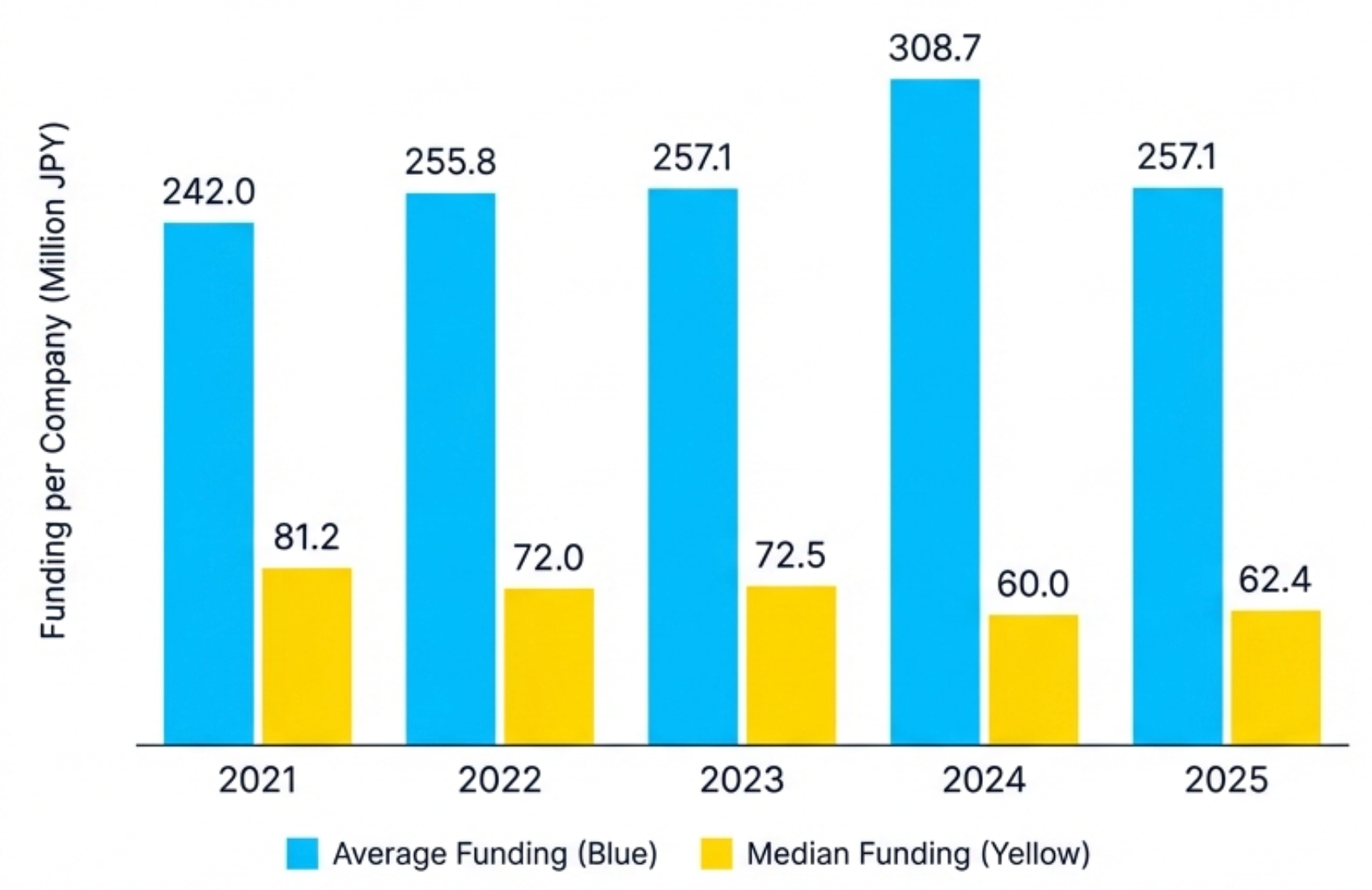

Compared to previous years, the total funding amount remained almost flat, indicating a stabilization of the market after the peaks of 2021-2022 and the subsequent correction. However, a deeper look at the per-company metrics reveals a significant divergence that speaks to a more selective investment environment.

The substantial gap between the average and median funding values is a critical insight. While large, high-conviction deals pull the average up, the median—representing the typical startup's experience—has stabilized at 62.4 million yen, a significant drop from the levels seen from 2021 to 2023, but slightly better than 2024. This divergence supports the conclusion that capital is increasingly flowing with more precision, shifting towards "selection and smaller bridge rounds" to support existing portfolio companies rather than broad-based, early-stage investment.

Looking at the historical trajectory, total funding in Japan saw a dramatic rise, peaking at over 990 billion yen in 2022 before settling into the current plateau around the 760-880 billion yen range. The number of companies funded has also decreased from its peak of over 4,400 in 2022, reinforcing the trend of a more concentrated and selective market. This high-level overview suggests a maturing ecosystem where investors are prioritizing proven traction and clear paths to scale.

From this macro perspective, we now turn to a more granular analysis of how this capital was distributed across startups of varying maturity levels and funding stages.

1. Capital Allocation by Startup Maturity and Funding Stage

Analyzing funding distribution by company age and investment series is essential for understanding investor risk appetite and the flow of capital through the startup lifecycle. This data reveals which stages—from nascent ideas to established growth companies—are attracting the most significant investment, providing a clear map of the current strategic priorities within the venture capital community.

1.1 Analysis by Company Age (Years Since Establishment)

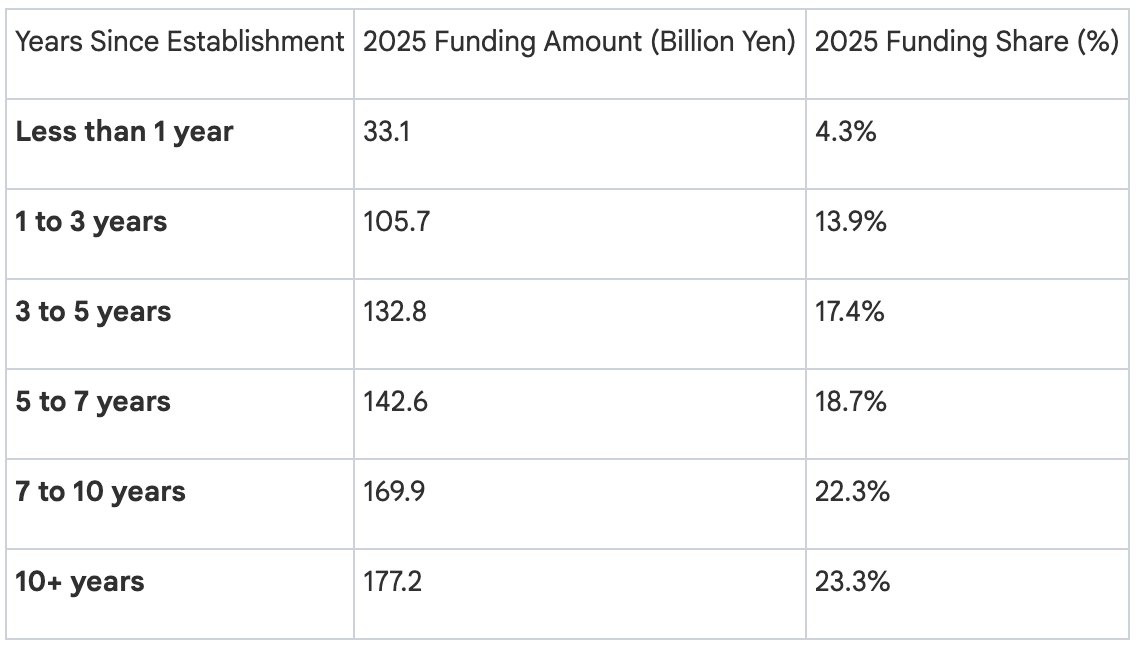

In 2025, investment was heavily concentrated in more mature startups, a clear indicator of a flight to quality and a preference for companies with established track records and de-risked business models.

The data clearly illustrates a pronounced trend: companies established for seven or more years attracted a combined 45.6% of all startup capital in 2025. In stark contrast, the earliest-stage companies (less than three years old) received just 18.2% of total funding. This allocation pattern underscores the market's current emphasis on later-stage growth equity over early-stage venture risk, suggesting investors are deploying "dry powder" into companies with proven product-market fit and clearer paths to exit.

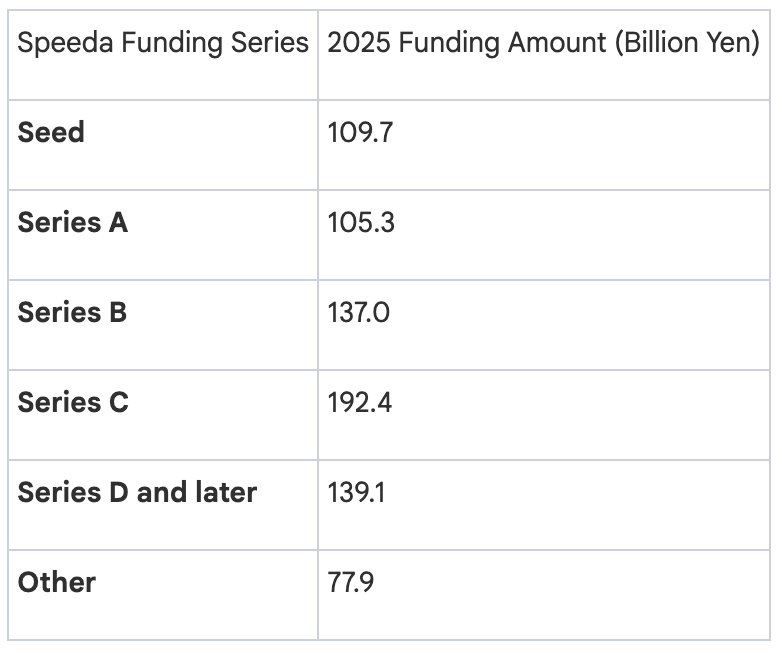

1.2 Analysis by Speeda Funding Series

The "Speeda Funding Series" is an objective classification system based on historical funding data, providing a standardized way to define a startup's growth phase regardless of how the company self-identifies its round. This data-driven approach offers a consistent lens through which to view capital allocation.

In 2025, Series C rounds attracted the most capital, totaling 192.4 billion yen. This reinforces the trend observed in the age-based analysis, where capital is flowing to companies in the crucial scale-up phase. While Seed and Series A funding remain active, the lower totals suggest that early-stage startups are facing a more challenging fundraising environment, while late-stage companies are successfully commanding larger rounds to fuel their expansion.

This examination of funding stages naturally leads to the question of which specific companies and deals defined the landscape in 2025.

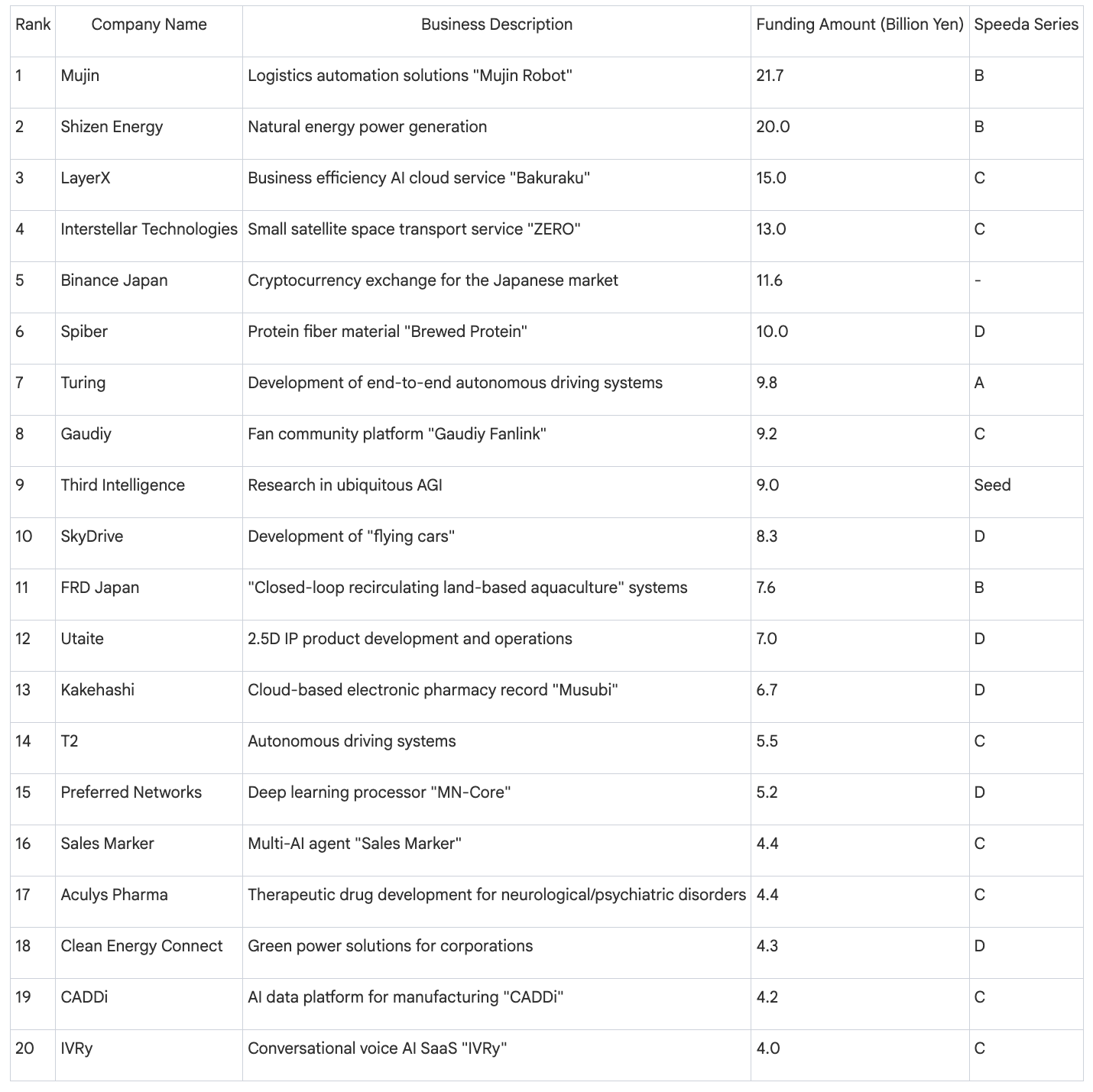

2. Leading Companies and High-Value Deals

While market-wide data provides a broad overview, an analysis of the top-performing companies and largest funding rounds offers concrete examples of the sectors and business models capturing the highest levels of investor interest. These landmark deals not only shape the funding statistics but also signal key areas of technological and commercial momentum. The prevalence of companies like Mujin (robotics), Turing (autonomous driving), and Third Intelligence (AGI) in the top 10 underscores the thematic shift toward Deep Tech and AI that is reshaping investor priorities, a trend further explored in Section 5.

2.1 Top 20 Funding Rounds of 2025

The largest deals of the year spanned a diverse range of sectors, from industrial automation and generative AI to deep tech and renewable energy, highlighting the breadth of innovation within Japan's ecosystem.

Top 20 Startup Funding Rounds in Japan, 2025

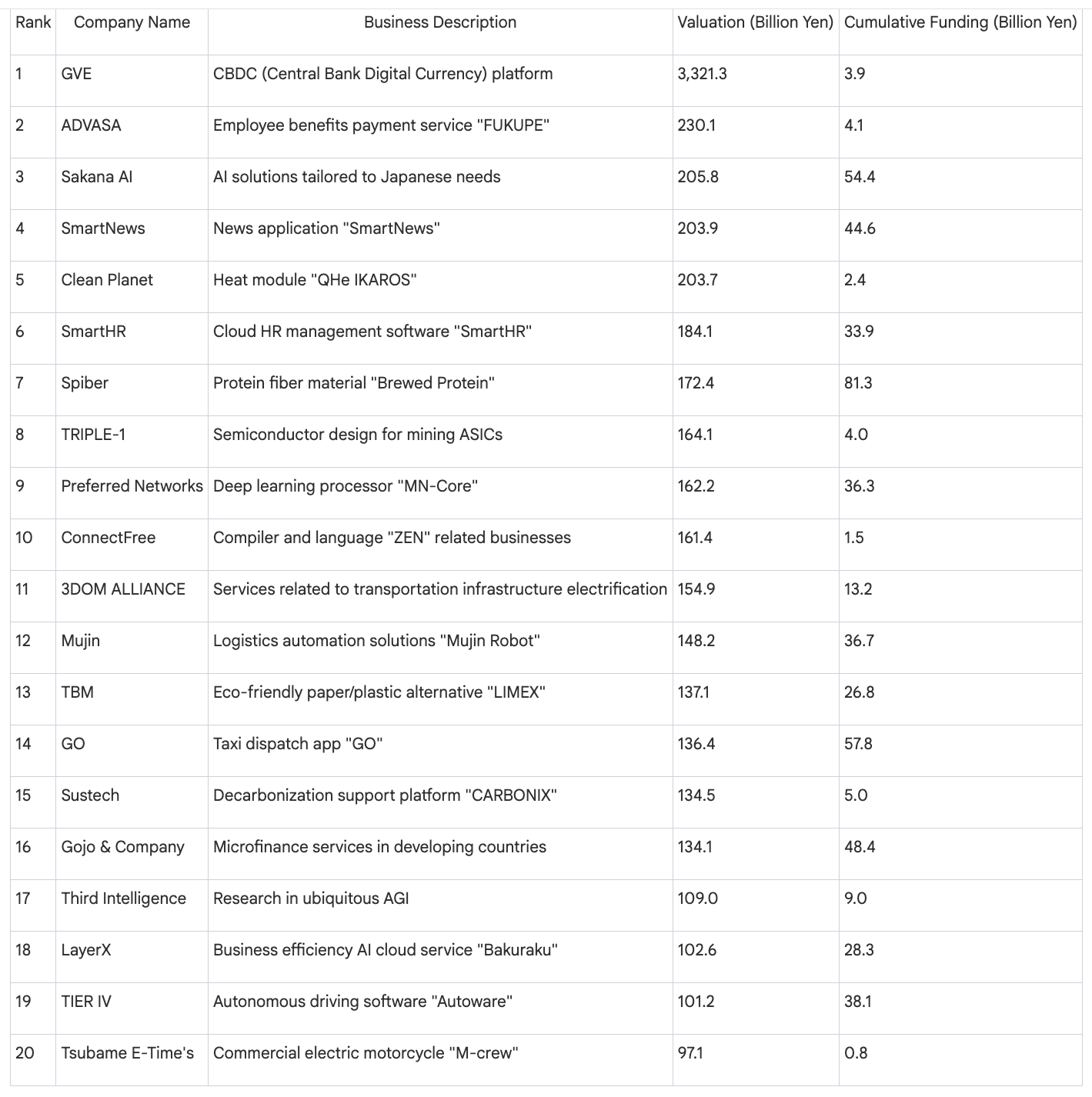

3.2 Top 20 Most Valuable Startups

The list of Japan's most valuable startups reflects the cumulative success of companies that have consistently attracted capital and demonstrated significant growth potential over time.

Top 20 Startups by Post-Money Valuation (as of Jan 18, 2026)

It is important to approach valuation data with a degree of caution. As noted by Speeda, a company's valuation can be updated based on even a very small capital increase. To highlight this, the report flags companies where the dilution from the most recent funding round was in the bottom 1% percentile. This "Dilution Rate Lower 1% Flag" serves as a reminder that the headline valuation may not always reflect a substantial new investment round.

Having examined the top performers, the analysis now shifts to the geographic and institutional foundations that underpin this activity.

3. Geographic and Academic Hubs of Innovation

A vibrant startup ecosystem is often sustained by concentrated hubs of talent, capital, and research. Analyzing the geographic distribution of funding and the role of academic institutions provides insight into the core engines of innovation in Japan. This section examines where startup activity is most concentrated and highlights the critical contribution of university-led ventures.

3.1 Regional Funding Distribution

While startup activity exists across Japan, funding remains overwhelmingly concentrated in its capital. The top five prefectures by funding amount in 2025 were:

- Tokyo: 559.0 billion yen

- Fukuoka: 30.1 billion yen

- Kanagawa: 22.1 billion yen

- Hokkaido: 17.8 billion yen

- Osaka: 17.4 billion yen

The dominance of Tokyo is stark, accounting for 73.4% of all startup funding in Japan in 2025. While other cities like Fukuoka and Osaka are emerging as important regional hubs, the vast majority of venture capital remains centered in the Tokyo metropolitan area, underscoring its role as the undisputed epicenter of the nation's startup ecosystem.

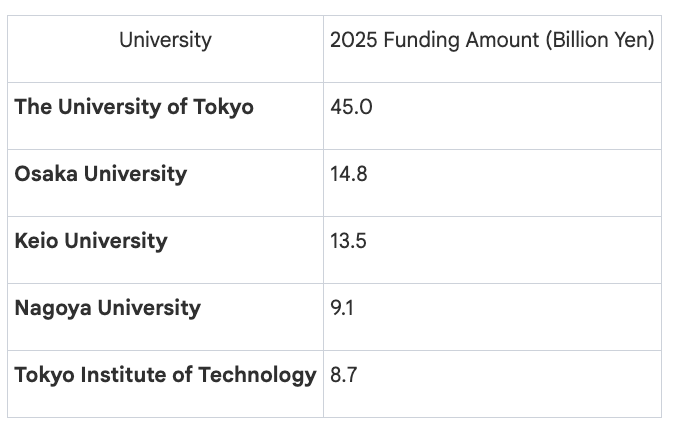

3.2 The Role of University-Affiliated Startups

University-affiliated startups have become a cornerstone of Japan's deep tech and R&D landscape. According to the Japan Venture Capital Association (JVCA), these ventures have consistently accounted for approximately 20% of total funding in recent years. In 2025, total funding for university startups reached 197.8 billion yen.

Funding is heavily concentrated around the nation's leading research institutions, with five universities leading the pack.

Despite this success, a significant challenge persists. The JVCA highlights that the difficulty in securing management talent is the biggest bottleneck to the growth of these technically-sophisticated ventures. Bridging the gap between world-class research and experienced executive leadership remains a key priority for unlocking the full potential of Japan's academic innovation pipeline.

Moving beyond quantitative data, the next section explores the qualitative insights and strategic shifts shaping investor sentiment and the future of the ecosystem.

4. Investor Sentiment and Ecosystem Evolution: Insights from the JVCA

To understand the "why" behind the 2025 funding data, this section distills key insights from an interview with Tomotaka Goji and Soichi Tajima, chairmen of the Japan Venture Capital Association (JVCA). Their perspectives provide a strategic analysis of the underlying forces reshaping investment theses, exit strategies, and the overall playbook for success in Japan's evolving startup landscape.

4.1 The Impact of Generative AI and Shifting Investment Theses

According to Soichi Tajima, Generative AI was a major disruptive force in 2025, effectively commoditizing traditional, metric-driven investment approaches. This technological paradigm shift has triggered two significant changes in investor focus:

- A Move to Earlier Stages: With later-stage valuations becoming harder to predict, investor interest has shifted toward earlier, seed-stage investments.

- Proactive Company Creation: VCs are increasingly adopting "company creation" models, taking a hands-on role in shaping business ideas from inception to build a competitive edge.

This has also altered the perception of established business models. SaaS companies, once a venture capital staple due to their predictable growth, are now viewed as having less potential for "non-linear upside" when compared to the transformative power of Generative AI and Deep Tech. This has led to more conservative market valuations for traditional software businesses.

4.2 The Blurring Lines Between Venture Capital and Private Equity

Tomotaka Goji observes that the strategic distance between Venture Capital (VC) and Private Equity (PE) is rapidly shrinking. This convergence is manifesting in several ways:

- PE firms are acquiring VC-backed startups to apply their operational expertise and drive the next phase of scaling.

- Large VC funds are extending their support through and after an IPO, behaving more like long-term growth equity partners than traditional early-stage investors.

This trend signifies a maturing market where financial tools and strategies from different asset classes are being blended to support companies across their entire lifecycle.

4.3 A New Era for Exits: The Rise of M&A

The JVCA leaders report that Japan's M&A market is "clearly activating," creating a more resilient ecosystem that is no longer solely dependent on IPOs for liquidity. This diversification of exit pathways is a healthy development. In the context of Japan's declining labor population, "acqui-hires" (acquisitions primarily for talent) are becoming an increasingly viable and strategic option for large corporations.

This does not diminish the importance of IPOs, but reframes their purpose. The emerging norm is to not see a public listing as the "goal" but rather as a milestone. The emphasis is now on building robust governance structures that can withstand the pressures of public markets and ensure sustained post-IPO growth.

4.4 Global Perception and VC Firm Dynamics

The "global view" of Japanese startups has changed dramatically, according to Tomotaka Goji. International stakeholders, including key industry players and government officials, are now showing a greater willingness to engage with Japanese companies, even at the seed stage. This reflects a growing recognition of Japan's technological prowess and commitment to fostering innovation.

Within the venture capital industry itself, a theme of "polarization" is emerging. Limited Partners (LPs), the investors in VC funds, are rigorously evaluating the discipline and reproducibility of a fund's performance. This heightened scrutiny is forcing VC firms to professionalize their operations, institutionalize their knowledge, and prove that their success is the result of a systematic process, not just individual intuition.

These evolving dynamics set the stage for the strategic challenges and opportunities that lie ahead in 2026.

5. Conclusion and Strategic Outlook for 2026

The analysis of the 2025 Japan startup ecosystem reveals a market in transition. While headline funding figures suggest stability, a closer look shows a more discerning and strategic allocation of capital. Synthesizing the key findings, we can identify the dominant trends that defined the year and will shape the landscape moving forward.

The three most critical trends from 2025 are:

- Market Stability with Capital Concentration: The overall funding level remained stable, but capital became highly selective. Investment flowed disproportionately to later-stage, proven companies, creating a significant gap between average and median deal sizes that signals a tougher environment for early-stage ventures.

- Thematic Shift Towards Deep Tech & AI: Investor enthusiasm pivoted from the predictable growth of SaaS models to the disruptive, non-linear potential of Generative AI and deep technology. This has begun to reshape valuation paradigms and favor companies with foundational technological advantages.

- Maturation of Exit Pathways: M&A has emerged as a powerful and increasingly common exit strategy alongside IPOs. This diversification is creating a more robust and resilient ecosystem, offering alternative liquidity routes for founders and investors alike.

Looking ahead, the strategic outlook for 2026 is defined by an intensification of these trends. Based on expert commentary, the key themes for the year will be "M&A and the diversification of financing methods," including greater use of venture debt and LBO-style transactions.

With the foundational elements of the ecosystem strengthening and government initiatives like the "Startup 5-Year Plan" in full effect, the primary focus must shift from potential to performance. The challenge for 2026 is clear: stakeholders must now concentrate on "executing growth strategies" to convert the market's potential into tangible, scaled results.

In 2026, the Japanese startup ecosystem will be defined not by its potential, but by its performance. The ability to adapt and execute in this rapidly changing technological and financial landscape will separate the enduring players from the rest of the field.