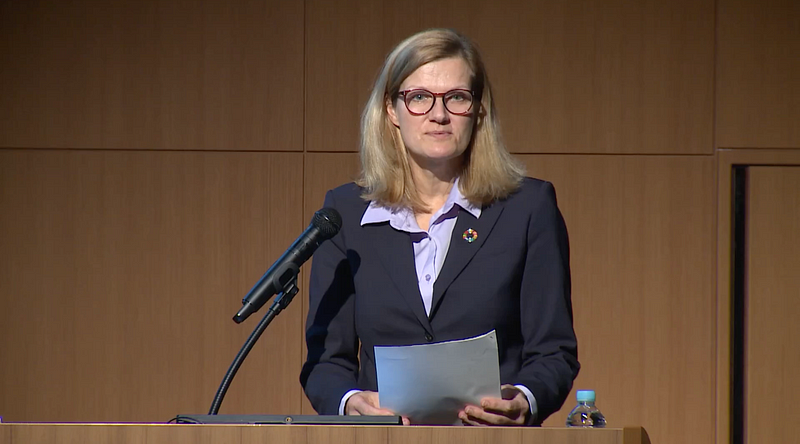

Stefanie Drews, Nikko AM: Harnessing the Power of International Partnerships

Stefanie Drews, President of Nikko Asset Management Group, gave a keynote address during the recent “Frontiers of International Finance”…

Stefanie Drews, President of Nikko Asset Management Group, gave a keynote address during the recent “Frontiers of International Finance” Forum, hosted by Nikkei, during which she covered — among other topics — the opportunity that presents itself to Japanese companies through international partnerships, providing ample examples from Nikko AM.

As Japan opens its doors to international firms, a unique opportunity arises for Japanese companies to leverage the expertise, resources, and global networks of these players. Strategic partnerships with international firms can serve as a powerful engine for growth, but successful collaboration hinges on achieving true business compatibility between the two parties. This synergistic relationship should strive to create a value greater than the sum of its parts, going beyond a simple 1+1=2 equation to achieve a multiplicative effect.

At Nikko Asset Management, we have a long and successful track record of collaborating with international players, gaining invaluable insights into the intricacies of forging fruitful partnerships. We believe that establishing a strong foundation is paramount for successful collaboration, and this requires a three-pronged approach:

1. Strong Foundation

- Independence from Parent Company: To ensure unbiased decision-making and avoid conflicts of interest, operational independence from the parent company is crucial. This allows for a more objective and globally oriented perspective.

- Highest Global Standards: Adhering to the highest global standards in corporate governance, investment practices, and ethical conduct builds trust and credibility among international partners.

- Scalability: Possessing the capacity to scale operations efficiently and effectively is vital for accommodating the growth and expansion potential that comes with international partnerships.

Illustrating Strong Foundation: Nikko AM’s Corporate Governance

Nikko Asset Management demonstrates its commitment to a strong foundation through its unique corporate governance structure:

- Independent Board of Directors: Comprising nine members, the Board consists of independent directors and an independent chair, ensuring objective decision-making and robust corporate governance.

- Diversity and Relevant Experience: Board members are chosen for their diverse backgrounds and expertise, providing valuable insights and ensuring comprehensive multi-stakeholder engagement.

- Global Perspective: A significant portion of the Board members are non-Japanese, bringing international perspectives and experience, further solidifying the firm’s global outlook.

2. Effective Bridging

- Flexible Operational Construct: A flexible operational framework that accommodates different working styles, cultural nuances, and business practices facilitates smoother collaboration and fosters a more inclusive environment.

- Language Solutions: Effective communication is fundamental for successful partnerships. Investing in language solutions such as translation tools and interpretation services ensures clear and efficient communication across language barriers.

Embracing a Global Matrix Construct: Breaking Down Silos

Nikko Asset Management adopts a Global Matrix System, a crucial element in its operational structure:

- Dual Reporting: Every employee reports to both a regional head and a functional head, fostering cross-functional and cross-regional collaboration.

- Equal Responsibility: Both regional and functional heads share equal responsibility for compensation and performance evaluation, ensuring a balanced approach and promoting shared accountability.

- Removal of Silos: The Global Matrix System effectively eliminates departmental silos, encouraging a more integrated and collaborative approach across the entire organization.

- Global Best Practices: The system encourages the adoption and implementation of best practices from different regions, enriching the firm’s overall operational efficiency.

Powering a Global Executive Team: Fostering Collaboration and Connectivity

In addition to the Global Matrix System, Nikko Asset Management has established a global executive committee, which plays a vital role in fostering effective bridging:

- Representation of Key Functions and Regions: The committee comprises individuals representing all key functional areas and geographical regions, ensuring comprehensive perspectives and insights.

- Diverse Professional Backgrounds: Members bring a wealth of diverse professional experience, enabling informed decision-making and a more holistic understanding of the business.

- Efficient Decision-Making: The committee conducts formal weekly and informal daily meetings, facilitating efficient and targeted decision-making.

- Cross-Functional and Cross-Regional Collaboration: The committee encourages collaboration across different functional areas and geographical locations, strengthening connectivity within the firm and facilitating a cohesive global approach.

This structure ensures strong connectivity between the executive team and the business, making the implementation of new initiatives, such as the integration of a new joint venture partner from abroad, a seamless process. The diverse and globally representative nature of the committee fosters greater understanding and acceptance, paving the way for smoother collaborations.

3. Partnership Model

- Clearly Defined Objectives: Clearly defining the objectives of the partnership from a business perspective is critical. Understanding the goals, targets, and desired outcomes ensures alignment between the two parties.

- Appropriate Capital Stake: The type of capital stake, whether minority or majority, should be determined based on the partnership’s objectives and the level of influence desired by both parties.

- Flexibility in Execution: Flexibility in executing the partnership agreement is crucial to accommodate evolving market conditions and ensure a dynamic and responsive collaboration.

Understanding Nikko AM’s Approach to Partnerships

To illustrate our approach to the partnership model, let’s explore two successful examples:

a) Osmosis Investment Management: A Strategic Minority Investment

Nikko Asset Management made a strategic minority investment in Osmosis, a UK-based sustainable investment manager. This partnership was driven by a clear business objective: to leverage Osmosis’s expertise in sustainable investing and introduce their innovative products to the Japanese market.

This collaboration demonstrates several key points:

- Strong Foundation: Prior to the investment, a comprehensive assessment was conducted to ensure business compatibility and establish a solid foundation for collaboration.

- Effective Bridging: The partnership leveraged Nikko AM’s existing infrastructure and expertise in the Japanese market to seamlessly integrate Osmosis’s products and services.

- Partnership Model: A minority investment, coupled with a seat on the Board, provided the necessary level of influence and commitment for both parties.

This partnership has proven successful, enabling Nikko AM to gain a foothold in the rapidly growing sustainable investment market and expand its product offerings to Japanese investors.

b) ARK Investment Management: A Long-Standing Partnership

In 2017, Nikko Asset Management entered a strategic partnership with ARK Invest, a US-based investment manager specializing in disruptive innovation. This collaboration was motivated by a shared vision of introducing ARK Invest’s expertise in disruptive technologies to the Japanese market.

Key takeaways from this partnership include:

- Effective Bridging: The partnership leveraged Nikko AM’s established distribution network and understanding of the Japanese market to introduce ARK Invest’s investment strategies.

- Partnership Model: A minority investment with an observer seat on the Board facilitated the necessary level of engagement and influence.

- Long-Term Vision: The partnership has endured for several years, demonstrating a long-term commitment and shared vision for growth.

This collaboration has been highly successful, enabling Nikko AM to introduce over 10 innovative investment strategies to the Japanese market and expand its product offerings in a high-growth segment.

The full recording of the keynote is currently available here:

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on Medium, on LinkedIn, or on Substack.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.