Stellar FinTech Performance Drives Mercari's Full-Year Results

Introduction

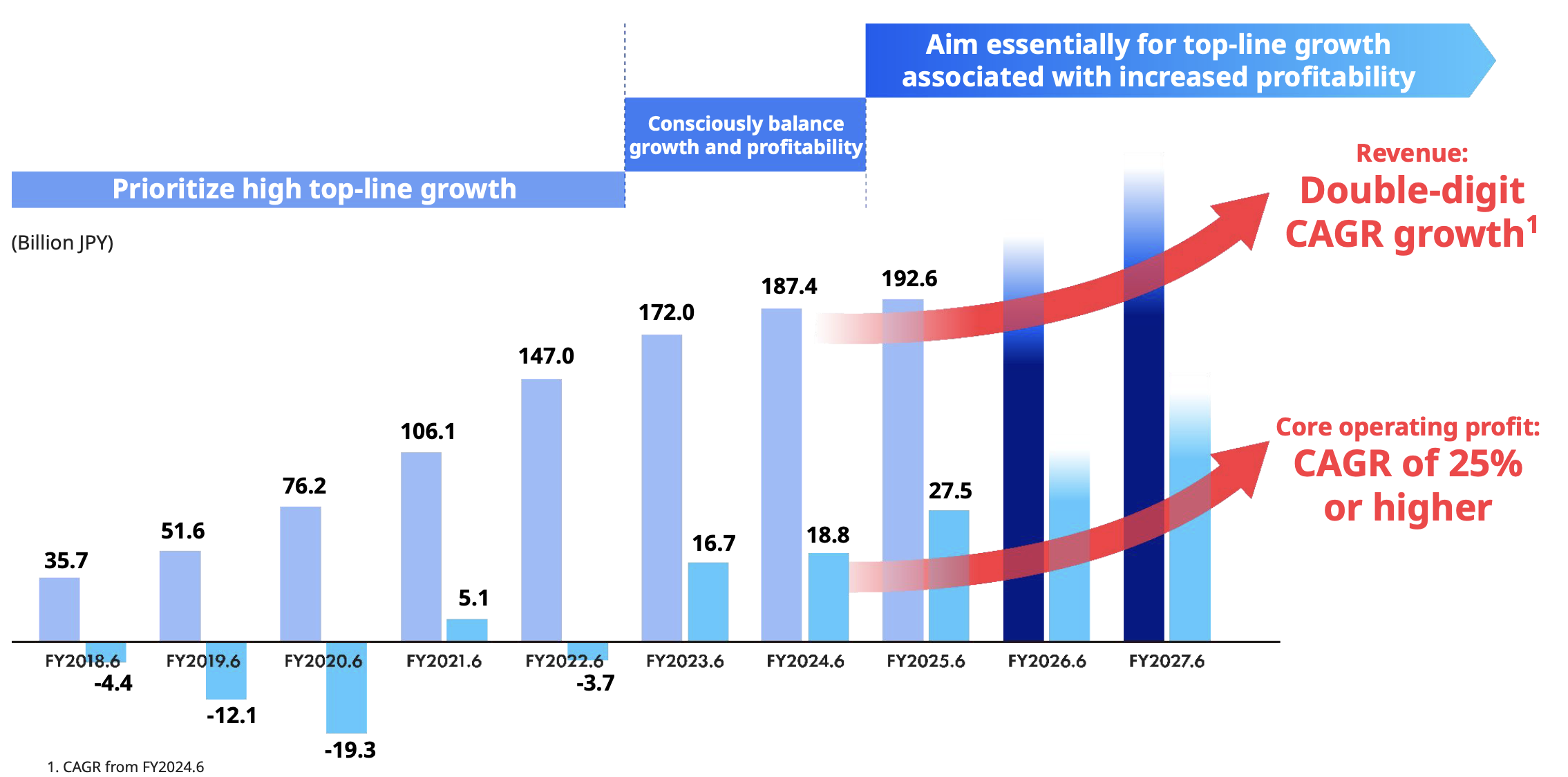

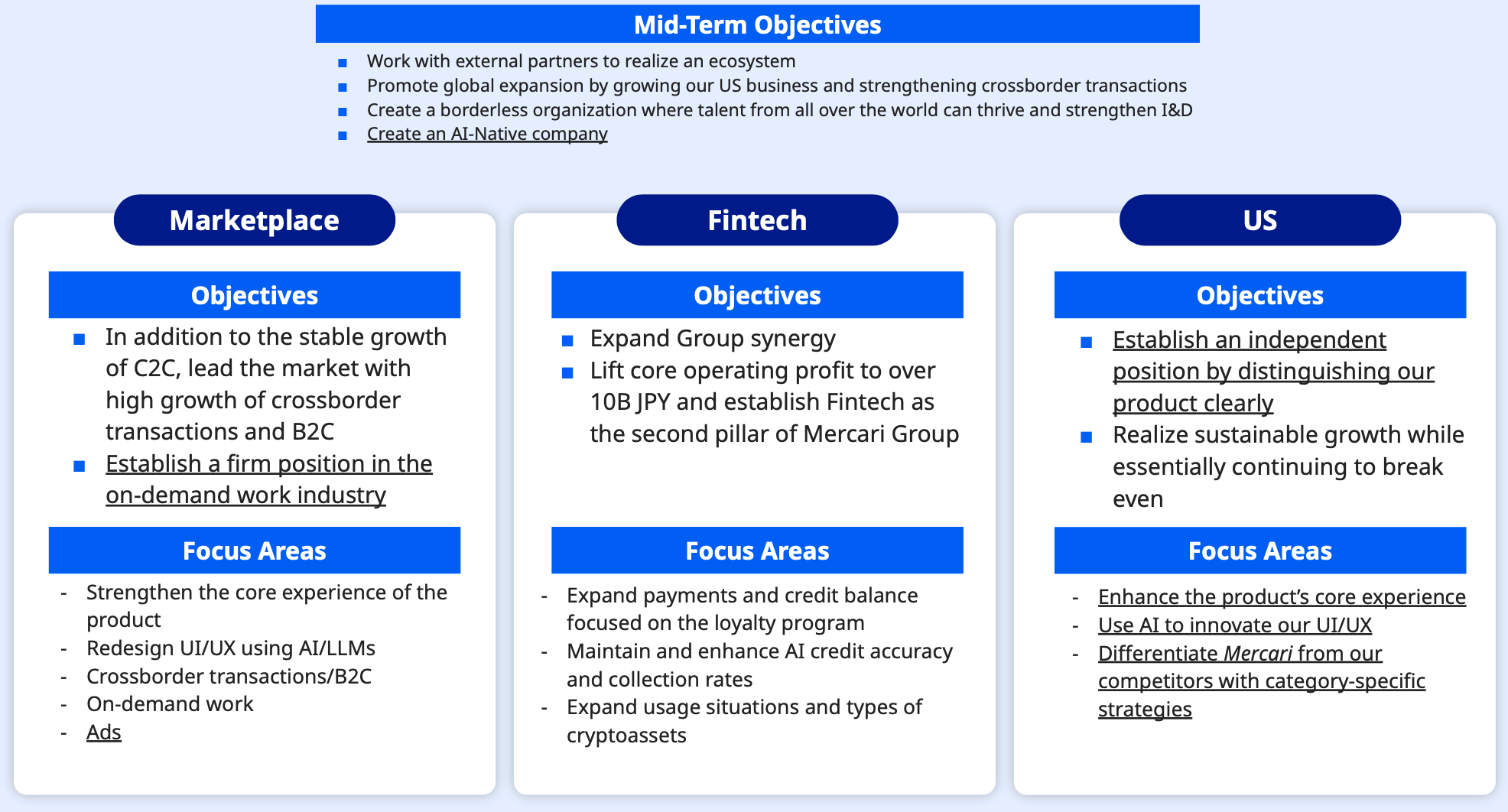

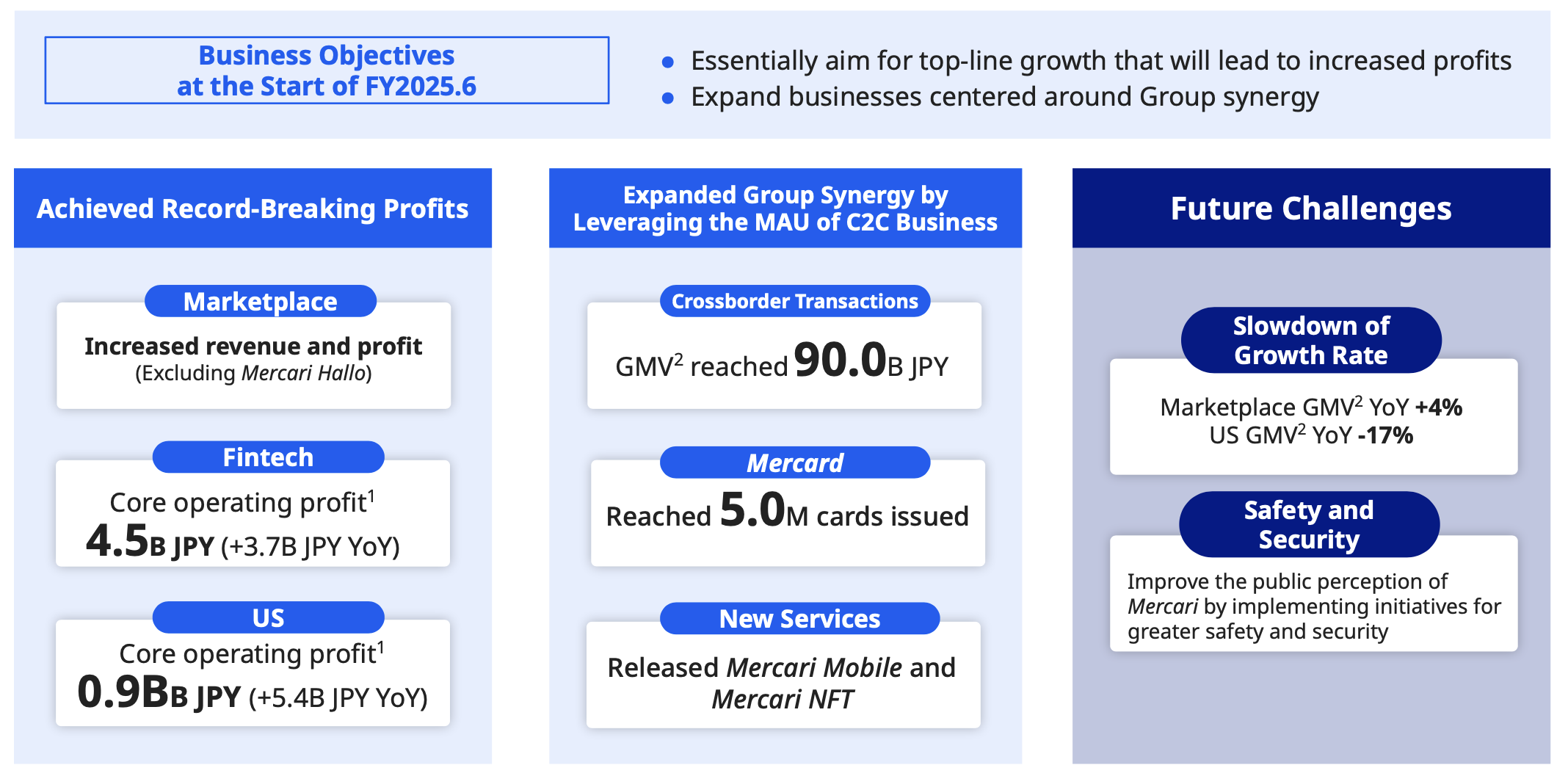

Mercari is committed to achieving the mid-term policy announced in FY2024.6, which aims for double-digit CAGR growth in revenue and a CAGR of at least 25% in core operating profit in FY2027.6. These targets remain unchanged. Following Mercari's basic policy to essentially aim for top-line growth that will lead to increased profits, they are driving growth in Marketplace, Fintech, and US to achieve these targets.

- For the Marketplace segment, Mercari's key initiatives include building an easy-to-use and safe and secure C2C platform that leverages AI, increasing the supply of listings with B2C, and expanding TAM globally through strengthening the Entertainment & Hobbies category in crossborder transactions.

- For the Fintech segment, with the credit business at the center, Mercari is focusing on strengthening its revenue base by increasing its user base and maximizing usage opportunities.

- For the US segment, Mercari aims to contribute to the top line by getting back on track for growth.

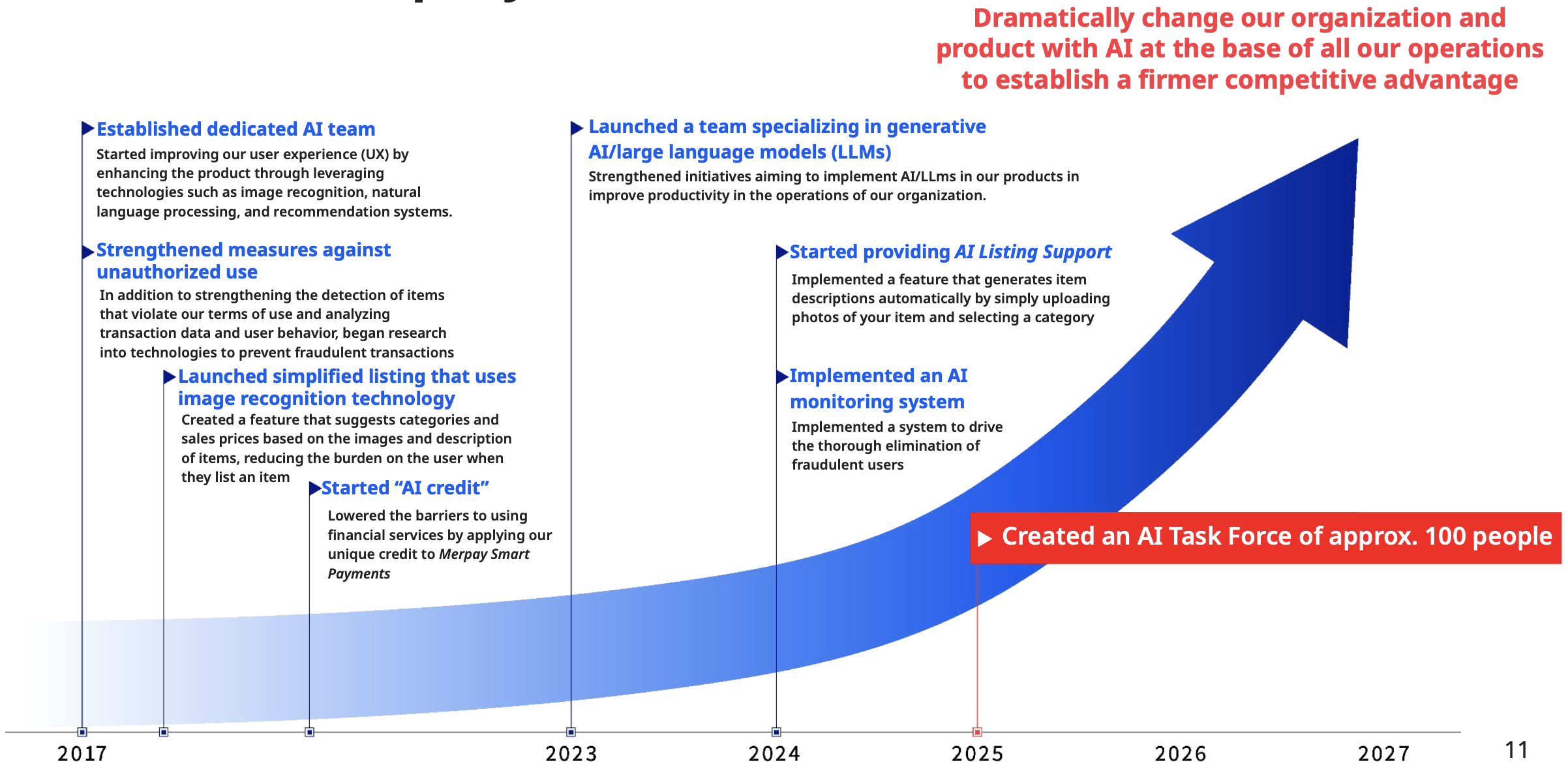

With AI at the base of all its operations, Mercari is evolving into an AI-Native company, and has established an AI Task Force of around 100 employees to redesign its product and workflows for dramatic reform. As many as 95% of all employees now utilize AI in their work, and 70% of the code for product development is generated using AI. This has dramatically improved productivity while also improving development speed, achieving a productivity increase per engineer involved in development of 64% YoY. Going forward, Mercari will continue to establish a firmer competitive advantage centered around AI to achieve sustainable growth.

FY2025.6 Summary

Consolidated

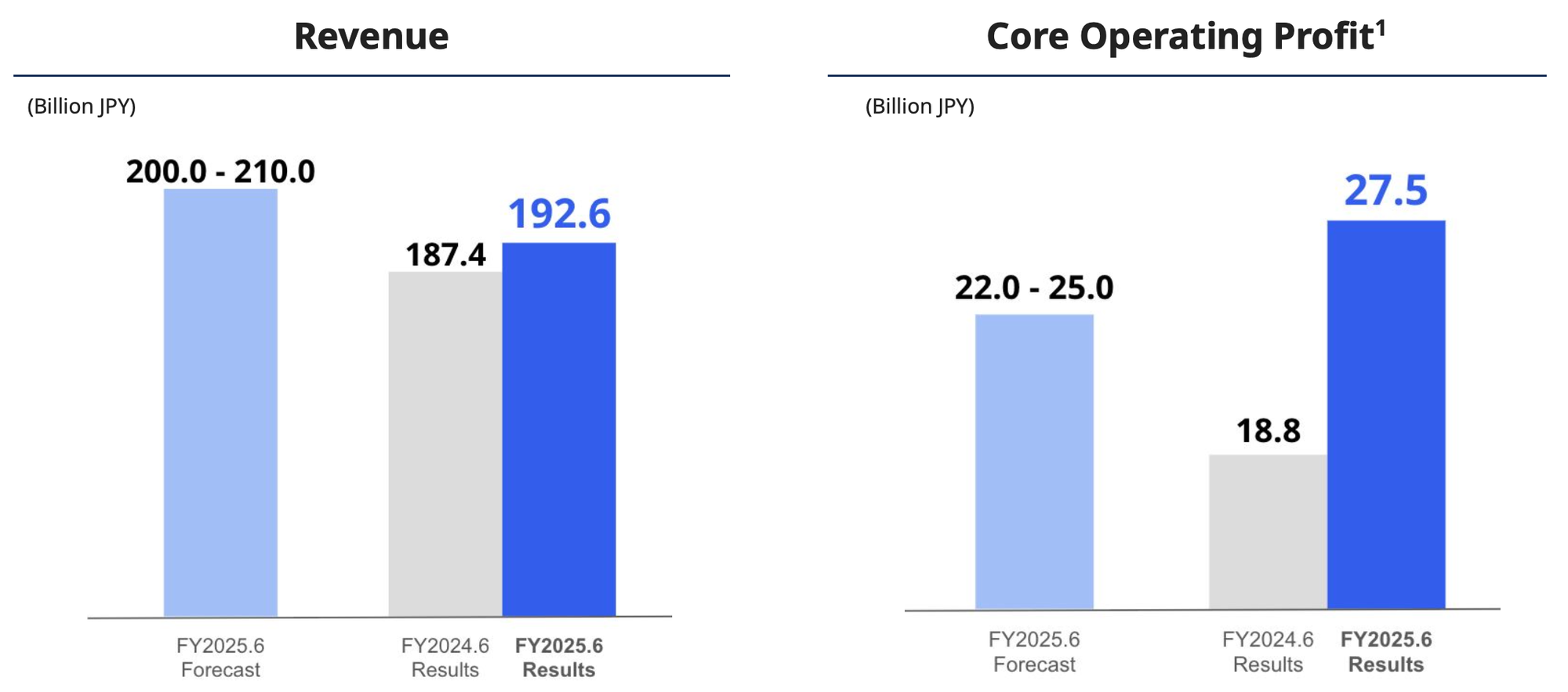

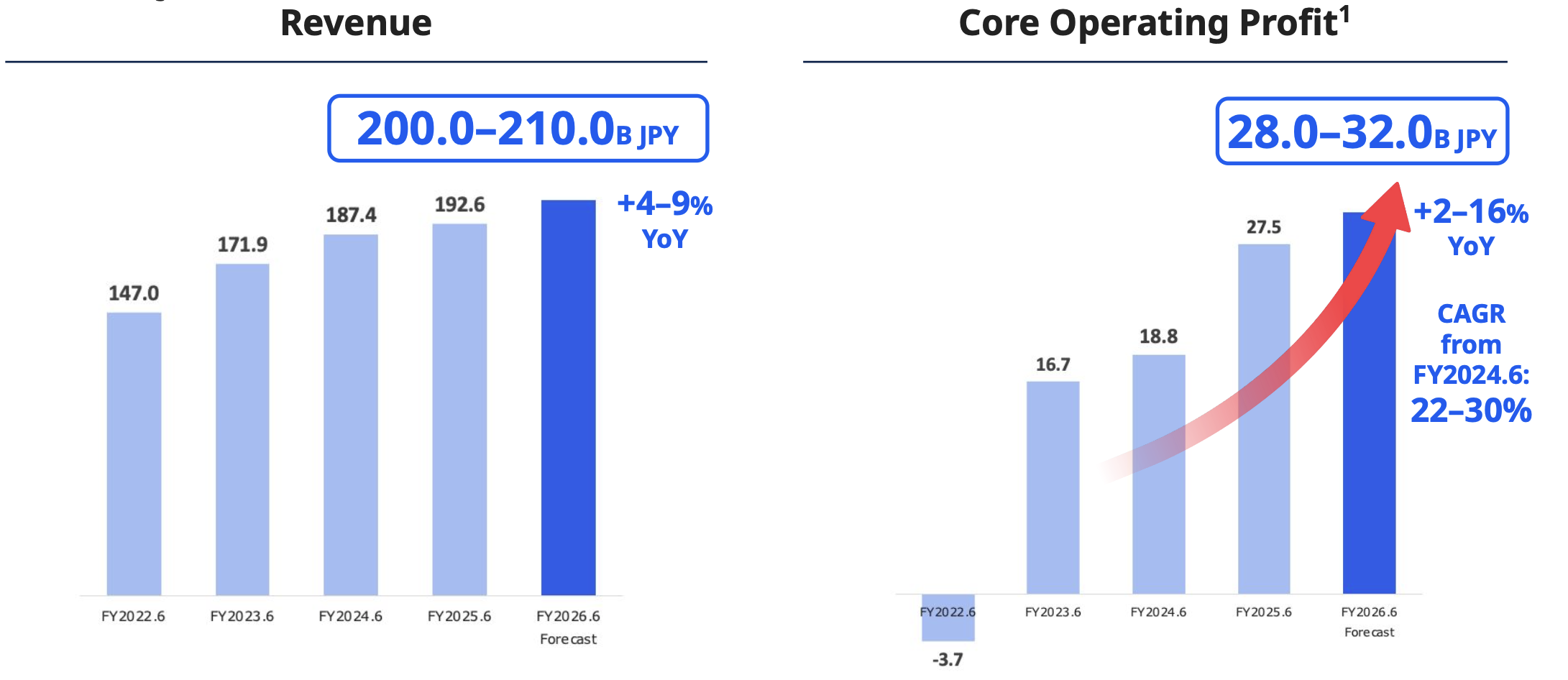

Despite not achieving its forecast results, Mercari achieved the highest figures to date, with consolidated revenue for FY2025.6 at 192.6B JPY (+3% YoY). Core operating profit was much greater than expected, landing at 27.5B JPY (+46% YoY), indicating a large increase in profitability. Marketplace, Fintech, and US all recorded a profit, driving consolidated revenue growth.

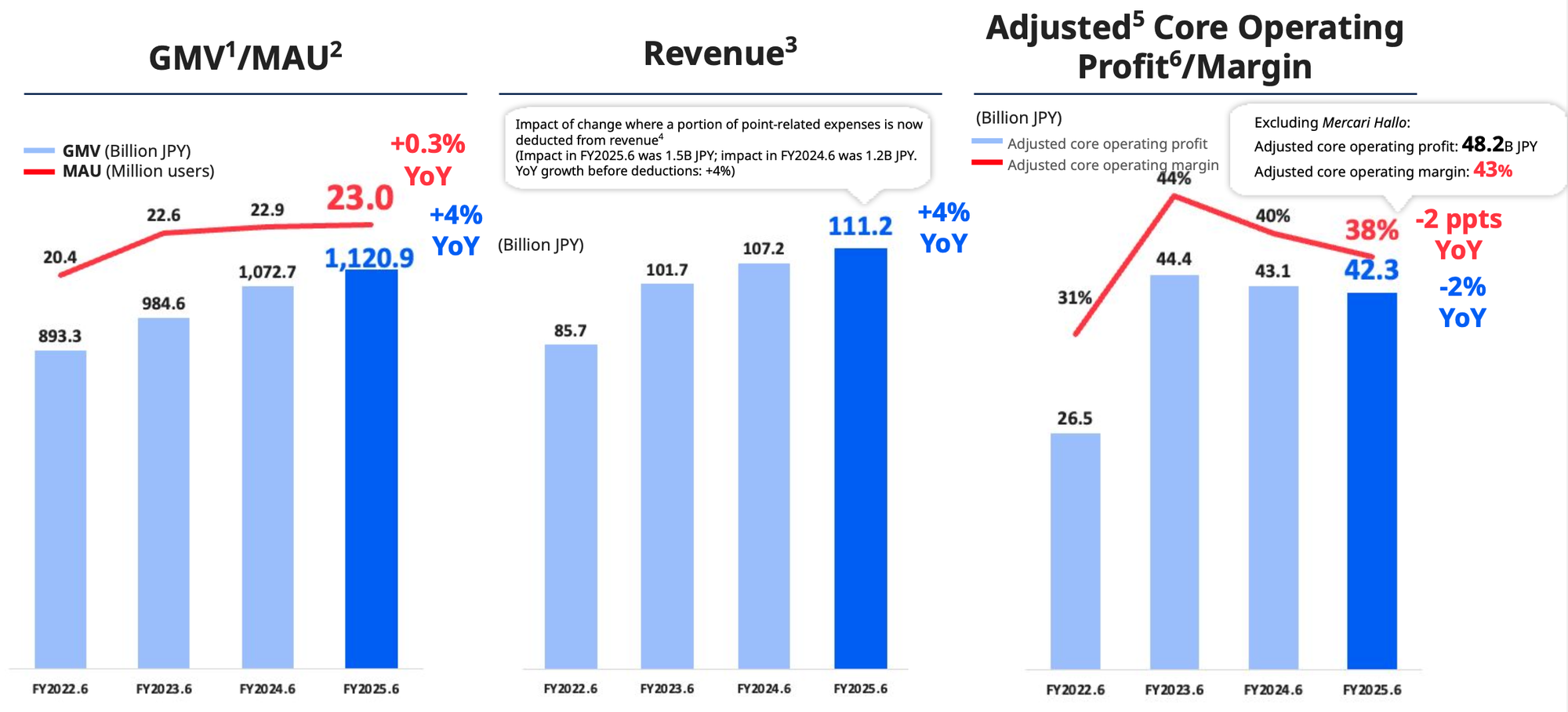

Marketplace

The stable growth of C2C, as well as high growth of areas such as crossborder transactions and B2C, continued to contribute to Marketplace numbers. While the impact of fraudulent use, which affected user trust during the period, on GMV was kept minimal due to Mercari's speedy response, the GMV growth rate for the full year remained at +4% YoY. On the other hand, adjusted core operating margin maintained a high level at 38% including Mercari Hallo and 43% excluding Mercari Hallo. Mercari Hallo showed steady progress, growing the number of registered crew and partner locations and starting to collect service fees in April.

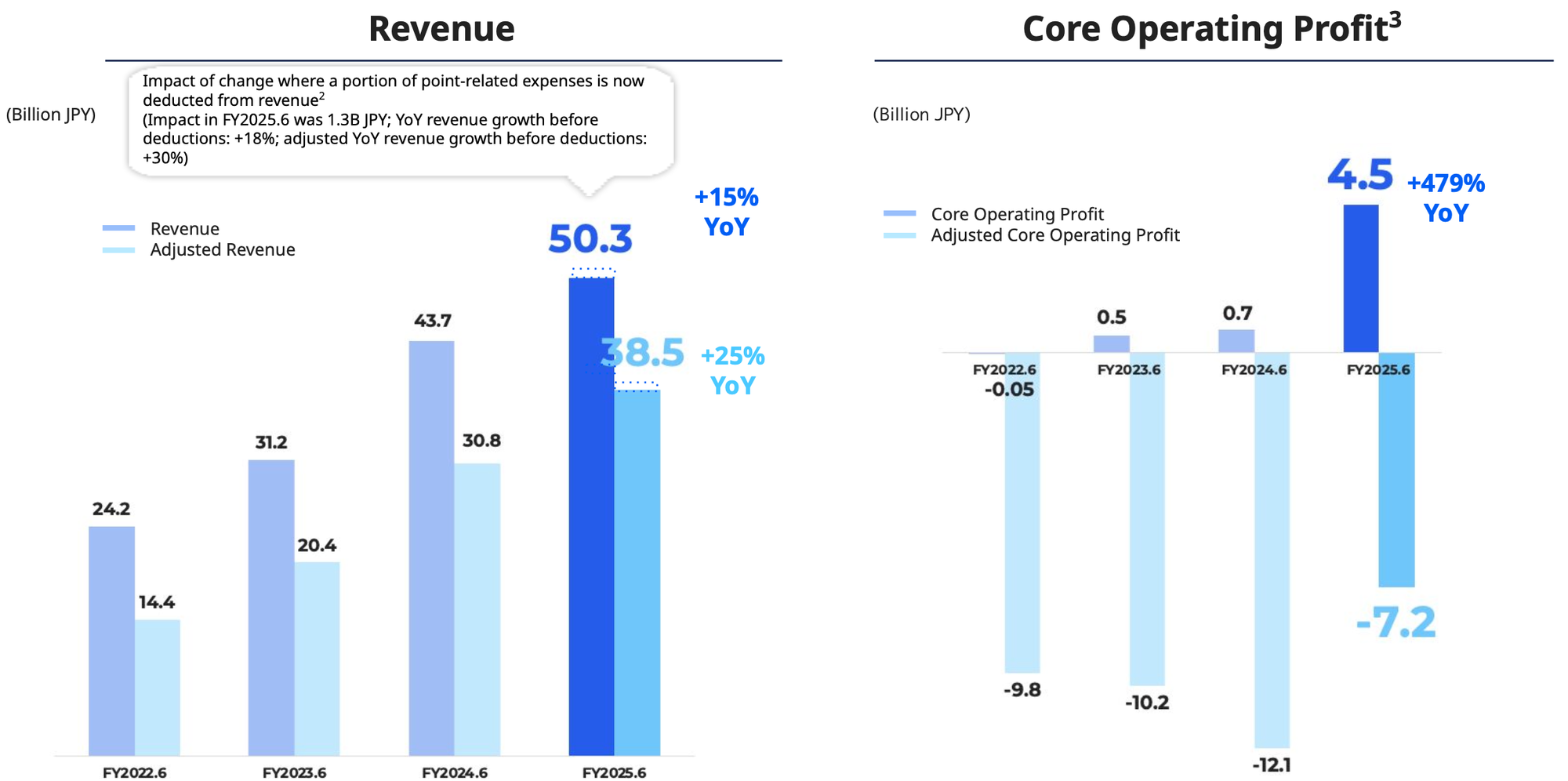

FinTech

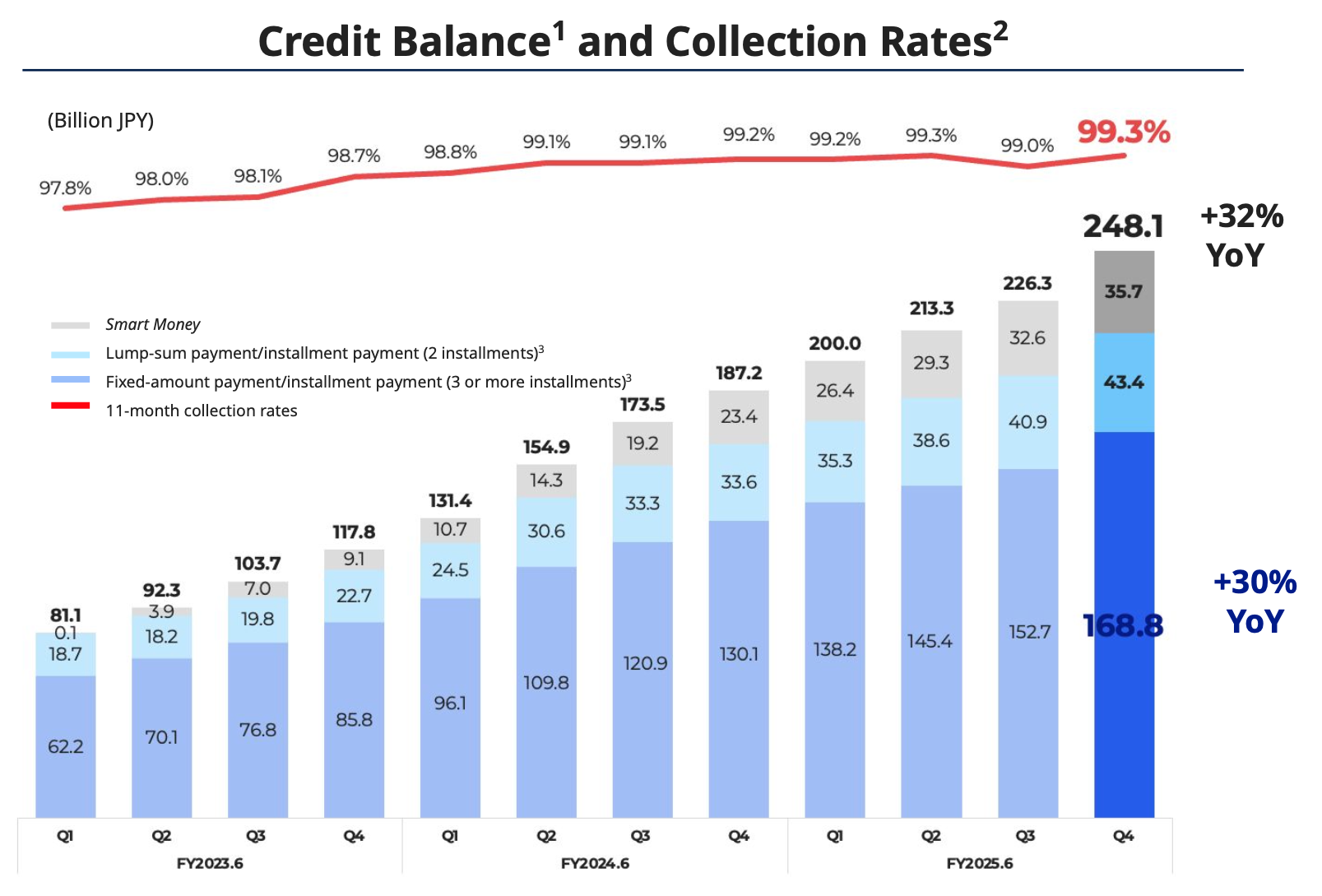

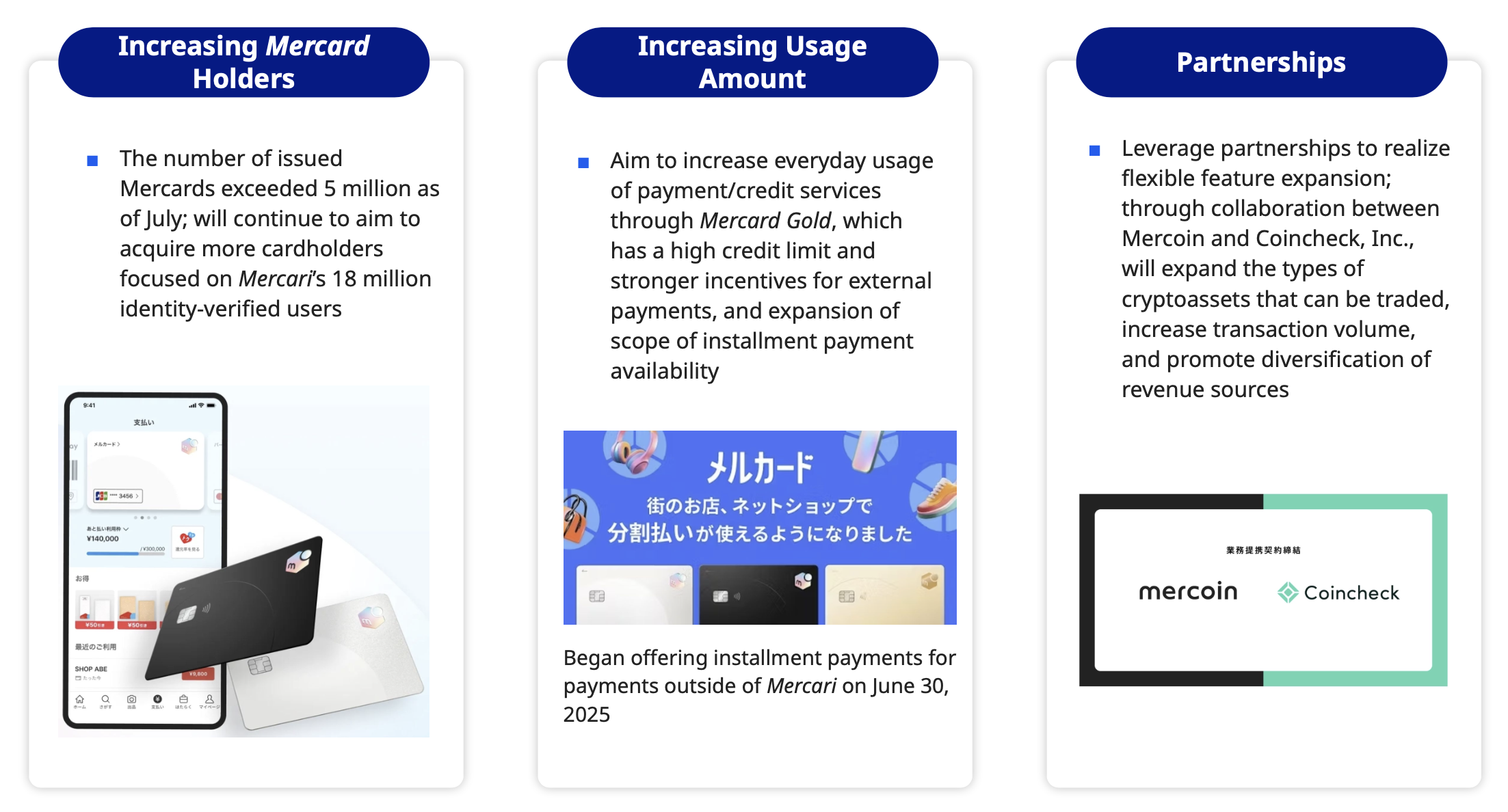

The Fintech segment achieved high growth of both sales and profits, with core operating profit reaching 4.5B JPY to significantly exceed the full-year target of 3.0B JPY. Mercari reached a cumulative total of more than 5 million Mercards issued, and the user base in the credit area is growing steadily.

Credit balance grew 32% YoY to land at 248.1B JPY, and management efficiency improved alongside the growth of the business. In March, Mercari released Mercard Gold , which has stronger incentives for external payments, as a means of increasing payment income and expanding the credit business.

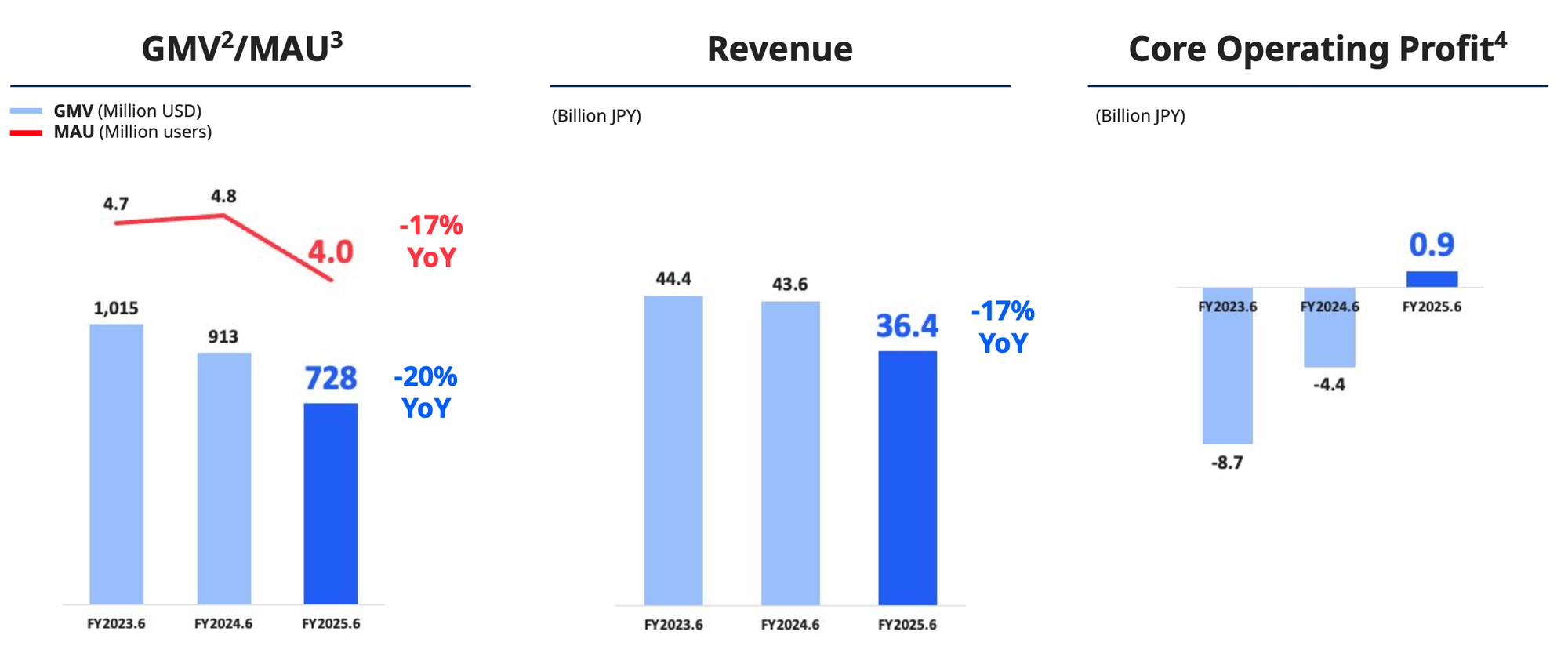

US

During the second half of the fiscal year, the US segment transitioned to a management structure with Group CEO Shintaro Yamada assuming the additional role of US CEO. As a result of placing focus once again on strengthening the product’s core experience and carrying out updates to the fee model, Mercari is seeing signs of improvement in GMV growth rate. Enhancing unit economics through product improvements, optimizing marketing costs, and further reviewing fixed costs enabled Mercari to achieve the US segment’s first positive full-year profit with a core operating profit of 900 million JPY.

FY2026.6 Financial Forecast & Business Objectives

Consolidated

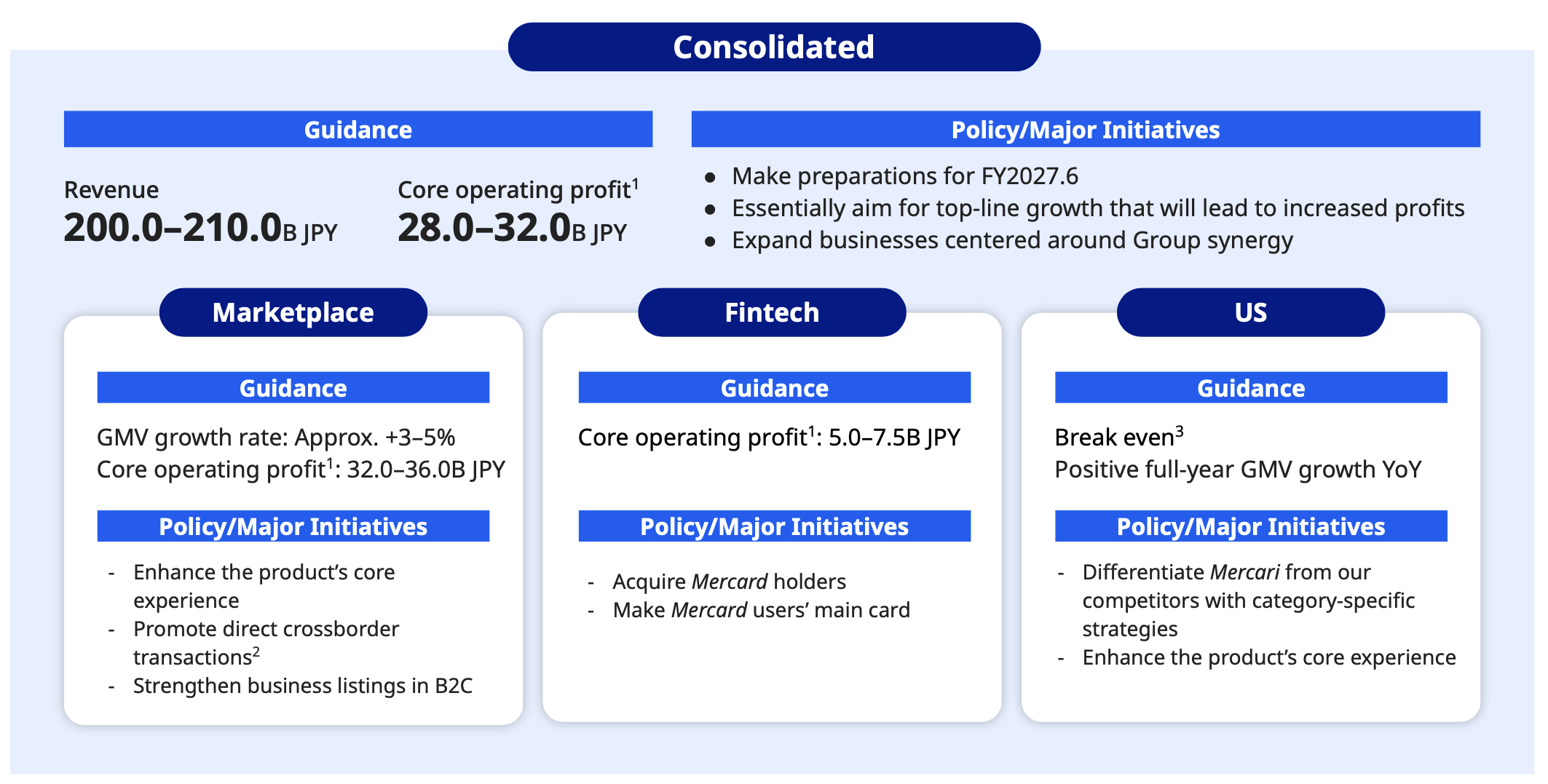

Mercari announced two changes to its disclosure policy. Going forward, Mercari will disclose core operating profit without adjustments based on internal transactions between the Marketplace and FinTech segments. Mercari will also capitalize development labor costs to enable mid- to long-term growth investments. Mercari has positioned FY2026.6 as a year to make preparations for growth in FY2027.6 and beyond, and will aim to balance investments and growth. Mercari announced a financial forecast of 200.0–210.0B JPY in consolidated revenue (+4–9% YoY) and 28.0–32.0B JPY in core operating profit; for core operating profit, the guidance is on track to achieve Mercari's mid-term objective of a CAGR of at least +25% for the three years from FY2024.6.

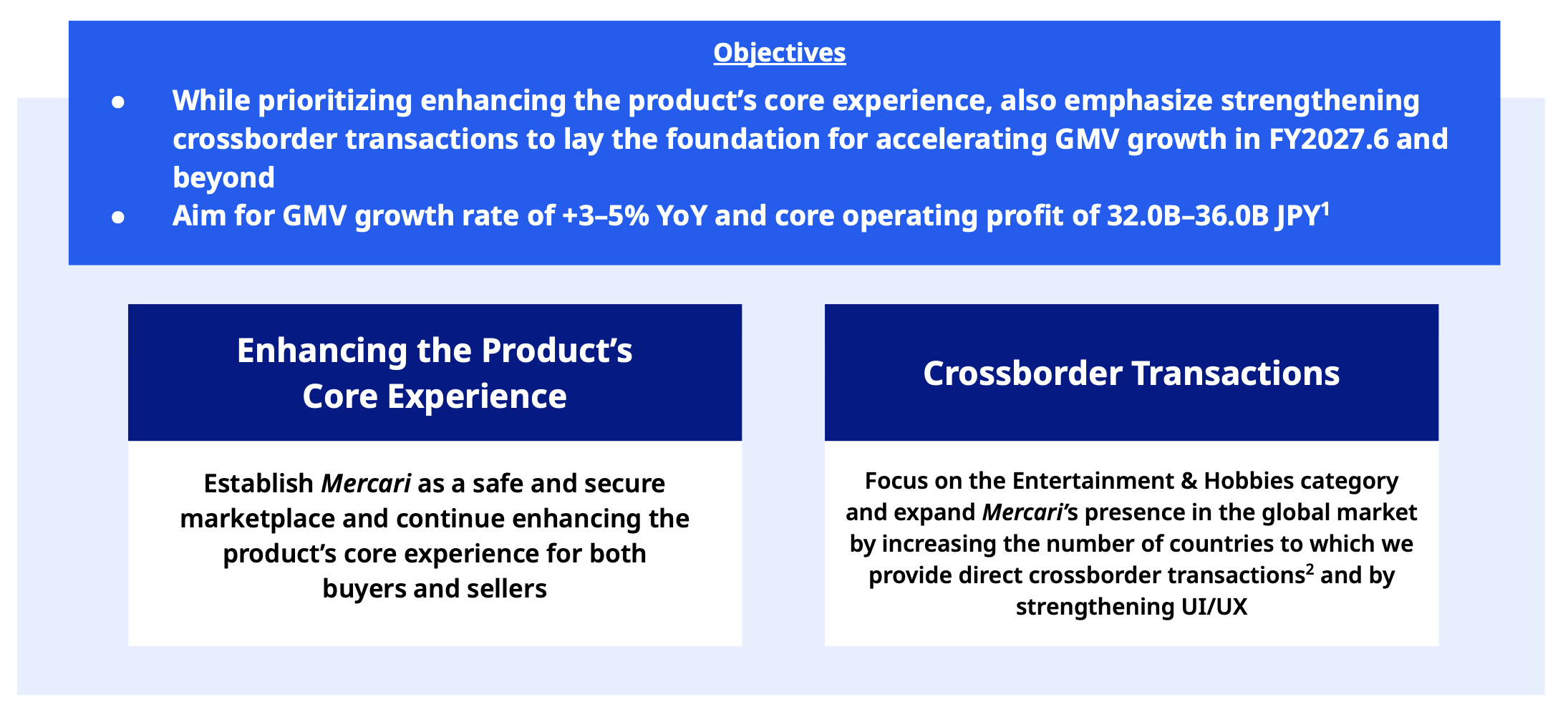

Marketplace

Mercari aims for a GMV growth rate of +3–5% YoY and a core operating profit of 32.0–36.0B JPY for the Marketplace segment, and lay the foundation for accelerating GMV growth in the future through leveraging AI to build a safe and secure transaction environment, improving the UI/UX, and expanding crossborder transactions. Especially for the latter, Mercari will strengthen direct crossborder transactions focused on the Entertainment & Hobbies category, utilizing the popularity of Japanese IPs. For Mercari Hallo, Mercari will improve profitability with the introduction of fees collected from partners.

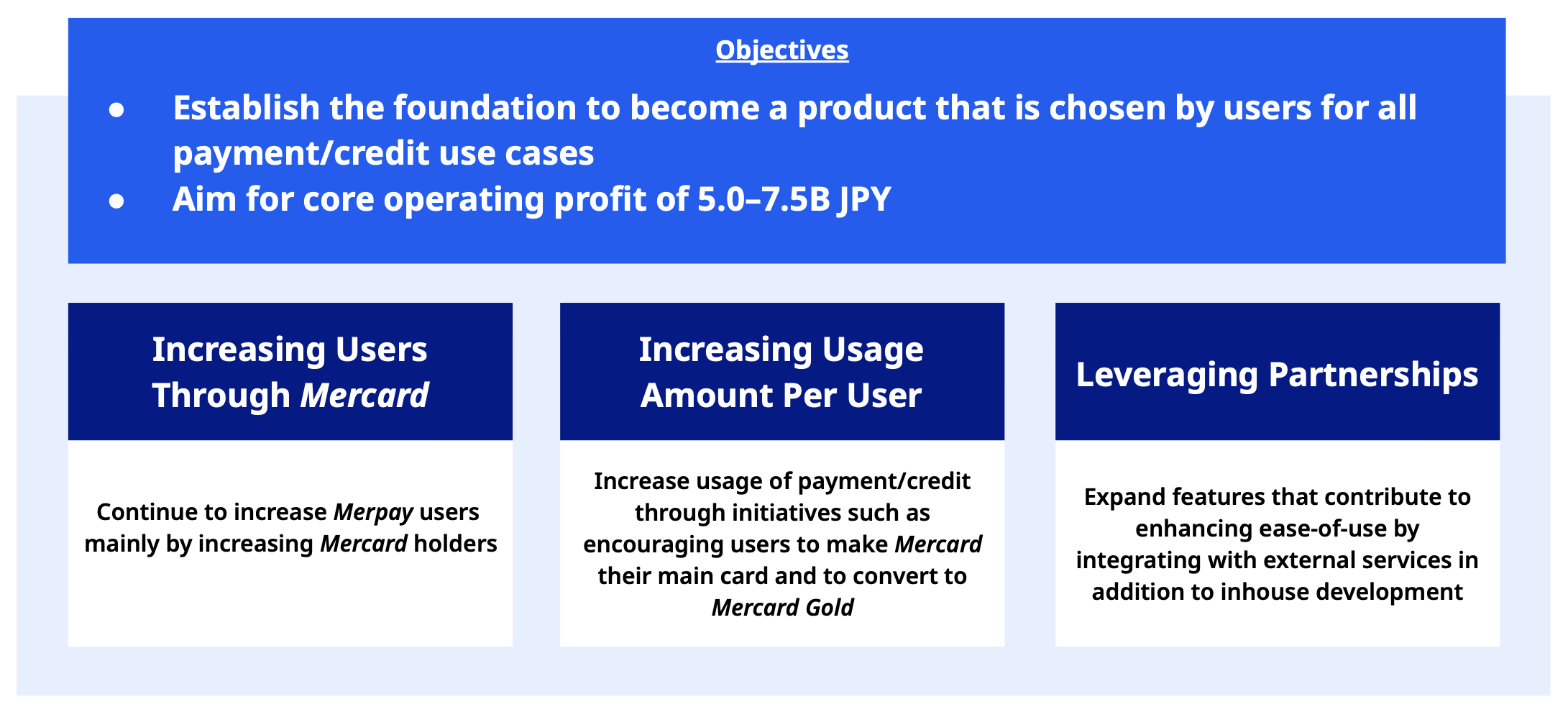

FinTech

Mercari's core operating profit in the FinTech segment is estimated to be in the range of 5.0–7.5B JPY as it aims for its payment and credit area products, such as Mercard, Mercard Gold, and installment payments, to become everyday payment methods. By increasing usage amounts by measures such as further increasing the number of cardholders and expanding usage situations, Mercari is striving for the continuous expansion of the payment and credit businesses. In doing so, Mercari will expand features that increase the convenience for users.

One such action was just announced with the partnership with Coincheck through which Mercari will strive for the expansion of cryptoasset transactions and the diversification of revenue sources.

US

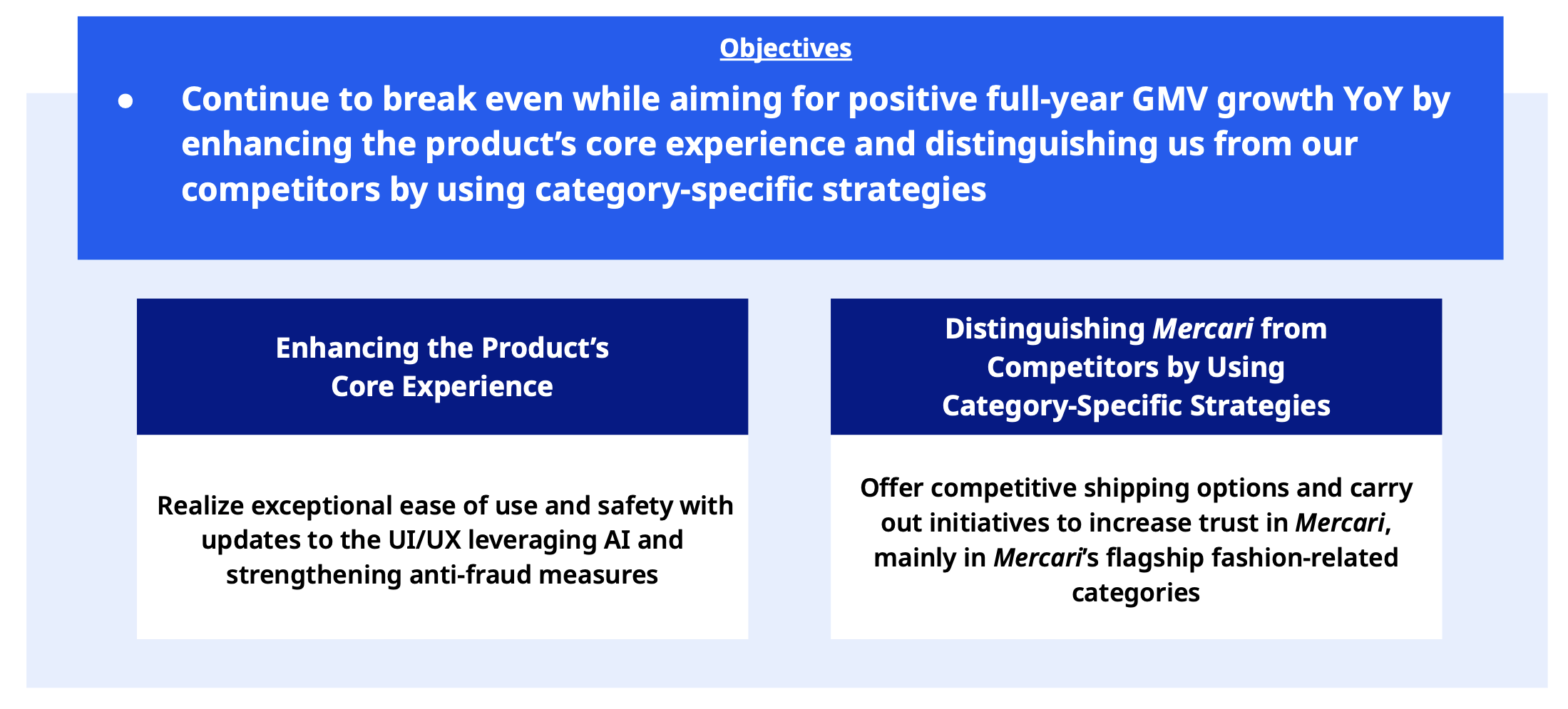

In the US business, Mercari will update its UI/UX to leverage AI and strengthen anti-fraud measures while continuing to break even. Additionally, Mercari will aim for the positive growth of GMV by differentiating Mercari from its competitors with category-specific strategies. For the fashion categories, which have the highest GMV rates, Mercari will provide new shipping options and launch a proof of concept for a clothing exchange program. Furthermore, Mercari will advance the horizontal expansion of other categories over the mid- to long-term period.

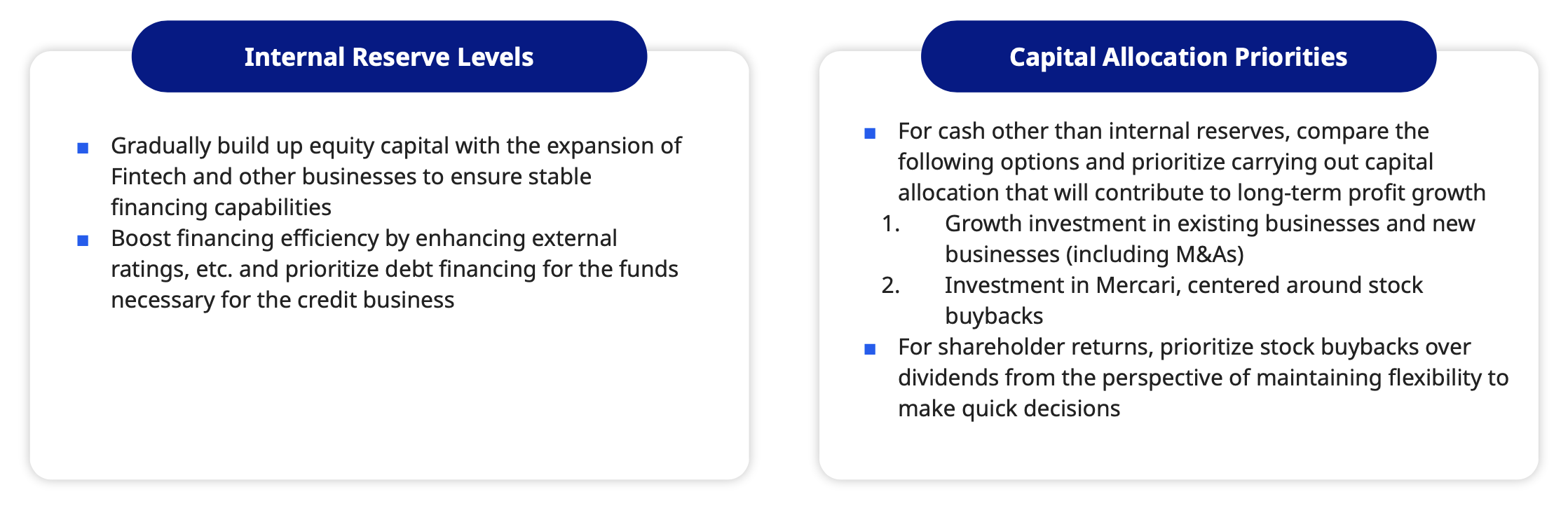

Financial Policy

Having shifted to a profit building and profit growth phase over the past three years, Mercari Group forecast it will see a evolve to positive retained earnings in FY2026.6. Especially in association with the expansion of FinTech’s credit field, Mercari will secure a structure for competitive financing in order to accumulate company capital in stages. In general, financing will prioritize loan procurement and increase capital efficiency. Additionally, for cash on hand other than internal reserves, Mercari will compare the options of growth investment in existing businesses and new businesses including M&A and investment in Mercari Group by acquiring company shares, and prioritize capital distribution in anticipation of long-term profit growth. In regard to shareholder returns, Mercari's policy is to focus on flexibility and prioritize stock buybacks over the payment of dividends.

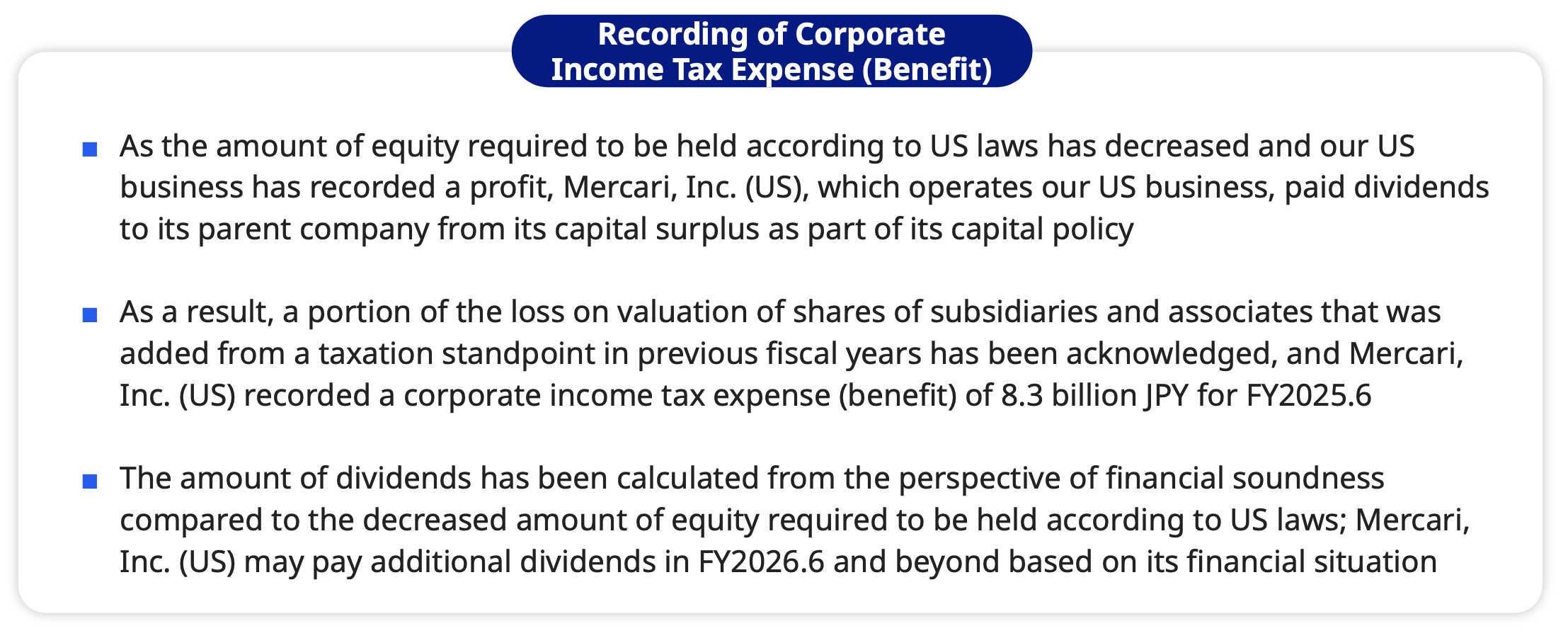

In addition, as the amount of equity required to be held according to US law has decreased and Mercari's US business has recorded a profit in FY2025.6, Mercari (US) paid dividends to the parent company as part of its capital policy. As a result, Mercari (US) recorded a corporate income tax expense (benefit) of 8.3B JPY for FY2025.6. Mercari (US) may pay additional dividends in FY2026.6 and beyond based on its overall financial situation.