Structural Implications of Interest Rate Normalization on Household Debt Archetypes

On February 6, 2026, the NLI Research Institute hosted a webinar focused on why home purchases continue to be made despite rising housing prices, interest rates, and inflation. They used various published data on the mortgage market to summarize and explain households' adaptive behavior, incorporating a financial theory perspective. Additionally, they considered the challenges inherent in such adaptive behavior and future issues that may arise in households and the housing market, providing a current outlook.

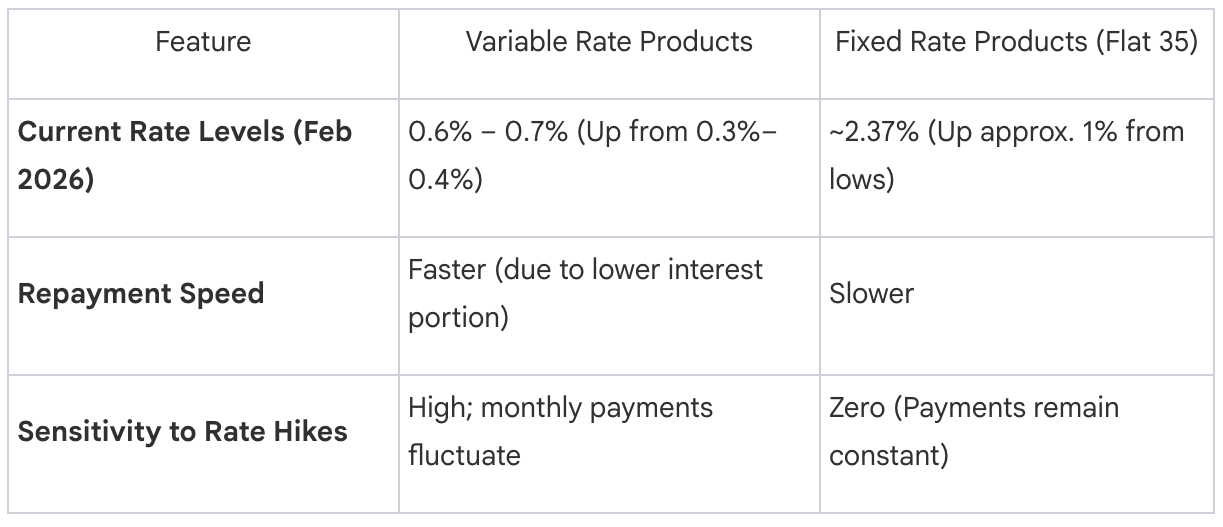

The Japanese mortgage market is undergoing a structural pivot as the era of ultra-low interest rates yields to normalization. Floating-rate (variable) products continue to dominate the landscape, capturing approximately 84% of new originations. However, the velocity of change is increasing; while variable rates previously sat at a floor of 0.3%–0.4% during the negative interest rate era, current minimums have migrated toward the 0.6%–0.7% range. This shift is accompanied by a significant institutional bifurcation: digital banks and regional banks (particularly those in Kyushu and southern Japan) have spearheaded the move toward 50-year loan terms to preserve affordability. In contrast, mega banks have remained the conservative holdouts, generally maintaining traditional 35-to-40-year ceilings. These innovations are survival mechanisms triggered by a widening chasm between property valuations and stagnant nominal wages.

1. The Catalyst: Divergence Between Property Valuation and Nominal Wages

The fundamental driver of current mortgage adaptation is the profound disconnect between real estate appreciation and household income. Since 2010, the gap between asset prices and earning power has fundamentally altered borrower psychology, forcing a shift in priority from "total interest cost" to "immediate monthly cash flow."

A comparative analysis of economic indices (Base Year 2010 = 100) through 2024 highlights the severity of this divergence:

- Mansion (Condominium) Price Index: 202 (Prices have effectively doubled).

- Detached Housing Price Index: 117.

- Nominal Wage Index: 112.

While detached housing prices have tracked relatively closely with wages, the affordability crisis in the urban condominium market is acute. With mansion prices rising nearly ten times faster than wages, the traditional 35-year mortgage has been marginalized as a viable entry point for middle-class urban buyers. Households are now forced to manage the "denominator" of their financial equation—extending loan durations to the absolute limit—to satisfy the rigid 30–35% repayment ratio thresholds maintained by lending institutions.

2. Maintaining the 30–35% Threshold: The Mechanics of Repayment Ratio Preservation

The "Repayment Ratio"—the percentage of annual gross income dedicated to debt service—remains the critical ceiling in bank credit screenings and a primary systemic stabilizer. Despite skyrocketing property values, lenders have not significantly relaxed this 30–35% threshold, requiring borrowers to utilize two primary levers to satisfy the constraint:

- Denominator Management (Payment Reduction): Artificially lowering monthly obligations by extending the amortization period (e.g., to 50 years).

- Numerator Management (Income Aggregation): Utilizing "Pair Loans" to combine dual incomes, thereby increasing the qualifying income base.

This behavior reflects a shift toward an "Objective-Based Loan" philosophy. Because a primary residence is a non-liquid asset—the owner must occupy it rather than sell it to service debt—Japanese banks increasingly underwrite based on "attributes" (future labor potential and 50 years of projected income) rather than the collateral’s resale value. Effectively, banks are now lending against half a century of human capital.

3. Structural Shifts: Ultra-Long-Term Loans and Income Aggregation

To bridge the affordability gap, 50-year durations and "Pair Loan" structures have moved from the periphery to the mainstream.

- The 50-Year Extension: The mathematical impact of term extension is profound. For a standard 50 million JPY loan, moving from a 35-year term (monthly payment: 136,530 JPY) to a 50-year term (monthly payment: 101,136 JPY) yields a monthly reduction of 35,394 JPY. This specific savings of over 35,000 JPY is often the margin that allows a household to clear the 30% repayment ratio hurdle.

- Income Aggregation Trends: Among the younger cohort (borrowers in their 20s), the utilization of Pair Loans has reached 70%. This trend signifies a "dual-income commitment," where the mortgage's viability is predicated on both partners maintaining high-tenure employment within a seniority-based wage system for the duration of the loan.

4. Systemic Risk Analysis: Rate Hikes and the "Duration Trap"

The transition to 50-year terms creates a mathematical "Duration Trap." Longer-dated debt with higher remaining principal balances is exponentially more sensitive to interest rate fluctuations. A simulation of a 1% policy rate hike reveals the following impact on new borrowers:

- Impact on 35-year variable loans: 16% increase in monthly payment.

- Impact on 50-year variable loans: 24% increase in monthly payment.

Duration Risk and the 125% Rule: For every 0.25% incremental hike, a 50-year loan experiences a significantly larger percentage jump in burden because the principal amortizes much slower. While many variable products include a "125% Rule" (capping payment increases) and a "5-Year Rule" (fixing payments for 5 years), these are not debt-relief measures. They trigger the accumulation of Unpaid Interest (mikisai risoku). In a rising rate environment, this can lead to negative amortization, where the monthly payment fails to cover even the interest, causing the principal balance to balloon and backloading massive financial risk to the end of the loan lifecycle.

5. Demographic Implications: Backloading Risk to Older Age Cohorts

The 50-year mortgage fundamentally conflicts with traditional Japanese retirement timelines.

- The Retirement Gap: Under a traditional 35-year structure, a 30-year-old borrower would achieve debt-free status by age 65. Under the new 50-year archetype, that same borrower remains obligated until age 80.

- Asset Formation Friction: High initial repayment ratios in a normalizing rate environment consume the discretionary income that would otherwise be used for liquid wealth formation (stocks/bonds). This delays the household’s ability to build a retirement buffer, making them entirely dependent on their home’s future equity.

Given that the borrower will likely enter retirement with a significant remaining balance, the home must be viewed as a liquid asset rather than a static inheritance. Late-stage mitigation strategies, such as Reverse Mortgages or Leasebacks, will become mandatory components of the household lifecycle to settle balances in the 7th and 8th decades of life.

6. Strategic Conclusions and Household Adaptations

In an era of interest rate normalization, passive debt repayment must be replaced by active "Household Management." Borrowers must distinguish between Liquidity Management (cash on hand) and Solvency Risk (the ability to pay off debt over 50 years).

Prioritized Adaptation Strategies:

- Payment-Reduction Prepayment: Unlike "Term-Reduction," which saves interest but maintains the monthly burden, "Payment-Reduction" prepayments lower the monthly repayment ratio. This is the superior risk-management tool for households with limited risk tolerance, as it creates an immediate cash-flow buffer against future rate hikes.

- Asset Diversification: Borrowers must hold inflation-hedged assets (stocks/bonds) alongside their debt. If investment returns outpace the mortgage rate, this capital provides a "solvency fund" to settle the principal if rates spike.

- Real Estate Value Maintenance: Homeowners must prioritize the property's marketability through consistent maintenance to ensure the asset remains eligible for reverse mortgages or high-value liquidation in the "Retirement Gap" years.

Final Expert Verdict: While ultra-long-term loans solve the immediate hurdle of the "Repayment Ratio" in a high-priced market, they transform mortgage debt from a mid-life milestone into a lifelong financial management task. The modern Japanese mortgage is no longer a path to ownership, but a complex, 50-year exercise in cash-flow engineering and long-dated risk management.