Suica & PASMO Evolve: Introducing teppay

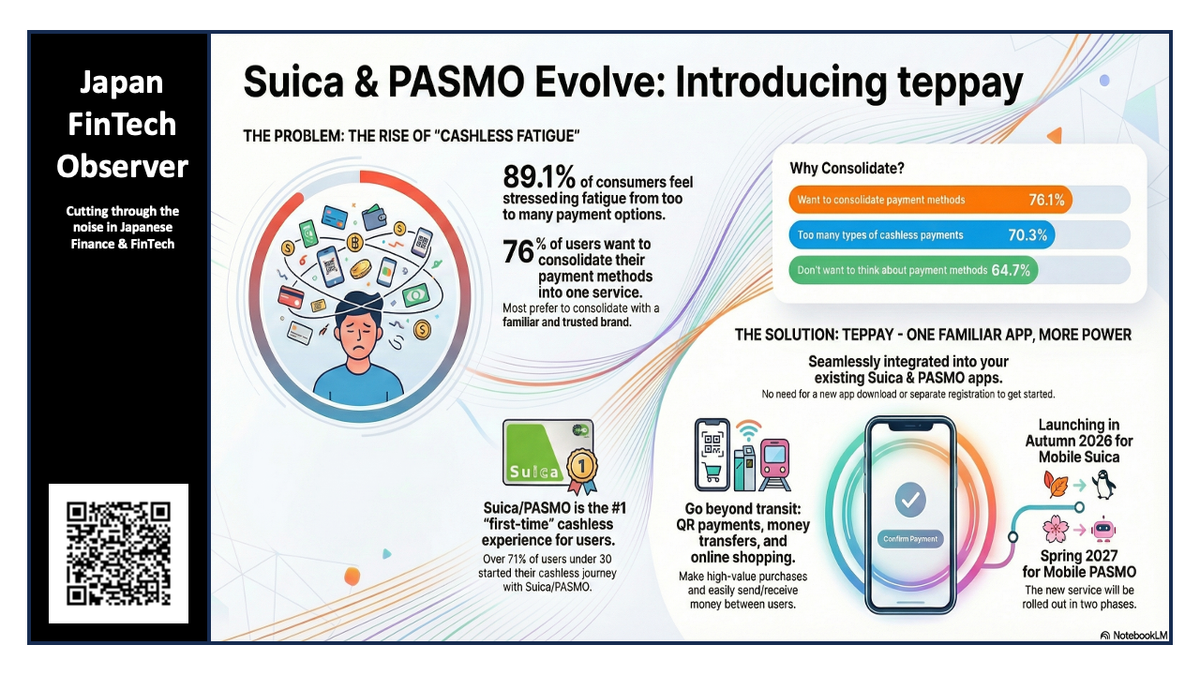

East Japan Railway Company (JR East) and PASMO have announced a landmark initiative to unify Japan's leading transit wallets with "teppay" (テッペイ), a new integrated code payment service poised to resolve growing "cashless fatigue" among consumers.

The service will be integrated directly within the existing Mobile Suica and Mobile PASMO applications, eliminating the need for users to download new software. The launch is scheduled to begin in Autumn 2026 for Mobile Suica users, with Mobile PASMO users gaining access in Spring 2027. This initiative represents a significant evolution of Japan's most familiar transit payment systems, transforming them into a comprehensive "life device" designed to simplify daily commerce for millions.

Strategic Rationale: Addressing "Cashless Fatigue" with a Trusted, Unified Platform

JR East and PASMO are developing teppay as a direct response to clear market needs identified in a recent "Cashless Payment Survey," which revealed significant user stress related to the proliferation of payment options. Understanding this consumer sentiment is critical in the rapidly evolving digital payments landscape.

The survey findings highlight the specific market challenges that teppay is engineered to solve:

- Widespread Stress: Approximately 90% of consumers in the Tokyo metropolitan area report feeling some form of stress or fatigue due to the increasing complexity and number of cashless payment options available.

- Desire for Consolidation: A clear majority of users—76.1%—expressed a wish to consolidate their payment methods. Furthermore, 77.5% indicated a strong preference for consolidating their payments under a familiar and trusted brand.

- Unmatched Brand Trust: Suica and PASMO hold a uniquely trusted position in the market. Based on those with experience using cashless services, they were the "first-ever" cashless service for over half of all users (52.4%) and for over 70% of users under 30. With an ownership rate of 84.3%, the brands are viewed by over 80% of their users as familiar, safe, and reliable.

The teppay service is engineered with a specific mandate: to leverage this deep-seated consumer trust and deliver a unified, intuitive payment experience that eliminates the very complexities consumers have rejected.

Core Features and Benefits of the teppay Service

The features of teppay are engineered to directly address consumer needs for simplicity, integration, and expanded functionality. By building upon the trusted foundation of Mobile Suica and Mobile PASMO, teppay delivers a powerful and versatile payment experience.

A. Seamless Integration and Accessibility

Existing Mobile Suica and Mobile PASMO users can access teppay's full functionality without downloading a new application or completing a separate registration process. This ensures immediate and frictionless adoption for the current user base.

B. Unprecedented Interoperability

A key innovation of the service is the ability for users to send and receive teppay balance directly between Mobile Suica and Mobile PASMO accounts. This feature creates a connected and fluid ecosystem between Japan's two leading mobile transit platforms. Please note that this interoperability applies to the teppay balance only; the standard transit IC balance cannot be sent or received.

C. Expanded Purchasing Power and Versatility

- Code Payments for Higher-Value Purchases: teppay enables QR code-based payments for transactions exceeding the 20,000 JPY limit of the standard transit IC balance, opening up a wider range of purchasing opportunities.

- Broad Merchant Acceptance: The service will be usable at participating teppay merchants and at over 1.6 million locations nationwide that accept Smart Code™ (as of October 2025).

- Online and Mobile Commerce: Users can issue a "teppay JCB PREPAID" virtual card within the app for secure online shopping. The service will also be available for mobile orders at businesses such as taxis and restaurants.

D. Flexible Account Management and Rewards

- The teppay balance can be funded through multiple convenient methods, including bank accounts, ATMs (cash), and View Card. The teppay balance cannot be withdrawn to a bank account or via ATM.

- Users can easily charge their transit IC balance (Mobile Suica/PASMO) and purchase commuter passes directly from their teppay balance within the app.

- Purchases made with teppay will earn users "teppay points," adding a rewards component to the service.

E. Driving Local Economies with "Barichike"

- The "Barichike" (地域限定バリュー) feature allows for the issuance of regionally restricted value that can be used in combination with the main teppay balance.

- This function serves as a powerful tool for local governments to implement premium voucher programs and cashback campaigns, fostering public-private collaboration to stimulate local travel and consumption.

These integrated features collectively transform the familiar Mobile Suica and Mobile PASMO apps from simple transit tools into powerful, all-in-one payment platforms for everyday life.

Phased Rollout

The launch of the teppay service will follow a phased schedule, with ample opportunity for businesses to prepare for integration.

- Merchant Recruitment: Begins Summer 2026.

- Mobile Suica Launch: Autumn 2026.

- Mobile PASMO Launch: Spring 2027.