SuMi TRUST Second Quarter Financial Results

During the first half of fiscal year 2025 (1HFY2025), Sumitomo Mitsui TRUST delivered an exceptional financial performance, culminating in a record-high net income. This robust result was driven by the successful execution of its strategy across three core pillars: strong growth in underlying business profit, a significant positive reversal in credit costs, and substantial gains realized from the strategic reduction of shareholdings. This outperformance provides a strong foundation for the significant upward revision of SuMi TRUST's full-year consolidated earnings and dividend forecasts.

SuMi TRUST's headline performance indicators underscore the strength of the first half:

- Record H1 Net Income: Achieved ¥171.3 billion, a substantial increase of ¥38.4 billion year-over-year (YoY).

- Net Business Profit Before Credit Costs: Grew to ¥181.9 billion, a YoY increase of ¥12.3 billion.

- Earnings Per Share (EPS): Increased to ¥242, representing a YoY growth of ¥57.

- Return on Equity (ROE): Reached 10.75%, a YoY improvement of 2.32 percentage points.

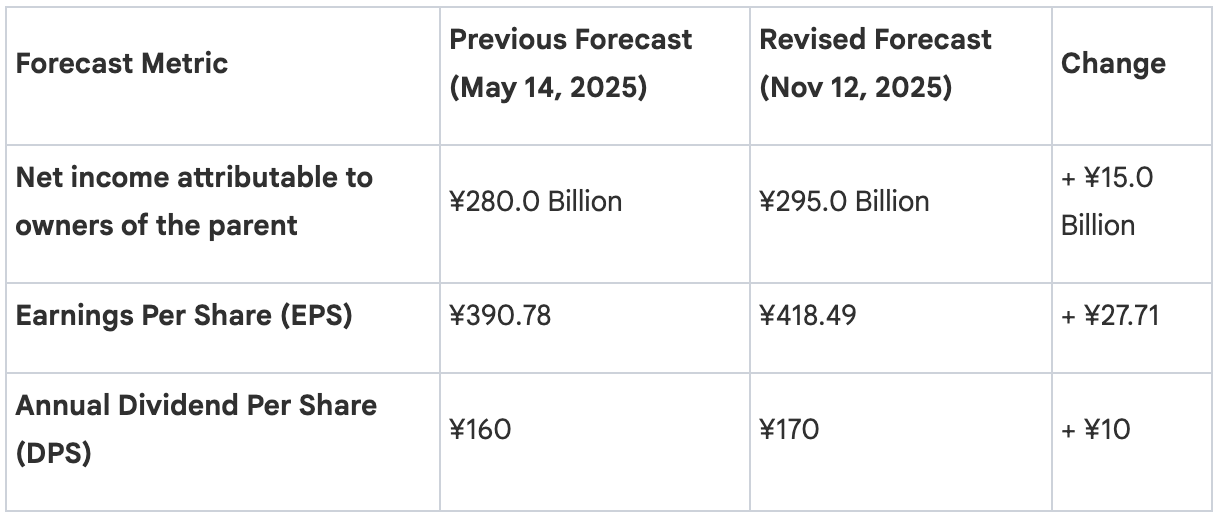

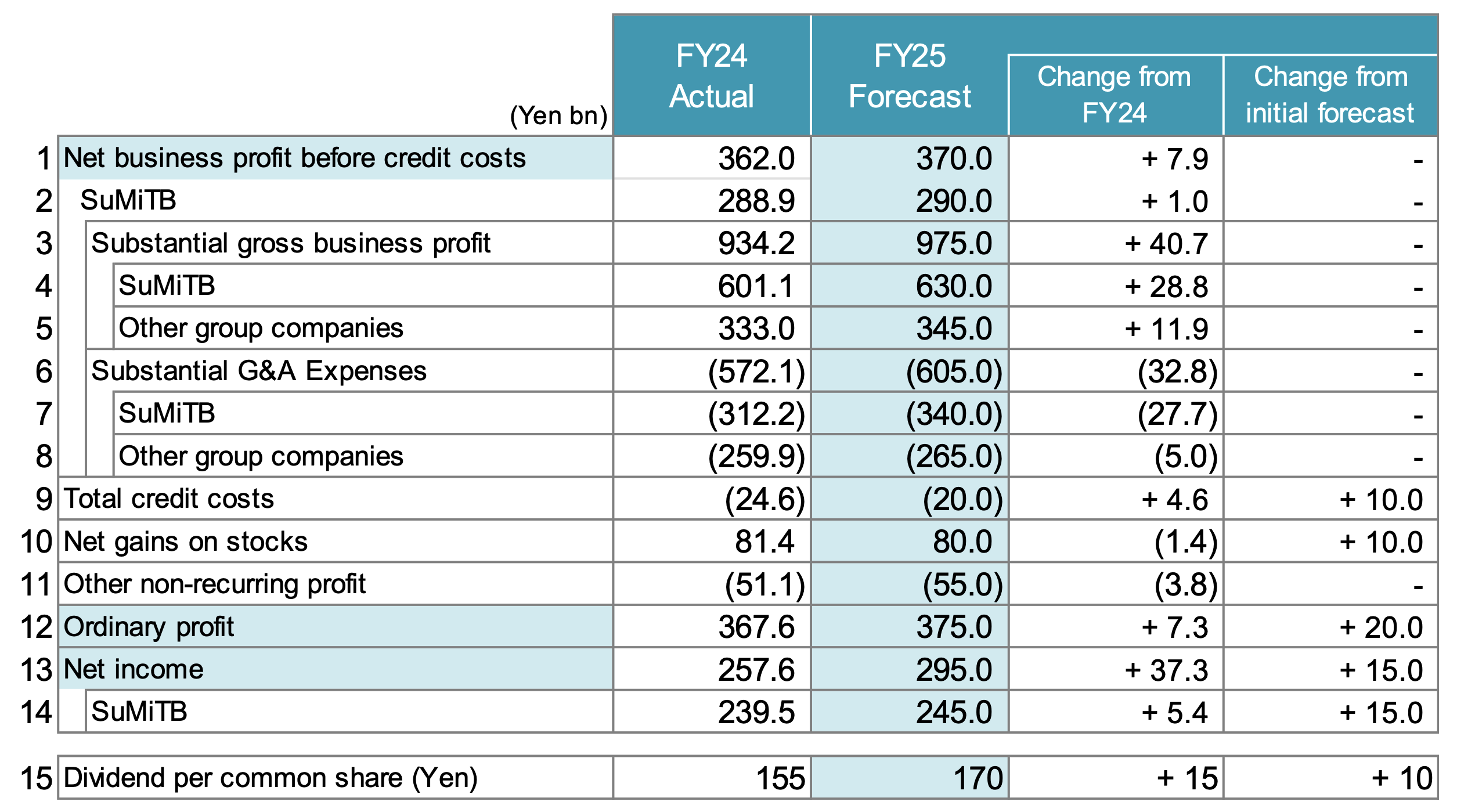

Reflecting this strong momentum and SuMi TRUST's confidence in the remainder of the fiscal year, the consolidated forecasts for FY2025 has been upgraded.

The following sections provide a detailed analysis of the key drivers behind these impressive results, SuMi TRUST's robust financial position, and the strategic execution that underpins the upgraded outlook.

Analysis of Key Profit & Loss Drivers

A detailed examination of the income statement reveals the fundamental sources of SuMi TRUST's enhanced profitability and improved operational efficiency during the first half. The significant YoY increase in net income was broad-based, stemming from strong core earnings, positive shifts in credit costs, and gains from strategic initiatives.

The ¥38.4 billion YoY increase in Net Income was driven by several key factors:

- Net Business Profit Before Credit Costs: This core metric, a key indicator of underlying earnings power, increased by ¥12.3 billion YoY to ¥181.9 billion. This growth was fueled by a ¥15.1 billion increase in "Effective interest related earnings" and an ¥8.8 billion rise in "Net fees and commissions," which successfully absorbed a planned ¥15.1 billion increase in "Substantial G&A expenses."

- Total Credit Costs: This area saw a significant positive turnaround, improving by ¥8.9 billion YoY. The result shifted from a net cost of ¥6.2 billion in 1HFY24 to a net positive contribution of ¥2.7 billion in 1HFY25, primarily due to limited new credit expenses and the successful release of existing reserves.

- Extraordinary Profit from Strategic Divestments: Extraordinary items provided a substantial boost, with extraordinary profit increasing by ¥38.6 billion YoY. This was almost entirely attributable to gains realized from the strategic sale of stocks in subsidiaries and affiliates, an initiative detailed further below, which was a primary driver of SuMi TRUST's outperformance against the initial forecast.

- Progress Against Forecast: The first-half Net Income of ¥171.3 billion represents 61% progress against the initial full-year forecast of ¥280.0 billion. This outperformance was a primary catalyst for revising the full-year guidance upward.

This strong profitability is supported by an equally robust balance sheet and capital framework, ensuring financial stability and the capacity for future growth.

Balance Sheet Health & Capital Position

A strong and resilient balance sheet is fundamental to SuMi TRUST's ability to support strategic growth, navigate market volatility, and meet all regulatory obligations. As of September 2025, the balance sheet has expanded, and the capital position has been further reinforced, demonstrating the financial stability of the group.

Key changes to the balance sheet between March 2025 and September 2025 include:

- Total Assets: Grew by ¥4,367.7 billion to reach ¥82,614.8 billion.

- Total Liabilities: Increased by ¥4,200.8 billion to ¥79,320.6 billion, driven largely by a ¥2,459.9 billion increase in Deposits, reflecting continued client confidence.

- Total Net Assets: Strengthened by ¥166.8 billion, reaching ¥3,294.2 billion.

- Net Assets Per Share (BPS): Increased by ¥279 to ¥4,634, delivering tangible value to shareholders.

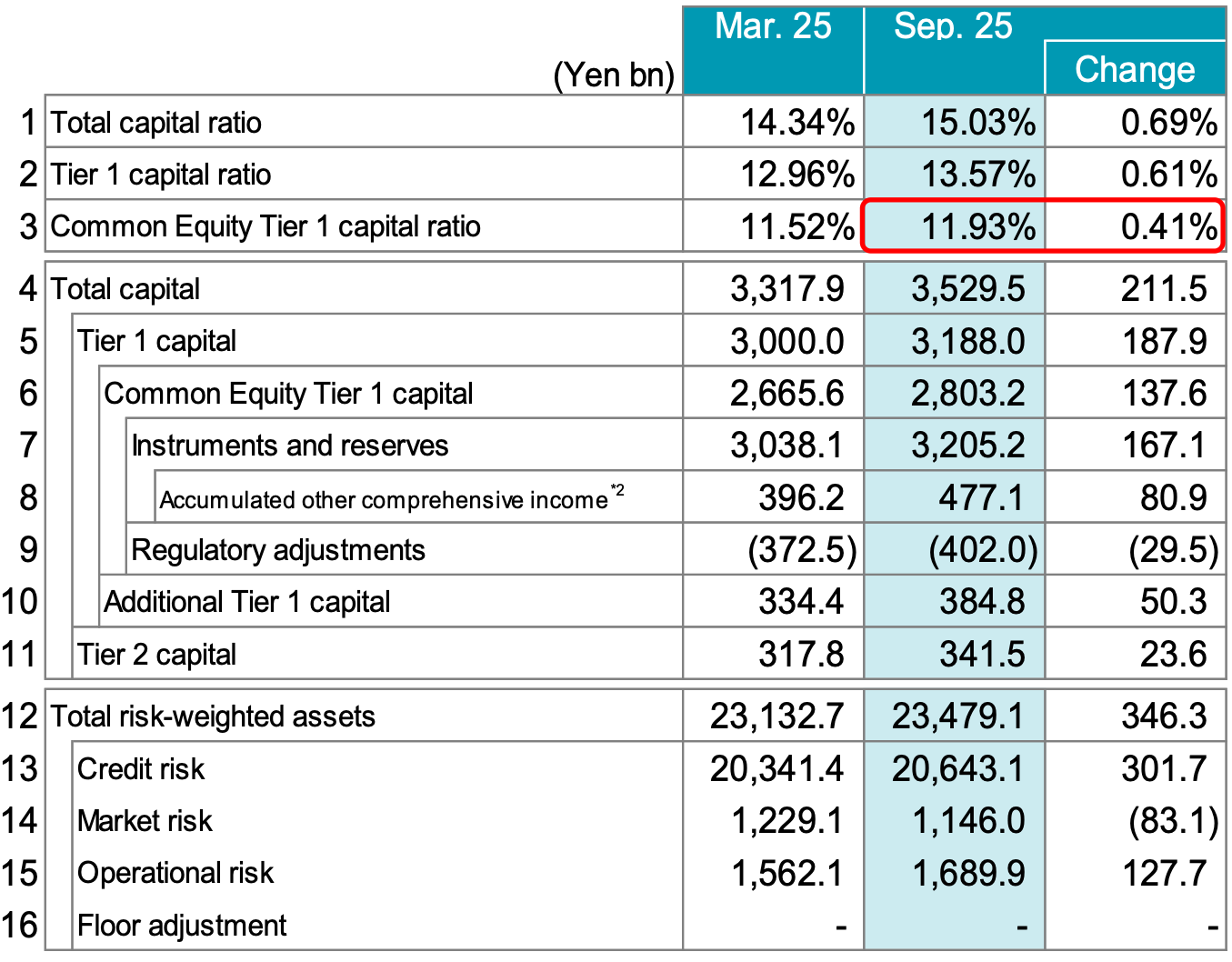

SuMi TRUST's capital adequacy remains well above regulatory minimums, highlighting prudent risk management:

- Common Equity Tier 1 (CET1) Capital Ratio: Stood at 11.93% as of September 2025, an increase of 0.41% from March 2025. This improvement was driven by the accumulation of retained earnings (+¥171.3 billion from net income) and positive valuation differences on the available-for-sale securities portfolio.

- CET1 Capital Ratio (Finalized Basel III basis): At 10.9%, this ratio remains comfortably in excess of regulatory requirements.

This strong financial foundation enables SuMi TRUST to confidently execute its strategic priorities and enhance shareholder returns.

Strategic Execution and Shareholder Returns

SuMi TRUST's strong financial results are a direct reflection of disciplined strategic execution. In the first half of the year, SuMi TRUST made significant progress on key initiatives aimed at optimizing its portfolio and enhancing capital efficiency, which in turn has enabled SuMi TRUST's to increase returns to its shareholders.

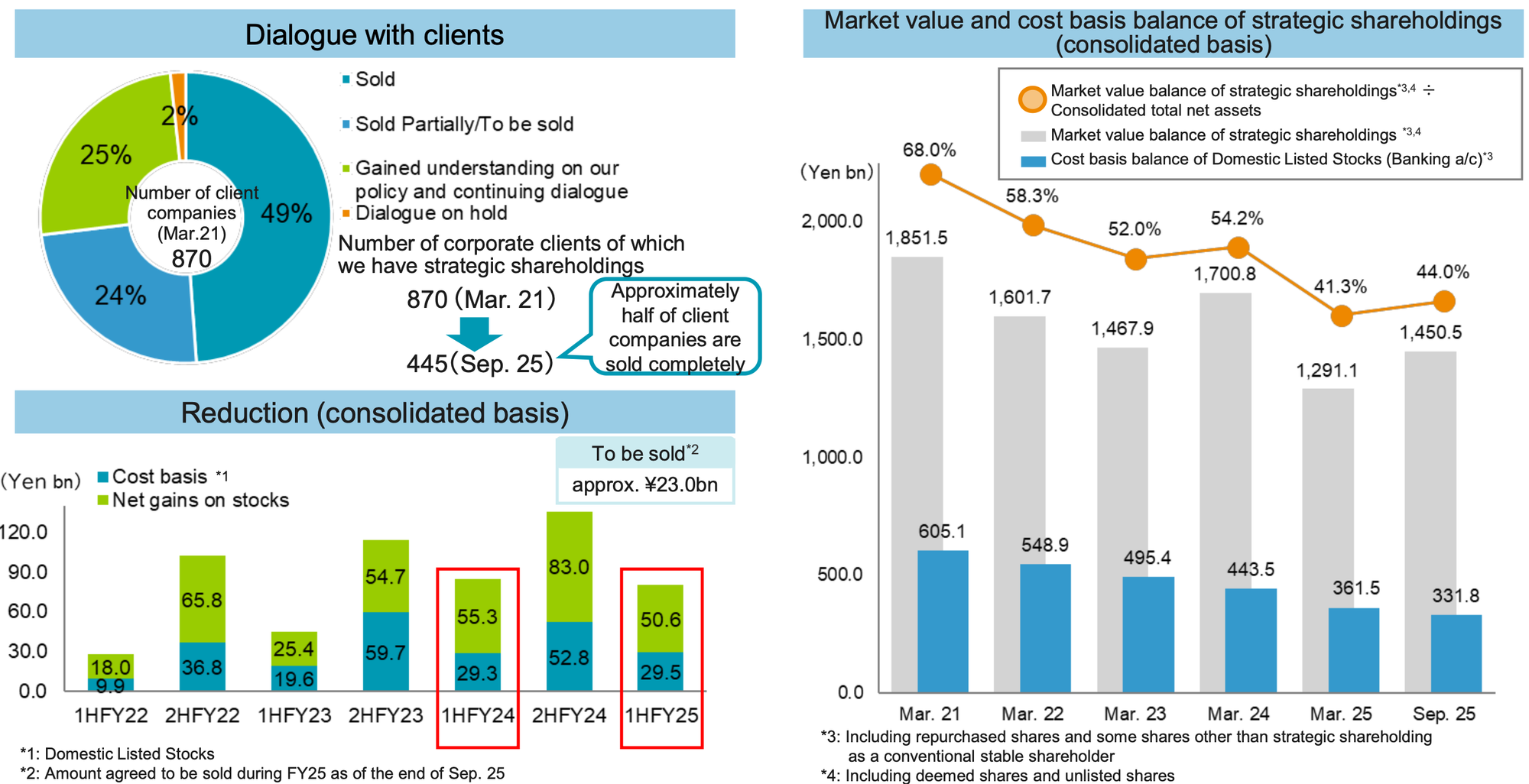

Progress in the strategic reduction of shareholdings has been a key success factor:

- SuMi TRUST successfully reduced its strategic shareholdings by ¥29.5 billion on a cost basis during 1HFY25.

- Since March 2021, SuMi TRUST has reduced the number of client companies in which it holds strategic stakes by approximately 50%, demonstrating a clear commitment to this long-term objective.

- The gain on sales from these divestments was a primary reason for exceeding the initial net income forecast and contributed directly to enhanced profitability.

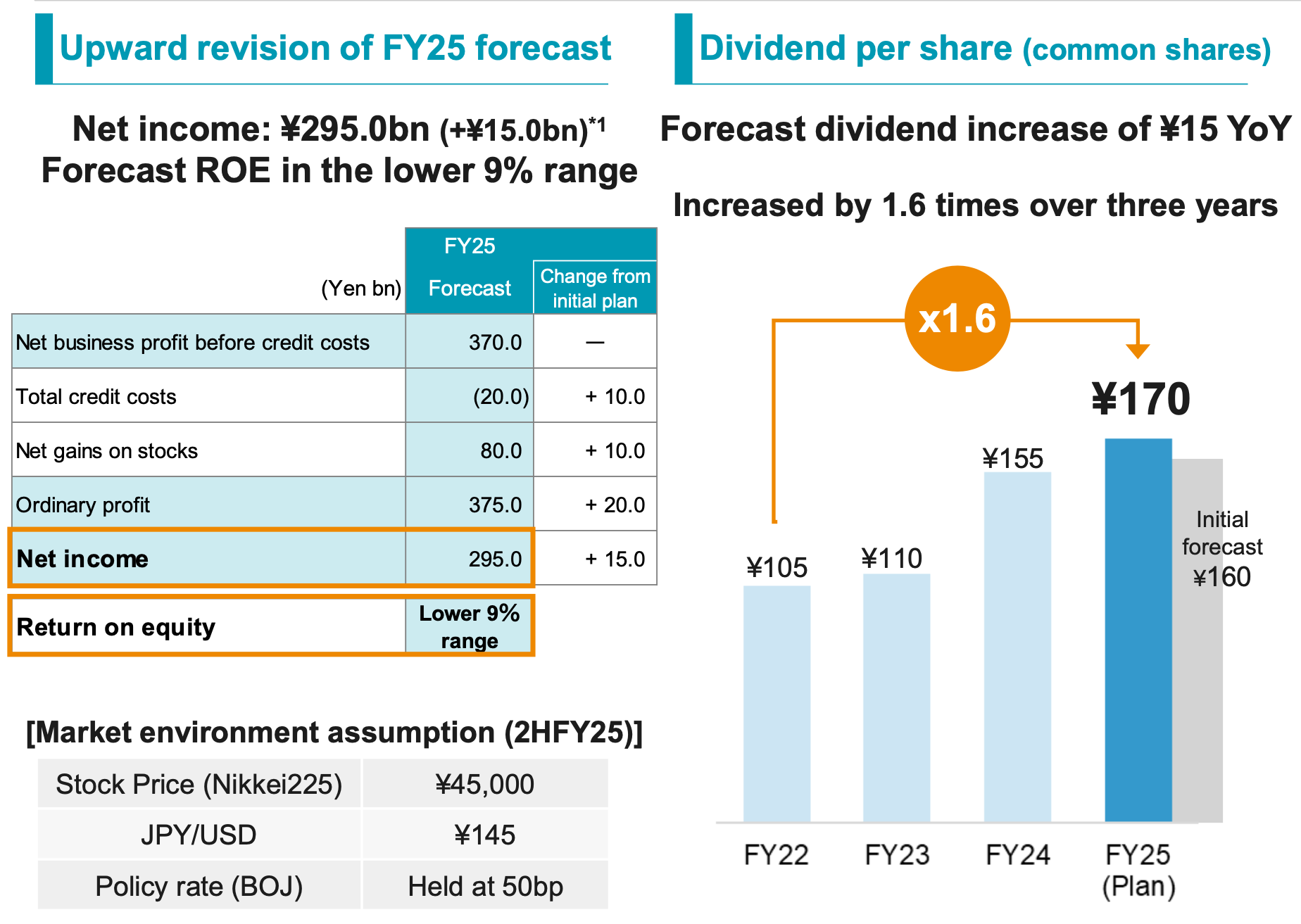

Based on this strong performance, SuMi TRUST has revised its shareholder return policy to deliver greater value:

- Dividend Increase: The annual dividend forecast has been raised by ¥10 to ¥170 per share, a year-over-year increase of ¥15. This action is consistent with SuMi TRUST's policy of maintaining a dividend payout ratio of 40% or above and pursuing progressive dividend growth.

- Share Repurchase Program: SuMi TRUST has announced a share repurchase program of up to ¥30.0 billion. This is a proactive measure to improve capital efficiency, reflecting SuMi TRUST's view that its stock remains undervalued and is made possible by the robust capital position outlined previously.

This disciplined execution of SuMi TRUST's strategic priorities and commitment to shareholder returns provides a strong foundation for the revised outlook for the remainder of the fiscal year.

Revised FY2025 Outlook and Key Assumptions

Grounded in its strong first-half performance and a clear view of the operating environment, SuMi TRUST has revised its full-year forecast. This updated outlook reflects SuMi TRUST's confidence in sustained business momentum and the continued execution of the strategic plan.

The revised key forecasts for the full FY2025 are as follows:

- Net Income: ¥295.0 billion

- Net Business Profit Before Credit Costs: ¥370.0 billion

- Net Gains on Stocks: ¥80.0 billion

- Return on Equity: Lower 9% range

This revised forecast is based on the following key market environment assumptions for the second half of fiscal year 2025 (2HFY25):

- Stock Price (Nikkei 225): ¥45,000

- JPY/USD Exchange Rate: ¥145

- Policy Rate (BOJ): Held at 50bp

With a robust performance in the first half and clear strategic priorities, SuMi TRUST is confident in its ability to navigate the market environment ahead and achieve these upgraded targets, delivering sustainable value to all of its stakeholders.