Sumitomo Mitsui Financial Group's Third Quarter Results

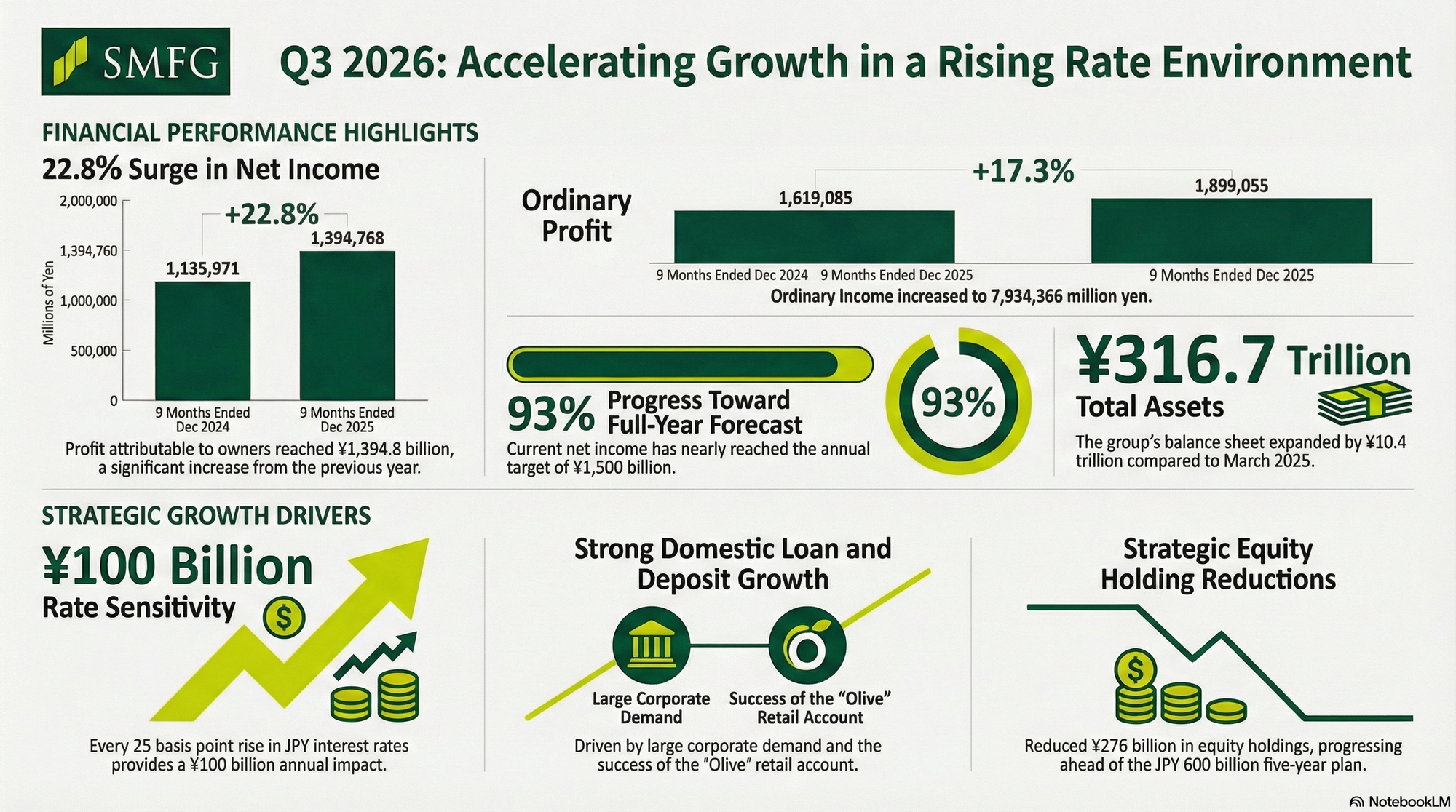

Sumitomo Mitsui Financial Group (SMBC Group) continues to demonstrate exceptional momentum as of the third quarter of FY3/2026, benefiting significantly from the normalization of the Japanese macro-financial landscape. The results through December 31, 2025, indicate a robust transition into a higher-interest-rate environment, with top-line growth fueled by domestic margin expansion and disciplined corporate lending. While the headline figures suggest record-breaking pace, a deeper analysis reveals a divergence between core operating performance and bottom-line results propped up by strategic asset divestments.

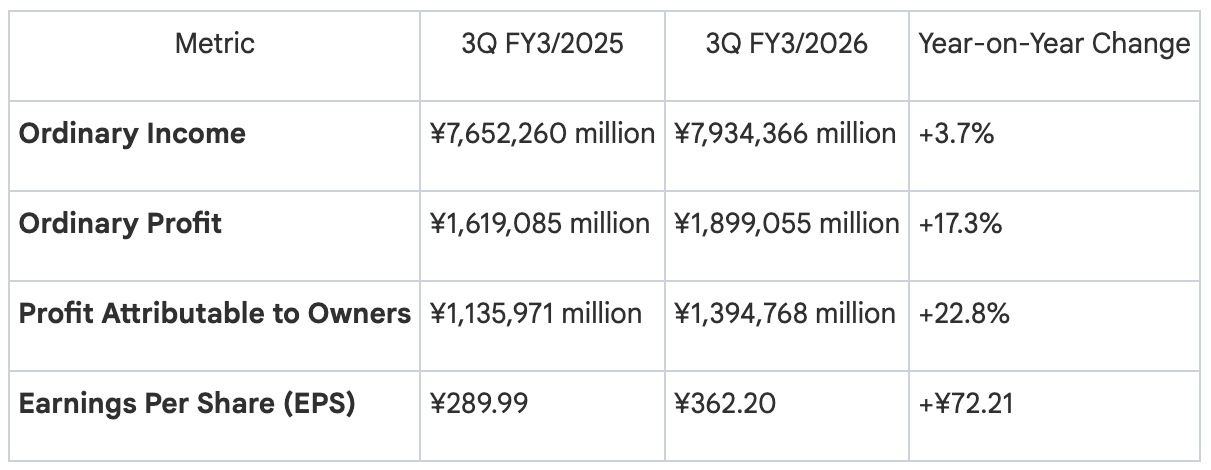

The following table summarizes the consolidated financial results for the nine months ended December 31, 2025:

Analysis of Progress Rates and Core Performance

SMFG has achieved 93% of its full-year profit target (¥1,394.8 billion against a ¥1,500 billion forecast) by the end of 3Q. However, institutional investors should note that the Net Business Profit progress rate stands at a more modest 88% (¥1,801.8 billion against a ¥2,050 billion forecast). The accelerated bottom-line progress is partially attributable to non-core gains on stocks, most notably the ¥94 billion gain from the Kotak Mahindra Bank share sale. While the progress provides a comfortable buffer for the final quarter, the focus remains on the sustainability of Net Interest Income (NII) as the primary engine of growth.

This financial trajectory is fundamentally linked to the evolving yield curve and the bank’s superior balance sheet positioning.

1. Impact of Shifting Interest Rate Environments

The Bank of Japan’s (BoJ) shift to a 0.75% policy rate as of December 2025 serves as the definitive catalyst for SMFG’s revenue model. The bank’s ability to reprice its massive domestic book while maintaining stable funding costs has fundamentally shifted its earnings power.

Upside Potential of JPY Interest Rates

The sensitivity of SMFG’s NII to JPY rate movements remains a key valuation driver:

- Annual Sensitivity: Every 25-basis-point (bp) hike in JPY rates delivers an estimated +¥100 billion in annual NII.

- Realized FY3/26 Impact: Recent hikes contributed +¥130 billion year-on-year to the current results.

Net Interest Income (NII) Trends: Strategic Bifurcation

SMFG is managing two distinct interest rate narratives:

- Domestic Drivers: NII increased by ¥193.2 billion, driven by improved loan-to-deposit spreads and strong demand from large corporations.

- Overseas Strategic Pivot: NII decreased by ¥135.1 billion. While rate cuts and deposit volume growth impacted margins, the decline also reflects a deliberate reduction of low-return assets (Asia loan balances fell 4% excluding FX impact) to focus on ROE-accretive deals.

The "So What?" of the JPY Balance Sheet Mix

As of December 2025, SMFG’s domestic deposit base stands at ¥125 trillion against a loan base of ¥70 trillion. The strategic value lies in the ¥85 trillion in "Savings" deposits, which represent a "low-beta" funding advantage. In a rising rate environment, these deposits remain largely insensitive to rate hikes, allowing the bank to capture massive margin expansion as the ¥70 trillion loan book—53% of which is floating-rate spread-based—reprices upward. This structural asymmetry dictates an asset-liability management strategy focused on maximizing the value of this sticky, low-cost funding.

2. Business Unit Analysis: Growth Drivers and Profitability

Diversified operations contributed to a consolidated Gross Profit of ¥3,593 billion. Performance across units shows a mix of structural efficiency and one-off benefits:

- Wholesale (WS): Remained the group’s powerhouse with a net business profit of ¥684.6 billion (+¥126.8 billion YoY). Efficiency is paramount here, evidenced by a sector-leading Overhead Ratio of 34.4%.

- Retail (RT): Gross profit rose by ¥124.2 billion, supported by the 7.0 million Olive accounts reached by January 2026. However, the profit surge was heavily propped up by a ¥99 billion one-off reversal from the absence of an allowance on interest repayments at SMBCCF. Furthermore, the Retail OHR remains high at 74.1%, indicating a continued need for structural cost reform.

- Global (GB): Achieved a net business profit of ¥510.9 billion (+¥41.0 billion YoY). Growth was driven by a selective focus on high-return deals, although G&A expenses rose due to inflation and a ¥5 billion FX impact (USD TTM at 156.53).

- Global Markets (GM): Performance was disappointing, with profit declining by ¥36.2 billion YoY. Despite claims of "nimble operations," the unit was unable to fully offset the volatility stemming from April’s market turmoil.

Subsidiary Performance and Operational Efficiency

SMBC Nikko demonstrated a strong recovery with net income of ¥108.5 billion (+¥33.5 billion YoY) on robust investment banking activity. SMCC/SMBCCF reported ¥76.4 billion in net income, though investors should view this through the lens of the aforementioned ¥99 billion allowance reversal.

Overall, the group’s Overhead Ratio improved to 52.9% (-3.2% YoY), reflecting strong top-line growth outpacing inflationary cost pressures.

3. Asset Quality and Risk Management Profile

SMFG maintains a disciplined risk posture, though specific overseas credit events and disposal activities have elevated the credit cost profile in the near term.

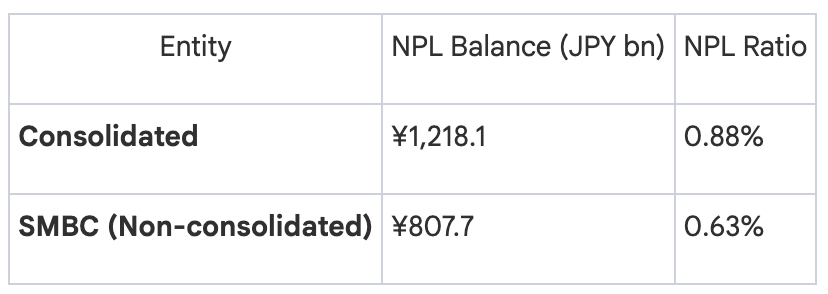

Credit Costs and Non-Performing Loans (NPL)

Total Credit Cost increased to ¥216.8 billion. This was driven by two primary factors: the ¥31 billion disposal of OTO/SOF NPLs in 3Q and provisions for several large overseas borrowers, including exposures in Brazil.

Note: The Consolidated NPL ratio rose from 0.67% in March 2025, with "Claims on borrowers requiring caution" reaching ¥1,218.1 billion.

Securities Portfolio and Duration Strategy

SMFG is aggressively reducing cross-shareholdings, having executed ¥276 billion of its ¥600 billion equity reduction plan (FY3/25–FY3/29) ahead of schedule.

In the bond portfolio, Yen bond duration was lengthened to 3.2 years (from 1.0 year in March 2025). This was achieved through a strategic shift into the Held-to-Maturity (HTM) category, which now stands at ¥3,046.2 billion, effectively locking in higher yields and protecting the balance sheet from further interest rate volatility.

4. Institutional Outlook and Strategic Progression

SMFG’s 3Q results confirm that the bank is the primary beneficiary of Japan’s exit from negative interest rates. The current strategic plan is successfully converting macro tailwinds into tangible shareholder value.

Forward-Looking Indicators

- Shareholder Returns: Annual dividend forecast is maintained at ¥157 per share.

- Profitability: ROE improved 2.4% YoY to 16.2%.

- Bond Strategy: The build-out of the JGB portfolio is being timed against the assessment of "terminal rate levels" to maximize long-term carry.

The "So What?" Layer

SMFG remains the top pick for investors seeking exposure to Japanese rate normalization. While the 93% progress rate is slightly flattered by the Kotak sale and consumer finance reversals, the core banking business is exceptionally lean.

The +¥100 billion NII tailwind for every 25bp domestic rate rise, supported by an ¥85 trillion low-beta deposit base, provides a structural earnings growth profile that offsets risks in Global Markets and overseas credit. SMFG enters the final quarter with a formidable capital position and a clear path to record full-year profitability.