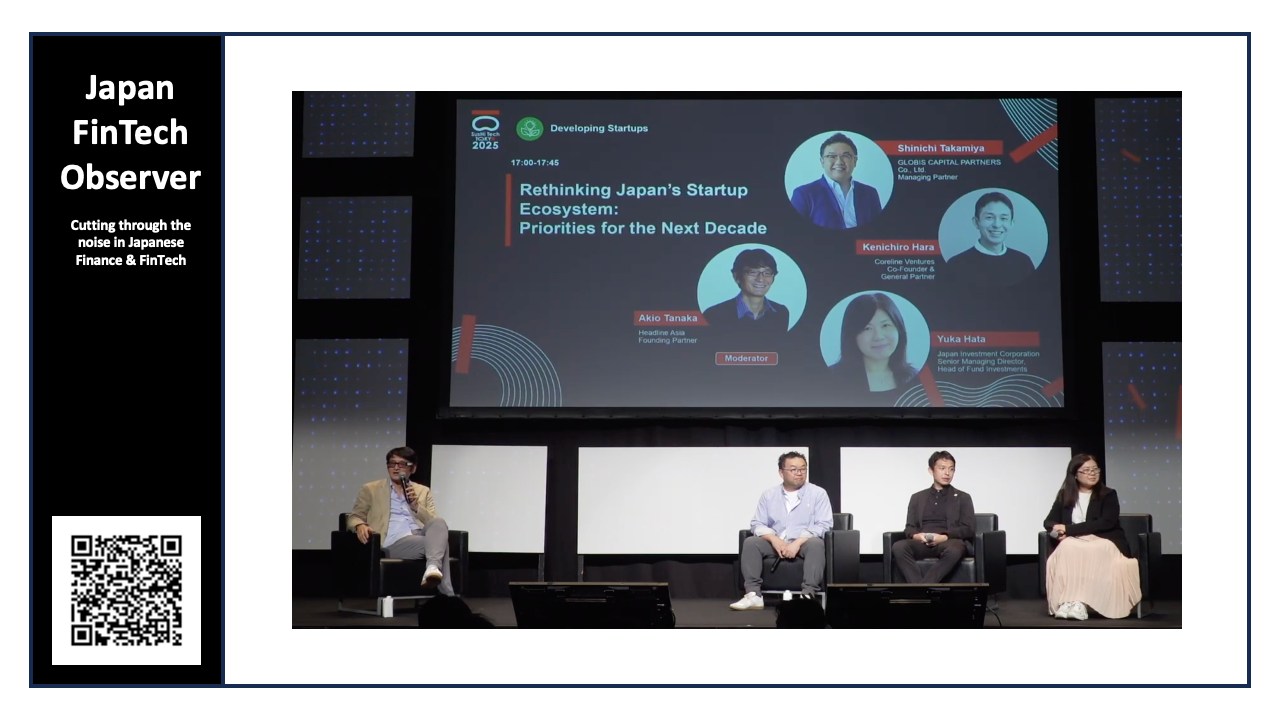

Sushi Tech #3 - Rethinking Japan's Startup Ecosystem: Priorities for the Next Decade

This Sushi Tech panel discussed the theme of "Rethinking Japan's Startup Ecosystem: Priorities for the Next Decade." Moderated by Akio Tanaka, Founding Partner of Headline Asia, the panel consisted of industry experts who offered their perspectives on the current state of Japan's startup landscape, its unique characteristics, challenges, and opportunities for growth. The distinguished panelists included Shinichi Takamiya, Managing Partner from Globis Capital Partners; Kenichiro Hara, Co-founder and General Partner of Coreline Ventures; and Yuka Hata, Senior Managing Director and Head of Fund Investments of Japan Investment Corporation (JIC).

The panel explored how Japan's startup ecosystem has evolved over the years, emphasizing its shift from infancy to a point of inflection. The discussion underscored the immense potential of the Japanese market due to its large consumer base and a thriving stock exchange. However, it also addressed the criticisms leveled against Japan for not producing as many unicorns as its neighbors, such as South Korea. To provide context, the discussion included the perspectives of both domestic and international investors, ensuring a comprehensive examination of Japan's startup dynamics.

Current State and Evolution

The panelists presented a detailed examination of the contemporary Japanese startup environment. Shinichi Takamiya remarked, "Japanese startup ecosystem has now surpassed the inflection point."

- He highlighted significant growth in investment from approximately $300 million in 2008 to about $10 billion in recent years.

- Takamiya also noted the first unicorn's public listing in 2018, generating about $7 billion. Since then, 74 companies have neared the $1 billion mark in their private phase or within a year of going public.

The discussion also highlighted the peculiarities of the Japanese stock market. The panelists emphasized that Japanese startups could go public at a smaller scale, "pretty small or pretty immature, for good and for bad." This factor differentiates Japan from other markets, notably the United States, where startups generally stay private for longer and achieve larger valuations.

Government Backing and Changes in Talent Pool

Yuka Hata emphasized the critical role the Japanese government plays in backing the ecosystem, including the role of JIC. Thanks to that backing, the Japanese startup ecosystem has seen increased talent attraction. “The talent pool is definitely increasing in this ecosystem.” She said.

- Additionally, Yuka highlighted that the initial public offering (IPO) landscape has become more flexible, enabling small IPOs in the ecosystem.

- She also noted the growth of serial entrepreneurs, which is crucial in pushing companies towards global expansion.

- The increase in institutional investors such as the Government Pension Investment Fund (GPIF) signifies a growing interest from both domestic and international sources.

Challenges in the Japanese Startup Ecosystem

The discussion then pivoted to the unique challenges facing Japan's startup environment. Kenichiro Hara highlighted that, while the market has interesting potential, the number of entrepreneurs is still relatively low given its size.

- "Given the size of the market, given the number of B2B companies, we don't have that many entrepreneurs yet," Hara noted.

- Kenichiro also pointed out that the success rate for startups to go public or exit is high, yet the outcomes are still small.

- Hara noted the potential reasons could be timing of IPOs or the ambitions of entrepreneurs.

Tokyo Stock Exchange Listing Requirements

Kenichiro Hara discussed Tokyo Stock Exchange’s new regulations concerning listings. The exchange had released guidelines that proposed new exit bars for startups, setting a higher standard for initial market capitalization. Takamiya explained that about 70% of listed startups might not meet the new bar, potentially leading to their delisting from the growth market, which is primarily for small-cap companies. The panelists viewed these adjustments as an attempt to weed out the "public living dead" or "zombie companies" to promote industry vitality.

Takamiya elaborated on these concerns: "We have too many small companies go public, and sometimes they become like a public living dead." The new requirements encourage companies to aim higher in terms of valuation and market potential. The long-term goal is to foster the growth of companies capable of becoming the core of new industries and achieving $10 billion in value. However, this shift could also mean a change in how smaller companies are structured and supported.

Global Ambitions and International Talent

The discussion shifted toward Japan's global presence and the need to foster a more international mindset among startups. Yuka Hata acknowledged the necessity of creating global startups out of the Japanese market. To that end, JIC has been investing in global players, such as NEA in the US, Atomic in Europe, and Vertex in Southeast Asia. Yuka said “We try to create more diversified investor ecosystems.”

Akio Tanaka commented, “In our previous generations, Japan actually built global companies where they make more revenue outside of Japan than in Japan.” He noted the lack of current-generation Japanese internet companies with substantial overseas revenue. He said, “We have very little current generation of Japan's internet companies that make a lot of large revenues overseas."

Local versus Global Strategy

The moderator raised the question of whether Japanese startups need to focus on global ambitions to attain larger outcomes. The panel had contrasting opinions:

- Hara: Believes B2B startups could focus on the Japanese market to reach $100 million in revenue, but going beyond that would require global expansion.

- Takamiya: Acknowledged that, while it is possible to become a $10 billion market-cap company in Japan, it is equally essential to pursue global competitiveness.

Need for Global Talent

A major point of agreement was the need to improve Japan’s ability to attract international talent. Takamiya said, “There is no such thing as a domestic startup going for the global market. You probably have to be global from day one." Takamiya said he believed that top-tier Japanese entrepreneurs were recognizing the need to “swing for the fences.”

Referencing a portfolio company, Joses, he described how the founder brought in global talent for key leadership roles, including an Indian CTO and a CPO from Silicon Valley. They recognized a global pain point and developed solutions applicable worldwide. He stressed that high risk, high return investment strategies are crucial for VC, leading to a portfolio where both high potential and more reliable, low-risk opportunities are equally represented.

Changes in Immigration Policy

The moderator highlighted government policy support for attracting talent, referencing the ease of immigration for entrepreneurs. “Japan now has the easiest and loosest immigration policy for entrepreneurs,” Tanaka remarked, drawing a contrast with the United States. He also pointed to the inbound tourism as a recruitment opportunity. “If you’re also outside of Japan, it’s perfectly fine if you don’t leave sushi tech and just stay here and continue your business."

Maturity of the VC Industry

Panelists explored whether Japan’s VC industry has reached global maturity. Key points included:

- Communication and Governance: Yuka Hata noted improvements in communication and understanding of institutional investors' expectations. Many Japanese VC people had not had a chance to communicate on international levels. “Just Japan VC people didn’t have a chance to communicate," she said. Hata highlighted improvements in communication and learning.

- Ambition: She pointed out the need for more ambition and aggressiveness in scaling businesses and challenging global markets, particularly among emerging managers.

- Talent Acquisition: Hara shared how emerging managers aggressively hire Singaporean people in investor relations to better engage with global markets.

Ultimately, the panel discussed the necessity to approach Japanese startup ecosystems with an understanding of local dynamics, along with the recognition of how global forces and strategies can propel further growth.

Conclusion

The panel agreed that, while challenges exist, Japan's startup ecosystem has reached an inflection point with increasing capital and talent. A global perspective is essential for creating decacorns.

The panel recommended:

- A flexible approach to IPOs, accompanied by robust M&A activity and a viable secondary market.

- Strategies that focus on attracting international talent, thus fostering a more diversified mindset.

- The continued support from government to remove entry barriers.

With these adaptations, Japan could position itself to be a major hub for globally successful startups.