sustainability

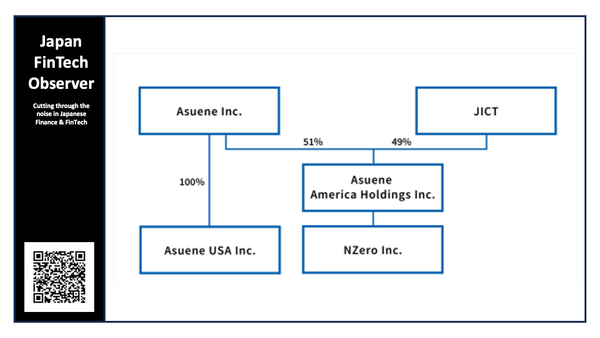

ASUENE's Final Close of Series C2 Round and Second US M&A

ASUENE has completed the acquisition of 100% of the shares and integration of Iconic Air, a U.S. company providing GHG visualization and methane leak management SaaS. Following NZero, this second M&A further accelerates the expansion of ASUENE's U.S. operations and strengthens our technological foundation.