The Economic Impact of Startups in Japan

This post presents a comprehensive overview of the “Economic Impact of Startups in Japan” report, published in July 2024 by the Ministry of…

This post presents a comprehensive overview of the “Economic Impact of Startups in Japan” report, published in July 2024 by the Ministry of Economy, Trade and Industry (METI). The report examines the significant role startups play in driving economic growth and shaping the future of Japan’s economy.

Background and Objectives

The report builds upon a history of government initiatives aimed at fostering a thriving startup ecosystem in Japan. Starting with the 2013 “Japan Revitalization Strategy,” which prioritized investment in innovative ventures, the government has implemented various policies to promote startup growth. These include the “Venture Challenge 2020,” the “Global Startup Ecosystem Hub Strategy,” and regulatory reforms to create a more conducive environment for startups.

This study aims to provide a quantitative assessment of the economic impact of startups in Japan. By analyzing the economic activity of startups and their supply chains, the report estimates the contribution of startups to GDP, employment, and income generation. The findings serve to inform future policy decisions, benchmark progress against other countries, and highlight the crucial role startups play in driving economic growth and societal transformation.

Key Findings

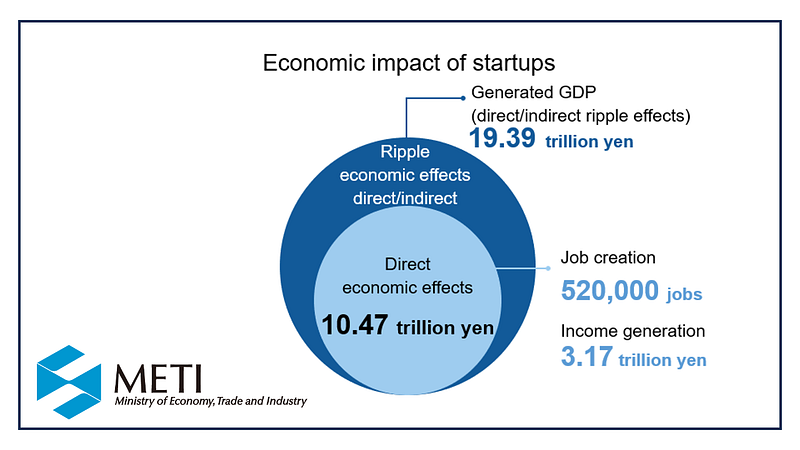

The report reveals several key findings about the economic impact of startups in Japan:

- Significant GDP Contribution: Startups in Japan generated an estimated 19.39 trillion yen in GDP (including indirect effects), comparable to the nominal GDP of many prefectures in Japan. This underscores the substantial contribution of startups to the national economy.

- Employment Generation: Startups created 520,000 jobs and generated 3.17 trillion yen in income. This highlights the role of startups in fostering employment opportunities and contributing to individual income growth.

- Impact of EXITed Companies: Startups that have undergone an “exit” event, either through an IPO or M&A, demonstrate a disproportionately large impact on the overall economic impact. These companies, although a smaller proportion of the total number of startups, contribute significantly to GDP growth.

- Role of Venture Capital (VC): Startups that have received VC funding show a higher economic impact. 70% of the startups surveyed had received VC funding, and these companies generated 72% of the total GDP contribution from startups. This highlights the importance of VC funding in supporting startup growth and driving economic impact.

- Sectoral Analysis: The information and communications technology (ICT) sector plays a dominant role in the startup landscape, followed by business services, commerce, real estate, and finance & insurance. These five sectors account for 78% of the total GDP generated by startups.

- Potential for Transformation: The report highlights the potential of startups to reshape the Japanese economy. Notably, the increasing trend of startups acquiring other startups and the high proportion of female entrepreneurs in startups point towards a dynamic and transformative force within the Japanese economy.

Methodology

The study utilizes a robust methodology to quantify the economic impact of startups:

- Data Source: The primary data source for the study is “INITIAL,” a comprehensive startup information platform. The analysis focuses on approximately 9,000 startups from the INITIAL database that have received external funding.

- Startup Definition: The study adopts INITIAL’s definition of a startup, which includes companies that possess unique technologies, products, or business models; are actively seeking growth through investment; and have received or are likely to receive equity funding from venture capitalists, corporations, or angel investors.

- Inclusion Criteria: The analysis includes startups established after 1995 that have received external funding. Notably, the study also includes startups that have undergone an “exit” (IPO or M&A) as they are considered a product of successful startup policies.

- Economic Impact Estimation: The study employs a two-pronged approach to estimate economic impact:

- Direct effects: Calculated based on the economic activity of startups, such as sales, employment, and income generation.

- Indirect effects: Estimated using an input-output table to capture the ripple effects of startup activity on their suppliers and the broader economy. The study considers indirect effects up to the second order.

Detailed Breakdown of the Key Findings

1. Economic Impact

- GDP: Startups generated 19.39 trillion yen in GDP, a significant contribution to the Japanese economy. This figure includes both direct effects (economic activity of startups themselves) and indirect effects (economic activity induced by startups in their supply chain and through consumption spending).

- Employment: Startups created 520,000 jobs, indicating their role in driving employment generation in Japan. This emphasizes the importance of startups in providing job opportunities and fostering a dynamic labor market.

- Income: Startups contributed 3.17 trillion yen in income, representing a substantial injection of income into the Japanese economy. This highlights the positive impact of startups on individual livelihoods and overall economic prosperity.

2. EXITed Companies

- Significant Contributors: Startups that have undergone an exit (IPO or M&A) play a crucial role in driving the overall economic impact. These companies, representing 18.3% of the total number of startups analyzed, contribute to 76.9% of the total GDP generated by startups. This highlights the importance of fostering an environment that supports successful exits for startups, which in turn leads to greater economic impact.

- Inclusion Rationale: Despite having exited, these companies are included in the analysis because they originated as startups and their growth can be attributed to successful startup policies. This approach acknowledges the long-term impact of startup policies on the economy.

3. Role of Venture Capital (VC)

- Prevalence of VC Funding: 70% of the startups analyzed had received funding from venture capital firms, emphasizing the significant role of VC in the Japanese startup ecosystem.

- Impact on GDP: VC-backed startups account for 72% of the total GDP contribution from startups, highlighting the positive association between VC funding and economic impact. This suggests that VC investment plays a crucial role in fueling startup growth and generating economic activity.

4. Sectoral Analysis

- Dominance of ICT: The information and communications technology sector leads in terms of GDP contribution, highlighting its importance as a driver of innovation and economic growth in the startup landscape.

- Key Contributing Sectors: The top five sectors — information and communications technology, business services, commerce, real estate, and finance & insurance — contribute to 78% of the total GDP generated by startups. This indicates a concentration of economic activity within these sectors, suggesting potential areas for future policy focus.

5. Potential for Transformation

- M&A Activity: The report notes a growing trend of startups acquiring other startups, indicating a maturing ecosystem where successful startups are reinvesting in the growth of other ventures. This dynamic contributes to the overall dynamism and resilience of the startup ecosystem.

- Female Entrepreneurship: The proportion of female entrepreneurs in startups is significantly higher than in established large corporations. This suggests that startups provide a more inclusive environment for female leadership, contributing to diversity and potentially driving innovation and economic growth.

International Comparison

- Funding Gap: While Japan demonstrates a positive economic impact from startups, the total amount of funding raised by Japanese startups is significantly lower compared to other leading startup ecosystems, particularly the United States.

- Potential for Growth: Despite the funding gap, Japan’s GDP contribution from startups relative to the UK suggests that there is considerable potential for growth. By bridging the funding gap and further nurturing the startup ecosystem, Japan can unlock even greater economic benefits from its startups.

Policy Implications

The findings of the report have important implications for future policy directions:

- Support for Exits: The significant contribution of EXITed companies to GDP highlights the need for policies that support successful exits for startups, such as facilitating IPOs and M&A activities.

- Strengthening VC Ecosystem: The positive association between VC funding and economic impact suggests the importance of continuing to strengthen the VC ecosystem in Japan, attracting more investment and supporting the growth of VC firms.

- Sectoral Focus: The dominance of certain sectors in the startup landscape suggests potential areas for focused policy interventions, such as promoting innovation and entrepreneurship in those sectors.

- Promoting Diversity: The high proportion of female entrepreneurs in startups highlights the importance of continuing to promote diversity and inclusivity in the startup ecosystem.

Conclusion

This comprehensive study provides a valuable assessment of the economic impact of startups in Japan. The findings emphasize the crucial role startups play in driving economic growth, creating jobs, and shaping a dynamic and innovative future for the Japanese economy. The report’s insights will inform policymakers, investors, and entrepreneurs alike, contributing to the continued growth and success of the Japanese startup ecosystem.