The Evolution of Alternative Data and AI Integration

The release of the 4th annual Alternative Data Factbook, produced by the Japan Alternative Data Accelerator Association (JADAA) and SOMPO Institute Plus, confirms that the market has successfully navigated its initial volatility. Survey participants have moved decisively past the "pandemic surge"—a period characterized by reactive, uncritical data acquisition—into a phase of structural and persistent demand. In 2025, the strategic context shifted towards the sophisticated integration of data into institutional workflows. This is a maturation phase where technological synergy, rather than volume alone, dictates market leadership.

The thematic analysis of this year’s findings reveals a critical shift in momentum. While 80% of institutional respondents now possess direct experience with alternative data, the era of "growth at any cost" has ended. The market has transitioned toward "strategic differentiation," where the value of a dataset is measured by its ability to provide a unique edge in an increasingly efficient environment.

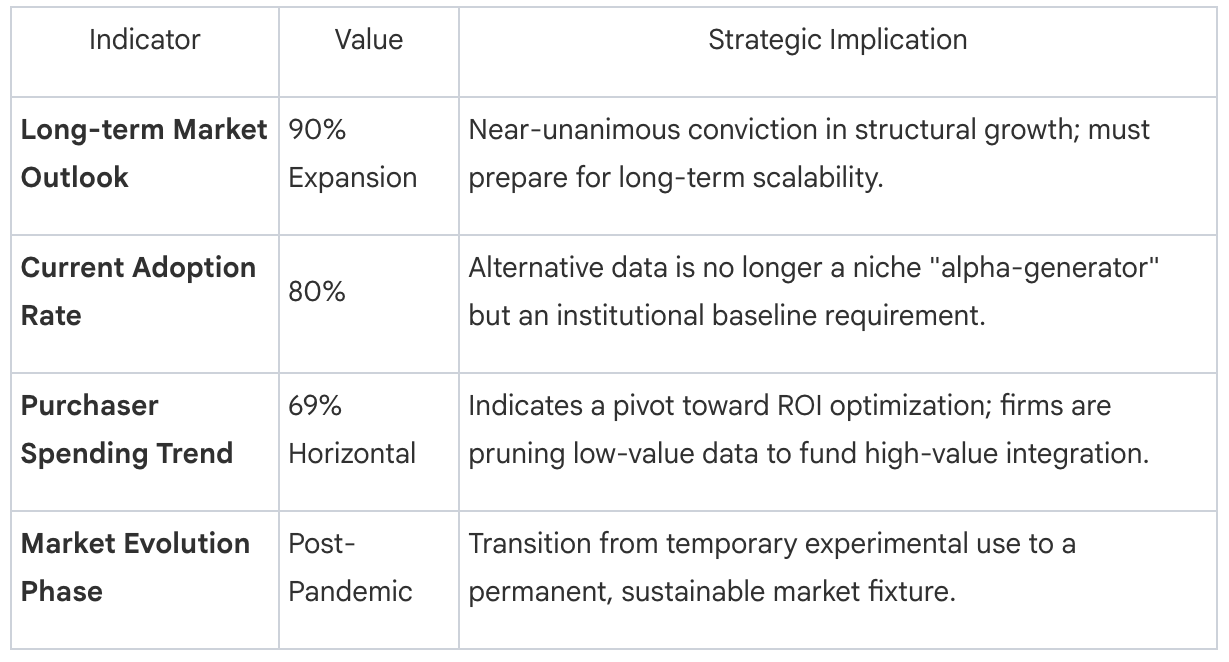

Market Maturity Indicators (2025)

This stabilization of spending amidst high long-term optimism suggests a market-wide pivot. Organizations are now focused on maximizing the utility of existing assets, leading to a significant bifurcation in how budgets are deployed.

1. The Divergence of Spending: Cost Optimization vs. Strategic Investment

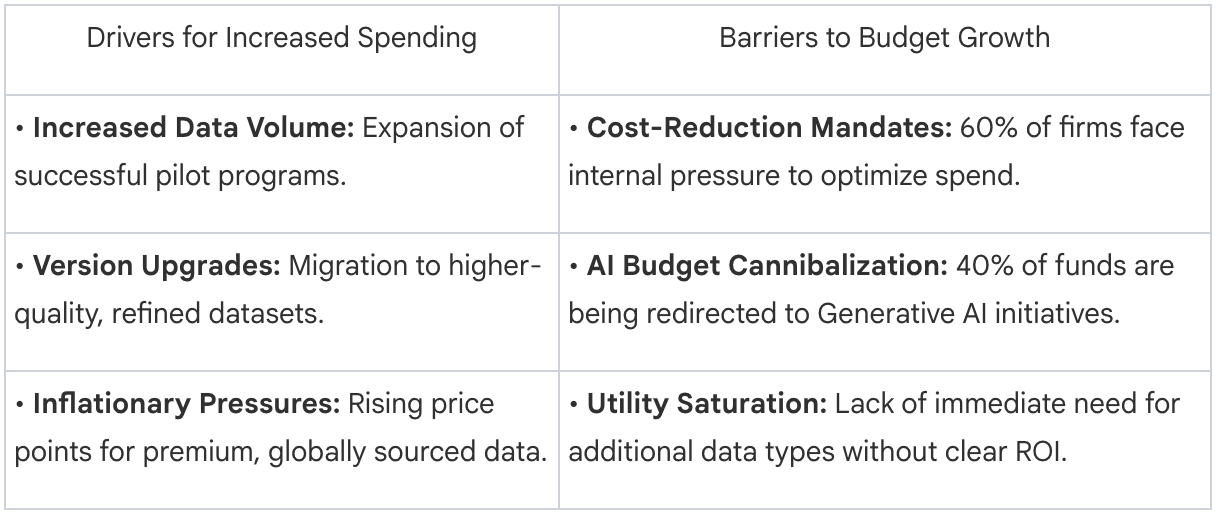

Current spending trends reflect a sophisticated market where "horizontal spending" is not a sign of institutional discipline. For the 69% of purchasers reporting flat year-over-year spending, the priority has shifted from broad-spectrum data acquisition to rigorous ROI evaluation. However, horizontal spending in a bullish market can be a trap for laggards; as the landscape expands, failing to strategically increase investment in high-impact areas results in a net loss of competitive position.

The current budget landscape is defined by a clear divergence between growth drivers and institutional barriers.

The rationale for this budget shift is structural: survey particpants are witnessing a competition for capital between AI and alternative data. This is a "survival of the fittest" environment where only data that can demonstrably fuel AI models survives the pruning process. Strategic advisors must view this as a necessary consolidation of resources toward high-utility assets.

2. The Generative AI Catalyst: Redefining Data Value

In 2025, Generative AI (GenAI) has transitioned from a speculative tool to a primary "value multiplier" for alternative data. The findings mark a fundamental turning point: AI integration is now the leading justification for new data utilization. For firms treating AI and Data as separate silos, this represents a critical failure point; the synergy between these two pillars is now the only viable path to non-linear returns.

The 2025 AI-Data synergy is defined by three critical takeaways:

- Utilization Rates: While 82% of firms have integrated AI into their research or business processes, 62% specifically utilize alternative data within those AI workflows. The linkage is becoming the standard for elite performance.

- Top AI-Data Pairings: The most effective "fuel" for GenAI includes text data (company or government documents) at 29%, followed by SNS or news data (22%) and web scraping (22%).

- Primary Benefits: The value-add layer is dominated by Meaning Extraction from Text (73%), followed by Combined Analysis/Interpretation (54%) and Summarization (54%).

Despite these benefits, a 50% "Integration Gap" persists among those not yet using alternative data for AI, primarily due to a "lack of linkage." Bridging this gap via automated meaning extraction is the most immediate opportunity for firms to achieve strategic differentiation.

3. Competitive Differentiation: High-Frequency and High-Scarcity Data Archetypes

In a saturated information environment, alpha is found at the extremes of the data spectrum: superior speed (recency) or unique insights (scarcity). The 2025 utilization rates reflect a tiered approach to data sourcing, where news and web data provide the "what," but proprietary and high-scarcity sets provide the "why."

Dominant Data Sources:

- News Data (38%) – The baseline for high-frequency sentiment.

- Web Scraping (36%) – Essential for real-time competitive intelligence.

- POS & Location Data (31%) – The fundamental pillars for fundamental analysis and consumer behavior.

Strategic advantage is currently evaluated through a triad of factors: Differentiation (51%), Complementarity (47%), and Scarcity (42%). There is a notable divergence here: Purchasers prioritize "Complementarity" (69%), seeking data that fills gaps in traditional models. Conversely, Data Providers focus on "Scarcity" (57%), highlighting unique sources like job postings, TV data, or medical insights. For the investor, the goal is to integrate these "scarce" sources to explain the "why" behind the market movements captured by high-frequency news.

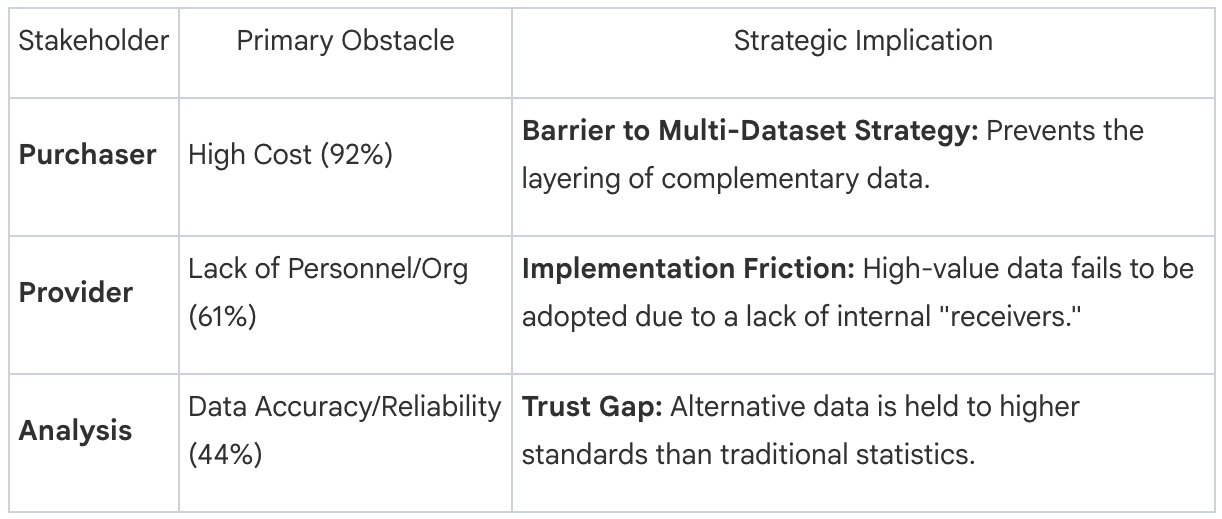

4. Navigating Structural Barriers: Cost, Talent, and the Legal Framework

Achieving data-driven alpha is currently stalled by significant friction points. For the C-suite, these are structural barriers that prevent the transition from Proof of Concept (PoC) to institutionalized implementation.

The Tiered Challenge Matrix

Furthermore, the legal landscape has become a prerequisite for sustainable operations. Organizations must prioritize compliance with the following three frameworks:

- Personal Information Protection Law (56%)

- Copyright Law (49%)

- Financial Instruments and Exchange Act (36%)

The shortage of specialized personnel remains the most acute bottleneck. Moving forward, the inability to find staff who can bridge the gap between investment strategy and data science will be the primary reason for PoC failure.

5. Conclusion and Strategic Outlook for Investment Professionals

The 2025 Factbook confirms that alternative data has matured into a structural and persistent demand phase. The transition from experimentation to institutionalization is well underway, but success now depends on the seamless linkage of data with AI-driven interpretation.

Strategic Roadmap (36-Month Horizon)

- Institutionalize Human Capital: Move from generalist teams to specialist "Data-Investment" hybrids. The rise in purchasers maintaining 3–5 dedicated staff represents a significant institutionalization of this function compared to previous years.

- AI-Centric Data Sourcing: Prioritize machine-readable datasets that excel in "Meaning Extraction" and "Summarization." Data must be sourced specifically for its utility within AI-led workflows.

- Regulatory Compliance as a Feature: Do not view compliance as a burden. Leverage the JADAA Due Diligence Questionnaire (DDQ)—a tool specifically updated to detect legal violations and other risks in Personal Information and Copyright—to accelerate implementation and mitigate risk.

The trajectory of the Japanese market is clear: firms must adopt "international learning" to solve domestic talent and cost challenges. Those who fail to link their AI initiatives with robust alternative data sets will face diminishing returns, while those who integrate these pillars will capture a sustainable lead in the pursuit of alpha.