The FUNDINNO IPO

FUNDINNO went public on the Tokyo Stock Exchange Growth Segment on December 5, 2025, at the top of the indicated range from JPY 600 to 620. After reaching a high of JPY 935 during the first day of trading, the stock has since settled in around the JPY 800 mark, giving FUNDINNO a market cap of approximately USD 120m.

FUNDINNO is not merely a FinTech company; it is the architect of a new, more equitable startup financing landscape for Japan. FUNDINNO's core mission is to fundamentally redesign the flow of capital, talent, and information to power the next generation of innovators. This ambition is captured in its foundational vision: "Create a future where everyone can challenge fairly" (「フェアに挑戦できる、未来を創る。」). FUNDINNO believes that groundbreaking ideas should be judged on their merit, not on their access to traditional, closed-off networks.

To realize this vision, FUNDINNO is building a comprehensive platform that provides "fair access to money, people, and information" (「カネ・ヒト・情報へフェアにアクセスできるプラットフォームを創る」). This platform serves as a central hub for the entire startup lifecycle, from initial funding to growth support and eventual liquidity. FUNDINNO's strategic goals are both clear and transformative: in the mid-term, the firm aims to "democratize the unlisted stock market," and its long-term ambition is to "replace financial markets with DX." This establishes the monumental scale of FUNDINNO's objective—to build the foundational infrastructure for Japan's innovation economy. The current confluence of government policy, evolving market dynamics, and vast untapped domestic capital creates an unprecedented and lucrative opportunity to turn this vision into reality.

1. The Market Opportunity: A Tectonic Shift in Japanese Venture Capital

The current market environment represents a strategic inflection point, creating a perfect storm for FUNDINNO's accelerated growth. A powerful alignment of government-led initiatives, shifts in capital market structures, and a vast, under-mobilized pool of domestic savings has created powerful tailwinds that directly amplify the value of its platform. FUNDINNO is not just participating in a growing market; they are positioned as an essential enabler of a national strategic priority.

- Government-Led Growth: Japan's national "Startup Development 5-Year Plan" has set a clear mandate: increase startup investment to 10 trillion JPY by 2027 (although this is unlikely to be met). Critically for FUNDINNO, the plan explicitly targets market intermediaries to facilitate 180 billion JPY in startup funding by the same year. This positions FUNDINNO's platform not as a peripheral player, but as a core component of Japan's national economic strategy, ensuring sustained policy support and market momentum.

- Evolving Capital Markets: The recent tightening of listing standards for the TSE Growth market will have a profound effect on the startup ecosystem. As the pre-IPO period for promising companies lengthens, the demand for alternative, pre-public funding and liquidity solutions will intensify. FUNDINNO's platform is perfectly designed to meet this escalating need, providing both growth capital for later-stage startups and exit opportunities for their early backers long before a traditional IPO.

- Untapped Household Capital: The sheer scale of domestic capital is staggering. Over 2,000 trillion JPY in Japanese household financial assets currently exist, with more than half held in low-yield cash and deposits. The government's nationwide push "from savings to investment" is actively encouraging the mobilization of this capital. FUNDINNO provides the ideal, regulated, and accessible platform to channel a portion of this immense wealth into the high-growth potential of the startup asset class, unlocking a massive new investor base.

This convergence of macro-level opportunity creates a clear and pressing need for a sophisticated, integrated, and reliable platform—a need that FUNDINNO was built to fulfill.

2. The Solution: An Integrated Equity Platform for the Entire Startup Lifecycle

FUNDINNO has built a comprehensive ecosystem designed to solve the core challenges of friction, opacity, and illiquidity that have historically plagued Japan's unlisted market. The platform is far more than a simple crowdfunding service; it is a full-stack support system for startups and investors, engineered as a single, unified segment: the "Unlisted Company Equity Platform Business." The entire model is built upon a self-reinforcing "risk money circulation cycle" (リスクマネーの循環サイクル), where capital is deployed, companies are supported, and returns are realized, encouraging reinvestment back into the ecosystem.

This cycle is powered by three interconnected and synergistic domains, with a business composition for the fiscal year ending October 2024 as follows:

- Primary Domain (68.0% of Revenue): This is the core funding engine of the platform. It provides the initial connection point, enabling startups to raise crucial capital directly from a growing community of individual and professional investors.

- Growth Domain (30.2% of Revenue): This domain provides essential post-investment support. FUNDINNO offers startups the tools and services—from shareholder management to talent acquisition—they need to scale effectively, maximizing their potential for success and enhancing investor value.

- Secondary Domain (1.8% of Revenue): This is the crucial liquidity and exit mechanism. It provides shareholders with opportunities to sell their unlisted shares, completing the investment cycle and providing the returns that fuel new primary investments.

This integrated, three-part structure creates a powerful flywheel effect, where activity in one domain directly strengthens the others, building a robust and defensible market position.

3. The Engine of Growth: A Multi-Tiered Service Architecture

FUNDINNO's strategic strength lies in its portfolio of synergistic services, which cater to startups at every stage and investors of every profile. By addressing the distinct needs of the market with specialized solutions, FUNDINNO creates multiple revenue streams and a powerful, defensible ecosystem.

3.1. Primary Domain: Powering Startup Funding

FUNDINNO's primary funding services are bifurcated to serve the entire spectrum of startup capital needs, from early-stage fan-building to large-scale growth financing.

Feature |

|

|

Investor Type | General & Professional Investors | Professional Investors Only |

Solicitation Method | Online Only | Face-to-Face & Online |

Annual Investment Limit | 500,000 JPY (General Investors) | No Limit |

Company Funding Limit | Under 100 Million JPY | No Limit |

Target Stage | Primarily Early-Stage | Mid- to Later-Stage |

The strategic synergy between these services is the key to FUNDINNO's market leadership. FUNDINNO serves as the broad-funnel acquisition engine, building a vast user base and establishing a dominant brand presence with a 90.8% market share in equity crowdfunding. This foundation allows FUNDINNO PLUS+, launched in November 2022, to efficiently connect high-potential, later-stage companies with qualified professional investors capable of deploying significant capital. FUNDINNO PLUS+ is now the primary engine of FUNDINNO's revenue growth, leveraging the trust and infrastructure built by its flagship service.

3.2. Growth Domain: Cultivating Success

Funding is only the beginning. FUNDINNO provides startups with the critical tools they need to manage their operations and accelerate growth.

- FUNDOOR: A sophisticated SaaS platform for shareholder and corporate management. Its key functions include a cloud-based shareholder registry, paperless shareholder meeting administration, and an integrated IR tool for investor communications. FUNDINNO's strategic capital and business alliance with Mitsubishi UFJ Trust and Banking Corporation for the co-developed

MUFG FUNDOORservice validates its quality and expands its distribution through a trusted institutional channel. - FUNDINNO GROWTH: FUNDINNO's in-house talent acquisition arm. This service directly addresses a primary use of funds for startups by providing specialized recruiting for CxO and other key personnel. This creates a powerful cross-sell opportunity and directly supports the success of companies funded through FUNDINNO's primary domain.

3.3. Secondary Domain: Delivering Liquidity

Solving the illiquidity of unlisted shares is the final, crucial piece of the puzzle. FUNDINNO provides novel exit paths for investors, closing the loop on the investment cycle.

- FUNDINNO MARKET: An online platform enabling the trading of unlisted shares within regulated "Shareholder Communities." This provides a unique marketplace for early investors to realize returns and for new investors to gain access to previously funded companies.

- FUNDINNO MARKET PLUS+: Launched in September 2025, this service caters to the needs of founders, funds, and other major shareholders by facilitating large, negotiated block trades. It provides a structured solution for significant liquidity events outside of a traditional M&A or IPO process.

This integrated service model creates a powerful, defensible ecosystem that captures value at every stage of a startup's journey, driving both customer loyalty and diversified revenue growth.

4. Performance & Traction: Validating the Model with Results

FUNDINNO's strategic execution is validated by tangible financial results and accelerating key performance indicators. The company's performance demonstrates powerful momentum, a scalable business model, and a clear and decisive turn towards sustainable profitability.

4.1 Financial Inflection Point

After a period of strategic, front-loaded investment in the platform and market position, FUNDINNO has reached a critical financial milestone. Revenue growth is accelerating, and FUNDINNO has successfully achieved operating profitability.

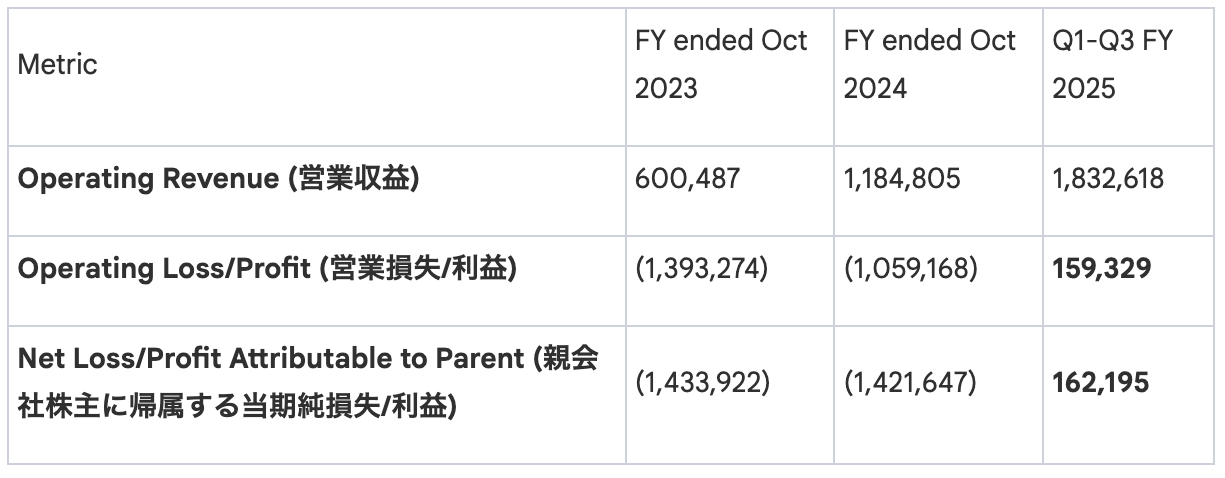

Consolidated Financial Highlights (Unit: JPY 1,000)

The data speaks for itself. FUNDINNO achieved 97.3% revenue growth in Fiscal Year 2024, driven by the successful scaling of the FUNDINNO PLUS+ service. Most importantly, the first three quarters of Fiscal Year 2025 mark a turn to an operating profit of 159.3 million JPY, a landmark achievement that validates FUNDINNO's investment strategy and demonstrates the powerful operating leverage inherent in the business model.

4.2 Key Growth Metrics

FUNDINNO's financial success is underpinned by the exponential growth of its core platform metrics. Gross Merchandise Value (GMV) and the number of professional investors are the leading indicators of market capture and future revenue potential. Both show a powerful upward trajectory.

Key Performance Indicators (Quarterly)

The explosive, step-function growth in quarterly GMV demonstrates the increasing scale and velocity of transactions on the platform. Simultaneously, the steady and rapid growth in the professional investor base ensures a deep and expanding pool of capital to meet the funding demands of high-quality startups. These strong results provide a solid foundation for FUNDINNO's ambitious future growth strategy.

5. Strategic Roadmap: From Market Democratization to DX Transformation

FUNDINNO is executing a clear, multi-phased strategy for long-term value creation. Its roadmap is designed to first lead and then fundamentally reshape Japan's financial industry, moving from FUNDINNO's established beachhead in startup finance to a broader vision of digital transformation.

5.1 Short-Term Strategy: GMV Expansion & Data Monetization

FUNDINNO's immediate focus is on aggressively expanding the Gross Merchandise Value (GMV) within the Primary Domain, with FUNDINNO PLUS+ serving as the principal driver. FUNDINNO will achieve this by broadening its investor base beyond high-net-worth individuals to include corporations, investment trusts, and overseas investors. Concurrently, FUNDINNO will begin creating value from its proprietary data assets, leveraging years of accumulated transaction and startup performance data to enhance the platform's intelligence and efficiency.

5.2 Mid-Term Strategy: Democratizing the Unlisted Stock Market

FUNDINNO's mid-term goal is to solve the three core challenges that have historically constrained Japan's private markets: insufficient risk money supply, information asymmetry, and a lack of stock liquidity. By scaling FUNDINNO's three-domain platform, the firm will create a transparent, liquid, and accessible marketplace that erases the hard line between private and public markets, empowering a new generation of companies and investors.

5.3 Long-Term Strategy: Replacing Financial Markets with DX

FUNDINNO's ultimate vision is to leverage its expertise in building regulated, tech-driven financial platforms to drive a broader digital transformation. FUNDINNO will unbundle legacy financial services and re-bundle them around a superior customer experience. By applying its DX know-how, FUNDINNO aims to build a more seamless, integrated, and customer-centric financial system, positioning FUNDINNO as a key architect of the future of finance in Japan.

This disciplined, phased approach ensures that FUNDINNO's foundational strengths in the unlisted market become the launching pad for a much larger, industry-defining opportunity.

6. The Investment Thesis: A Defensible Leader in a High-Growth Market

FUNDINNO represents a unique opportunity to invest in the primary engine of Japan's emerging innovation economy. FUNDINNO is creating a category-defining company with a proven model, accelerating traction, and a clear vision for the future. The case for investment is built on a foundation of distinct and powerful advantages.

- Vast, Unlocking Market: FUNDINNO is tapping into a multi-trillion yen opportunity, fueled by the national strategic priority of the "Startup Development 5-Year Plan" and the mobilization of over 2,000 trillion JPY in household savings. This is not just a market tailwind; it is a generational shift in capital allocation.

- Proven, Integrated Ecosystem: FUNDINNO's unique, three-domain platform creates a defensible "risk money circulation cycle." By controlling the flow from primary funding to growth support and secondary liquidity, FUNDINNO builds deep moats, network effects, and multiple, synergistic revenue streams that competitors cannot easily replicate.

- Explosive Growth & Profitability: FUNDINNO's exponential growth in GMV and professional investor registrations is translating directly to the bottom line. The recent, critical shift to operating profitability validates FUNDINNO's business model's scalability and demonstrates a clear path to sustainable, high-margin growth.

- Clear Strategic Vision: FUNDINNO has an ambitious and well-defined roadmap to expand from its current leadership position to democratize the entire unlisted market and, ultimately, drive the DX-powered transformation of Japan's financial landscape.

- Robust Governance & First-Mover Advantage: As a licensed and regulated financial institution with a mature corporate governance structure, FUNDINNO operates with the trust and credibility necessary to lead this market. FUNDINNO's deep experience and first-mover advantage have created a competitive moat built on regulatory expertise, technology, and an unmatched data asset.