The Future Mitsui Sumitomo Insurance Group

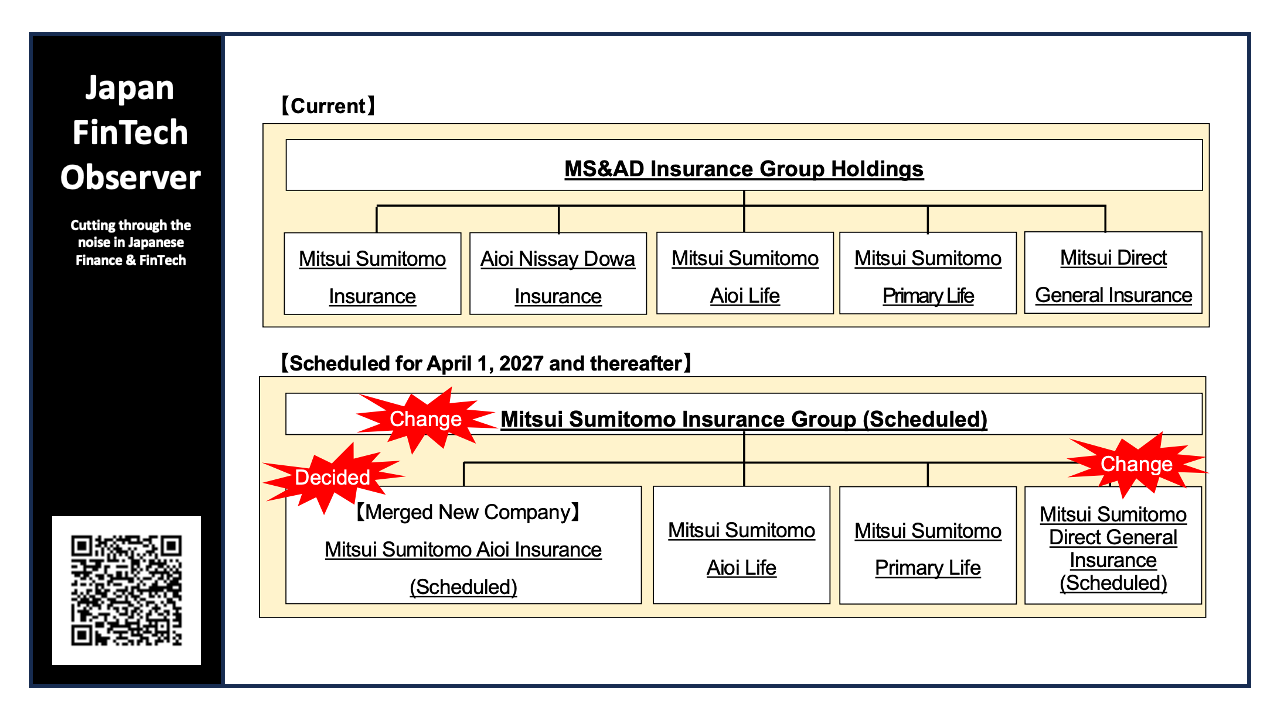

Mitsui Sumitomo Insurance (MSI) and Aioi Nissay Dowa Insurance (ADI), the core non-life insurance companies of MS&AD Insurance Group Holdings, are progressing with merger discussions as announced on March 28, 2025. Now, decisions have been made regarding changes to the company name and related details, as well as the corporate overview of the new company resulting from the merger, subject to the approval of shareholders' meetings and relevant authorities.

1. New Company Structure

MS&AD Insurance Group Holdings will change its name (see title graphic) since, upon merger, the core non-life insurance companies will no longer coexist within the group. The new company name, Mitsui Sumitomo Insurance Group, reflects the unified group brand, intended to attract recognition internationally and thus further enhance our brand. Mitsui Sumitomo Insurance Group will relocate its head office from the perspective of strengthening group management.

The name of the merged non-life insurance companies, Mitsui Sumitomo Aioi Insurance Company, is based on the existing brand built together with the strong customer base of MSI and ADI, minimizing the risk of misunderstanding or concern on the part of our customers. MSI will be the surviving company, and its headquarters will serve both Mitsui Sumitomo Aioi Insurance Company and Mitsui Sumitomo Insurance Group.

The trade names of group companies are planned to be aligned with a unified brand to demonstrate the strengthening of group management, such as changing "Mitsui Direct General Insurance" to "Mitsui Sumitomo Direct General Insurance." Decisions will be made after the prescribed procedures at each company.

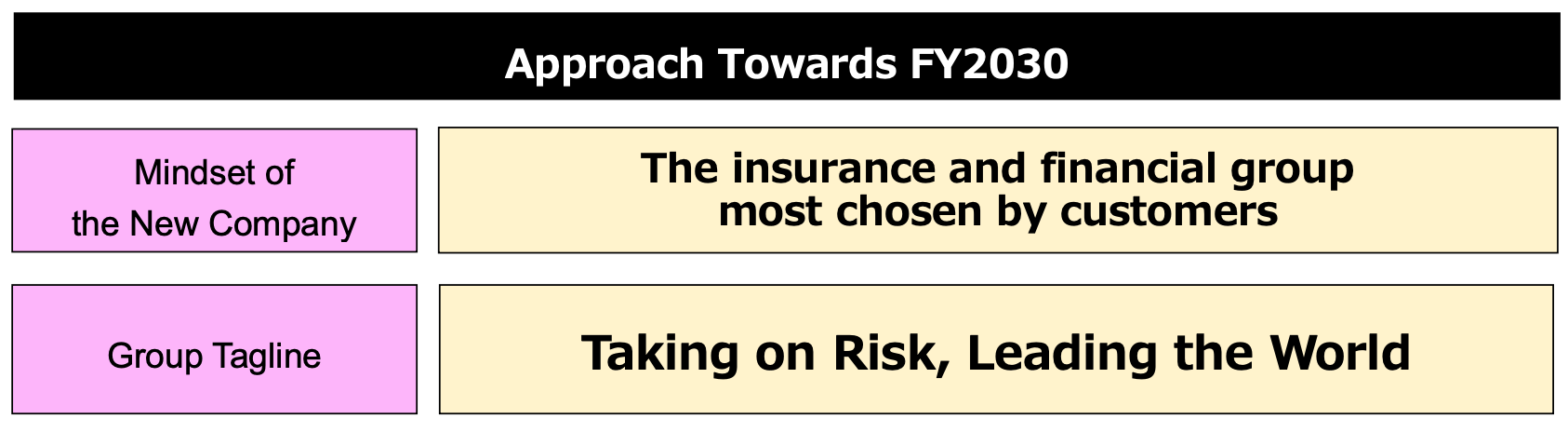

2. Aspiration for Fiscal Year 2030

Aspiration of the Group

The New Company will seek to deliver the intrinsic value of insurance and strive to become the insurance and financial group most chosen by its customers. Building on this effort, the Group will become an entity that, in an era of increasing uncertainty, forecasts changes and solves social risks in order to be entrusted with customers’ precious future (“Taking on Risk, Leading the World”) .

Through the Group's globally expanding business base, it will provide optimal security, the best experiences, and cutting-edge solutions, contributing to the development of a vibrant society and the healthy future of the Earth.

The profit target for FY2030 based on the current outlook assumes 700 billion yen as a level that can maintain a trend of increasing dividends even after completing the sale of strategic equity holdings. As the group's aspiration, 1 trillion yen in profit is set as one milestone, with the international business leading the Group’s profit growth as a strategic growth domain.

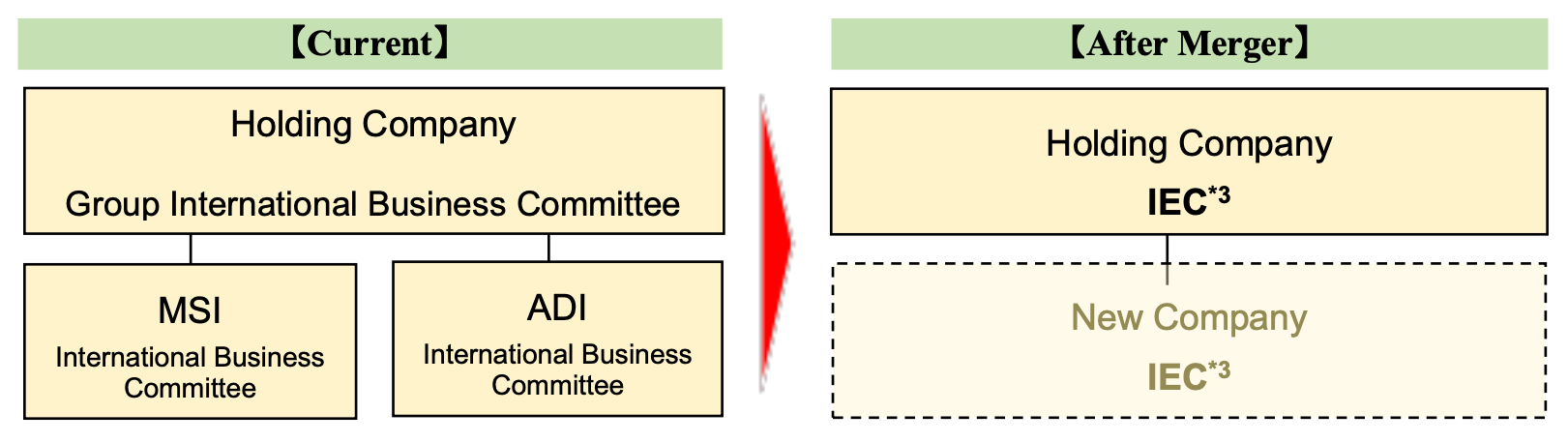

To balance group growth and discipline based on the grand strategy and appropriate allocation, group management will be strengthened centered on the holding company, with a particular focus on the following holding company functions.

- Strengthening the strategic planning function

- By strengthening the human resources and general affairs departments and establishing new departments such as the financial planning department, the effectiveness of the holding company’s steering functions will be enhanced.

- By establishing the life insurance business planning department and strengthening the functions of the international business planning department, strategic planning functions in growth domains will be reinforced.

- Strengthening the governance

- The holding company will consider placing personnel on the front lines of sales in its operating companies and establishing a system to share information about events that may lead to risk signals with the headquarters. This will enhance the group's capability to detect early signs of risk.

- The holding company will shift the operation of international businesses to the holding company-centered management. Accordingly, functions related to international businesses within the operating companies will, in principle, be consolidated into the holding company.

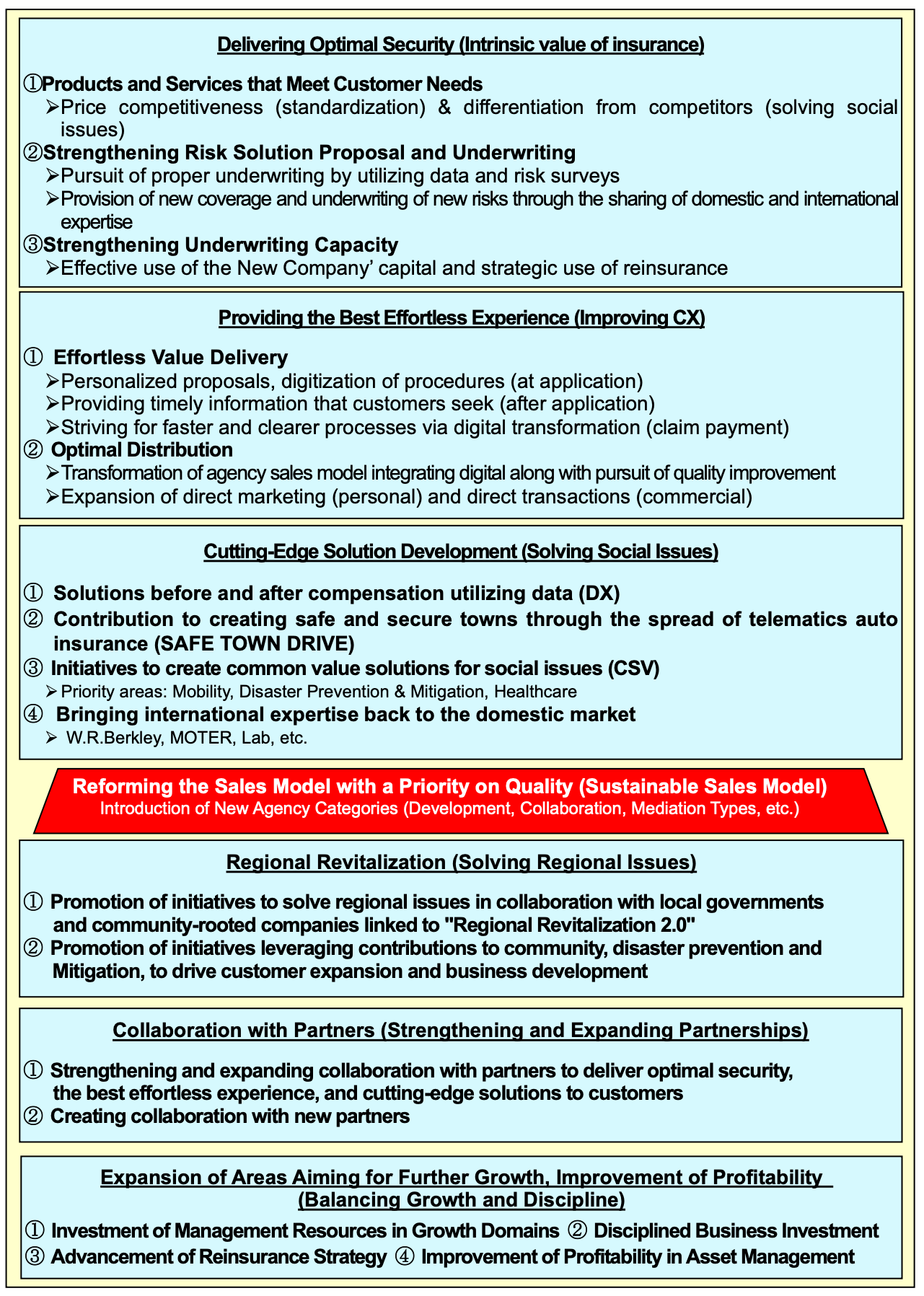

Aspiration of the Domestic Non-Life Insurance Business

The domestic non-life insurance business will continue to be positioned as the "core business domain of the group" by integrating and expanding the strengths of Mitsui Sumitomo Insurance and Aioi Nissay Dowa Insurance, and stably generating profits commensurate with its scale.

To achieve profit generation and market expansion that meet stakeholder expectations through the enhancement of the business foundation and continuous challenges, the merged entity will promote initiatives centered on the following, in line with the group aspiration.