The GO-NET Legacy - Japan's Three Megabanks to Jointly Issue Stablecoins

Japan's three megabanks are planning to jointly issue corporate-use stablecoins pegged to legal tender like the yen and the dollar, aiming to promote their use in the country.

MUFG Bank, Sumitomo Mitsui Banking Corp. and Mizuho Bank intend to issue the stablecoins under a unified standard for use in corporate fund settlements, as reported by the Nikkei.

The three megabanks, which have broad client bases, aim to accelerate the adoption of stablecoins in Japan by coordinating their efforts.

They will begin demonstration tests of their stablecoins using a system developed by Tokyo-based fintech firm Progmat.

Major general trading house Mitsubishi is being considered as the first user of the planned stablecoins for its settlements.

The GO-NET Legacy

All too often, Japanese institutions are considered as moving too slowly. Arguably, GO-NET marks an initiative where MUFG was ahead of its time, with an ambitiously broad approach to payments that has come to fruition about half a decade later. Hence, for the stablecoin alliance described above, it might be well worth to dust off those old GO-NET plans again.

Toward the full-scale launch of its payment network business, MUFG established Global Open Network jointly with Akamai. Furthermore, in April 2019 the two companies launched Global Open Network Japan (GO-NET Japan), an operating company aimed at providing an open payment network in Japan.

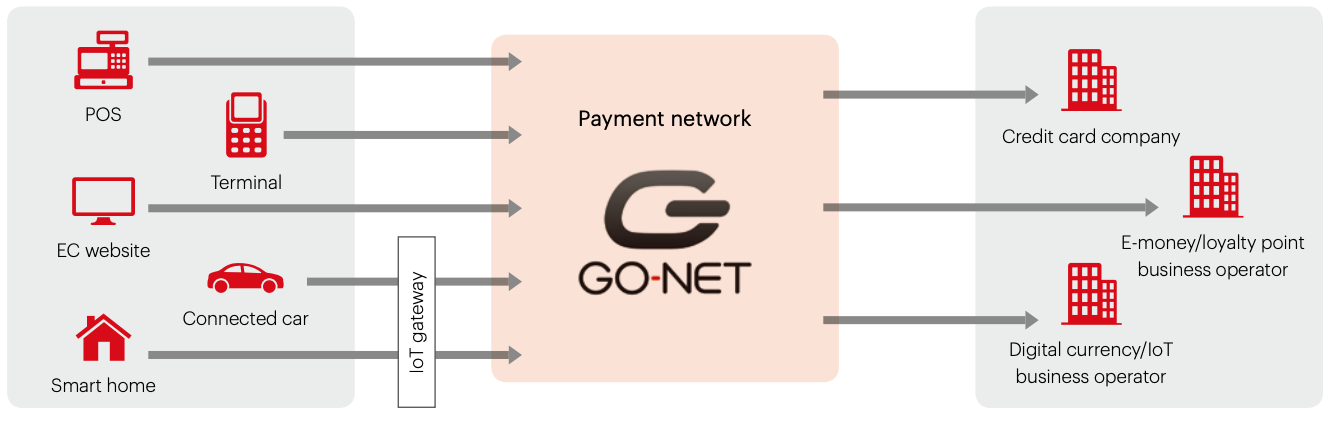

GO-NET Japan was planning to initiate services targeting credit card, e-money, digital currency, loyalty points and pre-paid card business operators after the first half of 2020.

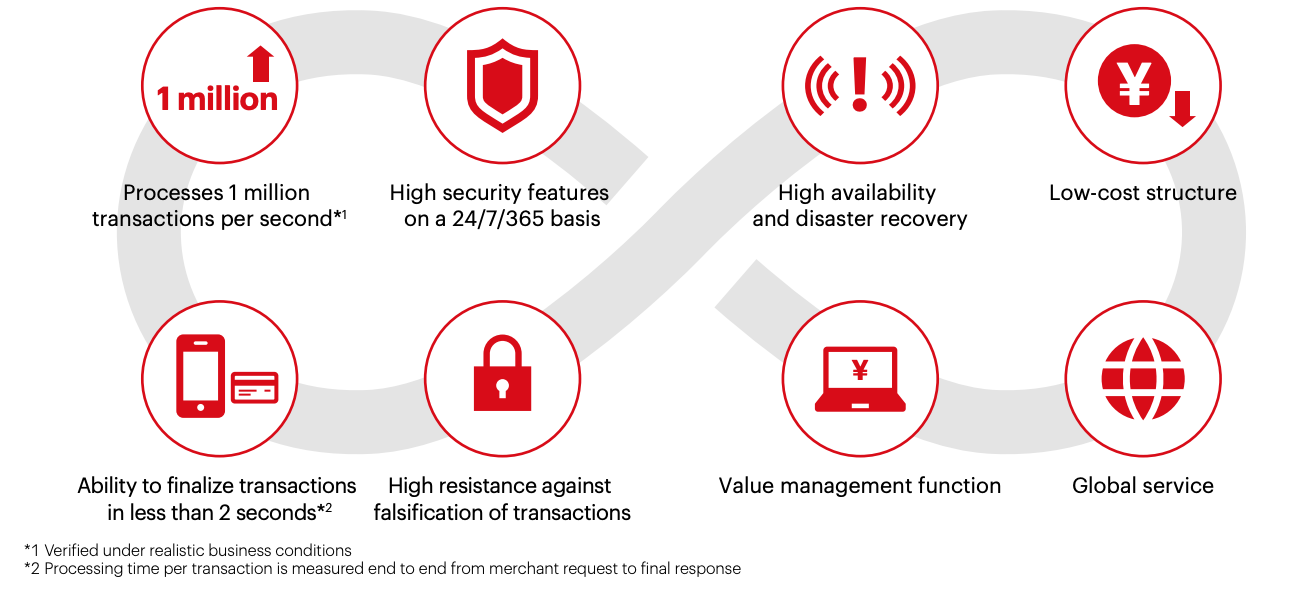

These services were to be supported by “GO-NET”, a highly secure payment network finely tuned to meet service needs in an IoT society employing new blockchain technology co-developed by MUFG and Akamai.

In fact, GO-NET was expected to have the capacity to process more than 1 million transactions per second. With this in mind, MUFG believed that this network is sufficiently capable of accommodating growing needs arising from the emergence of an IoT society that will entail large number of micro payments.

In February 2022, MUFG announced that it would suspend the operations of “GO-NET Japan”. While its primary business was launched in April 2021, the slow growth of payment transaction numbers caused by the impact of the COVID-19 pandemic and other factors made it difficult to develop its business on the scale originally anticipated.

In addition, in the IoT business, which GO-NET Japan had planned to expand in future, it struggled to find a fit to the growing market needs with its high scalability and multi-connectivity data processing blockchain, and commercialization of the product was expected to take longer than anticipated.

As a result, the business was not expected to be able to achieve profitability in a reasonable timeframe, and it was concluded that it would be desirable to suspend its operations.