The Impact Imperative: A Strategic Guide to Impact Accounting from Pioneering Japanese Corporations

A fundamental re-evaluation of corporate value is underway, compelling leaders to measure what was once considered immeasurable. At the forefront of this shift is impact accounting, a discipline defined by the International Foundation for Valuing Impacts (IFVI) and the Value Balancing Alliance (VBA) as the practice of measuring an organization's social and environmental impacts, converting them into monetary values, and integrating this data with traditional financial information to guide decision-making. This moves beyond treating societal effects as mere "externalities" and internalizes them as core components of corporate performance.

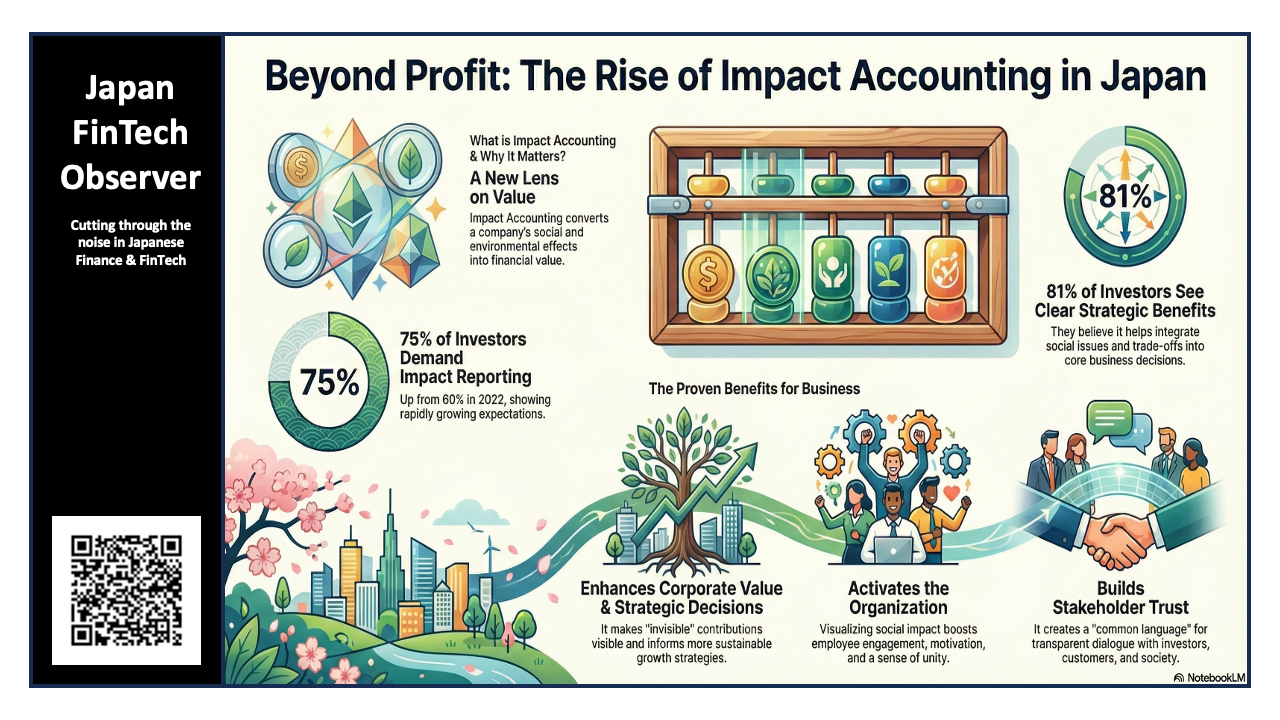

This strategic evolution is not an academic exercise; it is being driven by powerful market forces. A 2023 PwC survey of global investors reveals an undeniable trend: 75% of investors believe it is important for companies to report on their social and environmental impacts, and 81% state that clarifying the monetary value of these impacts helps integrate trade-offs into business decisions. The message from capital markets is clear: quantifiable, transparent impact data is no longer a "nice-to-have" but a critical element in assessing long-term value and resilience.

A recent white paper, published by the Impact Startup Association, the Japan Association of New Public (Shin Koeki Renmei), and Keizai Doyukai, serves as a strategic guide for corporations navigating this new landscape. By analyzing the methodologies, benefits, and challenges observed in the pioneering implementations of impact accounting by leading Japanese companies, it provides a clear framework for turning impact measurement into a strategic advantage. The move towards impact accounting is not driven by compliance alone, but by a clear set of strategic benefits that create tangible value across the enterprise.

1. The Five Core Benefits of Impact Accounting: A Strategic Analysis

The adoption of impact accounting is a strategic initiative that delivers tangible benefits across an organization. The experiences of Japan's pioneering corporations reveal that monetizing and managing impact creates a virtuous cycle. This process begins by quantifying comprehensive value to meet investor demands, which provides the robust data needed to sharpen strategic decisions. This, in turn, energizes employees who see their purpose quantified, leading to better execution and stronger, trust-based relationships with all external stakeholders. This section analyzes these five primary value drivers, demonstrating how impact accounting unlocks a more comprehensive and resilient form of corporate value.

1.1. Enhancing Comprehensive Corporate Value

Impact accounting makes a company’s non-financial contributions to society and the environment visible and quantifiable. By translating abstract concepts like environmental protection or social well-being into monetary terms, it elevates the assessment of corporate value far beyond traditional financial metrics. This provides stakeholders with a holistic ledger of value creation.

- Sekisui Chemical exemplifies this by disclosing a "Stakeholder Comprehensive Income," a metric that integrates net income with the monetized value of its positive and negative non-financial impacts.

- Similarly, pharmaceutical giant Eisai discloses "Product Impact Comprehensive Revenue," which adjusts its sales revenue to include the monetized social value generated by its products, offering a more holistic view of its top-line performance.

1.2. Sharpening Strategic Decision-Making

By placing a monetary value on social and environmental outcomes, impact accounting equips leaders to make more holistic and sustainable strategic decisions. This data provides a new lens for evaluating trade-offs, identifying previously hidden non-financial risks, and uncovering new business opportunities aligned with societal needs.

- Nissin Foods Holdings has adopted impact quantification with the explicit goal of creating a management framework that seeks to maximize both financial and social impact.

- Yamaha Motor uses the quantification of social value to create multi-axis business judgments, moving beyond purely financial criteria to build a more resilient and purpose-driven corporate strategy.

- Gojo & Company utilizes impact analysis to reconfirm the significance of its microfinance business and inform future business development, grounding its growth strategy in proven client benefits.

1.3. Revitalizing the Internal Organization

Making the social value of business activities concrete and measurable has a profound effect on employee engagement and motivation. When employees can see the tangible, positive impact of their work quantified in a common language, it fosters a powerful sense of purpose and organizational unity.

- KDDI leverages its impact data in internal study sessions to promote a deeper, shared understanding of its sustainability vision.

- For the health-tech startup Ubie, visualizing its impact serves as a "compass" for internal decision-making and has had a positive effect on employee engagement.

- Companies like Nissin Foods Holdings and Eisai use employment impact calculations to show quantifiable contributions to diversity and local communities, while Sekisui Chemical aims to raise employee awareness of their role in value creation. Yamaha Motor also explicitly cites improved employee motivation as an expected outcome.

1.4. Building Trust with External Stakeholders

In a world of complex sustainability claims, quantified impact data serves as a "common language" for credible dialogue with investors, customers, and the community. This transparency moves conversations beyond abstract commitments to concrete, measurable performance, enhancing corporate accountability and building deep, lasting trust.

- KDDI calculates and communicates the social impact of its IoT business in press releases and sustainability reports, fostering a greater external understanding of its sustainability-focused management.

- Ubie adopted impact accounting to create a common language that better conveys its mission and vision to external partners and stakeholders.

1.5. Responding to Evolving Demands for Non-Financial Disclosure

Impact accounting directly addresses the growing demand from investors and society for robust, comparable, and decision-useful non-financial data. It provides the quantitative evidence needed to evaluate a company's long-term growth prospects, risk management capabilities, and contribution to a sustainable economy.

- Sekisui Chemical began its journey to visualize corporate value in direct response to the shift in investor focus from short-term efficiency to long-term sustainability.

- Eisai's groundbreaking work on employment and product impact has been recognized by international initiatives like the G7 Impact Taskforce, positioning it as a leader in responding to this evolution.

- Yamaha Motor also cites improved understanding of its activities by external investors as a key outcome of adopting impact accounting.

These strategic benefits illustrate a clear and compelling business case. However, understanding the practical realities of implementation in the Japanese market is crucial for any company considering this path.

2. The Current Landscape: Impact Accounting Adoption and Challenges in Japan

To fully appreciate the strategic opportunity, it is essential to understand the current adoption landscape. Data from recent surveys provides a clear overview of how Japanese companies and investors are approaching impact accounting, as well as the primary obstacles they face on the path to implementation.

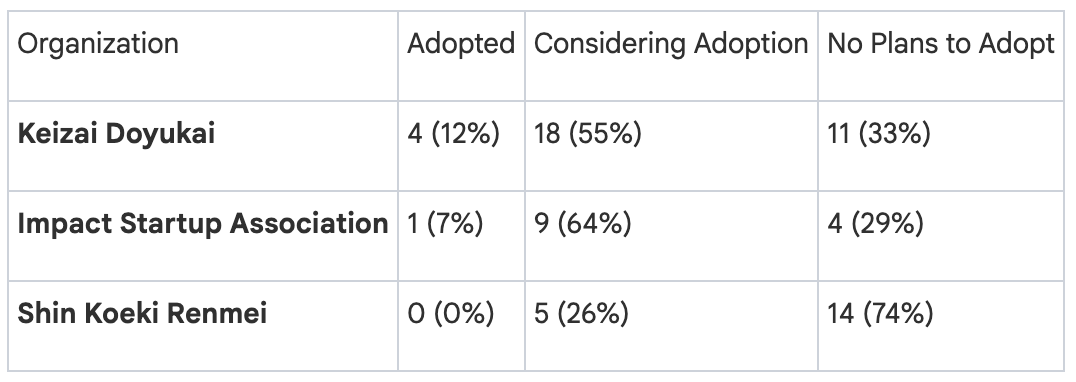

A joint survey of member companies from Keizai Doyukai, the Impact Startup Association, and Shin Koeki Renmei reveals a growing interest, with a significant number of organizations actively exploring implementation.

Among these organizations, at least 37 companies have either adopted or are currently considering the adoption of impact accounting. The primary challenges cited by these corporations include:

- Overcoming Internal Inertia: A lack of internal understanding and hurdles in building organizational consensus.

- Resource Constraints: Significant limitations in human resources, specialized know-how, and available budget.

On the investor side, a survey conducted by GSG Impact JAPAN found that at least 16 investment organizations have either adopted or are considering impact accounting for their analysis and decision-making processes. The key challenges identified by investors mirror corporate concerns but also highlight issues of data quality:

- Capability and Cost Barriers: Insufficient human resources and high implementation costs.

- Data Integrity Concerns: Doubts regarding the reliability, transparency, and comparability of disclosed impact data.

While these challenges are significant, they are not insurmountable. The following in-depth case studies provide a practical playbook, demonstrating how pioneering firms are successfully navigating these obstacles to unlock the strategic benefits of impact accounting.

3. Pioneering Implementation Models: In-Depth Case Studies

To move from theory to practice, it is essential to analyze the real-world models of pioneering companies. The following case studies deconstruct the objectives, methodologies, and outcomes of several leading Japanese firms. These examples provide a practical blueprint for how organizations across different sectors are leveraging impact accounting to drive strategy, enhance stakeholder engagement, and redefine corporate value.

3.1. Eisai: Quantifying Pharmaceutical and Human Capital Impact

- Corporate Profile and Objective: Eisai is a global research and development-focused pharmaceutical company. Its primary objective for adopting impact accounting was to quantitatively prove its corporate purpose—making contributions to patient health—and to complement its "Yanagi Model" of corporate value, which visualizes the influence of non-financial capital.

- Methodology and Application: In a joint research project with the Harvard Business School Impact-Weighted Accounts Initiative (HBS IWA), Eisai focused on two key areas:

- Employment Impact: An analysis quantifying the "quality of wages" (impact on employee satisfaction) and "employee opportunity" (gender pay and promotion gaps) for its Japanese workforce.

- Product Impact: Eisai calculated the social value created by its free distribution of the lymphatic filariasis treatment drug "DEC." This was done by monetizing the productivity loss and medical costs avoided due to the prevention and treatment of the disease.

- Quantified Results: For 2019, Eisai calculated a positive employment impact of ¥26.9 billion. More recently, the company has begun disclosing a "Product Impact Comprehensive Revenue," forecasting that by fiscal year 2030, this figure will reach ¥2.7 trillion, or approximately 1.5 times its projected consolidated sales revenue.

- Strategic Outcomes and Future Initiatives: The implementation provided powerful, quantitative evidence for investor engagement and helped demonstrate the social significance of its activities to employees. Eisai's work has been featured in international reports, contributing to the global development of impact accounting. The company plans to continue expanding its analysis to include new treatments like the Alzheimer's drug "Lecanemab."

3.2. KDDI: Monetizing the Social Value of Technology

- Corporate Profile and Objective: KDDI is a major telecommunications operator. Its main goals were to visualize non-financial corporate value, foster a deeper internal understanding of sustainability-focused management, and quantify previously unrecognized value created by its business activities.

- Methodology and Application: Using the HBS IWA framework, KDDI focused on the social impact created by its Internet of Things (IoT) business lines, including connected cars, home security, and smart meters. For example, to calculate the impact of connected cars, it estimated the value of lives saved through automated emergency calls by multiplying the number of KDDI IoT lines by the reduced fatality rate and the labor value of a statistical life.

- Quantified Results: For the fiscal year ending in 2024 (fiscal year 2023), KDDI calculated that its IoT business generated a social impact of ¥646.1 billion. This figure was 188.1% of the business segment's EBITDA, demonstrating a social value creation far exceeding its traditional financial earnings.

- Strategic Outcomes and Future Initiatives: The results were shared internally through study sessions, deepening employee understanding of how their services contribute to society. Externally, the disclosure was covered by major media, enhancing KDDI's reputation. The company plans to continue these calculations annually and is exploring methods to calculate the future impact of new business lines.

3.3. Sekisui Chemical: Integrating Impact into a "Stakeholder Comprehensive Income"

- Corporate Profile and Objective: Sekisui Chemical is a diversified manufacturing company active in housing, infrastructure, and chemicals. It adopted impact accounting to respond to the shift in investor focus from efficiency to sustainability and to create a framework for maximizing both profits and social impact.

- Methodology and Application: The company developed the concept of "Stakeholder Comprehensive Income." This metric starts with net profit and then adds monetized positive non-financial impacts and subtracts negative impacts. It uses the HBS IWA framework to visualize this across the entire product life cycle.

- Quantified Results: The results are visualized in a powerful waterfall chart that begins with "Net Profit" and then methodically adds positive impacts like "Employment Creation" and "Product Environmental Contribution" while subtracting negative impacts such as "GHG Emissions from Production" and "Supply Chain GHG Emissions." This provides a transparent, comprehensive view of how the company's financial performance is augmented and offset by its non-financial value creation, culminating in the final "Stakeholder Comprehensive Income."

- Strategic Outcomes and Future Initiatives: This approach clarifies corporate value that is not visible on traditional financial statements, showing both current and future value-creation potential. Initially used as a tool for dialogue with stakeholders, Sekisui Chemical is now exploring how to use impact accounting as a core management indicator to guide strategic business decisions.

3.4. Nissin Foods Holdings: Analyzing the Impact of Supply Chain and Employment

- Corporate Profile and Objective: A global leader in instant noodles, Nissin's objective is to use impact quantification to inform management decisions that maximize both financial and social impact.

- Methodology and Application: Using the IWA framework, Nissin focused on two priority areas:

- Product Impact: It calculated the net social impact of switching from non-certified palm oil to RSPO-certified palm oil, monetizing benefits like reduced CO2 emissions and improved labor conditions.

- Employment Impact: It measured its net impact on employees by starting with total wages and subtracting negative factors like gender wage gaps, while adding positive factors like local job creation.

- Quantified Results: The analysis delivered a decisive finding: the positive social impact generated by using certified palm oil significantly exceeded the additional procurement cost. The employment impact analysis found that approximately 67% of its total payroll translated into positive social impact, a level comparable to leading U.S. firms.

- Strategic Outcomes and Future Initiatives: The analysis provided quantitative proof that sustainable sourcing is not just an ethical imperative but a value-positive investment, giving management a powerful tool to justify and expand such initiatives against purely cost-based arguments. It also identified that improving the ratio of female managers could create further social and corporate value. Nissin plans to engage with investors to refine its analysis over time.

3.5. Yamaha Motor: Shifting from "Doing Good" to "Creating Value"

- Corporate Profile and Objective: Yamaha Motor is a multi-faceted manufacturer of mobility products. Its goals were to improve stakeholder understanding of its activities, update its management decision-making axes to include sustainability, and strengthen human capital management by boosting employee engagement.

- Methodology and Application: The company applied impact accounting to several initiatives, including its "Green Slow Mobility" electric vehicles. For this business, it monetized impacts such as reduced medical and nursing care costs resulting from increased physical activity among users.

- Quantified Results: For fiscal year 2023, the social impact generated by its Green Slow Mobility business across 31 operating units in Japan was calculated at ¥18.4 million.

- Strategic Outcomes and Future Initiatives: The most significant outcome was an internal mindset shift—from viewing these activities as "doing good" to seeing them as "creating social value." This reframing is critical for integrating sustainability into core business operations, transforming a cost center (CSR) into a value driver (strategic investment). This has improved partner understanding, enhanced multi-axis decision-making, and boosted employee motivation.

3.6. Ubie: Aligning a Startup's Mission with Health Impact Metrics

- Corporate Profile and Objective: A health-tech startup providing a symptom-checker platform, Ubie's core objective was to create a "common language" to express its vision of guiding people to appropriate medical care.

- Methodology and Application: Ubie developed a logic model to connect its activities to societal outcomes and monetized its primary impact: extending healthy lifespans. This was done by calculating the increase in Quality-Adjusted Life Years (QALYs) attributable to its platform and converting this to an economic value based on methodologies from the pharmaceutical industry.

- Quantified Results: Since its founding in 2017, Ubie estimates its platform has contributed to an extension of healthy lifespans by over 27,000 years, with a monetized economic value of more than ¥150 billion.

- Strategic Outcomes and Future Initiatives: Internally, the impact metrics have become a "compass for decision-making" and boosted employee engagement. Externally, they have helped Ubie more effectively communicate its value to investors and partners. The company is now working to refine its model to better isolate its specific contribution and integrate the impact story more deeply into its investor relations activities.

3.7. Gojo & Company: Measuring Direct Impact on Financial Inclusion

- Corporate Profile and Objective: A microfinance company dedicated to providing financial services in developing countries. Its objective was to enable stakeholders to holistically understand both its financial and social performance.

- Methodology and Application: In collaboration with IFVI and using the HBS IWA framework, Gojo surveyed over 1,600 clients in India to measure the change in their household income after receiving loans. This income increase was then monetized as a direct social impact.

- Quantified Results: The analysis found that the monetized impact of increased client income was USD 64 million. This represented 120% of the company's accounting revenue, signifying that for every dollar of revenue, it created an additional 20 cents of positive social impact for its clients.

- Strategic Outcomes and Future Initiatives: The pilot confirmed that impact accounting can effectively visualize social value that financial statements alone cannot capture. However, Gojo identified the critical challenge of needing to measure net income (after business expenses), not just gross income. This distinction is critical, as measuring only gross income risks overstating the true welfare impact and could lead to misguided product or service strategies. The challenge highlights the operational maturity required to move from high-level to decision-grade impact data.

These pioneering implementations reveal common threads for success. The use of established frameworks like HBS IWA provides initial credibility (Eisai, KDDI), a focus on a material business area yields the most actionable insights (Nissin's palm oil, KDDI's IoT), and even early-stage analyses can create powerful internal mindset shifts (Yamaha Motor) and serve as a "compass" for growth (Ubie).

4. A Framework for Successful Implementation: Key Considerations

The learnings from Japan's pioneering corporations distill into a clear framework of critical success factors. For any organization considering the adoption of impact accounting, focusing on the following three pillars is essential to move from a theoretical exercise to a value-creating management tool.

4.1. Ensuring Transparency and Credibility

To gain the trust of internal and external stakeholders, the process must be transparent. It is essential to clearly disclose the rationale for selecting a specific business area for analysis, the data sources used, and the complete calculation logic. Crucially, this includes reporting both positive and negative impacts to prevent any perception of "impact washing"—the selective disclosure of favorable results. Collaborating with external organizations, such as international standards bodies or audit firms, can further enhance objectivity and ensure the credibility of the final results.

4.2. Developing Data Systems for Continuous Improvement

Impact accounting should not be treated as a one-time project. To be truly valuable, it must be integrated into the organization's management rhythm. This requires establishing robust and efficient systems for data collection and storage. The goal is to create a continuous PDCA (Plan-Do-Check-Act) cycle where regular impact measurement provides feedback that informs ongoing business improvements, strategic planning, and resource allocation. This transforms impact accounting from a static report into a dynamic tool for management.

4.3. The Power of Narrative: Weaving Data into a Compelling Story

Numerical data alone is rarely sufficient to engage stakeholders on an emotional or strategic level. The true power of impact accounting is unlocked when the quantified results are woven into a compelling narrative. This story must connect the numbers to the company's core purpose, its business strategy, and the specific societal challenges it aims to address. A powerful narrative translates cold data into a story of value creation, fostering genuine understanding, empathy, and buy-in from employees, investors, and customers alike.

5. Conclusion: The Future of Corporate Value and the Role of Impact Accounting

The evidence from Japan's corporate pioneers is clear: impact accounting is more than a new accounting method; it is a fundamental re-examination of corporate value itself. It provides a practical toolkit for businesses to measure what has long been considered immeasurable, thereby aligning profit with purpose in a tangible and credible way.

The primary learnings from these advanced case studies demonstrate that a well-executed impact accounting strategy delivers transformative benefits:

- It provides a more comprehensive view of corporate value and enhances strategic decision-making by integrating non-financial risks and opportunities.

- It revitalizes the internal organization by connecting employees' daily work to a larger, measurable social purpose.

- It builds stronger, trust-based relationships with investors and other stakeholders through transparent, data-driven communication.

Successful implementation, however, is not without its challenges. The journey requires a steadfast commitment to transparency to avoid impact washing, the development of robust data systems to enable continuous improvement, and the ability to craft a compelling narrative that brings the numbers to life.

As methodologies become more standardized and globally accepted, impact accounting will evolve from a pioneering practice to an indispensable management tool. It will be central for companies seeking to demonstrate their purpose, enhance their long-term sustainability, and prove their contribution to a more inclusive and resilient economy. In doing so, it will play a vital role in realizing the vision of a "mutual assistance capitalism," where corporate success and societal well-being are not competing priorities, but two sides of the same coin.