The Inaugural Meeting of the Startup Policy Promotion Subcommittee

The inaugural meeting of the Startup Policy Promotion Subcommittee, held in early February, marked a subtle shift in Japanese industrial policy. While historically the domain of the Ministry of Economy, Trade and Industry (METI), the subcommittee’s establishment under the Japan Growth Strategy Council indicates a direct Prime Ministerial mandate. Operationally handled by the National Growth Strategy Bureau within the Cabinet Secretariat, this move is designed to create an alternative pathway to the bureaucracy and move the needle from quantity-based metrics—simply counting new entities—to the creation of "megaliths" capable of driving national GDP.

The leadership hierarchy confirms this high-level political willpower. Chaired by the Minister for Startups, the subcommittee includes vice-ministers from the Cabinet Office (overseeing both startup and financial affairs) and METI. The 11 external experts provide a sophisticated cross-section of the innovation economy:

- Academic Rigor: Michiko Ashizawa (Keio University).

- Market Architects: Tomotaka Goji (UTEC/JVCA), Tomoko Inoue (Red Capital), and Hitoshi Fujino (Rheos Capital Works).

- Industrial Frontliners: Mitsunobu Okada (Astroscale) and Kunihiro Tanaka (Sakura Internet).

- Strategic Skeptics: Kenichi Murofushi (Murofushi Policy Lab).

This structure functions as a specialized engine for the Japan Growth Strategy Council. It is a surgical unit intended to rewire the relationship between state regulation and risk capital. However, as the Secretariat’s diagnostic audit suggests, the administrative shift is a response to a sobering reality: Japan’s ecosystem is wide, but it is not yet deep.

1. The Secretariat’s Audit: A Landscape of Regional Growth and Scale-Up Hurdles

The Secretariat’s assessment in early 2026 paints a picture of a "Growth Paradox." While the volume of startups has swelled, the ecosystem remains domestic-bound and top-heavy, lacking the vertical height required for global dominance.

1.1 The Growth Paradox and the "Unicorn Gap"

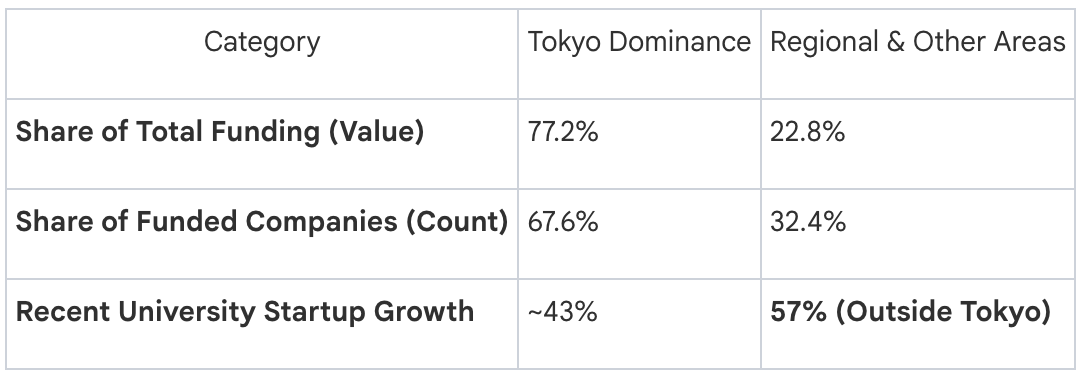

The data reveals that Japan reached 25,000 startups in 2025, a 1.5x increase since 2021. University-born startups also peaked at 5,074 in 2024. Yet, a sophisticated financial audience must look past the "Unicorn Gap" headline. While Japan has only 8 unlisted unicorns (compared to 690 in the US), the cumulative count of startups that hit a $1B valuation including those already listed stands at 41. This distinction is vital; it suggests that Japanese firms are exiting to the public markets too early, before achieving the private scale-up necessary for global impact.

1.2 The Centralized Capital Bottleneck

There is a growing regional tide—57% of recent university startup growth is happening outside Tokyo—yet capital remains stubbornly centralized. This creates a structural ceiling for regional innovation.

1.3 From Quantity to Industrial Impact

To break this "centralized capital bottleneck," the Secretariat has abandoned the pursuit of raw numbers in favor of "Selection and Concentration." By focusing on three pillars—Scale-up, Deep Tech, and Regional Ecosystems—the goal is to pivot from a quantity-based KPI to a quality-based mandate: maximizing GDP contribution through industrial-scale commercialization.

2. Financial Infrastructure: Unlocking Risk Capital and Retail Participation

The Financial Services Agency (FSA) is currently overhauling the nation’s financial "plumbing" to ensure risk capital flows into unlisted markets. This is an attempt to create an entirely new class of "Potential Professional Investors" (Senzaiteki Tokutei Toushika)—individuals who possess the capital and sophistication to invest but have historically been sidelined by disclosure requirements.

2.1 The Regulatory Toolkit

The FSA’s roadmap includes high-impact pivots to activate stagnant assets:

- Institutional Reform: Expanding Banking Reforms to allow investment periods to stretch from 10 to 20 years, providing the "patient capital" required for long deep-tech cycles.

- The Internet Solicitation Pivot: Implementation of a "Japanese version of Rule 506," easing restrictions on the solicitation of professional investors via the internet to broaden the base of available private capital.

- Retail & Crowdfunding: Raising the equity crowdfunding cap to 500M JPY and easing unlisted stock investment trust regulations.

- VCRHs & EMP: Utilizing the Venture Capital Guidelines and the Emerging Manager Program to professionalize the fund management class.

2.2 Contextualizing the JPY 180bn KGI

The FSA’s target—achieving 180 billion Japanese Yen in funding via market intermediaries by 2027—is aggressive. Considering current retail and crowdfunding totals hover around a mere 22 billion Japanese Yen, this KGI represents a massive attempted expansion of the secondary and retail bridge. By refining the "J-Ships" framework, the state is essentially attempting to manufacture a robust private placement market from scratch.

3. Expert Testimony: Strategies for Global Scale and National Impact

The expert testimony provided the subcommittee with the raw tactical shifts required to achieve global dominance, often framed by historical failures and the need for "Born Global" business models.

3.1 Synthesis of Expert Contributions

- Michiko Ashizawa (The Scale-Up Advocate): Ashizawa issued a stark warning against repeating the failures of the solar panel, LCD, and lithium-ion battery sectors, where Japan provided the scientific "seeds" only to see the "economic fruits" seized by overseas disruptors with superior scaling capabilities. She advocated for the SpaceX model, where government procurement acts as the ultimate anchor for private VC.

- Tomoko Inoue (The Global Integrationist): Inoue highlighted the "institutional inertia" of the Government Pension Investment Fund (GPIF), which allocates a mere 1.6% to alternatives—a far cry from the 20% global standard. She proposed a "Yozma-style" co-investment mechanism where successful private VCs can buy back government shares at low interest rates, a proven incentive for attracting elite global GPs.

- Mitsunobu Okada (The "Selection and Concentration" Tactician): Okada identified the "Wall of Scale-up"—the difficult transition from 100 billion Japanese Yen to 1 trillion Japanese Yen market cap. He urged the state to focus on 30-50 high-potential firms through "thick and long" multi-year procurement contracts.

- Tomotaka Goji (The JVCA Visionary): Goji set the "North Star" at a 100 trillion Japanese Yen startup market cap by 2027. He noted that Japan's 2nd-place ranking in 21st-century Nobel Prizes provides the scientific foundation for "Science-based" corporate groups that can match the impact of traditional conglomerates.

3.2 The Contrarian Perspective: Kenichi Murofushi

Kenichi Murofushi provided a necessary dose of skepticism toward the "VC-led" narrative. Using the iPhone as a case study—where the Internet, GPS, and SIRI were all results of state research—Murofushi argued that "The State is the Entrepreneur." He contrasted the "Exit-driven" models of VCs with the "Patient Capital" that only a sovereign actor can provide, insisting the government must take the initial, massive risks that private markets avoid.

4. Conclusion: Distilling a National Strategy for 2027

The inaugural meeting has consolidated a disparate range of challenges into a cohesive national vision. The subcommittee’s ultimate goal—reaching a 100 trillion JPY startup market cap by 2027—is the "North Star" for this new era of Japanese industrial policy.

National Strategy Essentials

- Selection and Concentration: Prioritizing the 100B → 1T JPY growth trajectory for 30–50 specific firms to maximize national impact.

- Strategic Government Procurement: Moving beyond subsidies to become a "Primary Customer" through multi-year, strategic contracts that foster demand.

- Capital Mobilization: Overcoming fiduciary risk concerns to transition pension and retail assets into "Patient Capital" via the J-Ships and Rule 506 frameworks.

- The "Global Management" Requirement: A specific mandate for talent that combines scientific expertise (PhD) with business acumen (MBA) to lead firms that are "Born Global."

The Startup Policy Promotion Subcommittee is the architect of what is being termed Japan’s "New Productive Forces" (Sinsitsu Seisanryoku). This is a competitive, geopolitical response to global industrial shifts. By aligning massive state risk-taking with private sector agility, Japan aims to build a generation of companies that do not just exist in the shadows of the traditional giants, but eventually match their total GDP impact.