TMN Taps DeCurret DCP for Digital Currency Push in Japan’s Distribution Sector

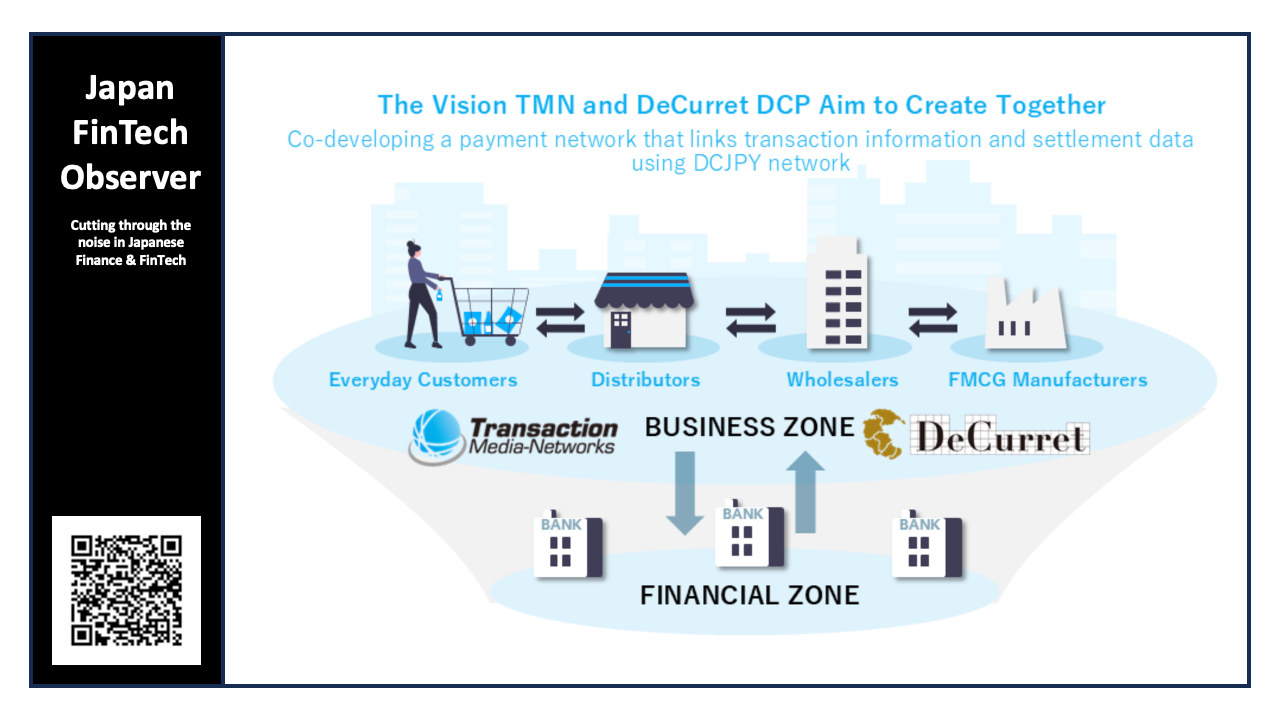

Transaction Media Networks (TMN) and digital currency operator DeCurret DCP have launched a strategic collaboration aimed at developing new settlement services for the distribution sector utilizing the digital currency DCJPY.

The partnership seeks to integrate TMN’s established payment gateway infrastructure with DeCurret’s blockchain-based platform to accelerate the practical adoption of tokenized deposits in retail and wholesale environments.

Integrating Infrastructure and Assets

Under the proposed framework, the companies will combine their respective strengths to create new value propositions for retailers and consumers:

- TMN will leverage its cashless payment network—which connects over 1.1 million terminals across Japan—and its infrastructure for analyzing consumer purchasing data.

- DeCurret DCP will provide the underlying financial technology through its "DCJPY Network," a platform that supports tokenized bank deposits (DCJPY) and digital asset accounts.

The collaboration aims to digitize value exchange between manufacturers, wholesalers, and everyday customers, promoting a more transparent and efficient financial zone powered by distributed ledger technology.

Strategic Background

The announcement follows TMN’s recent entry into the Digital Currency Forum in December 2025. Administered by DeCurret DCP, the forum facilitates discussions among industry players to establish new mechanisms in the payments sector.

TMN, listed on the Tokyo Growth Market, has been a key player in cloud-based electronic payments since commercializing thin-client solutions in 2011. DeCurret DCP, established in 2020, focuses on the issuance and operation of DCJPY to support societal digital transformation (DX).

Both companies stated they would disclose further details regarding specific service developments as discussions progress.