Tokio Marine FY3/25 Financial Results

Tokio Marine Holdings reported high growth for the fiscal year ending in March 2025.

- Adjusted net income (excluding capital gains from sales of business-related equities) rose to JPY 608.9bn in FY2024, +JPY 27.9bn vs full year projections released in February (+6% YoY) mainly due to the positive impact of JPY appreciation on Japan P&C results

- Excluding one-off effects, normalized based adjusted net income was JPY 679bn which was in line with the February projections. Achieved high growth of +14% YoY following strong performance by key international entities, rate increases and decrease of large losses in Japan P&C, and positive FX rate impact (+5% YoY excluding FX movement in FY2024)

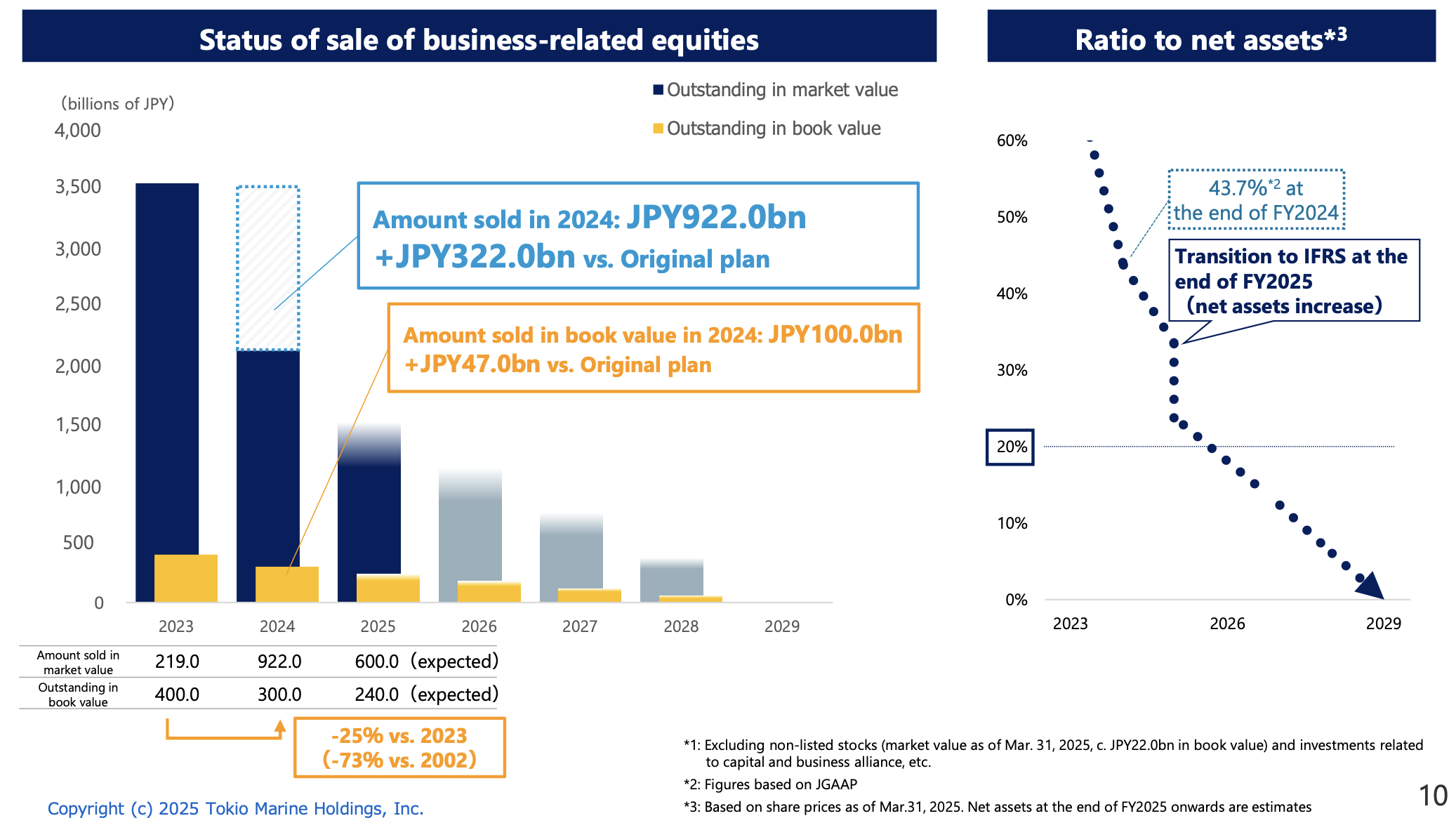

- In addition to the above, sales of business-related equities amounted to JPY 922.0bn, exceeding the February projections by JPY 10bn. As a result, adjusted net income including the capital gains (on an actual basis) amounted to JPY 1.215tn (+JPY 35.0bn vs the February projections and + 71% YoY)

Tokio Marine Holdings also projects a strong fiscal year ending in March 2026.

- Adjusted net income (excluding capital gains from sales of business-related equities) is projected at JPY 700bn for FY2025 (+3% YoY on a normalized basis and +7% excluding FX). The growth is expected to be driven by continued strong performance at key international entities and rate increases for auto at Japan P&C

- Tokio Marine plans to sell JPY 600 bn worth of business-related equities during the fiscal year, and adjusted net income including the capital gains is projected at JPY 1.1tn

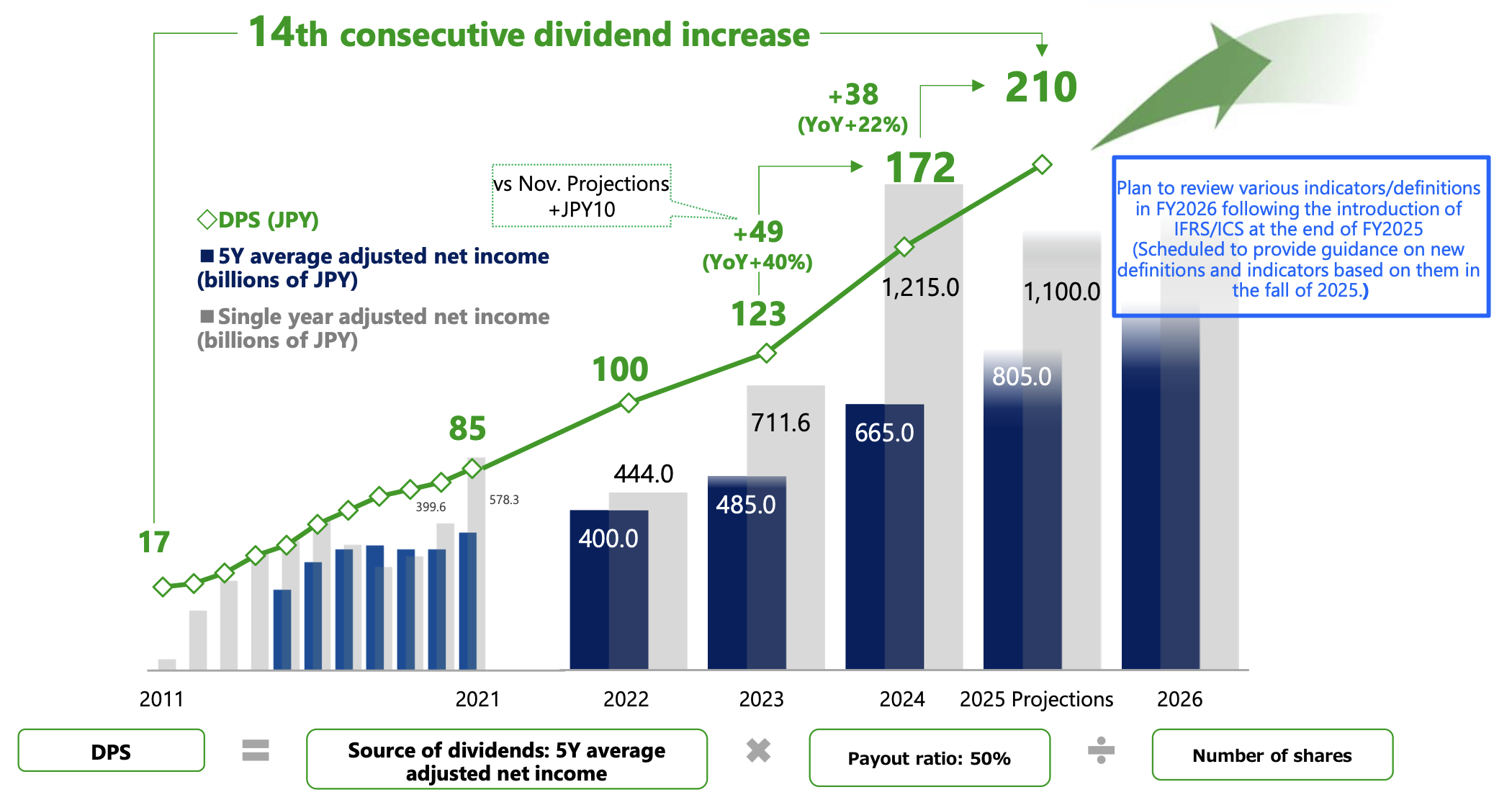

Tokio Marine continues to focus on shareholder returns consistent with profit growth.

- Dividends-per-Share (DPS) in FY2024 will be JPY 172, an increase of JPY 10 from the full-year projections (released in November) based on the profit growth (DPS growth: +40% YoY)

- DPS for FY2025 is projected at JPY 210 (DPS growth: +22% YoY) based on an increase in the moving average of the sources of dividends. Tokio Marine will continue realizing DPS growth consistent with profit growth

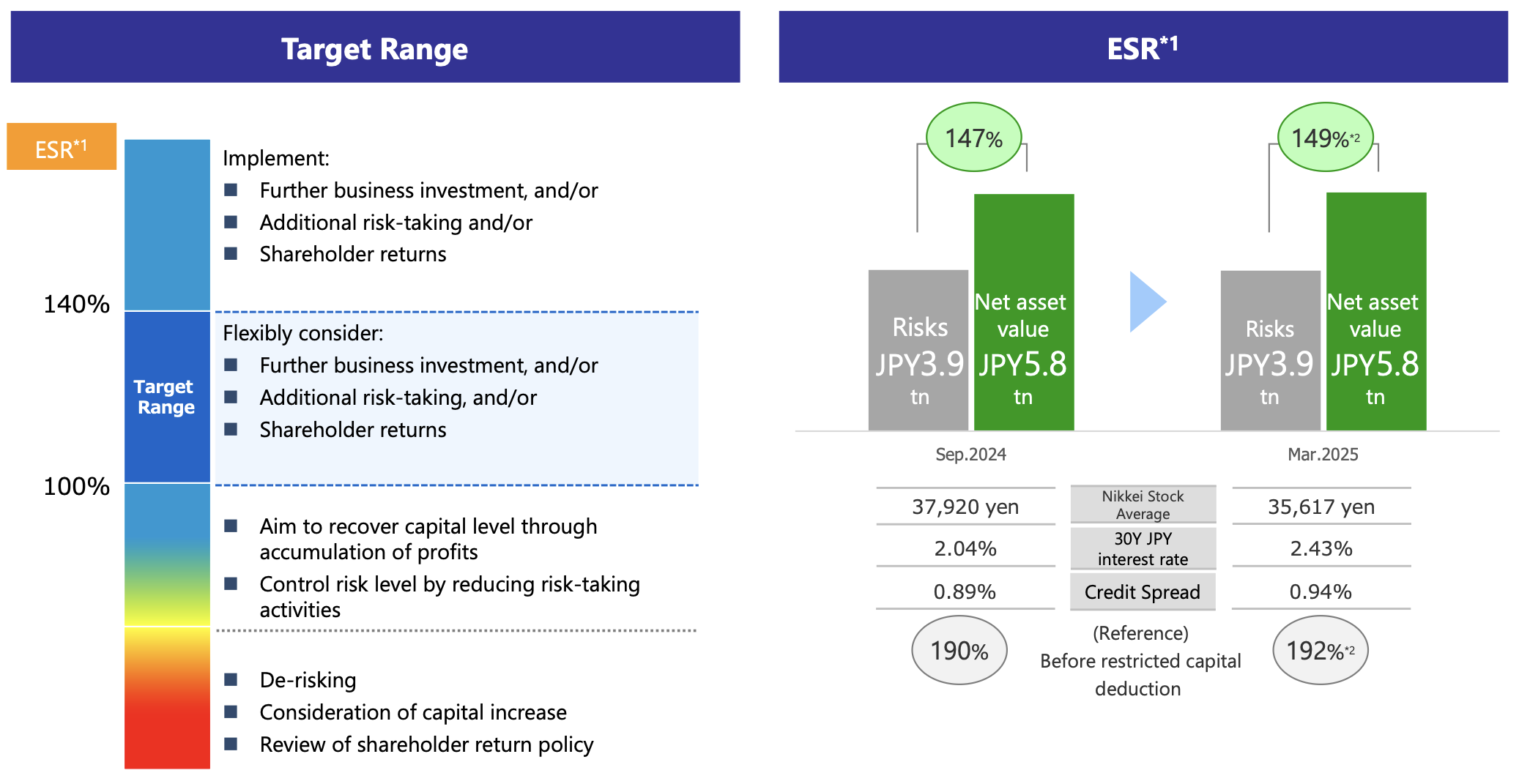

- The latest Economic Solvency Ratio (ESR) is 149%. Considering the level required to boost EPS growth by 2%, the M&A pipeline and other factors, the current plan for FY2025 share buyback is JPY 220bn throughout the year (as the first step, a JPY 110.0bn share buyback has been approved)

Join the Japan FinTech Observer group on Luma for online and offline meetups.

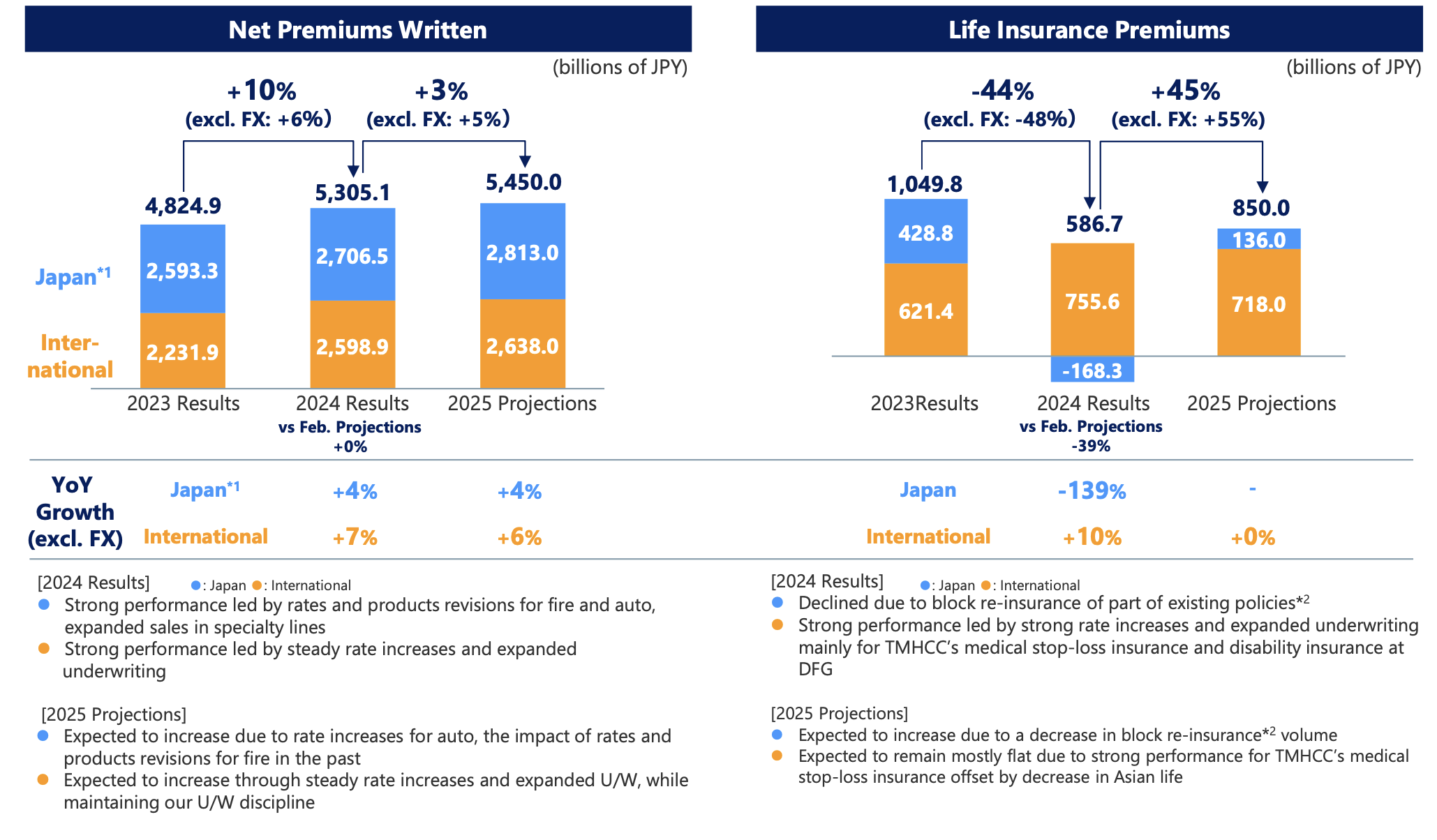

Top-Line

Top-line results for FY2024 were in line with the February projections and strong due to rate increases both domestically and internationally (Japan Life was behind the February projections due to the additional block re-insurance in March 2025). Tokio Marine projects solid top-line growth in FY2025. This will mainly be driven by rate increases and underwriting expansion in non-life business

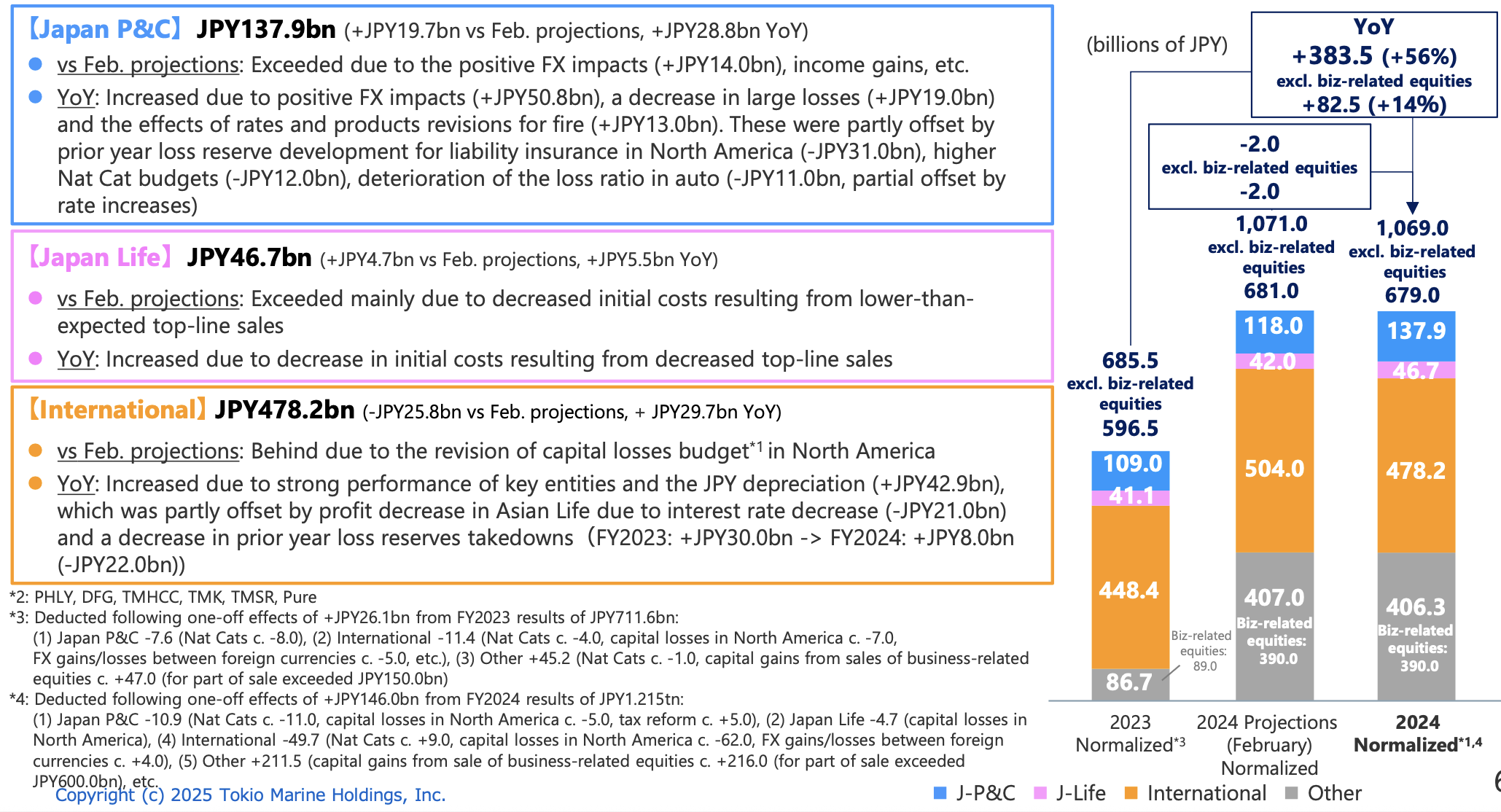

Adjusted Net Income Results (Normalized Basis)

Adjusted net income (incl. business-related equities) came in at JPY 1.069tn (JPY -2bn vs February projections, JPY +383.5bn YoY).

Adjusted net income (excl. business-related equities) is reported at JPY 679bn (JPY -2bn vs February projections, JPY +82.5bn YoY). These results are in line with February projections, as the positive impact of JPY appreciation on Japan P&C was offset by the revision of capital losses budget in North America. Achieved JPY +82.5bn, +14% YoY following strong performance by key international entities, rate increase and decrease of large losses in Japan P&C, and positive FX rate impact (+5% YoY excl. FX movement in FY2024).

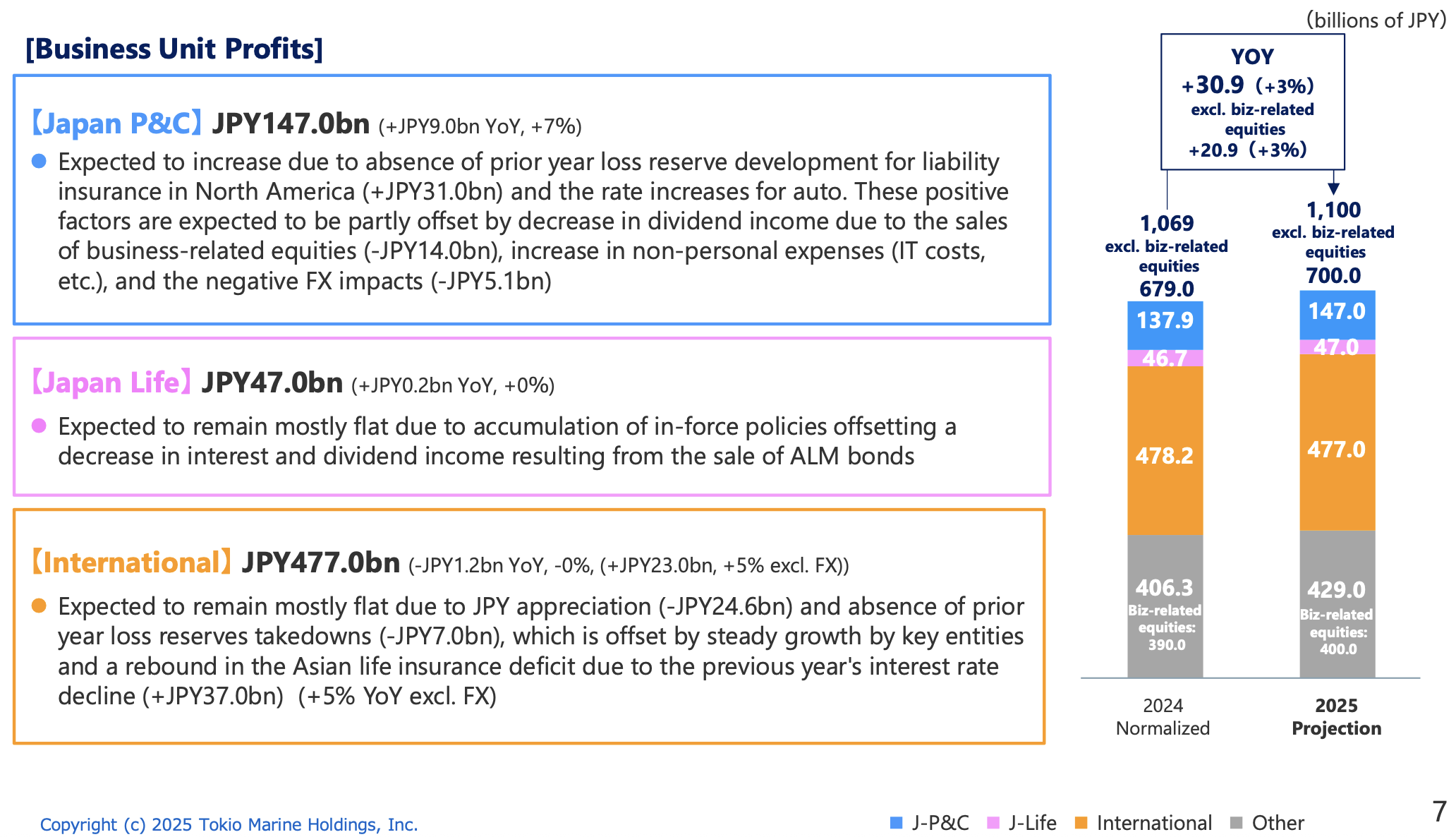

Adjusted Net Income Projections

Adjusted net income (excluding capital gains from sale of business-related equities) is projected to be JPY 700bn for FY2025 (+3% YoY on a normalized basis and +7% excluding FX). The growth is expected to be driven by continued strong performance at key international entities and rate increase for auto in Japan P&C. Tokio Marine plans to sell JPY 600bn worth of business-related equities during the fiscal year, and adjusted net income including the capital gains is projected at JPY 1.1tn.

Shareholder Returns

The FY2024 DPS is JPY 172 (+40% YoY), an increase of +JPY 10 from the November projections, reflecting the upward revision of profit. DPS for FY2025 is projected at JPY 210 (+22% YoY), based on the moving average growth in the source of dividends, and Tokio Marine will continue to deliver dividend growth consistent with profit growth.

Strong Capital Stock and Disciplined Capital Policy

The Economic Solvency Ratio (ESR) as of March 31, 2025 is 149%. The current plan for FY2025 share buyback is JPY 220bn throughout the year, comprehensively considering the level required to boost EPS growth by 2%, the M&A pipeline and other factors (as the first step, JPY 110bn share buyback has been approved).

Reduction of Business-Related Equities

Sales of business-related equities in FY2024 were 1.5 times the original plan due to further sale acceleration, indicating significant progress towards achieving ”zero” business-related equities by the end of FY2029. Tokio Marine expects to reach approximately 20% of IFRS net assets by the end of FY2026.