Tokyo Moves Up Seven Spots in the 38th Global Financial Centres Index

The Global Financial Centres Index (GFCI), published semi-annually by Z/Yen Group and the China Development Institute, stands as a premier benchmark for assessing the competitiveness of the world's major financial hubs. The 38th edition, dated September 2025, offers a timely and data-rich perspective on the shifting dynamics of global finance. By combining quantitative instrumental factors with thousands of assessments from financial professionals worldwide, the GFCI provides a nuanced ranking that influences policy, investment, and strategic business decisions.

This analysis delves into the performance of Japan's financial centres within the GFCI 38. It begins by establishing the broader global context, identifying the dominant players and overarching trends. It then narrows the focus to the fiercely competitive Asia-Pacific region, where Japan's cities vie for prominence against established leaders and rapidly emerging contenders. Finally, the report provides a detailed, city-specific examination of Tokyo, Osaka, and the promising associate centre of Fukuoka. The findings reveal a nation on a distinct upward trajectory, with Tokyo making a significant return to the top 15 and Osaka showing steady progress. However, the data also highlights persistent challenges related to international perception and the need to cultivate a more dynamic and diversified financial ecosystem to secure a leading role in the future of global finance.

Part 1: The Global Landscape – Stability at the Top, Volatility Below

The GFCI 38 paints a picture of a global financial system that is cautiously optimistic. The report notes that "the rating for almost all centres improved very slightly, with the average rating across all centres up 0.6%," suggesting a stabilizing economic outlook with diminishing inflation and slightly improving growth.

The Unchanging Apex of Global Finance

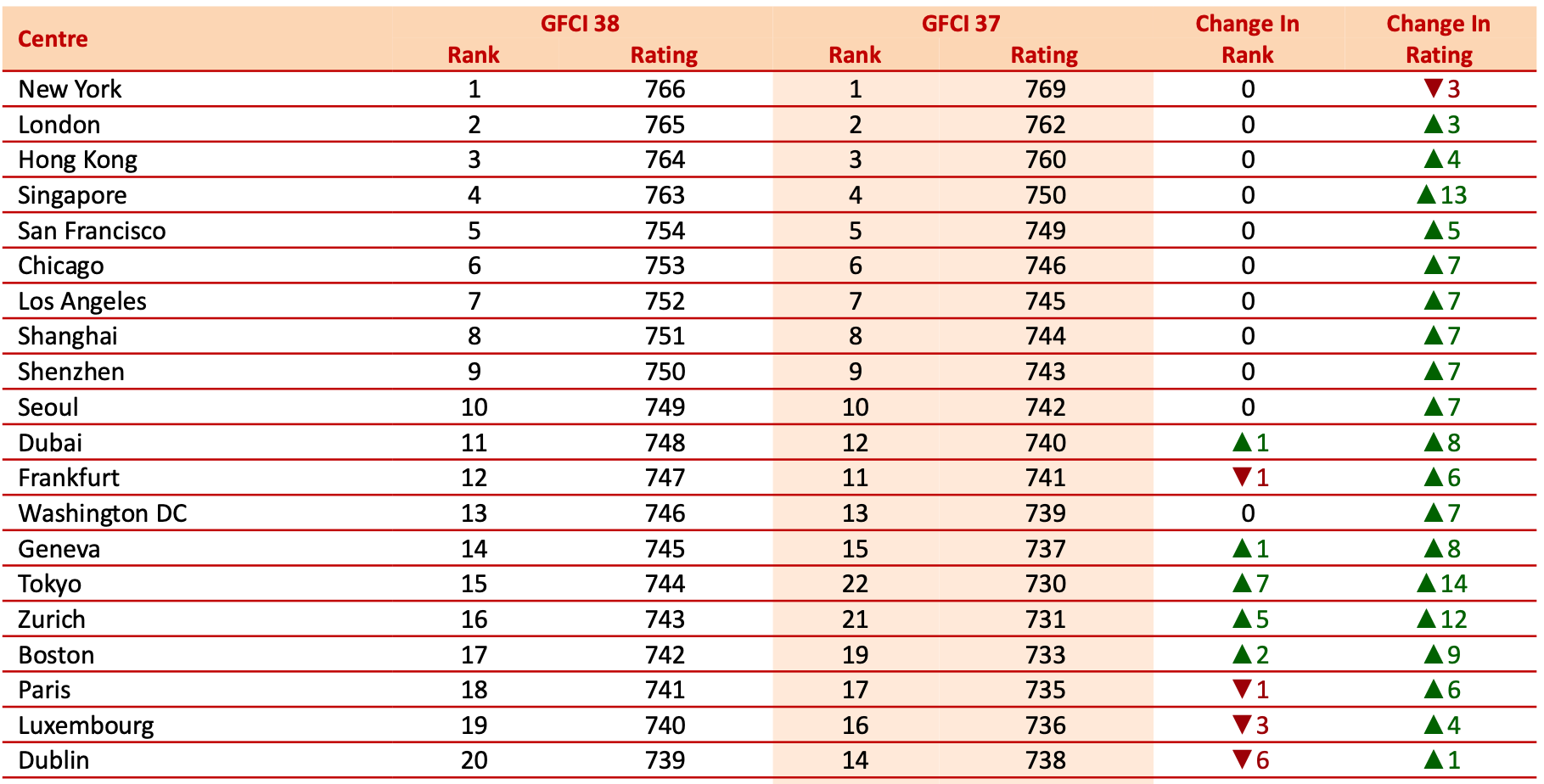

At the pinnacle of the index, a familiar quartet continues its dominance, albeit with intensifying competition. New York maintains its first-place position with a rating of 766, but its lead has narrowed significantly. London holds strong at second (765), having closed the gap to a single rating point. Hot on their heels are Hong Kong (764) and Singapore (763), with only one point separating each of these top four centres. This "Big Four" configuration underscores a multi-polar financial world where North America, Europe, and Asia each host globally indispensable hubs.

Beneath this top tier, the remainder of the top ten also shows remarkable stability, with no changes in rank from the previous edition. The US asserts its depth with San Francisco (5th), Chicago (6th), and Los Angeles (7th). They are joined by the Chinese powerhouses of Shanghai (8th) and Shenzhen (9th), and South Korea's capital, Seoul (10th). This lack of movement in the top ten suggests that the foundational strengths of these centres—deep capital markets, vast talent pools, and robust legal frameworks—create a significant competitive moat that is difficult for others to breach.

Japan's Re-emergence on the World Stage

It is within the top 20 that the most significant shifts are observed, and this is where Japan’s positive story begins. One of the report's key headlines explicitly states: "Tokyo and Zurich entered the top 20, replacing Beijing and Amsterdam." This is a noteworthy achievement for Japan's capital.

- Tokyo made a formidable leap, climbing seven places from 22nd in GFCI 37 to 15th in GFCI 38. Its rating surged by 14 points, from 730 to 744. This ascent places it firmly back among the world's elite financial centres, ahead of established European hubs like Zurich (16th) and Paris (18th).

- Osaka also registered a commendable performance, moving up four places from 40th to 36th. Its rating increased by 11 points to 723, positioning it as a globally significant centre and placing it ahead of cities like Copenhagen (37th) and Milan (41st).

The FinTech Revolution

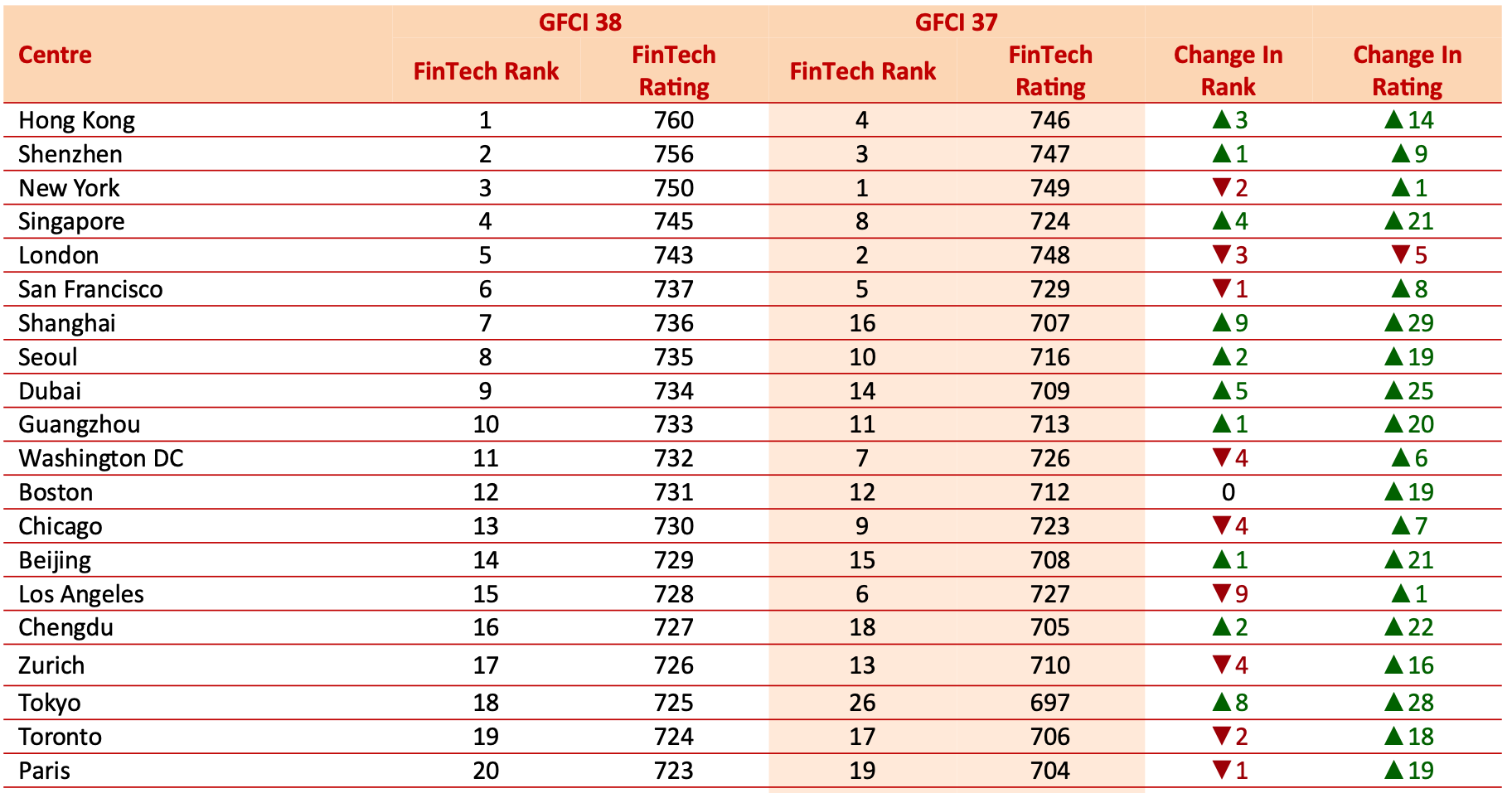

The GFCI report also includes a separate, crucial sub-index for FinTech, reflecting the sector's transformative impact on finance. Here, the global leadership has shifted, with Hong Kong taking the top spot, followed by Shenzhen and New York. This ranking is dominated by US and Chinese centres, which together occupy 12 of the top 20 positions, highlighting their intense focus on technological innovation in finance.

Against this competitive backdrop, Japan's progress is again evident:

- Tokyo made a strong advance in the FinTech rankings, moving up eight places to 18th. This is a critical indicator that the city is successfully modernizing its financial ecosystem and embracing technological disruption.

- Osaka also improved its FinTech standing, rising two places to 55th, signaling growing momentum in this vital sector.

Globally, Japan's narrative in GFCI 38 is one of resurgence. After a period outside the top 20, Tokyo has decisively reclaimed its place among the world’s leading financial centres, backed by strong fundamentals and growing FinTech capabilities.

Part 2: Positioning within the Asia-Pacific Arena – A Competitive Battleground

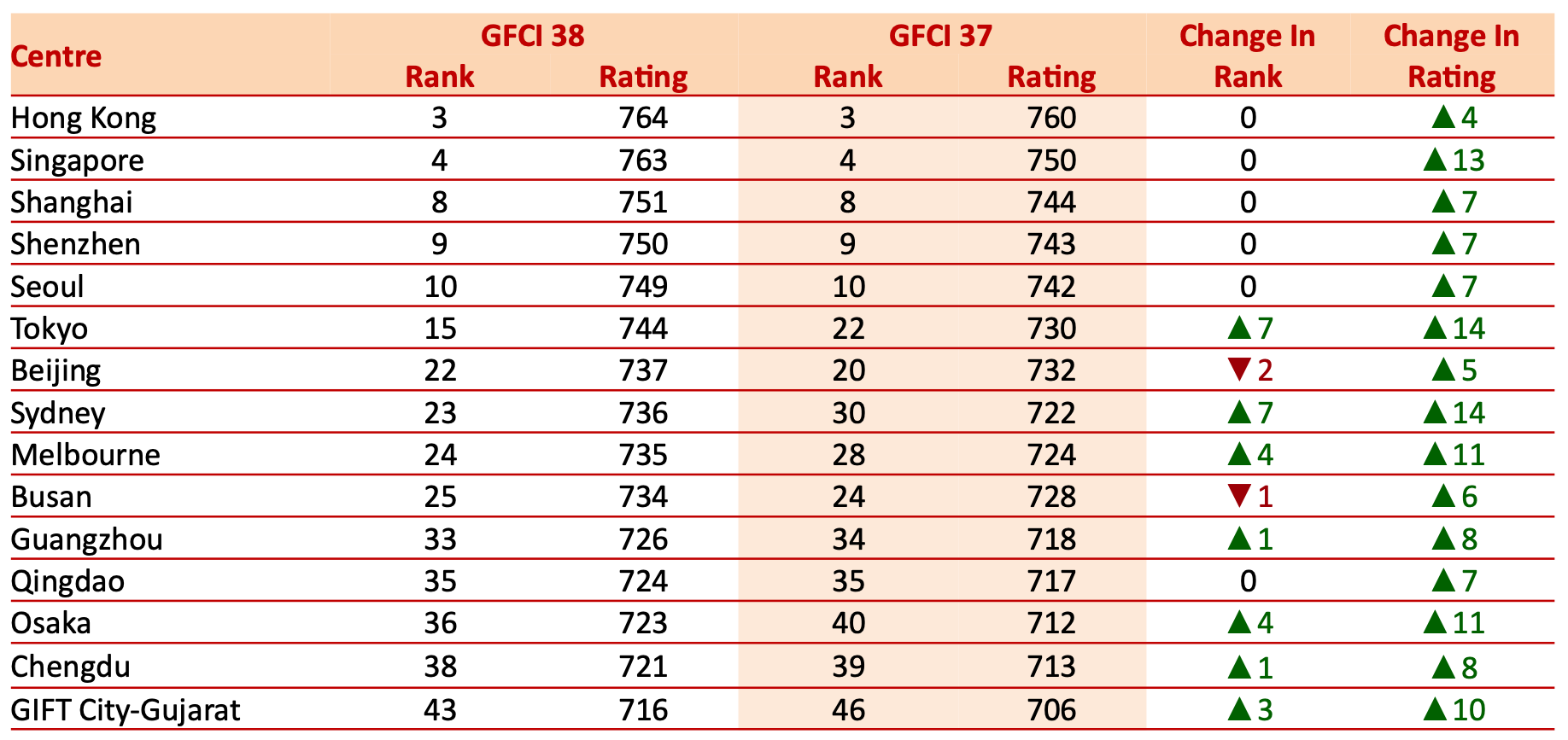

The Asia-Pacific region is arguably the most dynamic theatre of competition in global finance. The GFCI 38 report underscores its strength, noting that "Six Asia/Pacific centres feature in the world top 15 and the average rating for this region is up 1.27%." This growth outpaces that of North America (0.56%) and Western Europe (0.61%), signaling a continued shift in economic gravity towards the East.

The Regional Hierarchy

The region is led by a clear top tier of five financial centres that also rank in the global top ten:

- Hong Kong (Global Rank: 3)

- Singapore (Global Rank: 4)

- Shanghai (Global Rank: 8)

- Shenzhen (Global Rank: 9)

- Seoul (Global Rank: 10)

These cities form a formidable leading pack, combining international connectivity (Hong Kong, Singapore), immense domestic market scale (Shanghai, Shenzhen), and technological prowess (Seoul). They are the primary engines of financial activity in the region and are consistently rated as the most competitive hubs.

Japan's Place in the Regional Pecking Order

Within this context, Japan’s cities hold respectable, yet secondary, positions. According to the regional rankings presented above, Japan’s standing is as follows:

- Tokyo is the 6th ranked financial centre in Asia-Pacific. It sits just outside the top group, leading the "best of the rest" pack which includes Beijing (7th), Sydney (8th), and Melbourne (9th).

- Osaka is ranked 13th in the region, a solid mid-tier position among the 30+ Asia-Pacific centres included in the index.

While Tokyo's position as 6th in this high-powered region is strong, the gap between it and the top 5 highlights a persistent challenge. The dynamism of its neighbors, particularly the growth fueled by China's economy and Singapore's role as a global wealth and technology hub, sets a very high bar for competition.

The Perception Gap: A Lack of Future Buzz

Perhaps the most telling data point for Japan comes from the "Future Prospects" analysis. The report asks respondents which centres they "consider will grow in significance over the next two to three years." The resulting list of the top 16 mentions is dominated by Asia-Pacific and Middle Eastern centres like Dubai (1st), Singapore (2nd), Seoul (3rd), and Hong Kong (5th).

Critically, no Japanese city appears on this list. This reveals a significant perception gap. While Tokyo and Osaka have demonstrated measurable improvements in their rankings and ratings (performance), they are not viewed by global financial professionals as the future hotspots of financial growth. This suggests that Japan’s recent progress has not yet translated into a compelling international narrative about its future potential. The "buzz" surrounds other centres, indicating a potential weakness in Japan's global marketing, branding, and policy signaling compared to its rivals.

Fukuoka: A Glimmer of Diversification

On a more positive note, the emergence of Fukuoka as an "Associate Centre" adds an intriguing new dimension to Japan's regional presence. Associate centres are those that have not yet received the 150 assessments required for full inclusion but are being actively tracked. Fukuoka is not yet close to this threshold with just 50 assessments. Its mean assessment score of 722 is exceptionally high for a non-ranked city—on par with fully-ranked global centres like Copenhagen (37th). This suggests that those who are familiar with Fukuoka rate it highly, and it has the potential to debut strongly in the index once it achieves greater global visibility. This points to a possible future where Japan's financial landscape becomes more diversified beyond the traditional Tokyo-Osaka axis.

Part 3: A Deep Dive into Japan's Financial Centres

A granular analysis of each Japanese city reveals distinct profiles, strengths, and strategic challenges, painting a complex picture of a nation in transition.

Tokyo: The Stable, Resurgent Leader (Global Rank: 15)

Tokyo's return to the top 15 is the headline story for Japan. This jump of seven places is a powerful statement of its enduring strengths and renewed competitiveness.

Areas of Strength

Tokyo’s performance is not that of a versatile all-rounder but of a specialist with deep, mature capabilities. The "Areas of Competitiveness" view shows Tokyo ranking in the global top 15 for:

- Infrastructure (14th): Reflecting its world-class transport, ICT, and built environment.

- Financial Sector Development (14th): Indicating deep and liquid capital markets, a broad range of financial services, and high market liquidity.

The "Industry Sectors" view further refines this profile, showing Tokyo’s excellence in:

- Government & Regulatory (9th): Signaling a stable, predictable, and highly respected regulatory framework.

- Finance (9th) and Trading (9th): Reinforcing its status as a major global capital market.

- Banking (12th): A solid position reflecting its large and sophisticated banking sector.

Areas for Improvement

Tokyo’s absence from the top 15 in Business Environment, Human Capital, and Reputation & General points to structural challenges. These categories encompass factors like tax competitiveness, ease of doing business, availability of skilled personnel, flexible labor markets, and overall city brand appeal. The quote from a Taipei-based Head of Compliance is particularly relevant: "Taxation significantly sways where financial firms and capital choose to operate... high or complex taxes can drive financial activity elsewhere." This may hint at one of the hurdles Tokyo faces in competing with low-tax jurisdictions like Singapore and Hong Kong.

Profile and Stability

The GFCI classifies Tokyo as an "Established International" centre. This is powerfully corroborated by its position on the "Stability Of The Top 40 Centres" chart. Tokyo is located squarely in the "Stable Centres" quadrant. This means it exhibits low variance in assessments from professionals and low sensitivity to changes in instrumental factors. It is seen as predictable, reliable, and non-volatile—a safe harbor. While this stability is a tremendous asset for attracting long-term, risk-averse institutional capital, it can also be perceived as a lack of dynamism, potentially deterring more agile, innovation-driven firms that thrive in more rapidly changing environments.

Osaka: The Dynamic, Evolving Challenger (Global Rank: 36)

Osaka’s performance is one of steady, promising growth. Its four-place rise to 36th solidifies its position as a globally relevant financial centre with significant upward potential.

Profile and Volatility

In stark contrast to Tokyo, the GFCI classifies Osaka as an "Evolving Centre". This classification is dramatically illustrated on the stability chart, where Osaka is positioned in the "Unpredictable Centres" quadrant. This placement indicates high variance in assessments and high sensitivity to instrumental factors.

This is a critical finding. It suggests that Osaka is perceived as a far more dynamic and fluid centre than Tokyo. It has greater potential for rapid movement—both up and down—in future rankings. It may be seen as a place of greater opportunity but also greater risk. This profile could make it an attractive destination for niche sectors, startups, and investors looking for growth opportunities outside the saturated market of Tokyo.

FinTech Momentum

Osaka's improvement in the FinTech rankings to 55th, while modest, aligns perfectly with its "Evolving" profile. It is actively building its capabilities in new financial technologies, contributing to its dynamic character and signaling its ambition to grow beyond its traditional industrial base.

Fukuoka: The High-Potential Newcomer (Associate Centre)

Fukuoka represents an exciting new frontier for Japan's financial sector. Its status as an associate centre with a very high mean assessment score (722) indicates strong underlying fundamentals that are already recognized by a core group of international professionals.

Untapped Potential

Fukuoka's high rating suggests it may already possess the qualities of a top-40 financial centre in terms of business environment, infrastructure, and quality of life. Its primary challenge is not one of substance but of visibility. To graduate to the main index, it needs to attract the attention of a much broader international audience.

Strategic Niche

The Japanese government has designated Fukuoka as a special zone for financial startups and asset managers, offering tax incentives and streamlined processes. This strategic positioning as a FinTech and innovation hub could be its key to gaining global prominence, offering a clear alternative to the established models of Tokyo and Osaka.

Conclusion and Strategic Outlook

The Global Financial Centres Index 38 delivers a clear and encouraging verdict on Japan: the nation is experiencing a significant and positive momentum shift in its global financial standing. Tokyo's powerful re-entry into the top 15 demonstrates the enduring strength of its foundational market structures and regulatory stability. Simultaneously, Osaka's steady climb and its profile as a dynamic, "unpredictable" centre, coupled with the nascent potential of Fukuoka, suggest the beginnings of a more diversified and resilient national financial ecosystem.

However, the report also issues a stark warning. Despite these performance gains, Japan is currently losing the battle for international perception. The absence of any Japanese city from the list of centres expected to grow in significance is a critical vulnerability. This indicates an urgent need for a more proactive and compelling global narrative, one that goes beyond stability to highlight innovation, opportunity, and future growth.

The strategic path forward for Japan involves a dual approach. First, it must continue to build on the contrasting strengths of its leading cities: leveraging Tokyo's unparalleled stability to anchor global capital while actively promoting Osaka as a hub of dynamism and evolution. Second, it must invest heavily in raising the global profile of its entire financial ecosystem, including high-potential centres like Fukuoka. By successfully communicating its resurgence and clearly articulating its vision for the future, Japan can convert its current positive momentum into a sustainable leadership position in the global financial landscape of tomorrow.