TOPPAN Edge Confirmed as First Japanese Qualified vLEI Issuer

TOPPAN Edge, a TOPPAN Group company and wholly owned subsidiary of TOPPAN Holdings, was certified by the Global Legal Entity Identifier Foundation (GLEIF) as the first Japanese Qualified vLEI Issuer (QVI) in the verifiable Legal Entity Identifier (vLEI) ecosystem.

In November this year, TOPPAN Edge will launch vLEI-Gateway™, a vLEI issuance service targeting a wide range of global manufacturing and finance use-cases, including supply chain management, international trade, and financial transactions involving crypto-assets on the blockchain.

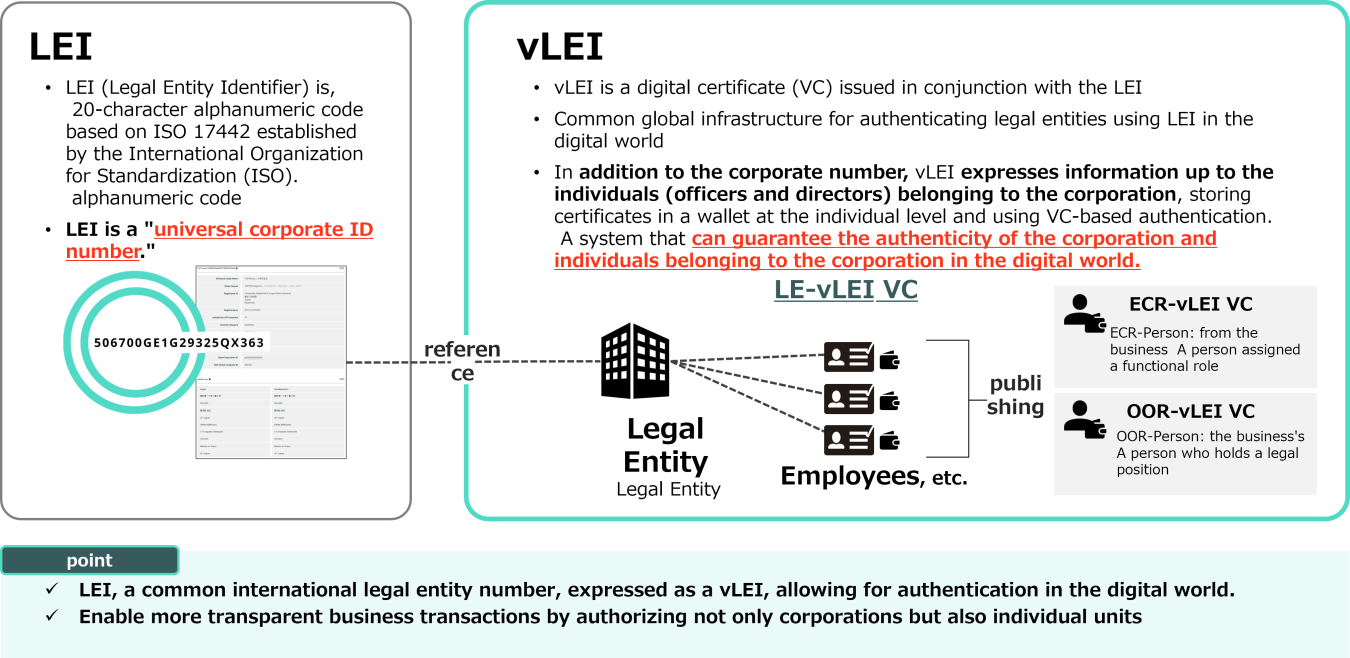

The Legal Entity Identifier (LEI) is a 20-character, alpha-numeric code based on the ISO 17442 standard. It provides a universally recognized identifier for legal entities, issued by qualified organizations in each country, with GLEIF's oversight. vLEI is a digital certificate that combines the LEI with Verifiable Credentials (VC) to confirm the identity of a company or other legal entity and the individuals belonging to it.

As a QVI, TOPPAN Edge will launch vLEI-Gateway™ in November this year. The vLEI-Gateway™ service will provide vLEI-based signature verification in addition to vLEI screening, issuance and renewal. TOPPAN Edge plans to expand its offering in fiscal 2026 to provide a Software as a Service (SaaS)-based system to prospective QVIs.

Ahead of its full launch, in September this year vLEI-Gateway™ has been adopted for a pilot conducted by the BRP Consortium Business Site Digital Certification Research and Development Working Group. The pilot will explore the use of the vLEI to verify the existence and authenticity of organizations to support the supply chain management of semiconductor business sites.

Background

In international transactions and finance, it has previously been difficult to verify that a company actually exists and who its representatives are. Prompted by the global financial crisis, the Financial Stability Board (FSB) established GLEIF to address this issue, and a universal legal entity identifier was realized in 2014. The recent surge in digital transactions is driving global demand for automated online authentication and verification of organizations, and an increasing number are considering the introduction of a vLEI, the digital counterpart of a conventional LEI.

LEI acquisition is mandated in Europe and North America to combat money laundering and manage global semiconductor, military, and pharmaceutical supply chains. Similar application of vLEI is now under consideration.

To tackle money laundering, Japan has revised legislation such as the Cabinet Office Ordinance on Restrictions on Over-the-Counter Derivatives Transactions, etc. In April 2024, LEI-related legislation came into effect, including a requirement for parties in a transaction to state the LEI when reporting to regulatory authorities. Meanwhile, vLEI is garnering attention as a means to verify the existence of an organization when conducting international money transfers in digital currencies.

In addition to the financial sector, government agencies including the Ministry of Internal Affairs and Communications and the Ministry of Finance are turning their attention to the use of vLEI in the industrial sector. To ensure economic security, private-sector organizations are also considering its use in fields requiring robust global supply chain management, such as semiconductors and network devices.

TOPPAN Edge’s confirmation as Japan’s first QVI is underpinned by an extensive track record in handling back-office operations for customers in the financial sector, including banking, investment, and insurance. Business process expertise, high-security operational capabilities, and ID-related digital technologies accrued over the years have been leveraged to build a model for vLEI issuance, screening, and operation that satisfies the international standards required by GLEIF.

Features of vLEI-Gateway™

As a GLEIF-certified QVI, TOPPAN Edge will conduct vLEI screening, issuance, renewal, and revocation based on applications from organizations that have acquired LEI. vLEI-Gateway™ will support all three types of vLEI: LE-vLEI, which verifies the existence of the entire legal entity; OOR-vLEI, which verifies the existence of authorized representatives such as officers and directors; and ECR-vLEI, which verifies the existence of employees in functional roles, such as department heads.

As a unique service from TOPPAN Edge, vLEI-Gateway™ will also provide the following:

- vLEI-based signature verification: Supporting authentication of documentation for electronic transactions through instant online vLEI-based verification of the electronic signatures of the parties.

- SaaS-based system for QVIs (scheduled to launch in fiscal 2026): Providing a SaaS-based vLEI issuance and management system to businesses entering the QVI service domain and providing services to support its introduction.

Future Initiatives

TOPPAN Edge is aiming to provide vLEI-Gateway™ to 6,000 companies by 2030. In addition to manufacturing industry supply chain management, vLEI-Gateway™ will be marketed to companies engaging in international trade transactions requiring confirmation of organizations’ locations or crypto-asset-based financial transactions requiring money laundering prevention.

As a QVI, TOPPAN Edge intends to contribute to a secure international transaction environment by assuring the authenticity of legal entities and the individuals belonging to them in the digital world.

vLEI-Gateway™ will be showcased at trade, logistics, and finance-related exhibitions in and outside Japan.