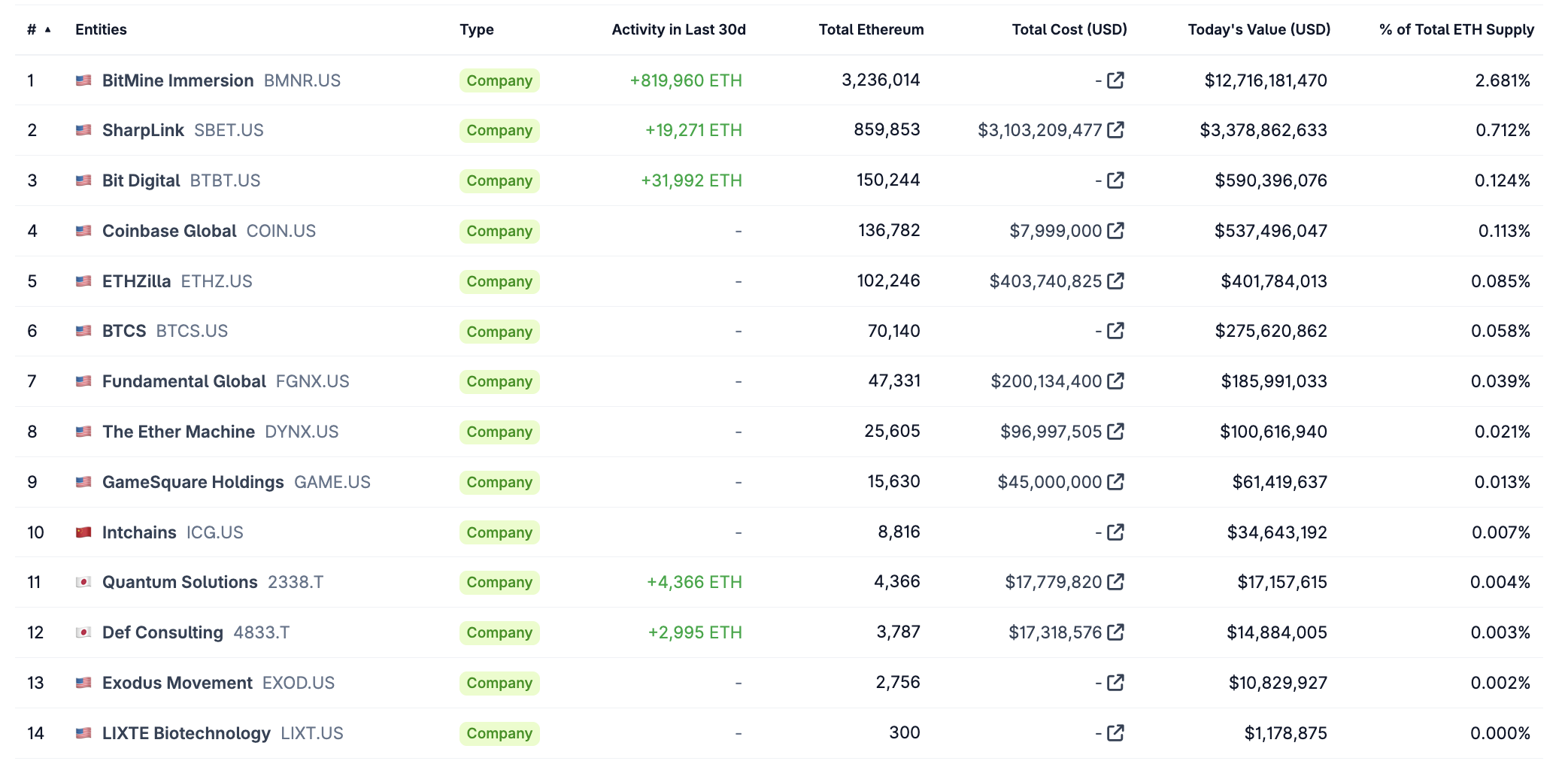

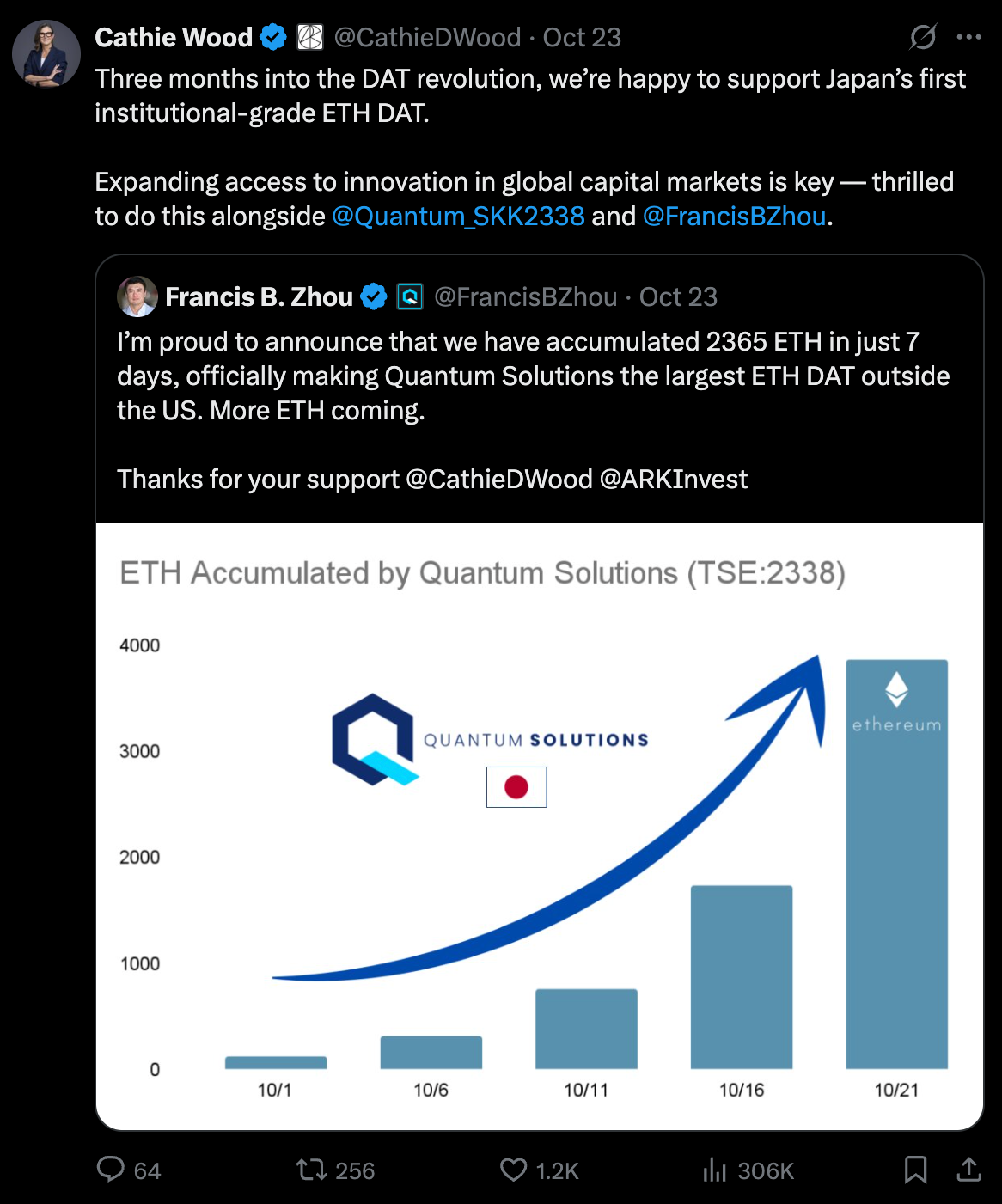

TSE-Listed Quantum Solutions Becomes Largest ETH DAT Outside the US

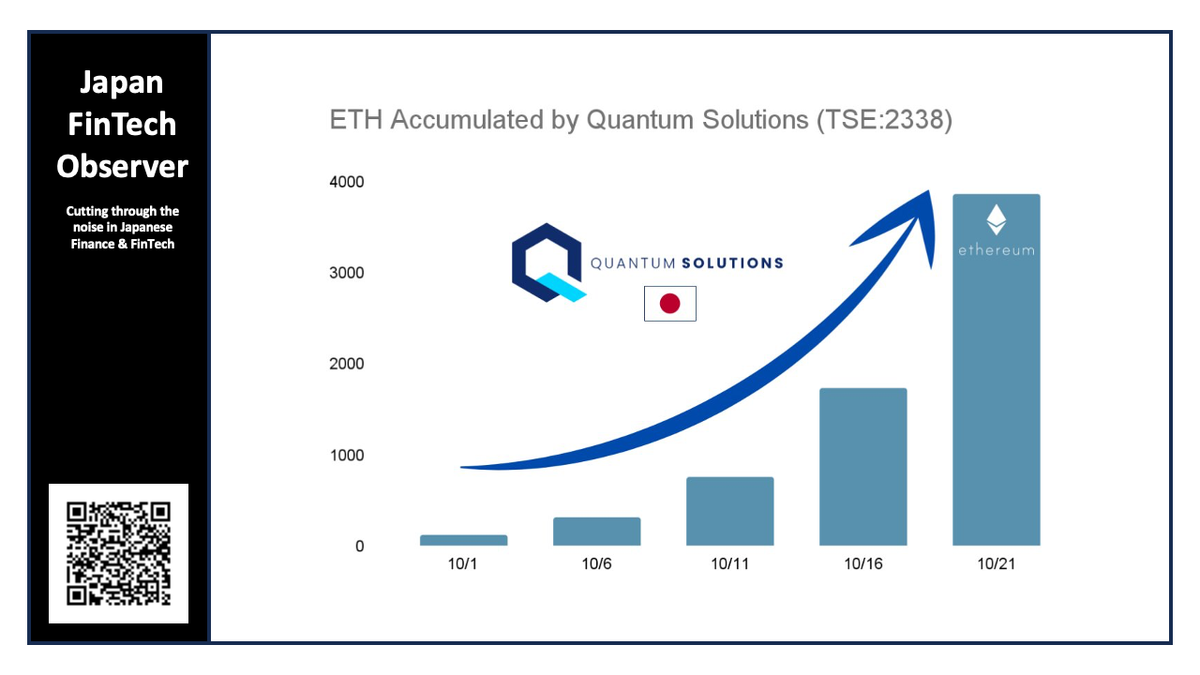

Quantum Solutions acquired an additional 500.43 ETH (approximately $1.925 million USD) through its Hong Kong subsidiary GPT Pals Studio Limited.

This brings the group's total ETH holdings to 4,366.27 ETH (total acquisition cost approximately $17.78 million USD), establishing Quantum Solutions as the largest Ethereum Digital Asset Treasury (DAT) company outside of the US.

In its second quarter results of the fiscal year ending February 2026 (i.e., the June to August 2025 period), Quantum Solutions disclosed its first holdings of Bitcoin. Previously, the company's business comprised an AI Solutions Business and an Eyelash Care (now renamed to Wellness) Business.

About Quantum Solutions

According to its second fiscal quarter results, Quantum Solutions is focusing on expanding its core AI Solutions business while maintaining profitability in the Wellness business.

A. AI Solutions Business (Segment Loss: ¥64 million)

- AI Infrastructure: Strategically shifting towards the AIDC (AI Data Center) Business. Signed strategic agreements with Singapore’s Turbo AI and Golden Gain for the joint development of AI clusters and the integration of AI data centers with Battery Energy Storage Systems (BESS) to optimize power costs. Revenue in this area was only ¥2 million (primarily from general server sales).

- AI Game: Acquired the distribution rights for the popular game "GYEE," generating ¥61 million in service revenue. The company has begun official development of "GYEE 2.0," aiming for global growth by integrating Web2.0 and Web3.0 technologies. It also launched "Codename N," an AI-driven digital entertainment project, in collaboration with AIGC experts.

- Enterprise AI Solutions: Continuing development and engagement with potential customers, though results are not yet reflected in the current period.

B. Wellness Business (Segment Profit: ¥7 million)

- The former Eyelash Care business has been renamed the "Wellness Business" to reflect a broader scope.

- Revenue declined slightly to ¥73 million (down 11.0% YoY).

- Focused efforts on stabilizing salon operations, ensuring personnel, and strengthening promotion via SNS and e-commerce led to improved profitability, resulting in a Segment Profit of ¥7 million (an improvement of ¥11 million from the previous period's segment loss).

C. Other Developments

- Quantum Solutions initiated cryptocurrency investments (Bitcoin, with plans for Ethereum) as part of its asset management strategy. A valuation loss on crypto assets was recorded as a non-operating expense (¥18.1 million).

Funding Status

On September 26, 2025 (after the close of the reporting period), the Board of Directors resolved to implement a major third-party allotment to CVI Investments and other investors to secure necessary operating capital:

- Issuance of the 13th Stock Acquisition Rights (SARs): 140,000 units with a downward price revision clause. Maximum potential funding is approximately ¥8.45 billion.

- Issuance of the 14th SARs: 200,000 units. Potential funding is approximately ¥11.84 billion.

- Issuance of the 4th Unsecured Convertible Bonds with SARs: Total value ¥2.07 billion.

- Resolution for Future Issuance of the 5th Unsecured Convertible Bonds with SARs.