2025 Chartbook: The Japanese FinTech Sector on the Tokyo Stock Exchange

The financial technology landscape within the Tokyo Stock Exchange (TSE) has undergone a profound structural metamorphosis until the end of 2025. Historically characterized by a rigid dichotomy between legacy banking institutions and a fragmented tier of systems integrators, the market has matured into a complex ecosystem of specialized verticals. This evolution is a direct response to macroeconomic pressures—specifically the persistent depreciation of the Yen, the demographic imperative for labor-saving Digital Transformation (DX), and the government’s aggressive push toward a cashless society.

The FinTech market as a whole, as captured by the Global X Japan FinTech ETF (Ticker: 2836), ended the year on a positive note, up approximately 18%, and showing resilience during the April 2025 tariff sell-off.

The current equity landscape for fintech in Japan can be broadly categorized into three dominant strategic vectors. First, the Infrastructure and SaaS (Software as a Service) Layer, comprised of payment gateways and cloud-ERP providers, has shifted from high-growth customer acquisition to maximizing unit economics through embedded finance and banking-as-a-service (BaaS) models. Second, the Digital Banking and Neo-Financial Layer has seen significant consolidation, exemplified by the integration of independent robo-advisors into mega-bank structures, effectively signaling the end of the "unbundling" phase of Japanese fintech and the beginning of "rebundling."

Third, and perhaps most disruptively, a new asset class of equities has emerged: the Corporate Bitcoin Treasury, or more generally, Digital Asset Treasury (DAT). Driven by the desire to hedge against currency debasement and revitalize stagnant valuations, a diverse cohort of listed companies—ranging from hospitality and retail to gaming and energy—has pivoted to adopt Bitcoin and/or digital assets as a primary reserve asset. This trend, unique in its intensity within the Asian markets, has turned specific TSE-listed tickers into proxy vehicles for digital asset exposure, challenging traditional definitions of corporate governance and treasury management. We will provide a tracker of DAT stocks separately, and exclude them from this post.

This post catalogues the specific entities listed on the Tokyo Stock Exchange that define the modern Japanese FinTech sector. It synthesizes data from index constituents, corporate disclosures, and market movements to offer a granular view of the ecosystem as of the end of the 2025 calendar year.

1. The Payment Infrastructure & Transactional Layer

The bedrock of the Japanese FinTech ecosystem remains the payment processing sector. As Japan transitions from a cash-centric economy—where cash usage historically exceeded 70%—to a digitized infrastructure, the companies facilitating this shift have entrenched themselves as indispensable utilities. Unlike consumer-facing apps which face high churn, these infrastructure providers enjoy compounding recurring revenue, making them core holdings in thematic indices such as the Indxx Japan Fintech Index.

GMO Payment Gateway (3769)

- Sector: Payment Processing / Embedded Finance

- Listing: TSE Prime

GMO Payment Gateway (GMO-PG) represents the premier benchmark for Japanese FinTech infrastructure. While originally established as a credit card payment processor for e-commerce, the company has successfully executed a strategic pivot toward becoming a comprehensive "FinTech Platform" provider. Analysis of its constituent weight in the Global X Japan FinTech ETF (Ticker: 2836) confirms its status as a top-tier holding, reflecting its systemic importance.

The strategic moat of GMO-PG lies in its diversification beyond simple merchant acquiring. By 2025, the company had deeply integrated its "stera" terminal ecosystem—a strategic alliance with Sumitomo Mitsui Card—which bridges the offline-online divide. The "stera" platform is positioned as an operating system for merchants, allowing for the deployment of third-party applications for inventory management, reservations, and customer loyalty directly on the payment device. This hardware-software integration increases switching costs for merchants, stabilizing GMO-PG's revenue base against lower-cost competitors.

Furthermore, GMO-PG has aggressively expanded into Embedded Finance. By leveraging the transaction data of its massive merchant base, the company offers lending (Transaction Lending), early payment services, and factoring. This moves the revenue model from purely transactional (fee per swipe) to financial (interest and spread income), significantly expanding the Total Addressable Market (TAM). The company’s consolidated subsidiaries, including GMO Financial Gate (itself a key player in offline terminals), reinforce this vertical integration strategy, securing the entire payment value chain from the physical card tap to the backend settlement.

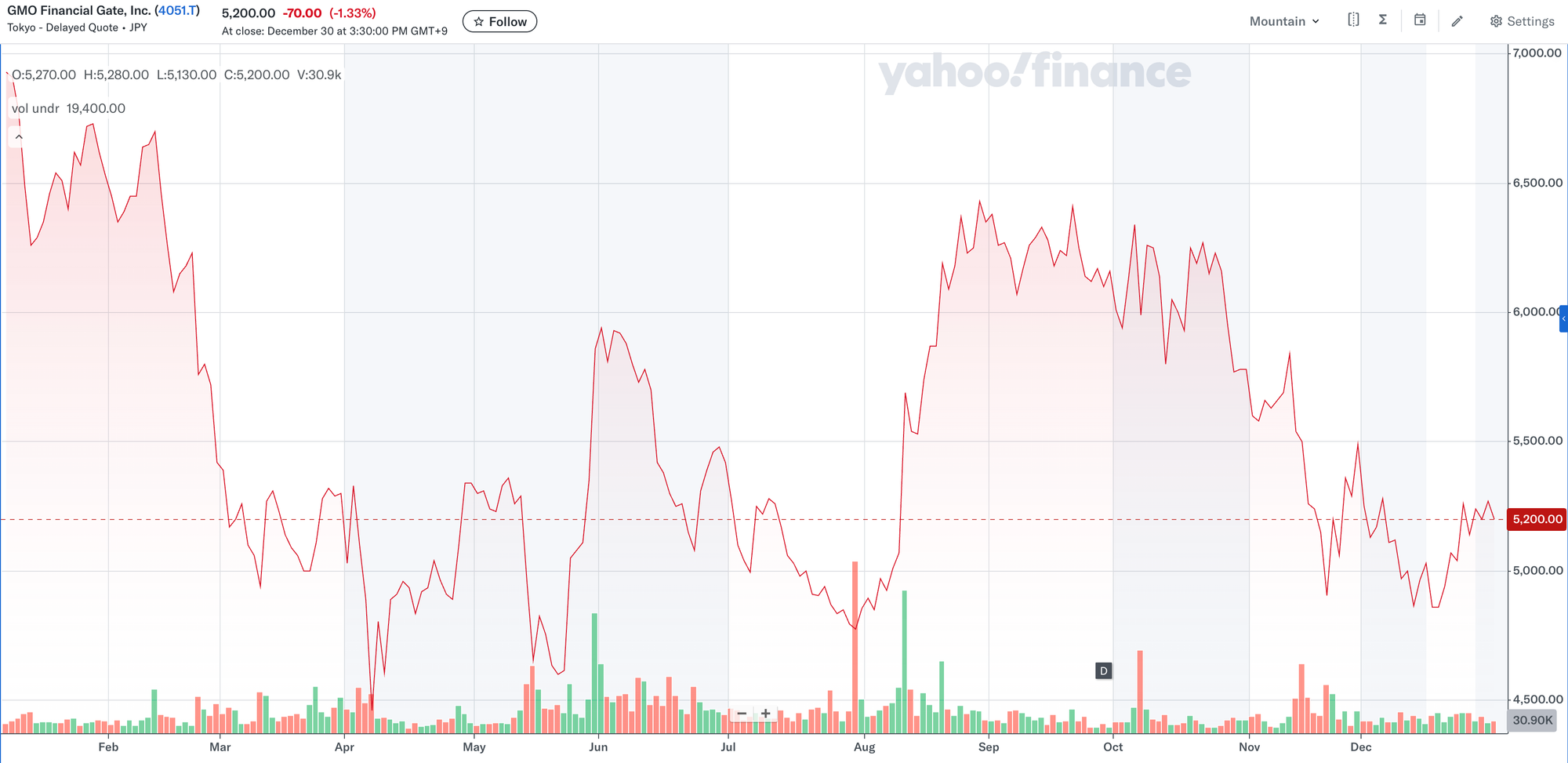

GMO Financial Gate (4051)

- Sector: Offline Payment Infrastructure / IoT Payments

- Listing: TSE Growth

While a consolidated subsidiary of GMO Payment Gateway, GMO Financial Gate (GMO-FG) is separately listed on the TSE Growth market and operates a distinct business model focused on the "face-to-face" (offline) payment sector. Unlike its parent company's dominance in online e-commerce, GMO-FG specializes in physical payment terminals and embedded cashless solutions.

The company's primary growth engine is the "Unattended Market"—embedding payment capabilities into vending machines, automated parking meters, and ticket kiosks. This niche provides a defensive moat, as installing hardware into industrial equipment requires specialized engineering that pure-software fintechs cannot easily replicate. Strategically, GMO-FG has shifted its revenue mix from "Initial" (one-time terminal sales) to "Recurring" (stock revenue from processing fees and subscriptions), which grew 29.8% YoY in Q3 FY2025.

By 2025, GMO-FG had aggressively expanded its "stera" terminal lineup and "Terminal-less" payment solutions (SoftPOS), allowing merchants to accept payments directly on standard smartphones without dedicated hardware. With a stated long-term goal of acquiring 1.2 million active payment IDs by 2033, the company serves as the physical infrastructure layer for Japan’s cash-to-cashless transition.

Digital Garage (4819)

- Sector: Payments / Incubation / Blockchain

- Listing: TSE Prime

Digital Garage (DG) operates a unique hybrid business model that defies simple categorization, functioning simultaneously as a high-volume payment processor and a strategic investment incubator. Listed on the TSE Prime Market, DG is a critical liquidity provider and innovator in the Japanese ecosystem.

The core of DG’s fintech operations is DG Financial Technology (DGFT), which processes a massive volume of e-commerce and utility payments. However, distinct from pure-play processors, DG emphasizes "Contextual Fintech"—the integration of payment capabilities directly into marketing and advertising contexts. This synergy is derived from its legacy marketing segment, allowing DG to offer merchants a closed-loop solution that acquires customers and processes their transactions.

In recent years, Digital Garage has actively reshuffled its portfolio to sharpen its fintech focus. In 2025, DG divested a portion of its stake in CyberBuzz to Ceres, another listed fintech, to reallocate capital toward next-generation infrastructure. Moreover, DG has been a pioneer in the blockchain space within the regulated Japanese environment. Through its joint venture with Daiwa Securities Group (DG Daiwa Ventures) and various blockchain initiatives, DG acts as a bridge between the regulated corporate world and the emerging Web3 economy, positioning it as a key enabler for future digital asset integration into the traditional banking system.

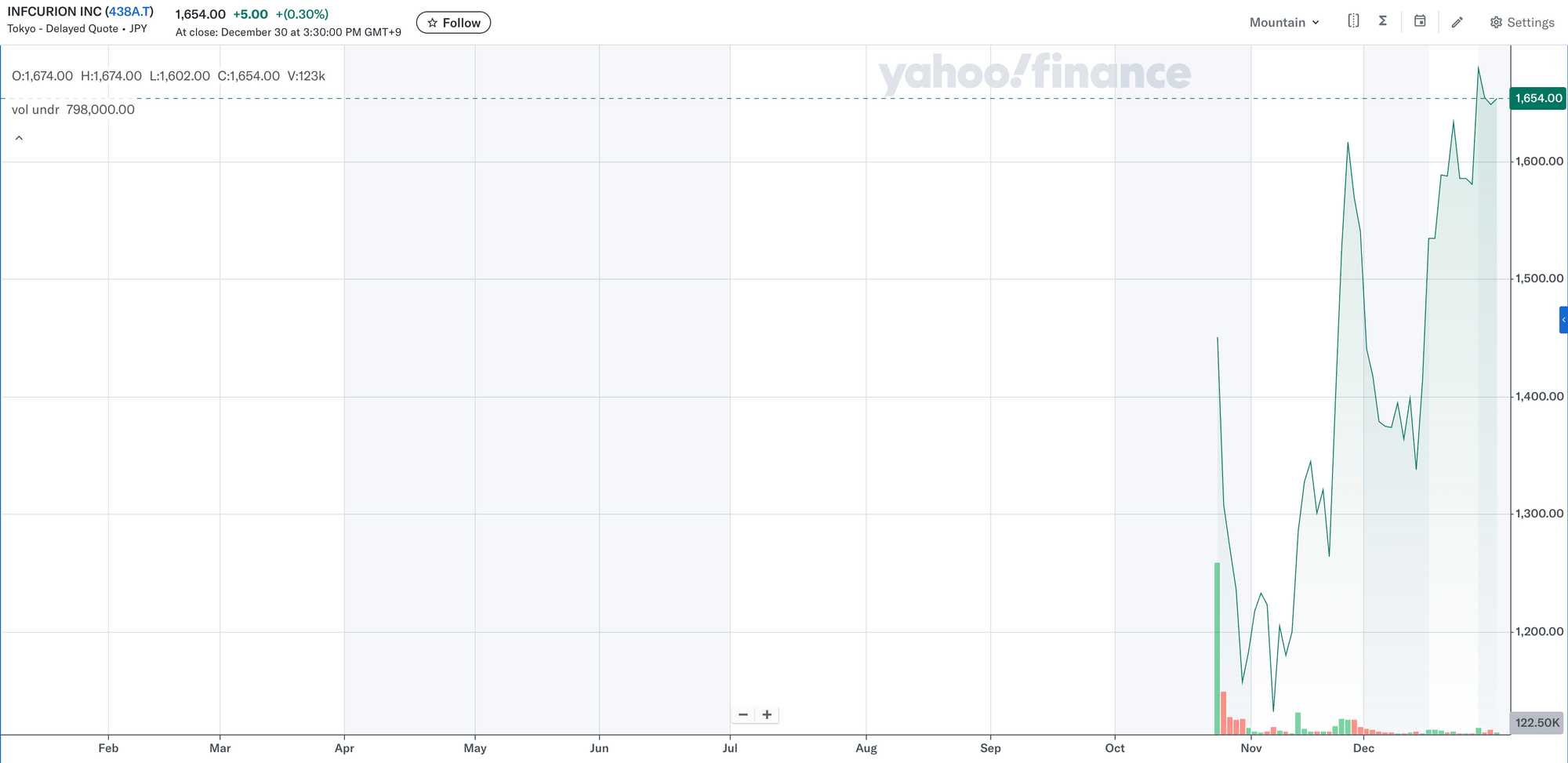

Infcurion (438A)

- Sector: Payment Processing / Embedded Finance

- Listing: TSE Growth

Infcurion operates as a financial technology entity within Japan, positioning itself as a "Payments Enabler". Its core business involves providing embedded finance solutions and platforms, facilitating the integration of payment and financial functions for a diverse client base spanning financial institutions, SaaS providers, and large enterprises across both business-to-business (B2B) and business-to-consumer (B2C) domains. Infcurion’s operations are structured into three distinct segments: Payment Platform, Merchant Platform, and Consulting. Infcurion aims to transform economic activities by making sophisticated payment functionalities accessible, thereby enabling new business models under its mission statement: "Making yesterday's impossible possible, starting with payments". We have discussed "The Infcurion IPO" extensively.

TIS (3626)

- Sector: Systems Integration / Core Banking / Payment Solutions

- Listing: TSE Prime

Often misclassified as a traditional Systems Integrator (SI), TIS is, in functional terms, one of the most significant FinTech enablers in Japan. It is a major constituent of the Global X Japan Fintech ETF, often holding a weight comparable to pure-play fintechs. TIS provides the critical "Credit SaaS" infrastructure—marketed under the PAYCIERGE brand—that powers the debit and credit card issuing capabilities of many neo-banks and non-financial retail brands.

The strategic significance of TIS lies in its role in Bank DX (Digital Transformation). As regional banks in Japan struggle with legacy COBOL-based systems that stifle innovation, TIS offers API-based modernization layers that allow these banks to connect with modern FinTech apps. This "hollow core" strategy allows banks to keep their legacy ledgers while offering modern digital experiences on the front end. TIS’s dominance in this niche ensures it captures value from the digitalization of the banking sector without taking on the balance sheet risk of a bank itself.

2. The SaaS & Digital Transformation (DX) Layer

The second major pillar of the TSE FinTech market is the "Software as a Service" (SaaS) sector, specifically focused on back-office automation, accounting, and financial management. This sector is driven by powerful regulatory tailwinds, most notably the Electronic Book Preservation Act and the Invoice System (introduced in Oct 2023 and matured through 2025), which mandate the digitization of tax and expense records.

Money Forward (3994)

- Sector: Cloud Accounting / PFM / SaaS

- Listing: TSE Prime

Money Forward is arguably the most recognizable brand in Japanese FinTech SaaS. The company operates a "Multi-Product" strategy that encompasses Money Forward ME (the dominant Personal Financial Management app in Japan), Money Forward Cloud (an ERP suite for SMEs and enterprises), and Money Forward X (a digital transformation consultancy for regional banks).

Financial analysis of Money Forward in the 2025 period reveals a company transitioning from a "growth at all costs" phase to a "profitable growth" phase. The company has successfully raised prices and cross-sold additional modules (payroll, attendance, expense reporting) to its existing user base, leveraging high switching costs. The market views Money Forward not just as an accounting software provider, but as a data aggregator; its "Money Forward Kessai" (B2B payment settlement) business leverages accounting data to underwrite credit for SMEs, effectively bridging the gap between SaaS and lending.

The company's stock is a staple in fintech indices, consistently appearing as a top holding in the Global X Japan Fintech ETF. Its strategic M&A activity continues to be aggressive, aiming to consolidate the fragmented back-office software market in Japan.

Freee (4478)

- Sector: Cloud ERP / Accounting

- Listing: TSE Prime

Freee competes directly with Money Forward but differentiates itself through an "Integrated ERP" philosophy. Unlike competitors that adapted legacy desktop paradigms for the cloud, Freee was built as a cloud-native platform that enforces automated double-entry bookkeeping. This architectural difference appeals heavily to startups and digital-native SMEs.

In the 2024-2025 period, Freee has focused on expanding its "Open Platform" strategy. By opening its APIs to banks and third-party applications, Freee has positioned itself as the operating system for small business finance. Its stock performance and inclusion in major ETFs reflect investor confidence in its ability to capture the long-tail of Japanese businesses that are only now digitizing their operations. The company is also expanding into HR tech and corporate card issuance, further entrenching itself in the daily financial operations of its clients.

Finatext Holdings (4419)

- Sector: Brokerage-as-a-Service (BaaS) / Insurance-as-a-Service

- Listing: TSE Prime

Finatext represents the "infrastructure" layer for consumer-facing financial services. Rather than competing for end-users directly, Finatext provides a cloud-native infrastructure—BaaS (Brokerage as a Service) and Insurance as a Service—that enables non-financial companies (e.g., retailers, loyalty programs, community apps) to launch their own branded stock trading or insurance products.

This model is highly scalable and capital-efficient. In 2025, Finatext demonstrated robust earnings growth, forecast to grow at over 43% annually, driven by the expansion of embedded finance. The company's ability to deploy a fully compliant securities trading system in a fraction of the time and cost of legacy vendors makes it a critical enabler for the "democratization of finance" trend in Japan. The stock's high volatility and growth valuation reflect its position as a high-beta play on the expansion of the Japanese retail investor base.

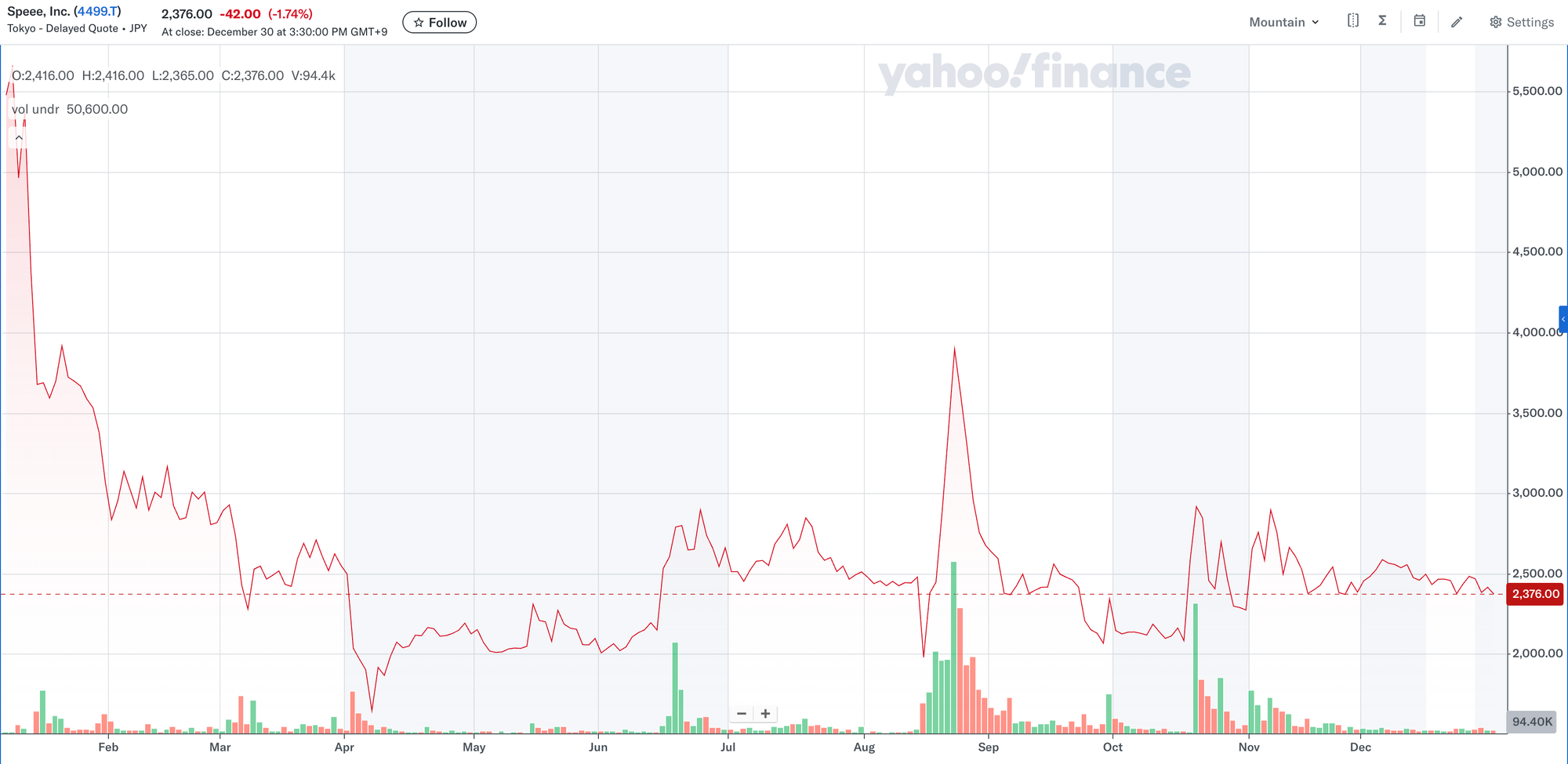

Speee (4499)

- Sector: DX Consultancy / Real Estate Tech / Corporate Treasury

- Listing: TSE Standard

While often categorized as a DX (Digital Transformation) consultancy and real estate tech firm, Speee has entered the FinTech conversation through two avenues: its blockchain-based data sharing initiatives and, more recently, its corporate treasury strategy. As a provider of data-driven marketing and real estate valuation platforms, Speee leverages vast datasets to bring transparency to illiquid markets. However, its late-2025 move to adopt a Bitcoin treasury strategy has re-rated the stock as a crypto-proxy, adding a layer of complexity to its valuation.

Avant Group (3836)

- Sector: Group Governance / Consolidated Accounting

- Listing: TSE Prime

Avant occupies a specialized but lucrative niche: Consolidated Accounting and Governance. As the Tokyo Stock Exchange pushes for higher corporate governance standards and conglomerate transparency, Avant's software solutions—which automate the complex process of consolidating financial statements for group companies—have become essential. While less consumer-facing than Money Forward, Avant is a critical FinTech infrastructure provider for "Japan Inc.," ensuring that the financial data reported to the exchange is accurate and timely.

3. Digital Banking, Neo-Banks, and InsurTech

The banking and insurance sectors on the TSE are characterized by the rise of "Neo-entities"—digital-first institutions that operate without physical branches, leveraging their cost advantages to offer superior rates and user experiences.

Rakuten Bank (5838)

- Sector: Digital Banking

- Listing: TSE Prime

Rakuten Bank is the giant of the sector. Spun off from the Rakuten Group, it is Japan's largest digital bank by number of accounts. Its primary competitive advantage is the "Rakuten Ecosystem"—the ability to acquire customers at near-zero cost from the Rakuten Ichiba e-commerce platform and Rakuten Card user base.

By late 2025, Rakuten Bank was trading with a market capitalization exceeding ¥1.2 trillion. The bank's business model is a textbook example of ecosystem synergy: users are incentivized to bank with Rakuten to earn loyalty points, which are then recycled back into the e-commerce platform. This "velocity of points" creates a liquidity loop that traditional banks cannot replicate. Furthermore, Rakuten Bank has become a dominant player in the mortgage market, utilizing AI-driven credit scoring to process applications faster than legacy peers.

SBI Shinsei Bank (8302)

- Sector: Digital Banking

- Listing: TSE Prime

As part of its efforts to enhance the corporate value of its banking group, SBI Shinsei Bank has been closely working with its parent company, SBI Holdings, and has been consulting with the government regarding the repayment of public funds, which was an important management issue. Subsequently to concluding an "Agreement on Confirmed Repayment Scheme" with the Deposit Insurance Corporation of Japan, the Resolution and Collection Corporation, and SBI Holdings, SBI Shinsei Bank was re-listed on the TSE Prime segment in December.

Lifenet (7157)

- Sector: InsurTech / Online Life Insurance

- Listing: TSE Growth

Lifenet is the pioneer of independent online life insurance in Japan. By eliminating the expensive sales force typical of traditional Japanese insurers ("Seiho ladies"), Lifenet offers significantly lower premiums. In the 2024-2025 period, Lifenet has aggressively pursued an "Embedded Insurance" strategy, partnering with mega-banks (like SMBC) and telecom carriers (KDDI) to bundle insurance products into their apps. This shift from a direct-to-consumer (D2C) model to a B2B2C model has been pivotal in accelerating its growth.

Advance Create (8798)

- Sector: Insurance Marketplace / InsurTech

- Listing: TSE Prime

Advance Create operates Hoken Ichiba, Japan's largest insurance comparison marketplace. While technically an insurance agency, its heavy reliance on web technology, CRM data analytics, and Online-to-Offline (O2O) attribution modeling classifies it as a key InsurTech player. The company utilizes a "common platform" strategy, aggregating data from hundreds of insurers to offer personalized recommendations, effectively functioning as the "Expedia of Insurance" for the Japanese market.

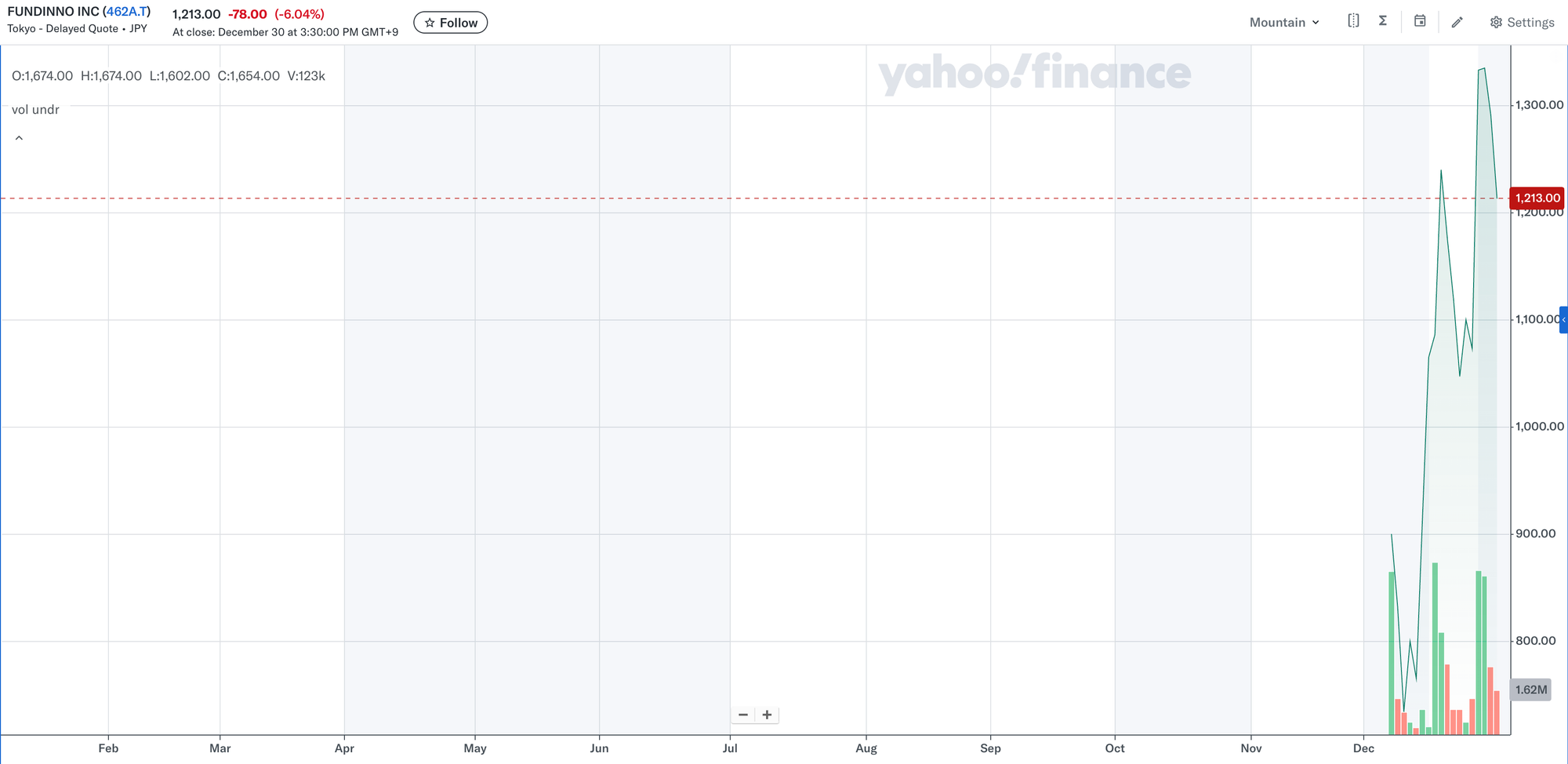

FUNDINNO (462A)

- Sector: Unlisted Company Marketplace

- Listing: TSE Growth

FUNDINNO has built a comprehensive ecosystem designed to solve the core challenges of friction, opacity, and illiquidity that have historically plagued Japan's unlisted market. The platform is a full-stack support system for startups and investors, engineered as a single, unified segment: the "Unlisted Company Equity Platform Business." The entire model is built upon a self-reinforcing "risk money circulation cycle", where capital is deployed, companies are supported, and returns are realized, encouraging reinvestment back into the ecosystem. We have discussed "The FUNDINNO IPO" extensively.

The WealthNavi Consolidation (Delisted)

A critical market development in 2025 was the acquisition and subsequent delisting of WealthNavi (formerly 7342), Japan’s leading robo-advisor, by MUFG Bank. This event signals a major consolidation trend: independent B2C FinTechs, having proven the market demand for digital asset management, are being absorbed by mega-banks seeking to modernize their retail offerings. This removes a key pure-play FinTech from the board but underscores the value of the sector.

4. The Conglomerate Ecosystems: The "Super Apps"

A holistic view of Japanese FinTech must include the massive conglomerates that control the majority of transaction volume, even if their FinTech operations are housed within broader holding structures.

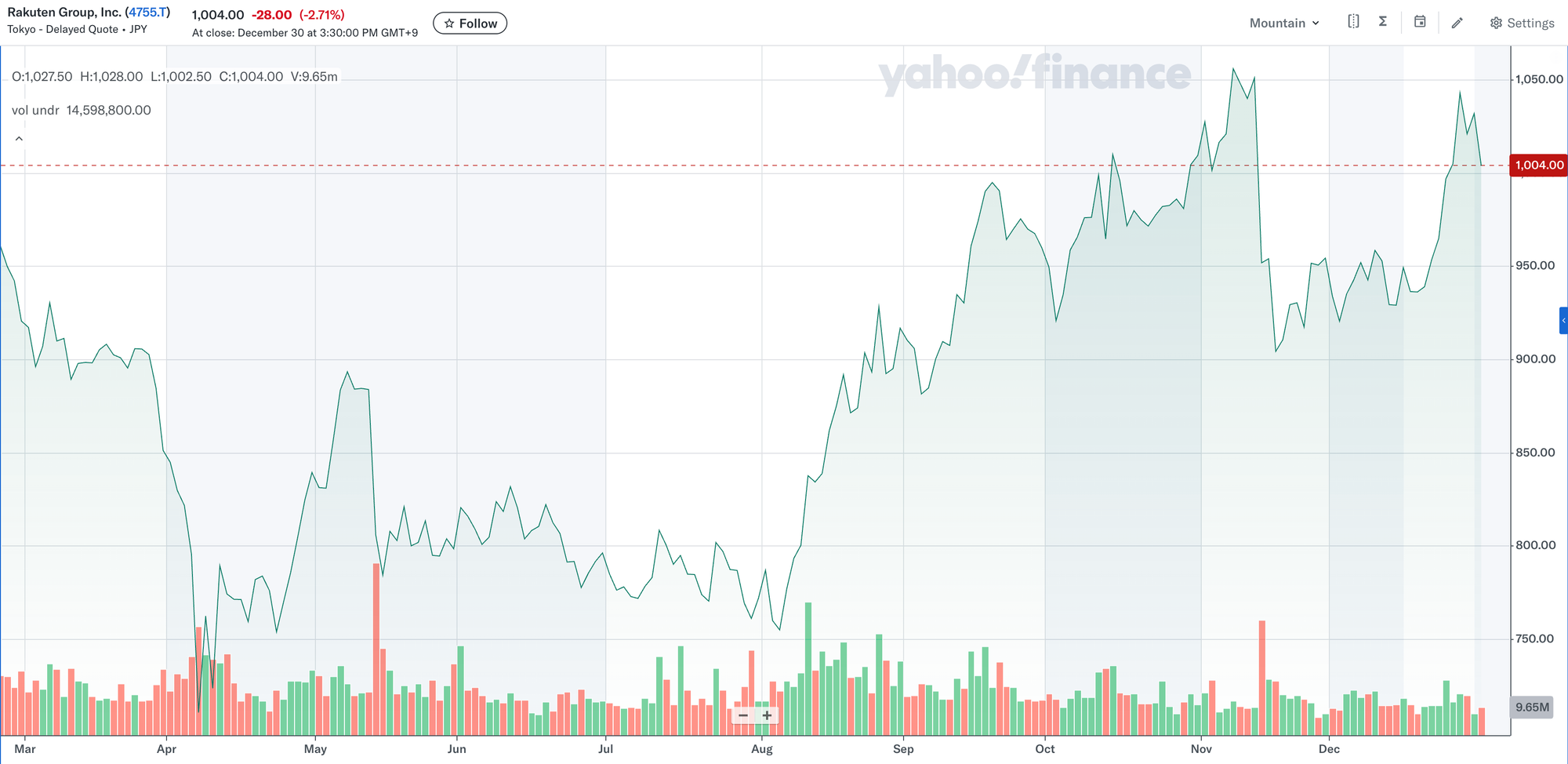

Rakuten Group (4755)

Rakuten pioneered the "Ecosystem" model. Its FinTech arm—comprising Rakuten Card, Rakuten Securities, Rakuten Bank, and Rakuten Edy—generates the majority of the group's operating profit, effectively subsidizing its mobile network ventures. The "Rakuten Economic Zone" is the most mature fintech ecosystem in Japan, characterized by high cross-use ratios among its 100 million+ member IDs.

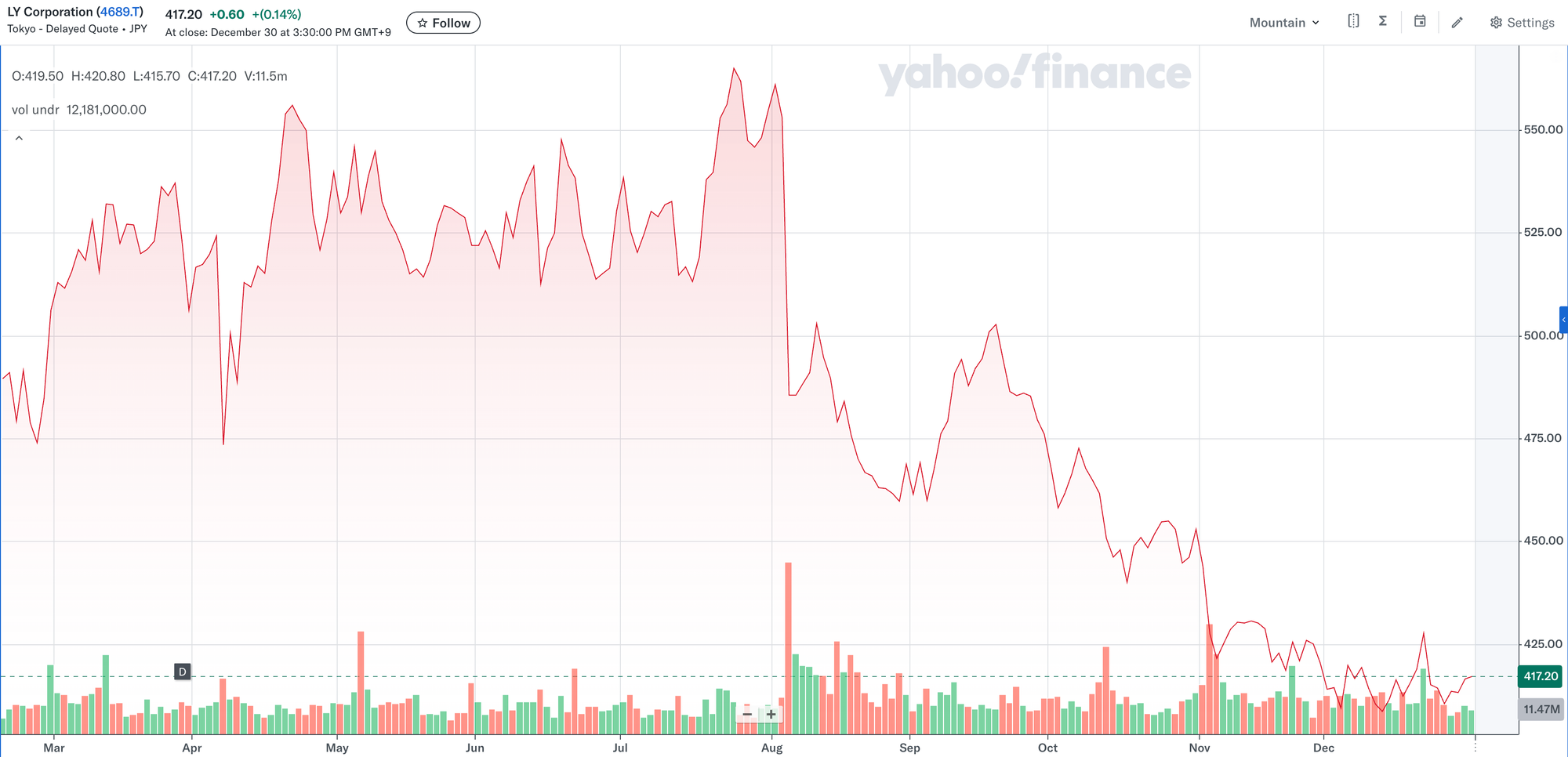

LY Corporation (4689)

Formed from the merger of Z Holdings (Yahoo Japan/SoftBank) and LINE, LY Corp controls PayPay, Japan's dominant QR code payment app. Although PayPay is a joint venture (and potentially a future IPO candidate), its financial impact on LY Corp is massive. Combined with LINE Pay and LINE Securities, LY Corp represents the "Super App" approach, aiming to integrate messaging, search, and finance into a single interface used by virtually the entire Japanese population.

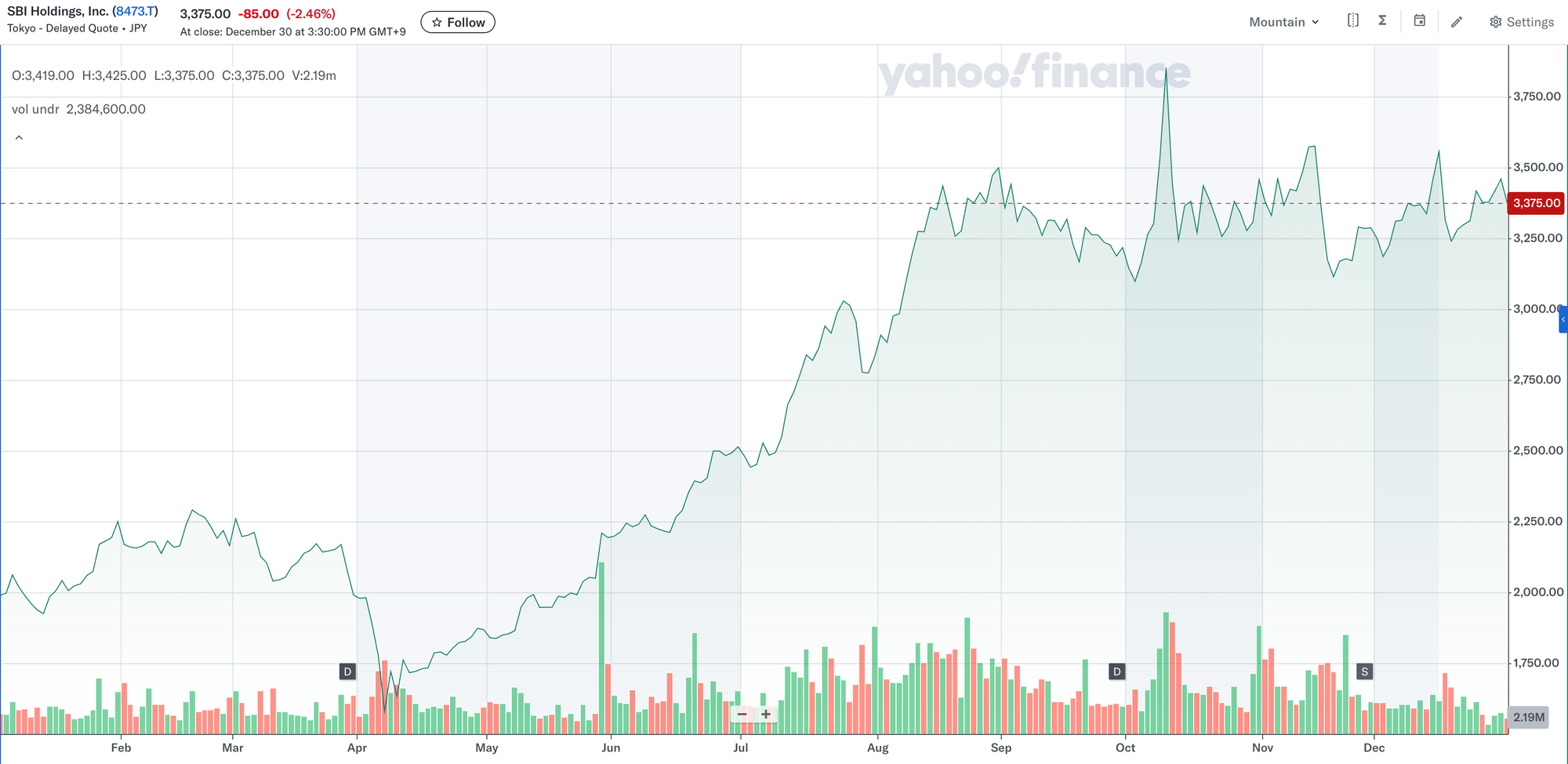

SBI Holdings (8473)

Led by the visionary Yoshitaka Kitao, SBI Holdings is the most aggressive financial conglomerate in the digital space. SBI acts as a FinTech incubator, creating and spinning off entities like SBI Securities, SBI Sumishin Net Bank, and SBI Global Asset Management (4765). In 2025, SBI spearheaded a joint venture with Franklin Templeton to launch Bitcoin ETFs in Japan, positioning itself as the primary conduit for institutional crypto adoption.