au Jibun Bank Fortifies Anti-Fraud Defenses with LAC’s AI-Driven Real-Time Detection System

au Jibun Bank has moved to bolster its internet banking security infrastructure, announcing the deployment of "AI Zero Fraud," a proprietary detection system developed by cybersecurity firm LAC. The integration, which went live during December 2025, represents a strategic shift toward artificial intelligence to mitigate the rising risk of illicit money transfers.

Shift to Real-Time Intervention

The newly adopted system utilizes advanced AI algorithms to monitor transactions in real time. Under the new protocol, if a transfer is flagged as high-risk, the system automatically suspends the transaction and triggers a requirement for additional identity verification. This mechanism is designed to balance rigorous security with customer convenience, intervening only when potential fraud is detected.

Overcoming Legacy Limitations

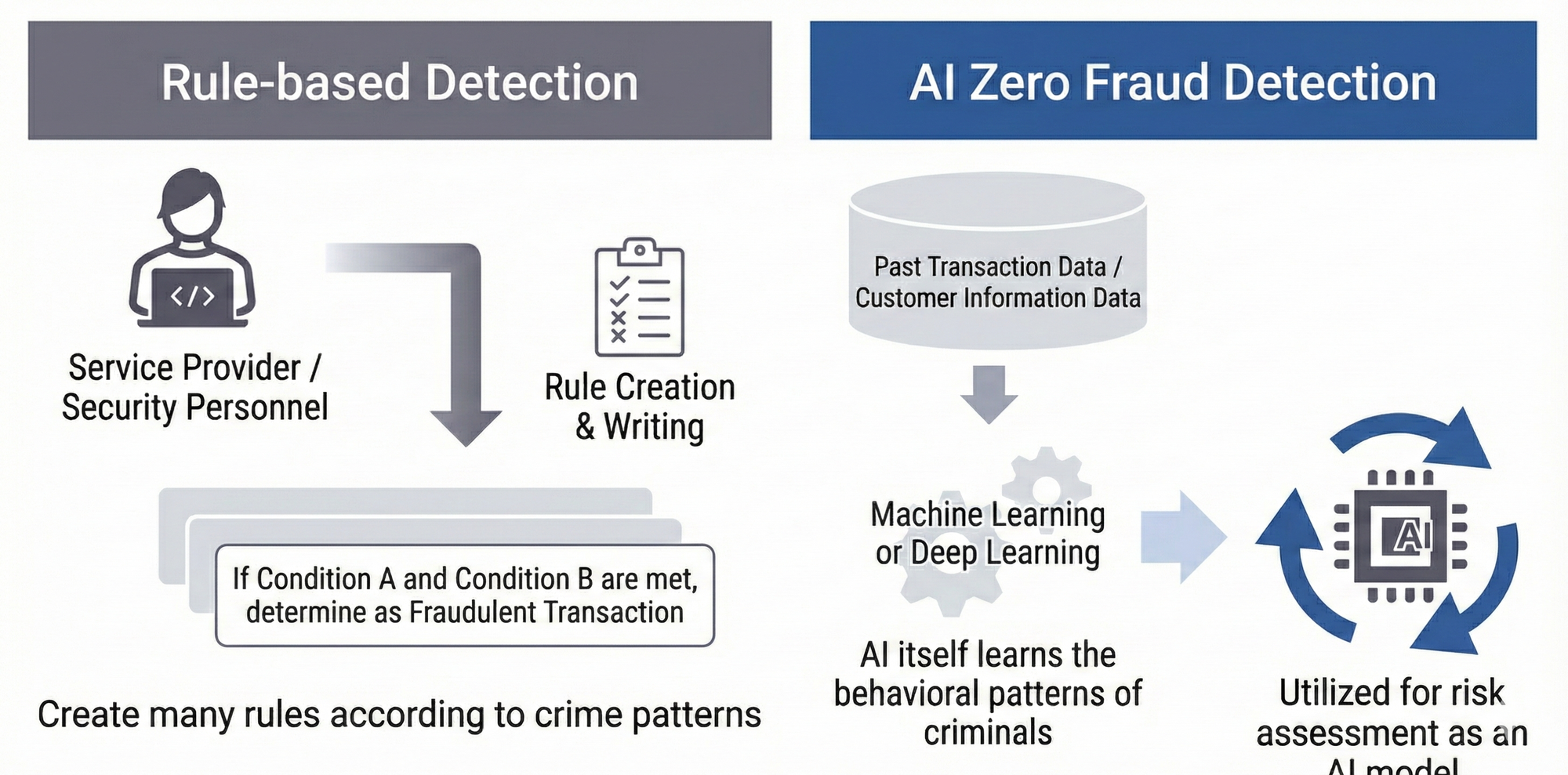

The adoption of "AI Zero Fraud" addresses the limitations of traditional "rule-based" security models, which rely on static, pre-defined criteria to approve or deny transactions. As financial crime syndicates employ increasingly sophisticated methods, these fixed rules often fail to recognize novel attack patterns.

LAC’s solution fuses cybersecurity expertise with deep learning capabilities. By analyzing historical transaction data and continuously ingesting the latest intelligence on criminal trends, the system evolves its detection logic. This allows it to identify irregular patterns that would typically evade standard rule-based filters.

Strategic Partnership

Both au Jibun Bank and LAC have committed to a continued partnership aimed at refining countermeasures against cyber and financial crimes. The initiative is part of a broader effort to ensure a secure financial environment for depositors amidst a landscape of evolving digital threats.