JPX Arm Taps Snowflake to Build Industry-Wide Data Hub, Targeting 2027 Launch

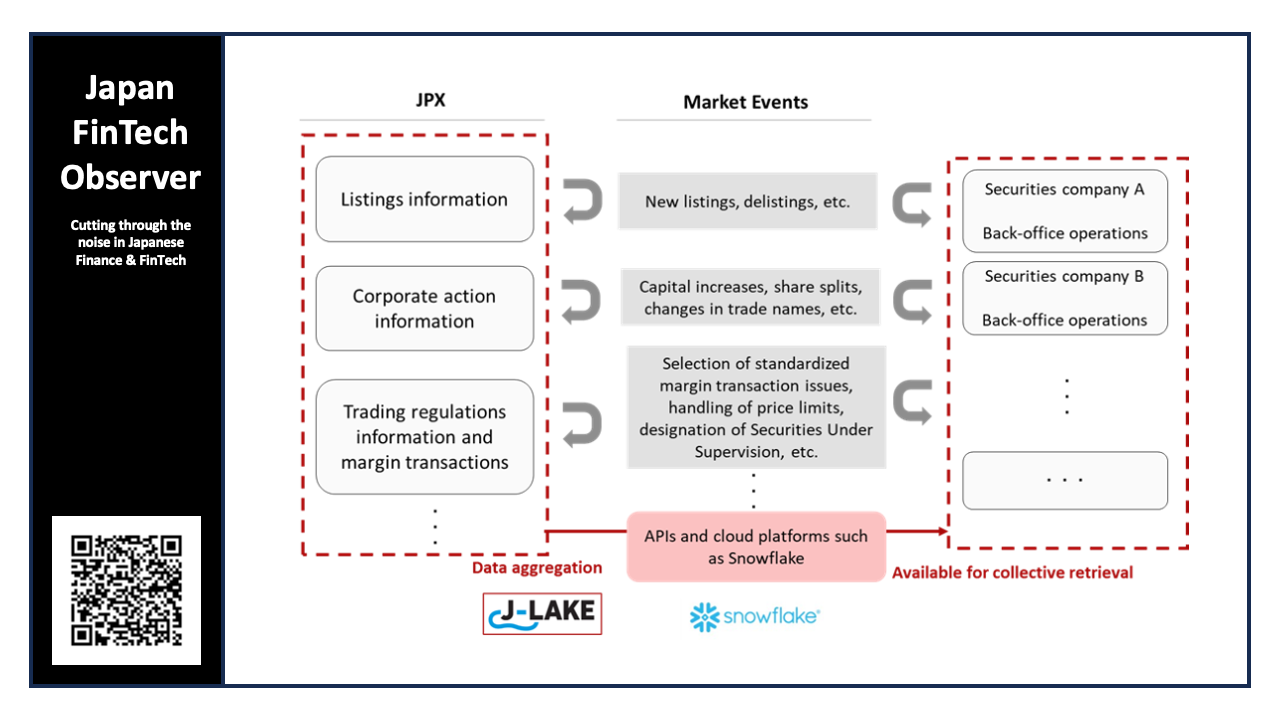

JPX Market Innovation & Research (JPXI) has initiated a major overhaul of the Japanese securities industry’s digital infrastructure, announcing plans to construct a common cloud-based data platform aimed at eliminating legacy inefficiencies in back-office operations.

The project, which leverages technology from data cloud company Snowflake, seeks to replace the sector’s reliance on manual data entry with an automated, standardized system. JPXI aims to open a beta environment in early 2027, with a full service launch projected for the spring.

Modernizing Market Plumbing

For years, back-office departments at Japanese brokerage firms have grappled with a labor-intensive workflow. Critical information regarding new listings, delistings, and corporate actions (such as stock splits and capital increases) is currently disseminated via PDF notices or scattered across various institutional websites.

According to JPXI, securities firms must currently retrieve this data manually and re-enter it into their internal systems—a process that is not only costly but prone to human error and heavily reliant on individual employee expertise.

The proposed platform aims to aggregate this data centrally and distribute it in a machine-readable format via APIs and Snowflake’s data-sharing infrastructure. The goal is to allow brokerage firms to ingest market updates directly into their systems, streamlining operations and freeing up resources for higher-value tasks.

Collaborative Effort

The initiative represents a shift toward industry-wide collaboration. JPXI has been defining system requirements in consultation with major market participants, including Mizuho Securities, Daiwa Securities, and the Daiwa Institute of Research.

The collaboration stems partially from discussions held in September 2025, where Mizuho Securities CIO Ken Utsunomiya advocated for a data ecosystem that transcends organizational boundaries.

"We aim to review current back-office operations... and promote business process reengineering across the entire securities industry," JPXI stated in its release.

Tech Integration

Snowflake will serve as a key technology partner for the distribution layer. Ryuji Ukita, President of Snowflake Japan, emphasized that the company's "data sharing" technology would allow for secure, seamless information flow without the traditional barriers of complex data integration.

"We hope this service will become the standard data foundation for the industry and an engine that powerfully promotes Digital Transformation (DX) in securities," Ukita said.

The platform is expected to handle a wide range of data points, from day-to-day corporate action notifications to trading regulations, including margin transaction handling and price limits.