Kaiko: Alameda Research-linked wallet consolidates holdings

As crypto data & analytics provider Kaiko reports, a crypto wallet, allegedly linked to FTX’s sister company Alameda Research, has been…

As crypto data & analytics provider Kaiko reports, a crypto wallet, allegedly linked to FTX’s sister company Alameda Research, has been actively moving funds over the past month, sparking speculation that the FTX bankruptcy estate is consolidating assets ahead of potential creditor repayments. Earlier this year, FTX announced that it had recovered enough tokens to pay most of its creditors back in full, based on the value of their holdings at the time it filed for bankruptcy. The exchange is expected to start repayments after the final approval of its wind-down plan, expected in early October.

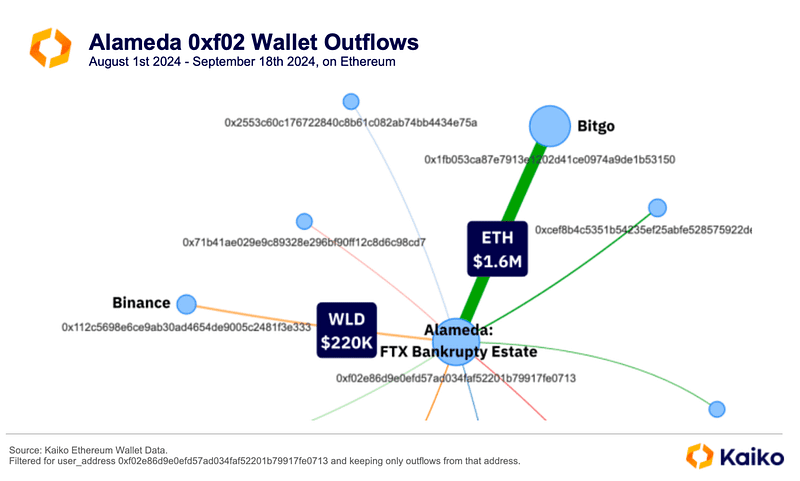

Using Kaiko’s wallet data solution, the company investigated the transfers in and out of the wallet (0xf02e86d9e0efd57ad034faf52201b79917fe0713). Over the past month, it has transferred $1.6 million in ETH to crypto custodian BitGo and $220K in World Coin (WLD) to Binance.

Transfers to exchanges are generally viewed as bearish because traders usually move assets there to sell them. Alameda Research was an early investor in Worldcoin, holding 75 million ($118M) WLD tokens. Since July, these tokens have been gradually unlocked by Worldcoin’s developer, Tools for Humanity (TFH).

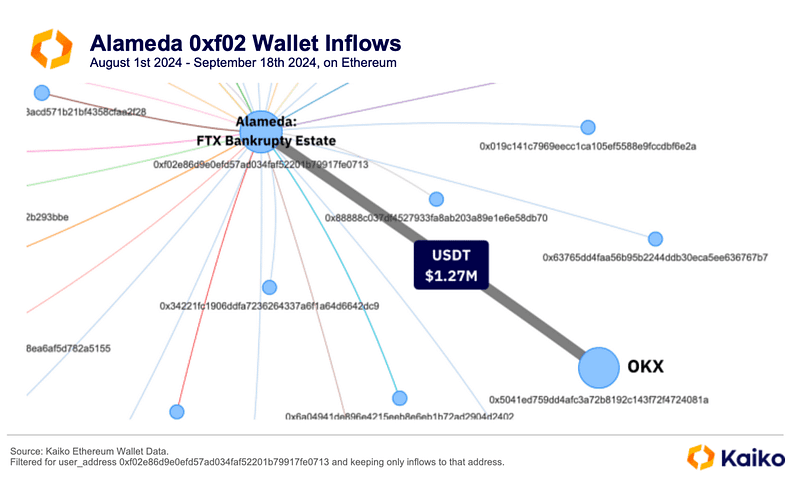

A closer look at the wallet’s inflows reveals asset consolidation through multiple transfers from various smaller wallets, most likely owned by Alameda Research, with the largest inflow totaling $1.27 million USDT coming from OKX.

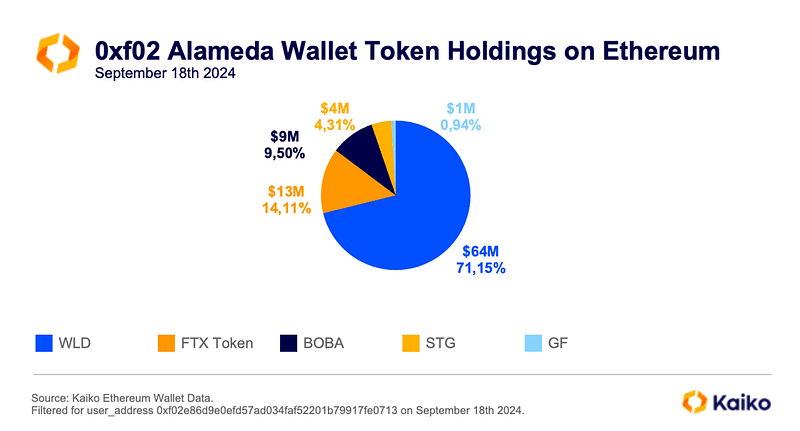

As of September 18, Alameda’s wallet still holds $64M in WLD. Selling these could heavily impact prices, which are already down 30% since the July 24 token unlock. Other major holdings include several small, illiquid tokens like FTX’s FTT ($13M) and Bona Network’s BOBA ($9M) tokens, which together have a 1% market depth of only $0.7M daily

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on Medium or on LinkedIn.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.